Florida Identity Theft Checklist for Minors

Description

How to fill out Identity Theft Checklist For Minors?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal use, categorized by types, states, or keywords. You can locate the latest versions of forms such as the Florida Identity Theft Checklist for Minors in just moments.

If you already have a subscription, Log In and download the Florida Identity Theft Checklist for Minors from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Make edits. Fill out, modify, print, and sign the downloaded Florida Identity Theft Checklist for Minors.

Each template you add to your account does not expire and is yours indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Florida Identity Theft Checklist for Minors with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get started:

- Ensure you have chosen the correct form for your city/state. Click on the Preview option to review the form's details. Check the form summary to confirm you have selected the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- When satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and provide your credentials to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

A credit card is essentially a means of taking out a loan; as such, you must be 18 to get one. If your child is under 18, the only way for them to ?get? a credit card is to add them as an authorized user to an existing account. An authorized user is allowed to use the card but isn't responsible for paying the bill.

Kids under the age of 6 don't need credit or loans. It's identity theft if you use their social security numbers with your name to get a loan for yourself. If you use their names and their SS#s, they can't qualify for a loan.

Warning Signs of Child Identity Theft Unexpected bills addressed to your child. Collection notices that arrive by mail or phone, targeting your child. Denial of government benefits for your child on the basis that they've already been paid to someone using your child's Social Security number.

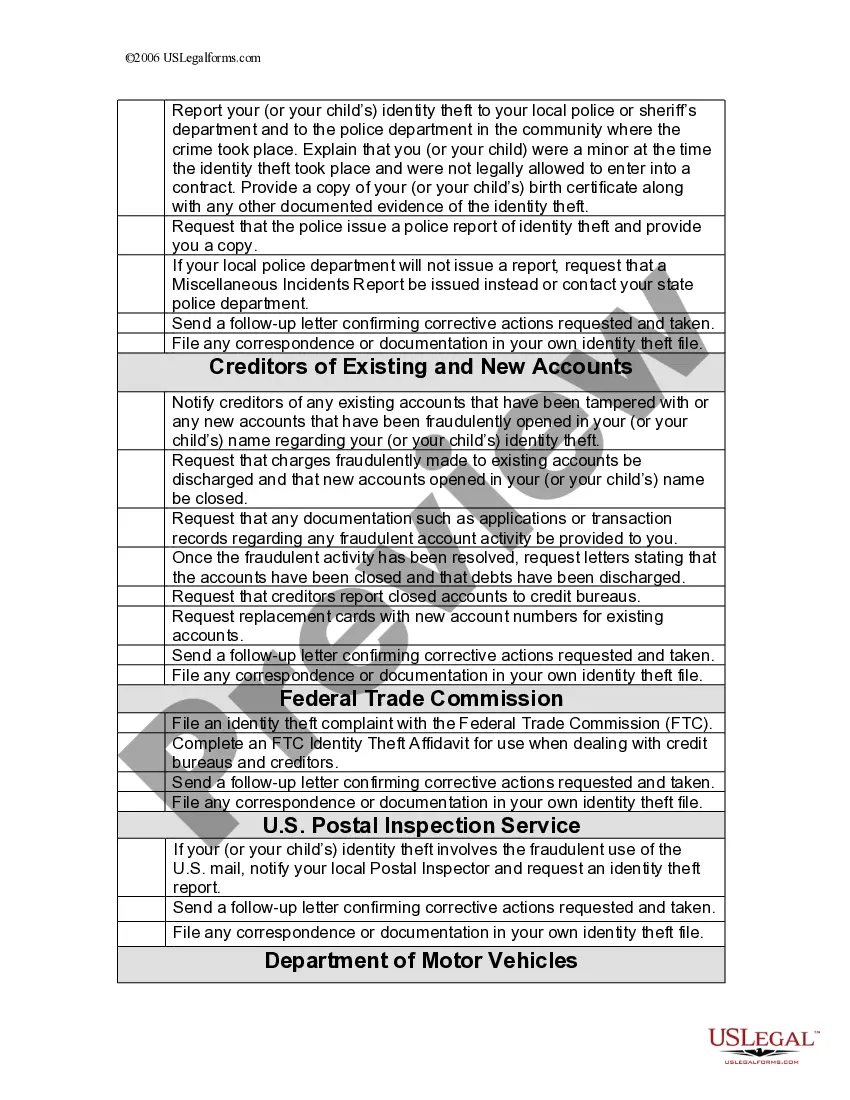

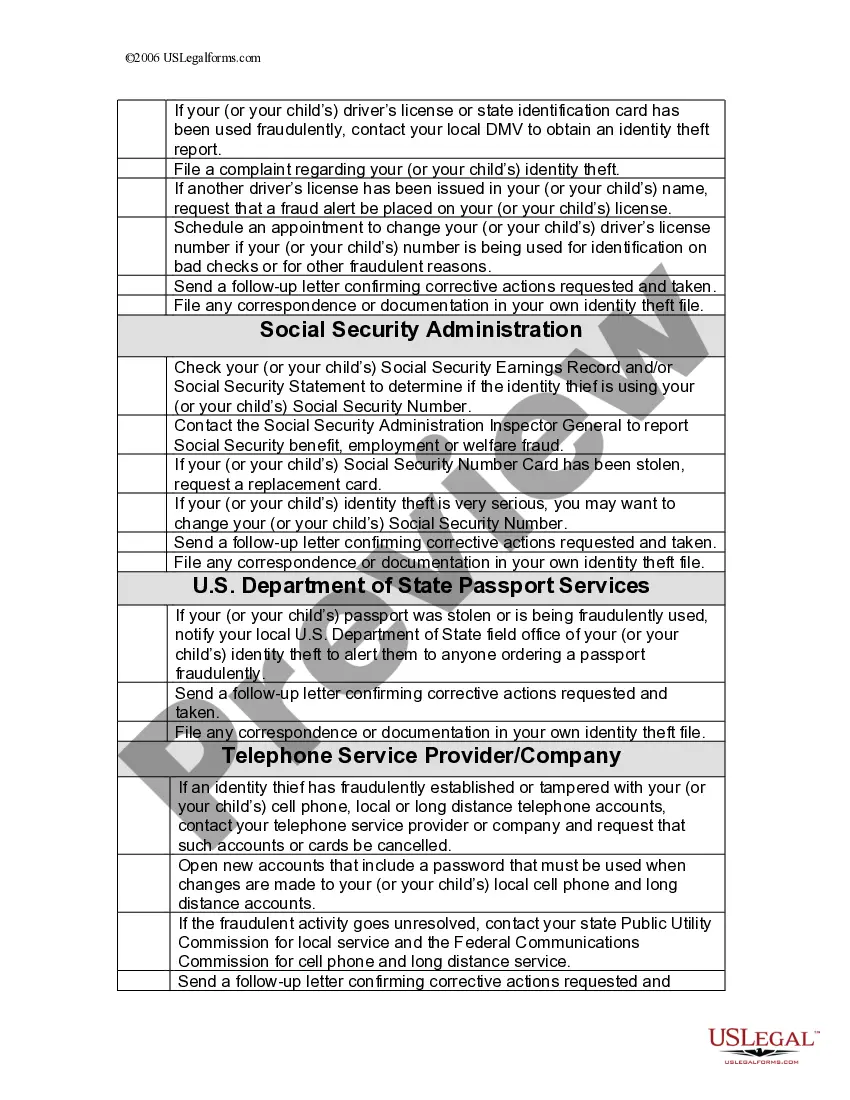

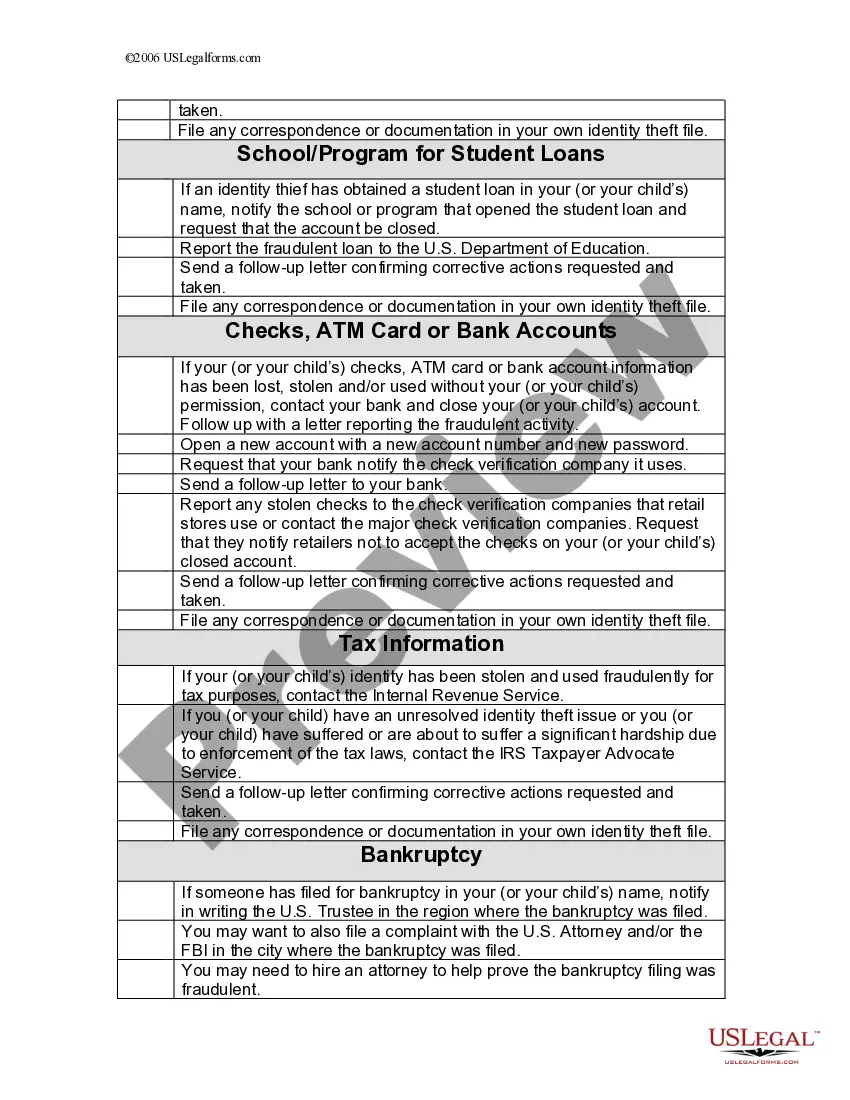

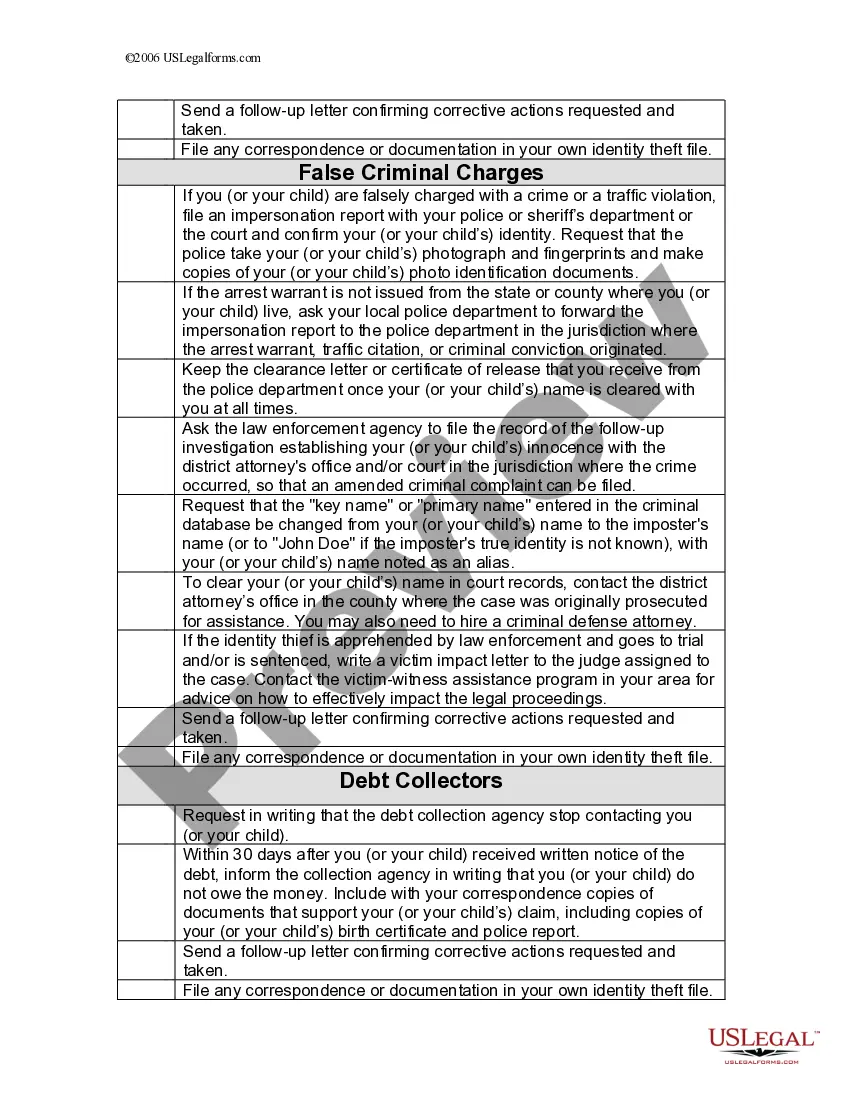

If your child's identity has been stolen, here are some steps you can take: Contact the Federal Trade Commission (FTC) to report the ID theft and get a recovery plan. Contact your local law enforcement and get a police report. Contact the fraud departments of companies where accounts were opened in your child's name.

They may think it's okay to use their child's identity temporarily. But if you don't pay it back, you will damage your child's credit score and set them up for financial hardship when they reach adulthood. The law remains the same, regardless of the circumstances.

Minors under the age of 18 cannot open their own credit cards by law (or get approved for other forms of credit), so adding children as authorized users is a simple workaround many parents use to give their kids access to the convenience and benefits of a credit card.

Unfortunately, scammers have discovered that they can use your child's sensitive information ? name, date of birth, and Social Security number (SSN) ? to take out credit cards, open loans, and more.

? Change logins, passwords, and PINs for your accounts. You might have to contact these companies again after you have an Identity Theft Report. Step 2: Place a fraud alert and get your credit reports. ? To place a fraud alert, contact one of the three credit bureaus.