Title: Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death Introduction: When a loved one passes away, it is essential to handle their financial matters properly. This detailed description will explain how to draft a Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death. This notification letter ensures a smooth transition and minimizes potential issues related to the deceased's credit cards and financial accounts. Below, we will explore the components, significance, and various types of Florida Letters tailored for different types of credit card companies and financial institutions. --- Components of a Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death: 1. Purpose: This formal letter serves as a legal and courteous way to inform credit card companies and financial institutions about the individual's passing, enabling the companies to take the necessary actions. 2. Contact Information: The letter should include the contact details of the deceased's representative, such as their name, address, phone number, and email address. This ensures that the companies have a point of contact for any further correspondence. 3. Identity Verification: To authenticate the letter, it should also include the full name, date of birth, and social security number of the deceased. 4. Date of Death: Specify the exact date of the deceased's passing to provide the companies with accurate information. 5. Supporting Documents: Attach relevant documents, such as a death certificate or obituary, to substantiate the claim and facilitate the account closure or transfer process. 6. Specific Requests: Mention any specific instructions, such as freezing the accounts, halting automatic payments, or requesting a waiver of outstanding balances for deceased individuals. --- Types of Florida Letters for Credit Card Companies and Financial Institutions: 1. Florida Letter to Credit Card Companies Notifying Them of Death: This type of letter is solely focused on notifying credit card companies about the deceased. It should be sent to all credit card providers the individual held accounts with. 2. Florida Letter to Financial Institutions Notifying Them of Death: This specific letter targets banks, credit unions, and other financial institutions, informing them of the individual's passing. It covers various accounts, including savings, checking, mortgages, loans, and investments. 3. Florida Letter to Credit Reporting Agencies: In addition to notifying credit card companies and financial institutions, it is essential to inform credit reporting agencies like Experian, Equifax, and TransUnion. This letter requests to update the deceased's credit profile accordingly and prevent any fraudulent activity. 4. Florida Letter Requesting Account Closure or Transfer: In some cases, the representative of the deceased may request account closure or transfer to a surviving spouse or designated beneficiary. This letter clarifies the intentions and provides instructions for seamless handling of the accounts. --- Conclusion: Sending an appropriate Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death is crucial for effective estate management. By addressing the various components and types of letters mentioned above, individuals can navigate this process with confidence and ensure a smooth transition of financial matters after the passing of a loved one.

Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death

Description

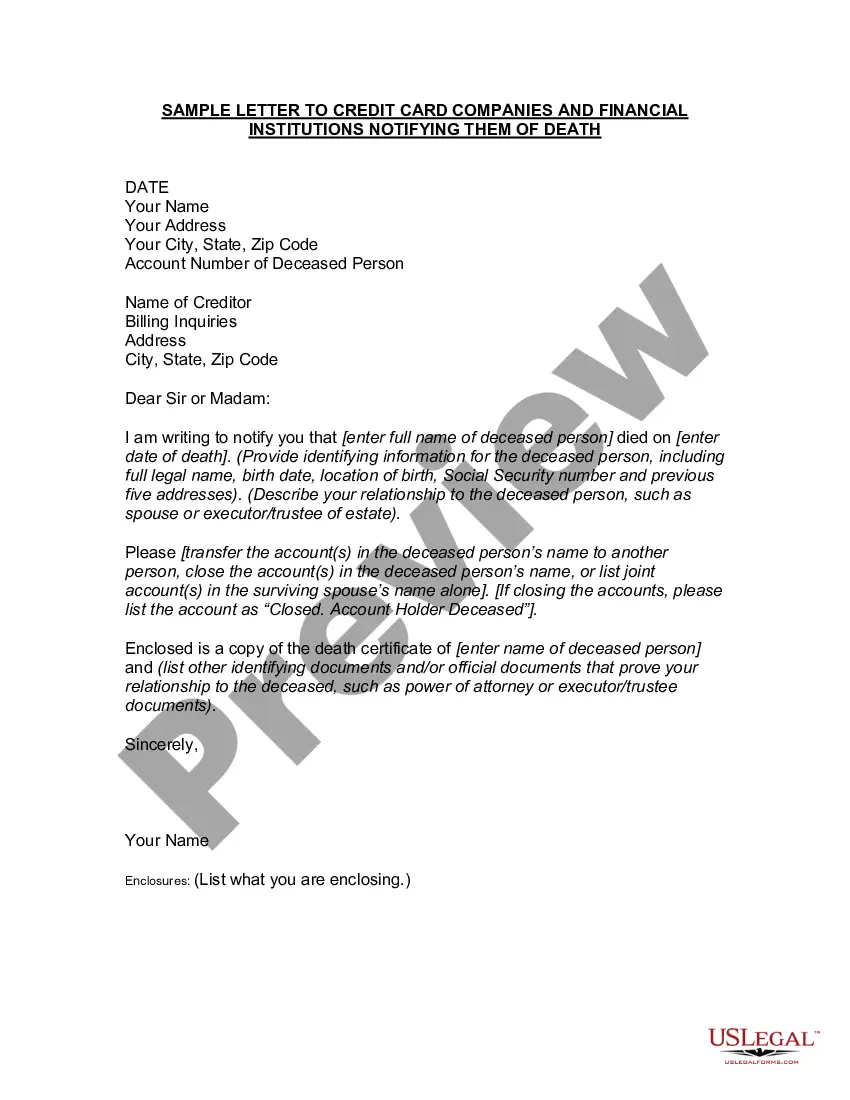

How to fill out Florida Letter To Credit Card Companies And Financial Institutions Notifying Them Of Death?

If you wish to total, download, or printing legitimate document themes, use US Legal Forms, the greatest collection of legitimate forms, that can be found on-line. Use the site`s simple and hassle-free search to obtain the documents you require. A variety of themes for enterprise and individual functions are categorized by classes and says, or search phrases. Use US Legal Forms to obtain the Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death in just a number of mouse clicks.

Should you be currently a US Legal Forms client, log in for your account and then click the Acquire switch to find the Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death. You may also entry forms you formerly saved in the My Forms tab of the account.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for the appropriate area/country.

- Step 2. Utilize the Review choice to check out the form`s content. Do not forget to read the information.

- Step 3. Should you be unsatisfied with all the kind, make use of the Look for discipline on top of the screen to locate other variations in the legitimate kind template.

- Step 4. Upon having discovered the shape you require, click on the Buy now switch. Select the costs plan you favor and include your references to sign up for the account.

- Step 5. Approach the deal. You may use your charge card or PayPal account to accomplish the deal.

- Step 6. Select the file format in the legitimate kind and download it on the product.

- Step 7. Complete, change and printing or signal the Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death.

Each and every legitimate document template you acquire is your own permanently. You have acces to each and every kind you saved in your acccount. Click the My Forms area and pick a kind to printing or download once again.

Remain competitive and download, and printing the Florida Letter to Credit Card Companies and Financial Institutions Notifying Them of Death with US Legal Forms. There are millions of skilled and status-particular forms you can use for the enterprise or individual demands.