This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

You have the capability to spend time online looking for the legal document format that meets the federal and state regulations you need.

US Legal Forms offers thousands of legal templates that can be assessed by experts.

It is easy to obtain or create the Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children from our services.

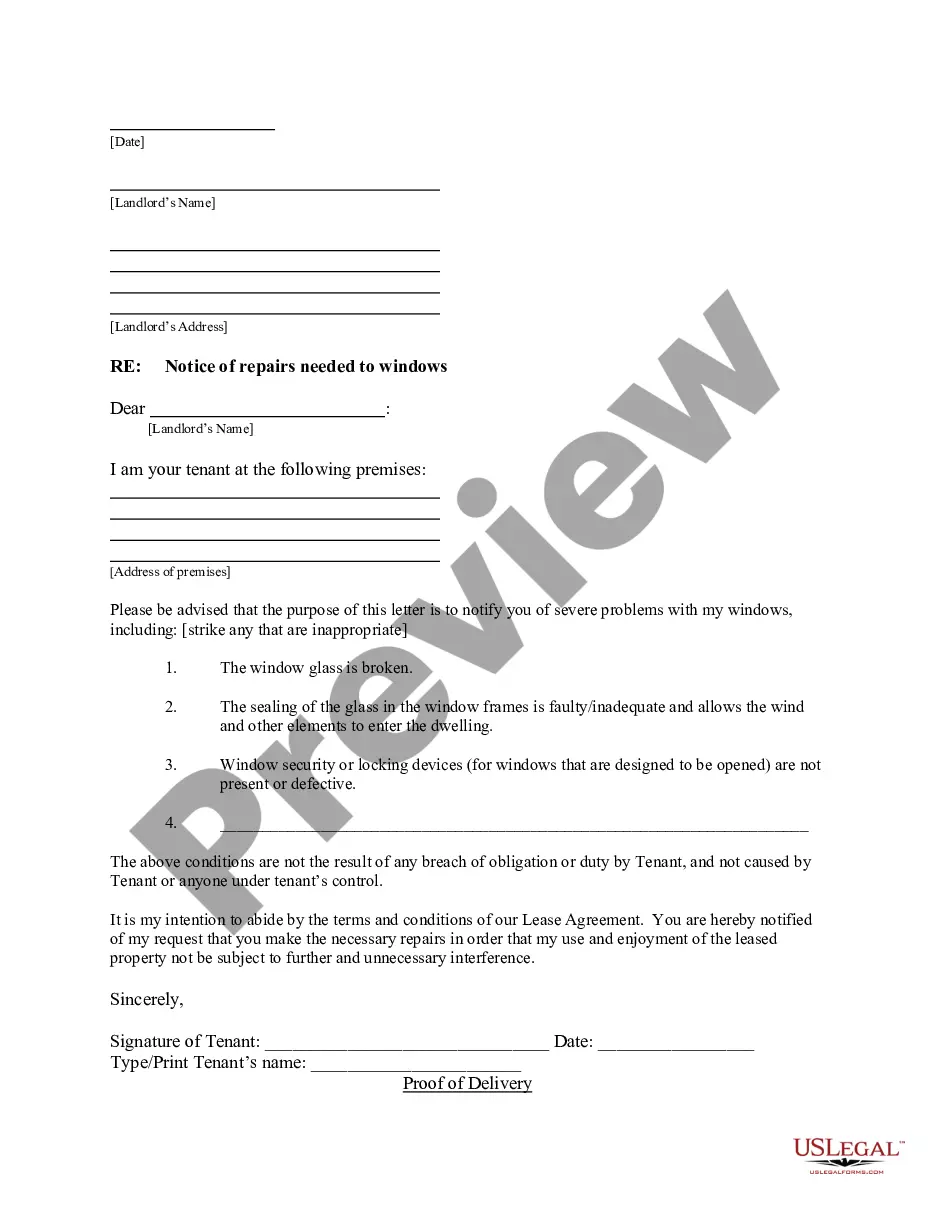

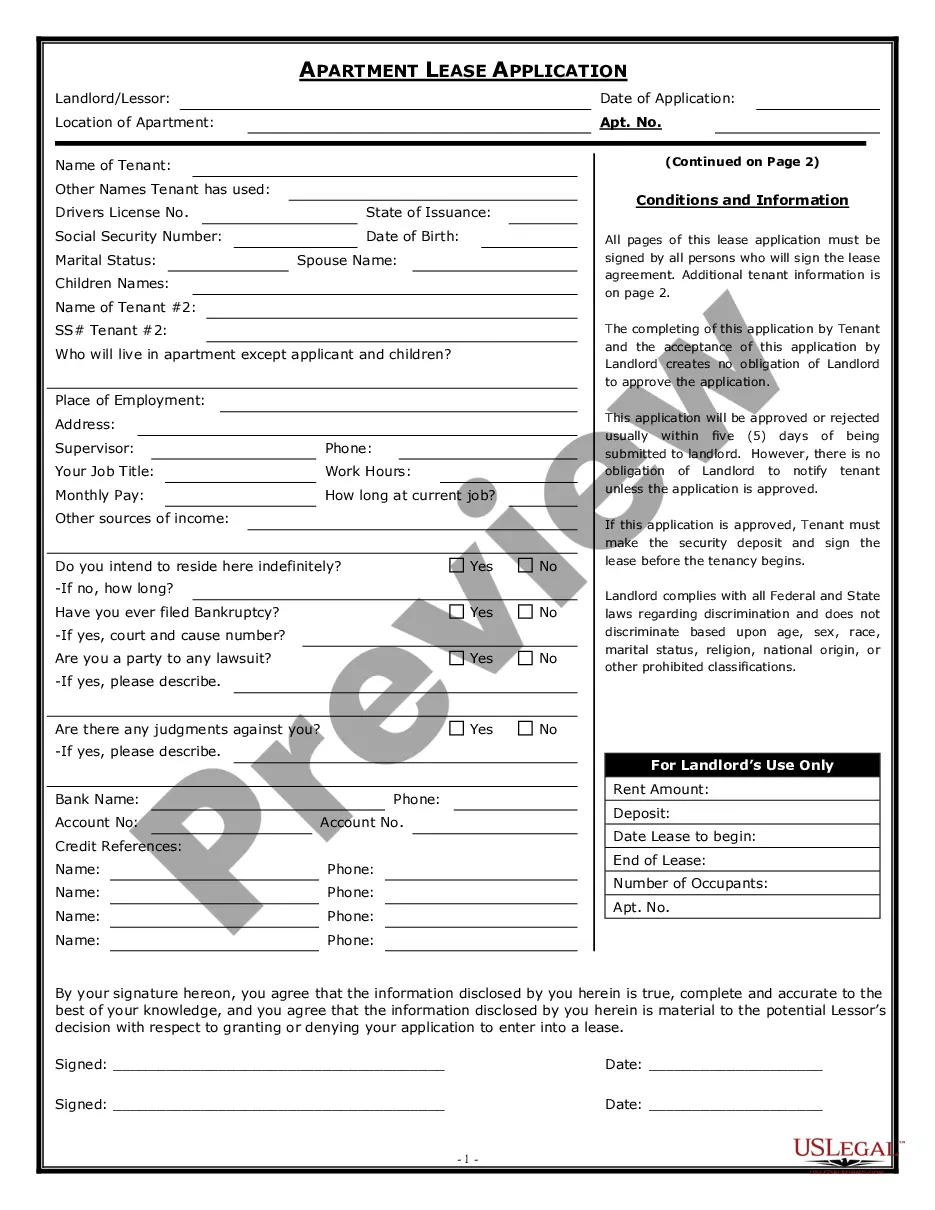

If available, use the Preview button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Afterward, you can complete, edit, create, or sign the Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

- Every legal document format you purchase is yours indefinitely.

- To obtain another copy of a purchased template, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct document format for the county/area of your choice.

- Review the document description to confirm you have chosen the correct template.

Form popularity

FAQ

In Florida, there is not a mandatory requirement to file a trust agreement with the court. However, when it comes to a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it is crucial to maintain proper records. This record-keeping ensures transparency and simplifies tax reporting. Utilizing uslegalforms can help create and manage your trust documents efficiently, ensuring you meet all necessary legal standards.

The best type of trust to set up greatly depends on your individual goals. For those focusing on minors, a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children may provide significant advantages. This trust not only facilitates efficient asset distribution but also helps in reducing potential tax liabilities. It’s essential to evaluate your circumstances and consult with professionals to choose the right type of trust for your specific situation.

The best trust for minors often depends on specific needs and goals. A common choice is a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, as it allows for tax benefits while providing valuable asset protection. This type of trust can help to ensure that funds are used wisely and efficiently over time. Consulting with an expert can help you select the most suitable option to meet your family’s needs.

A minor trust is designed specifically to manage assets for children until they reach a certain age. This type of trust handles distributions in a way that aligns with the best interests of the minor, often utilizing a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. The terms of the trust can specify when and how funds are to be managed or released, providing security and peace of mind for parents. It effectively safeguards a child’s financial future until they are ready to handle their assets.

In Florida, qualified beneficiaries of a trust typically include those who can receive distributions from the trust. This often includes minors, who may benefit from a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Parents or guardians may also be designated as beneficiaries during the minor's lifetime, ensuring the trust serves its intended purpose of financial protection and growth. Understanding these qualifications helps you make informed decisions when setting up your trust.

The annual exclusion for gift splitting allows married couples to combine their annual exclusions for gifting purposes. This means they can give double the exclusion amount to a recipient in a given year. Utilizing a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can optimize this benefit, allowing for substantial gifts without incurring tax liabilities.

The best type of trust for a minor often depends on the family's specific needs, but a revocable trust is generally a good option. A Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can provide flexibility and control. Additionally, it may help protect assets until the child reaches adulthood, ensuring responsible management.

One significant mistake parents often make is not being clear about their intentions and goals for the trust fund. When establishing a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it’s vital to communicate with all parties involved. This clarity helps ensure that the trust serves its intended purpose and meets the family’s financial objectives.

While trusts offer many advantages, there are some disadvantages to consider. A Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children may involve setup costs and administrative requirements that can be complex. Additionally, once assets are placed in a trust, the original owner may lose some control over those assets.

Gifts that qualify for the Generation-Skipping Transfer (GST) annual exclusion include gifts made to a grandchild or to a trust for their benefit. When using a Florida Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it’s crucial to structure these gifts properly. This allows them to qualify for the exclusion and avoid potential GST taxes.