Florida Letter to Report Known Imposter Identity Theft to Other Entities

Description

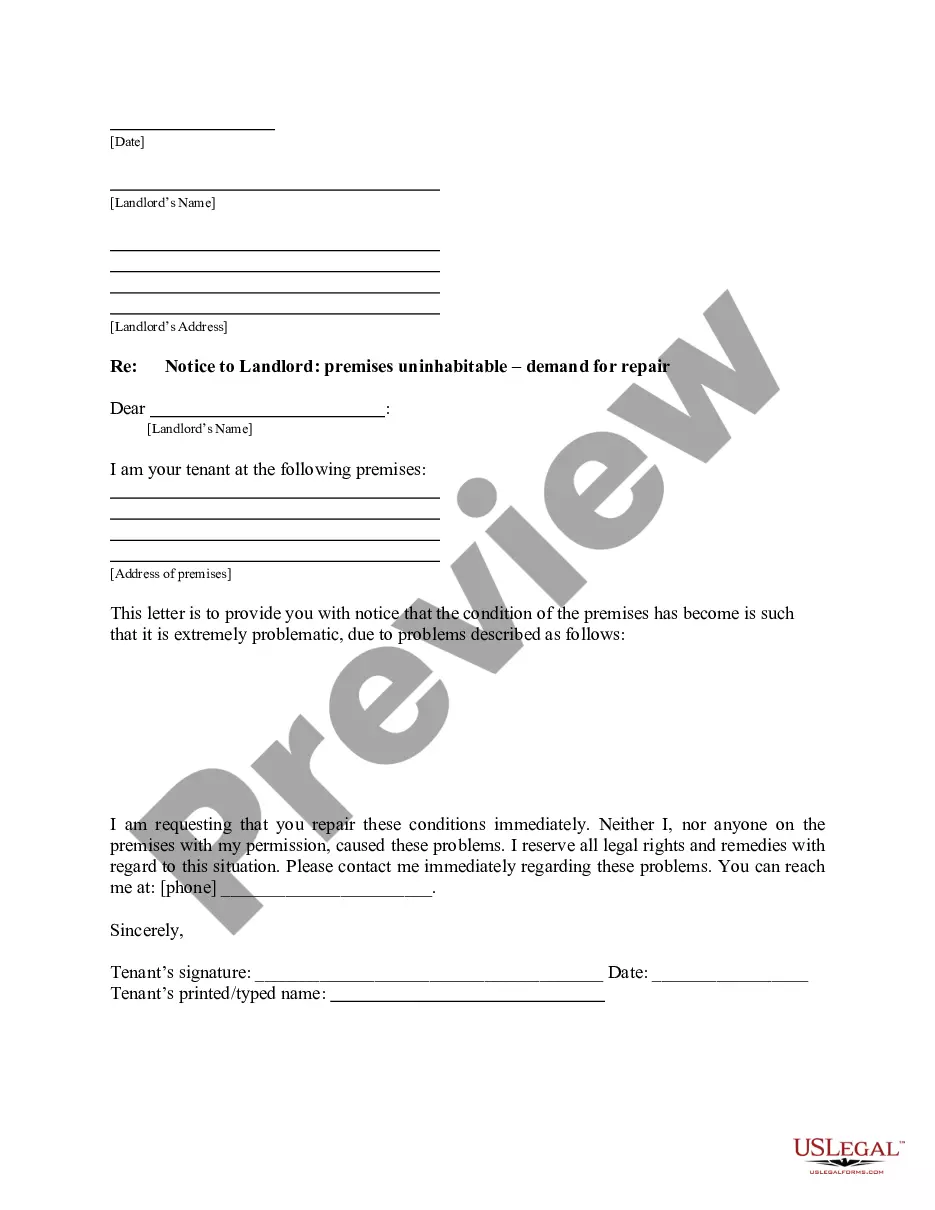

How to fill out Letter To Report Known Imposter Identity Theft To Other Entities?

US Legal Forms - one of many largest libraries of authorized types in the United States - gives a variety of authorized papers templates it is possible to download or print. While using website, you can get a huge number of types for company and specific functions, categorized by categories, says, or keywords.You can find the most up-to-date models of types like the Florida Letter to Report Known Imposter Identity Theft to Other Entities in seconds.

If you have a subscription, log in and download Florida Letter to Report Known Imposter Identity Theft to Other Entities from your US Legal Forms library. The Down load option will show up on each and every kind you perspective. You have access to all in the past downloaded types within the My Forms tab of your accounts.

If you would like use US Legal Forms the very first time, here are straightforward directions to get you started out:

- Make sure you have picked the right kind for your town/county. Click on the Preview option to review the form`s information. Look at the kind explanation to actually have chosen the appropriate kind.

- In the event the kind does not suit your requirements, use the Research industry near the top of the display to discover the one that does.

- Should you be pleased with the form, validate your selection by visiting the Purchase now option. Then, opt for the prices prepare you like and give your accreditations to sign up for the accounts.

- Approach the transaction. Use your credit card or PayPal accounts to finish the transaction.

- Select the formatting and download the form on the system.

- Make modifications. Fill out, edit and print and indicator the downloaded Florida Letter to Report Known Imposter Identity Theft to Other Entities.

Each web template you included in your bank account does not have an expiry time and is also your own forever. So, in order to download or print an additional backup, just proceed to the My Forms section and click on around the kind you want.

Get access to the Florida Letter to Report Known Imposter Identity Theft to Other Entities with US Legal Forms, probably the most extensive library of authorized papers templates. Use a huge number of professional and express-certain templates that meet up with your business or specific requires and requirements.

Form popularity

FAQ

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

The rate of identity theft in Florida is 186 per 100,000 people ? the highest in the country ? with Miami, Fort Lauderdale and West Palm Beach leading the pack. In these areas, the rate was 316 per 100,000 people.

Laws addressing identity theft For example, theft or fraud of at least $5,000 or use of 10 to 20 victim's identities carries a mandatory minimum penalty of 3 years in prison. Theft or fraud in excess of $50,000 or use of 20-30 victim's identities carries a mandatory minimum sentence of 5 years in prison.

Under Florida Statute 817.568(2), a conviction for fraudulent use of personal identification information is a third-degree felony, punishable by up to five years in prison and a $5,000 fine.

Under Florida Statute 817.568, the crime of Fraudulent Use of Personal Identification, more commonly called Identify Fraud, is committed when a person fraudulently uses, or possesses with intent to fraudulently use, the personal identification information of another person without first obtaining that person's consent.

How to report identity theft The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. ... The fraud department at your credit card issuers, bank, and other places where you have accounts.

Identity theft is a serious crime. It occurs when your personal information is stolen and used without your knowledge to commit fraud or other crimes. Identity theft can cost you time and money. It can destroy your credit and ruin your good name.

You can also call 877-438-4338 to report identity theft and get a recovery plan. FLAG YOUR FLORIDA DRIVER'S LICENSE. If you believe that the identity thief has used your personal information to secure a Florida Driver's License or Identification Card, DHSMV will conduct a fraud investigation.