The Florida Agreement and Release for Working at a Novelty Store — Self-Employed is a legal document that outlines the terms and conditions between a self-employed individual and a novelty store in the state of Florida. This agreement serves as a written contract to establish the rights, responsibilities, and obligations of both parties involved. The agreement typically consists of several sections, covering different aspects of the working relationship. Some key components and relevant keywords that may be included are: 1. Parties: Clearly identifies the self-employed individual, who is also known as the contractor, and the novelty store owner or hiring entity. 2. Scope of Work: Describes the specific tasks and responsibilities that the self-employed individual will undertake while working at the novelty store. It may include creating and selling novelty products, managing inventory, customer service, operating cash registers, and promoting the store's merchandise. 3. Duration: States the duration of the agreement, including the start date and the expected end date or the terms of the agreement (e.g., project-based or ongoing). This section may also specify the working hours and days. 4. Compensation: This section outlines the agreed-upon payment structure, including how the self-employed individual will be compensated for their services. Common keywords in this section could be payment terms, rates, commissions, and frequency of payment. 5. Independent Contractor Status: Clarifies that the self-employed individual is not an employee of the novelty store but rather an independent contractor, responsible for managing their own taxes, insurance, and other financial obligations. 6. Confidentiality and Non-Disclosure: Includes provisions that outline the confidentiality of sensitive business information to protect the novelty store's trade secrets, client lists, marketing strategies, and any other confidential materials. 7. Intellectual Property: Governs the ownership and rights associated with any intellectual property developed or used during the course of the self-employed individual's work for the novelty store. This section protects the store's trademarks, copyrights, patents, and trade secrets. 8. Termination: Specifies the circumstances under which either party can terminate the agreement, such as breach of contract, non-performance, or mutual agreement. It may also include procedures for notice period and any potential penalties or liabilities upon termination. Some potential variations or types of Florida Agreement and Release for Working at a Novelty Store — Self-Employed could be— - Short-Term Agreement: A contract with a fixed duration, typically for a specific project or event. — Long-Term Agreement: An ongoing contract with no specified end date, suitable for individuals providing regular services to the novelty store. — Commission-Based Agreement: A contract where the self-employed individual receives compensation based on a percentage of the sales or profits earned through their efforts. — Non-Compete Agreement: A separate clause within the agreement that restricts the self-employed individual from engaging in a similar business or working for a competitor for a specified period after the termination of the contract. It is important to note that the names and specific details of these agreements may vary, and it is advisable to consult legal professionals or utilize template resources to ensure compliance with Florida laws and to tailor the agreement to specific circumstances.

Florida Agreement and Release for Working at a Novelty Store - Self-Employed

Description

How to fill out Florida Agreement And Release For Working At A Novelty Store - Self-Employed?

You might spend hours online searching for the legal form template that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal documents that can be reviewed by specialists.

You can effortlessly obtain or create the Florida Agreement and Release for Working at a Novelty Store - Self-Employed through our services.

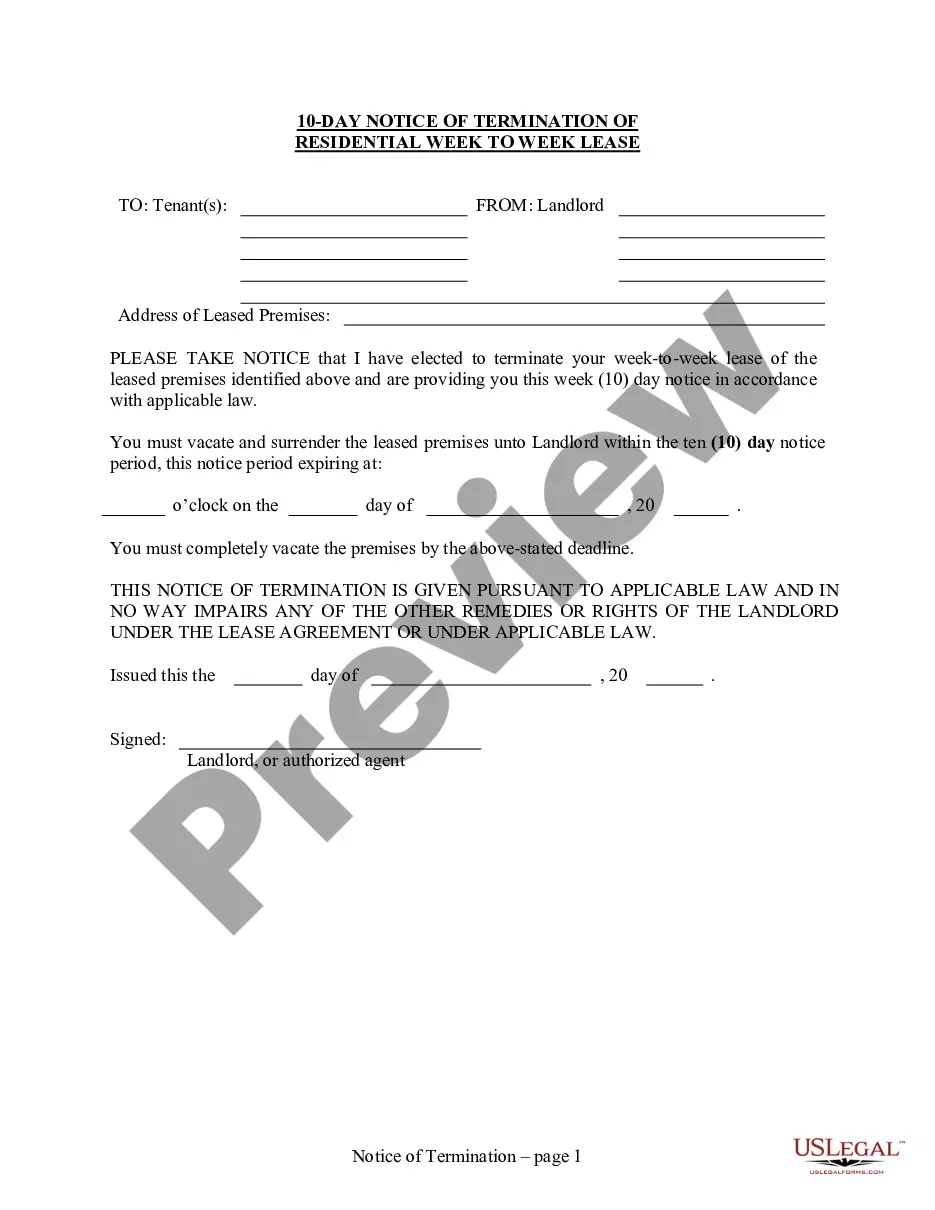

If available, utilize the Preview button to view the document template at the same time.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, generate, or sign the Florida Agreement and Release for Working at a Novelty Store - Self-Employed.

- Every legal document template you acquire is yours to keep permanently.

- To retrieve another copy of a purchased form, visit the My documents section and click on the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple steps below.

- First, ensure that you have selected the correct document template for your county/city of preference.

- Review the form details to ensure you have chosen the correct template.

Form popularity

FAQ

Yes, employment contracts are generally enforceable in Florida, provided they meet certain legal requirements. To ensure enforceability, contracts must be clear, mutual, and supported by consideration. When you create a Florida Agreement and Release for Working at a Novelty Store - Self-Employed, thoroughness and clarity are key to ensuring your agreement stands up in a legal context.

On July 1, 2024, Florida will implement a new law focused on enhancing rights and protections for workers, including provisions that may affect independent contractors. This law aims to address emerging labor issues and adapt to changing work environments. For those drafting a Florida Agreement and Release for Working at a Novelty Store - Self-Employed, this upcoming change will be significant in shaping future agreements.

Florida employment law covers a range of topics, including employee rights, workplace safety, and labor management. These laws shape the relationship between employers and employees or contractors. When creating a Florida Agreement and Release for Working at a Novelty Store - Self-Employed, it's crucial to align your contract with both state regulations and fair practices.

Florida's employment policy emphasizes at-will employment, allowing employers to terminate employees with limited reason. This framework also extends to independent contractors, who should establish clear terms in writing. For anyone utilizing a Florida Agreement and Release for Working at a Novelty Store - Self-Employed, understanding this policy is essential for drafting a fair and comprehensive agreement.

Yes, Florida is designated as a right-to-work (RTW) state. This status means that employment cannot be conditioned upon joining or paying dues to a labor organization. When you create a Florida Agreement and Release for Working at a Novelty Store - Self-Employed, incorporating this aspect can strengthen your agreement by ensuring it respects workers' rights.

The new work law in Florida pertains to several recent legislative changes affecting workers, businesses, and contract agreements. It aims to create more comprehensive guidelines for worker rights, especially for independent contractors. When developing a Florida Agreement and Release for Working at a Novelty Store - Self-Employed, it is important to stay informed of these updates to remain compliant and protect your rights.

In Florida, labor laws primarily govern employee relationships. Independent contractors, however, have a different legal status. As such, they may not have the same protections and rights under Florida labor law. Notably, when it comes to the Florida Agreement and Release for Working at a Novelty Store - Self-Employed, independent contractors should clearly define their terms in agreements to ensure protection.

A contract of service typically refers to an employment arrangement where an individual works under the direction of an employer. In contrast, a contract for services is an agreement where the contractor remains independent and provides specific services without direct oversight. Understanding these distinctions is essential when considering a Florida Agreement and Release for Working at a Novelty Store - Self-Employed, as it helps protect your rights as a contractor or business owner.

Yes, contract work is generally considered self-employment income. When you engage in contract work, you operate as an independent entity rather than as an employee. This means you are responsible for your own taxes and business expenses. Using a Florida Agreement and Release for Working at a Novelty Store - Self-Employed can guide you through the process and clarify your income status.

Employee non-compete agreements can be enforceable in Florida but must meet specific criteria. They should be reasonable in geographic scope and duration to protect legitimate business interests. If you are considering such agreements in the context of the Florida Agreement and Release for Working at a Novelty Store - Self-Employed, it's wise to seek assistance from professionals familiar with Florida law to ensure compliance.