Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document that outlines the mutually agreed terms and conditions for the dissolution and winding up of a partnership in the state of Florida. This agreement is specifically designed for situations where one partner is retiring from the partnership and wishes to sell their interests to one of the remaining partners. In Florida, there are different types of agreements to dissolve and wind up partnerships with sale to partner by retiring partner, each serving specific circumstances: 1. Voluntary Dissolution Agreement: This agreement is used when all partners voluntarily decide to dissolve the partnership and sell the retiring partner's interests. It outlines the terms of the sale and division of assets, liabilities, and profits between the remaining partners. 2. Retirement Agreement: This type of agreement is employed when a partner decides to retire and sell their share to one or more remaining partners. It includes provisions concerning the purchase price, payment terms, and any additional rights or obligations involved in the transaction. 3. Nominal Partnership Agreement: In some cases, partners may form a partnership for a specific project or venture. The Nominal Partnership Agreement allows for the dissolution of the partnership upon the completion of the stated objective or project, usually with a provision for the sale of a retiring partner's interest. Key provisions in a Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner may include: 1. Identity of the Parties: Clearly identify the retiring partner, the purchasing partner(s), and any remaining partners involved in the dissolution and sale. 2. Effective Date: Specify the date from which the dissolution and winding up will take place. 3. Purchase Price: State the agreed-upon purchase price for the retiring partner's interests, including any adjustments, if applicable. 4. Payment Terms: Detail the payment method, installments if any, interest rates, and due dates for the purchase price. 5. Allocation of Assets and Liabilities: Define how the partnership's assets and liabilities will be divided among the remaining partners, including the retiring partner's share. 6. Governing Law: Establish that the agreement will be governed by the laws of the state of Florida. 7. Confidentiality: Include confidentiality clauses to ensure that all parties maintain strict confidentiality regarding the terms and discussions involved in the dissolution and sale. It is important to consult with a qualified attorney experienced in partnership law in Florida to ensure the agreement meets all legal requirements and addresses the specific needs of the retiring partner, purchasing partner(s), and remaining partners.

Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Florida Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

US Legal Forms - one of several biggest libraries of lawful varieties in the United States - offers a wide array of lawful record templates you may download or printing. Utilizing the internet site, you can find a huge number of varieties for business and specific functions, categorized by categories, suggests, or keywords.You will find the newest models of varieties just like the Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner within minutes.

If you have a membership, log in and download Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner in the US Legal Forms local library. The Obtain button will show up on each develop you perspective. You get access to all previously acquired varieties from the My Forms tab of your respective accounts.

If you want to use US Legal Forms the very first time, listed below are straightforward instructions to get you began:

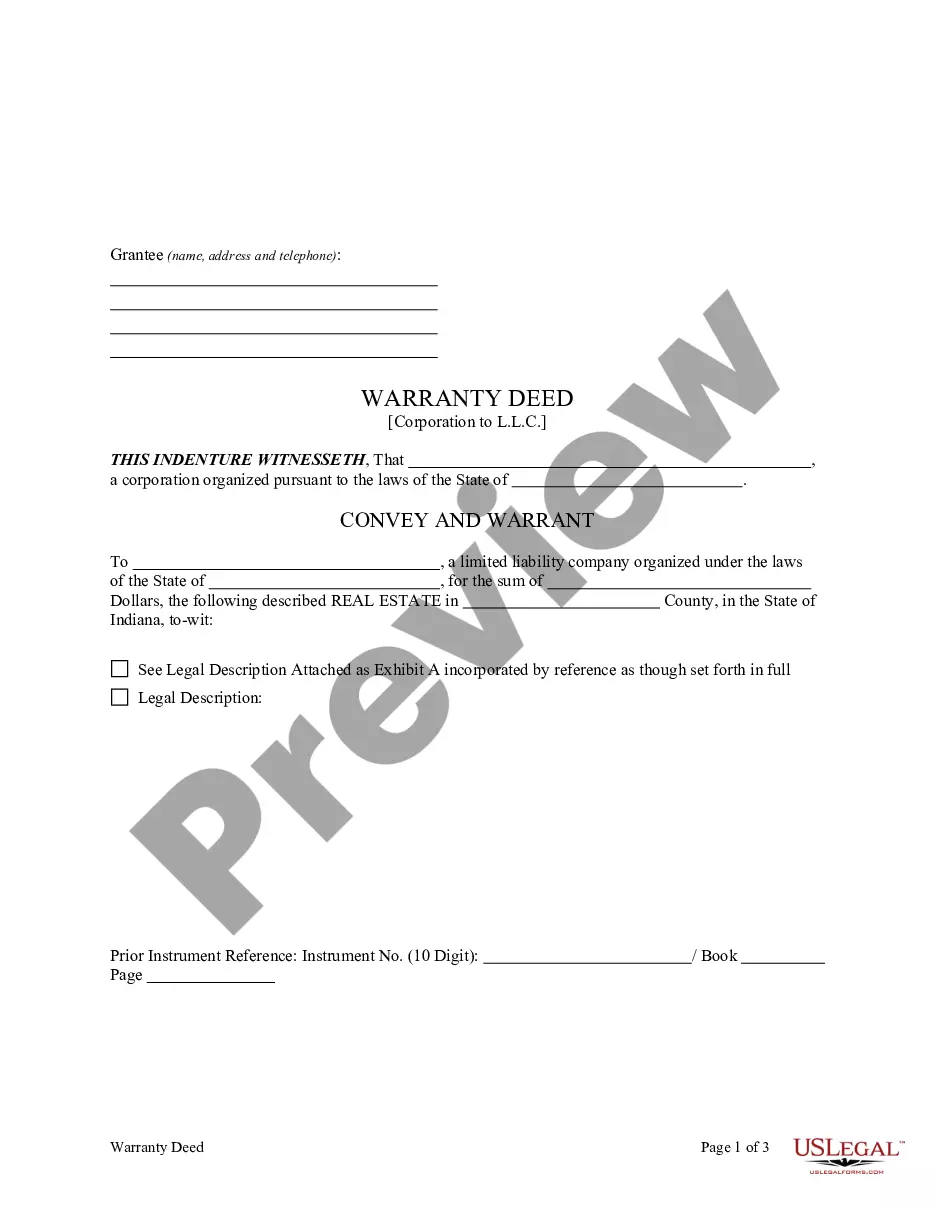

- Make sure you have picked the right develop for your town/area. Click on the Review button to review the form`s information. See the develop outline to ensure that you have selected the appropriate develop.

- When the develop does not suit your needs, utilize the Research field near the top of the monitor to obtain the one which does.

- In case you are happy with the shape, confirm your selection by visiting the Purchase now button. Then, select the prices prepare you like and supply your credentials to sign up to have an accounts.

- Process the purchase. Use your bank card or PayPal accounts to complete the purchase.

- Find the format and download the shape on the system.

- Make modifications. Complete, modify and printing and indicator the acquired Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

Every single format you included with your bank account lacks an expiration date which is your own property eternally. So, if you wish to download or printing another duplicate, just visit the My Forms portion and click in the develop you need.

Get access to the Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner with US Legal Forms, one of the most extensive local library of lawful record templates. Use a huge number of skilled and status-specific templates that satisfy your business or specific needs and needs.