Florida Lease to Own for Commercial Property

Description

How to fill out Lease To Own For Commercial Property?

Are you presently in a role where you require documents for either business or personal use almost daily.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a wide array of templates, including the Florida Lease to Own for Commercial Property, which can be filled out to comply with state and federal regulations.

When you identify the right form, simply click Purchase now.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After logging in, you can download the Florida Lease to Own for Commercial Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the appropriate city/county.

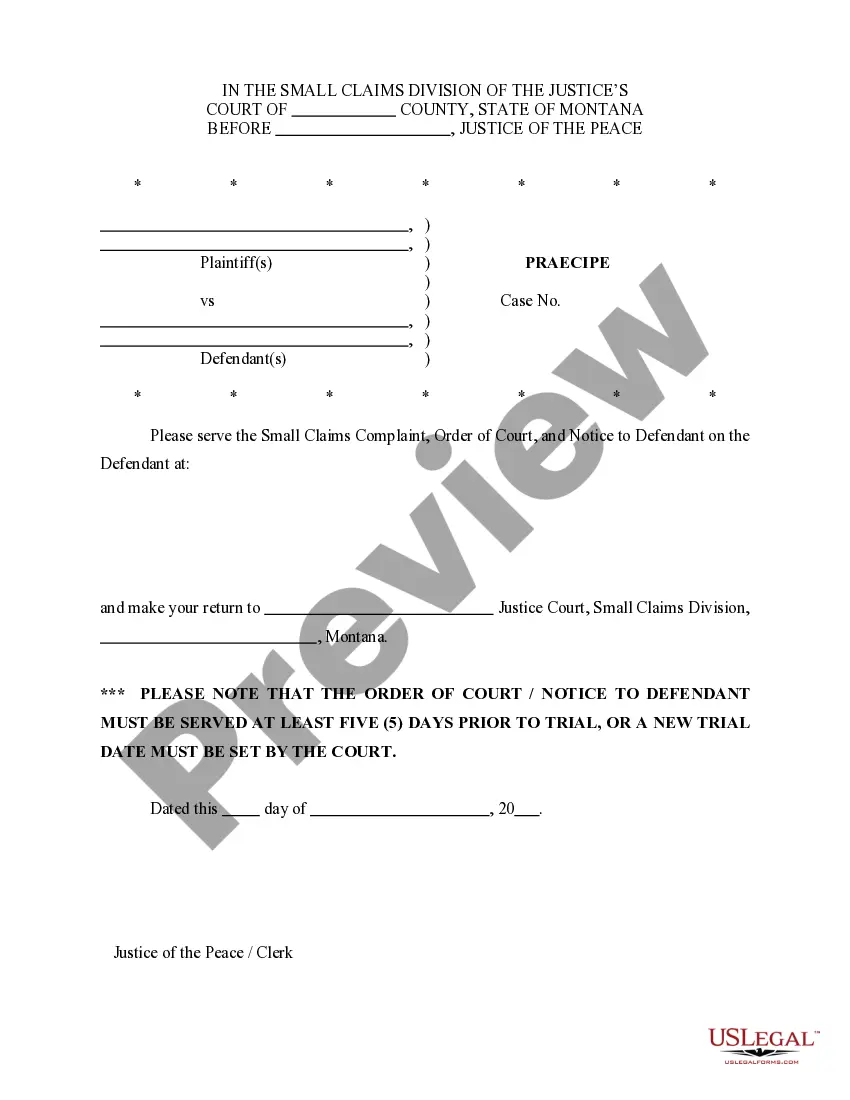

- Use the Review button to examine the form.

- Read the description to confirm that you've chosen the correct form.

- If the form doesn't meet your needs, utilize the Search field to find a form that satisfies your requirements.

Form popularity

FAQ

How long is a typical commercial lease? Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment.

In Florida, residential leases of any duration are acceptable. An oral lease agreement is legal and enforceable for any period of less than one year. Lease agreements that exceed one year are permitted, but they must be in writing to comply with the statutes of fraud concerning property transactions.

In Florida, there is no specific time limit to a residential lease agreement. Both oral and written lease agreements are considered legal and enforceable. Still, any lease agreement that exceeds one year must be in writing.

Florida law requires that any rent to own contract be in writing and signed by both parties. It must include all essential terms before it is signed, and a copy of the signed contract must be delivered to you.

In Florida, under F.S. §725.01, all leases greater than one year are void unless they are in writing. There is an exception to the Statute of Frauds, which can make an oral contract for a commercial lease greater than one year enforceable.

Yes, a contract to lease (or lease agreement) is legally binding in Florida. Both oral and written lease agreements are legal and enforceable in Florida. Written lease agreements must be signed in order to be legally binding, and the landlord must sign the lease in the presence of two witnesses.

How long is a typical commercial lease? Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment.

A Florida rent-to-own lease agreement allows the tenant an option to purchase the property under pre-determined terms. Similar to a standard lease, the landlord will request a financial background check on the tenant. If approved, the landlord will sign a lease and establish the terms for purchasing the property.

Florida law requires that any rent to own contract be in writing and signed by both parties. It must include all essential terms before it is signed, and a copy of the signed contract must be delivered to you.

Both landlords and tenants can terminate a month-to-month lease at any time, as long as they inform the other person in writing at least 15 days before the next rent payment is due. This timeline is much quicker than in other states, which generally require at least a month's notice.