A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

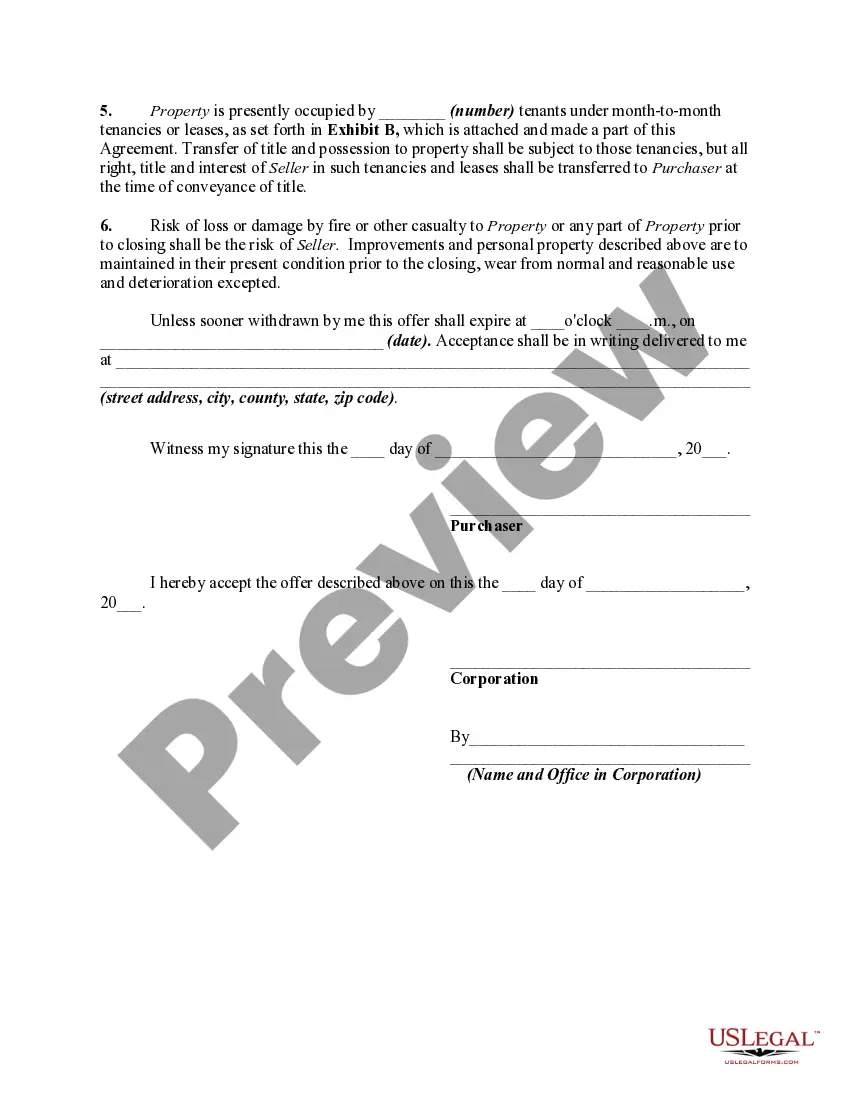

The Florida Offer to Purchase Commercial Property is a legally binding document used in the state of Florida to establish a formal agreement between a buyer and a seller for the purchase of a commercial property. This document outlines the terms and conditions of the transaction, ensuring a seamless and transparent process for all parties involved. The Florida Offer to Purchase Commercial Property consists of several key components, including: 1. Property Description: The document should clearly state the location and legal description of the commercial property being purchased. This information helps to identify and distinguish the property from others in the market. 2. Purchase Price: The offer must specify the agreed-upon purchase price for the commercial property. This amount should be realistic and reflective of the market value and condition of the property. 3. Earnest Money Deposit: The buyer is typically required to provide an earnest money deposit as a sign of good faith and commitment to the transaction. The offer should state the amount of the deposit and how it will be held in escrow until closing. 4. Financing Terms: If the buyer intends to secure a loan to finance the purchase, the offer should outline the financing terms, including the loan amount, interest rate, and any other relevant details. 5. Due Diligence Period: This refers to a specific timeframe granted to the buyer to conduct inspections, investigations, and review necessary documents related to the property. The offer should clearly state the duration of this period and any contingencies related to property inspections or approval of financial information. 6. Closing Date: The document should include a proposed closing date, indicating when the transfer of ownership will occur. This date should allow sufficient time for both parties to complete all necessary tasks and paperwork before finalizing the transaction. 7. Contingencies: Depending on the circumstances, contingency clauses may be included in the offer to protect the buyer's interests. Common contingencies include financing approval, satisfactory property inspections, and the ability to obtain necessary permits or licenses. Additionally, there may be various types of Florida Offer to Purchase Commercial Property, depending on specific circumstances or considerations: 1. Standard Offer: This is the most common type of offer used in commercial real estate transactions. It includes all the essential elements mentioned above, providing a comprehensive framework for the purchase. 2. All-Cash Offer: In some cases, buyers may opt for an all-cash offer, meaning they have sufficient funds to purchase the property without the need for financing. This type of offer can sometimes be more attractive to sellers as it eliminates the uncertainty associated with loan approvals. 3. Lease Option Offer: This type of offer allows the buyer to lease the commercial property for a predetermined period before deciding whether to purchase it at a specified price. Lease option offers can provide flexibility and allow the buyer to evaluate the property's commercial viability before committing to its purchase. In conclusion, the Florida Offer to Purchase Commercial Property is a vital legal document that outlines the terms, conditions, and obligations for both buyers and sellers in commercial property transactions. Its structure and content ensure a smooth and transparent process, safeguarding the interests of all parties involved.The Florida Offer to Purchase Commercial Property is a legally binding document used in the state of Florida to establish a formal agreement between a buyer and a seller for the purchase of a commercial property. This document outlines the terms and conditions of the transaction, ensuring a seamless and transparent process for all parties involved. The Florida Offer to Purchase Commercial Property consists of several key components, including: 1. Property Description: The document should clearly state the location and legal description of the commercial property being purchased. This information helps to identify and distinguish the property from others in the market. 2. Purchase Price: The offer must specify the agreed-upon purchase price for the commercial property. This amount should be realistic and reflective of the market value and condition of the property. 3. Earnest Money Deposit: The buyer is typically required to provide an earnest money deposit as a sign of good faith and commitment to the transaction. The offer should state the amount of the deposit and how it will be held in escrow until closing. 4. Financing Terms: If the buyer intends to secure a loan to finance the purchase, the offer should outline the financing terms, including the loan amount, interest rate, and any other relevant details. 5. Due Diligence Period: This refers to a specific timeframe granted to the buyer to conduct inspections, investigations, and review necessary documents related to the property. The offer should clearly state the duration of this period and any contingencies related to property inspections or approval of financial information. 6. Closing Date: The document should include a proposed closing date, indicating when the transfer of ownership will occur. This date should allow sufficient time for both parties to complete all necessary tasks and paperwork before finalizing the transaction. 7. Contingencies: Depending on the circumstances, contingency clauses may be included in the offer to protect the buyer's interests. Common contingencies include financing approval, satisfactory property inspections, and the ability to obtain necessary permits or licenses. Additionally, there may be various types of Florida Offer to Purchase Commercial Property, depending on specific circumstances or considerations: 1. Standard Offer: This is the most common type of offer used in commercial real estate transactions. It includes all the essential elements mentioned above, providing a comprehensive framework for the purchase. 2. All-Cash Offer: In some cases, buyers may opt for an all-cash offer, meaning they have sufficient funds to purchase the property without the need for financing. This type of offer can sometimes be more attractive to sellers as it eliminates the uncertainty associated with loan approvals. 3. Lease Option Offer: This type of offer allows the buyer to lease the commercial property for a predetermined period before deciding whether to purchase it at a specified price. Lease option offers can provide flexibility and allow the buyer to evaluate the property's commercial viability before committing to its purchase. In conclusion, the Florida Offer to Purchase Commercial Property is a vital legal document that outlines the terms, conditions, and obligations for both buyers and sellers in commercial property transactions. Its structure and content ensure a smooth and transparent process, safeguarding the interests of all parties involved.