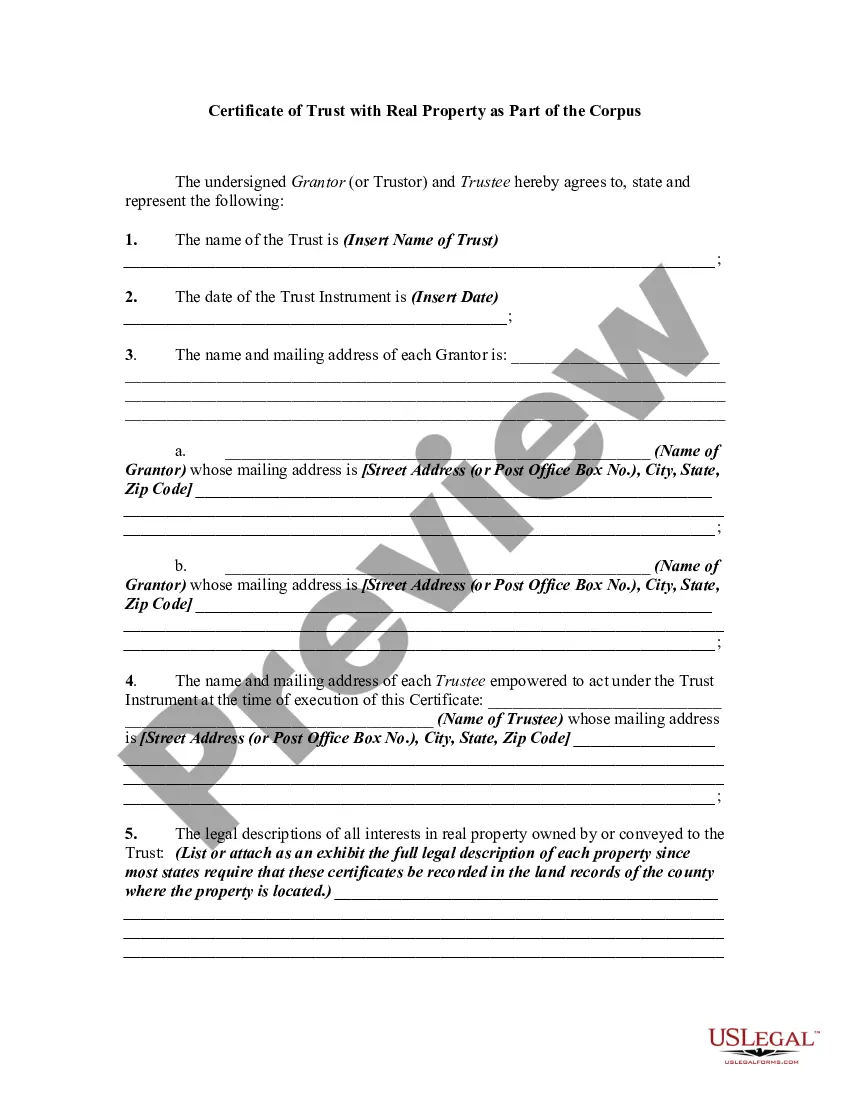

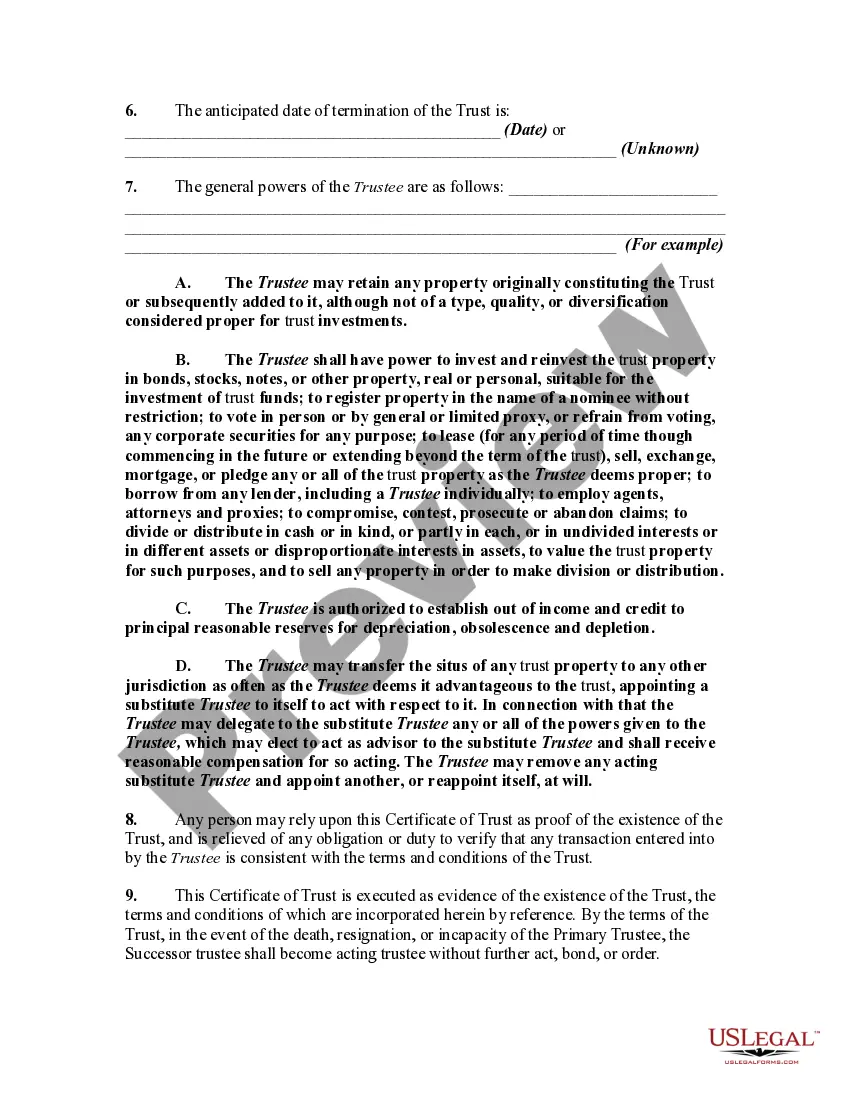

The Florida Certificate of Trust for Successor Trustee is a legal document that serves as evidence of the existence and terms of a trust agreement in the state of Florida. This certificate is commonly used to provide important information to financial institutions, real estate agents, and other parties when a successor trustee takes over the administration of a trust. The Florida Certificate of Trust contains vital details about the trust, such as the name and date of the trust agreement, the name of the initial trustee, and the powers given to the successor trustee. This document also confirms that the trust has not been revoked, modified, or amended in any way that would affect the powers of the successor trustee. Keywords: Florida, Certificate of Trust, Successor Trustee, legal document, trust agreement, evidence, terms, existence, financial institutions, real estate agents, administration, initial trustee, powers, revoked, modified, amended. Different types of Florida Certificates of Trust for Successor Trustee include: 1. Revocable Living Trust Certificate: This type of certificate is used when the trust agreement is revocable, meaning the creator of the trust can modify or terminate it during their lifetime. It grants the successor trustee the authority to manage and distribute assets as outlined in the trust agreement. 2. Irrevocable Trust Certificate: In contrast to a revocable living trust, an irrevocable trust cannot be changed or revoked without the permission of the beneficiaries or a court order. The certificate for this type of trust confirms the trustee's authority to act and carry out the wishes of the granter as stated in the irrevocable trust agreement. 3. Testamentary Trust Certificate: A testamentary trust is established through a person's will and only comes into effect upon their death. The certificate for this type of trust is issued to the successor trustee after the death of the settler, providing them with the authority to manage and distribute assets according to the terms specified in the trust agreement. 4. Special Needs Trust Certificate: This type of trust is designed to provide for the needs of a disabled individual without jeopardizing their eligibility for government benefits. The certificate for a special needs trust allows the successor trustee to administer the trust assets and ensure the beneficiary's needs are met in a manner compliant with the relevant laws and regulations. 5. Charitable Remainder Trust Certificate: A charitable remainder trust allows a donor to provide for their own financial needs during their lifetime while leaving the remaining assets to a charitable organization upon their death. The successor trustee receives the certificate, granting them the authority to oversee the trust's assets and distribute the income to the donor during their lifetime, and subsequently transfer the remaining assets to the designated charity. Keywords: Revocable Living Trust Certificate, Irrevocable Trust Certificate, Testamentary Trust Certificate, Special Needs Trust Certificate, Charitable Remainder Trust Certificate, authority, manage, distribute, revocable, irrevocable, testamentary, special needs, charitable remainder, assets.

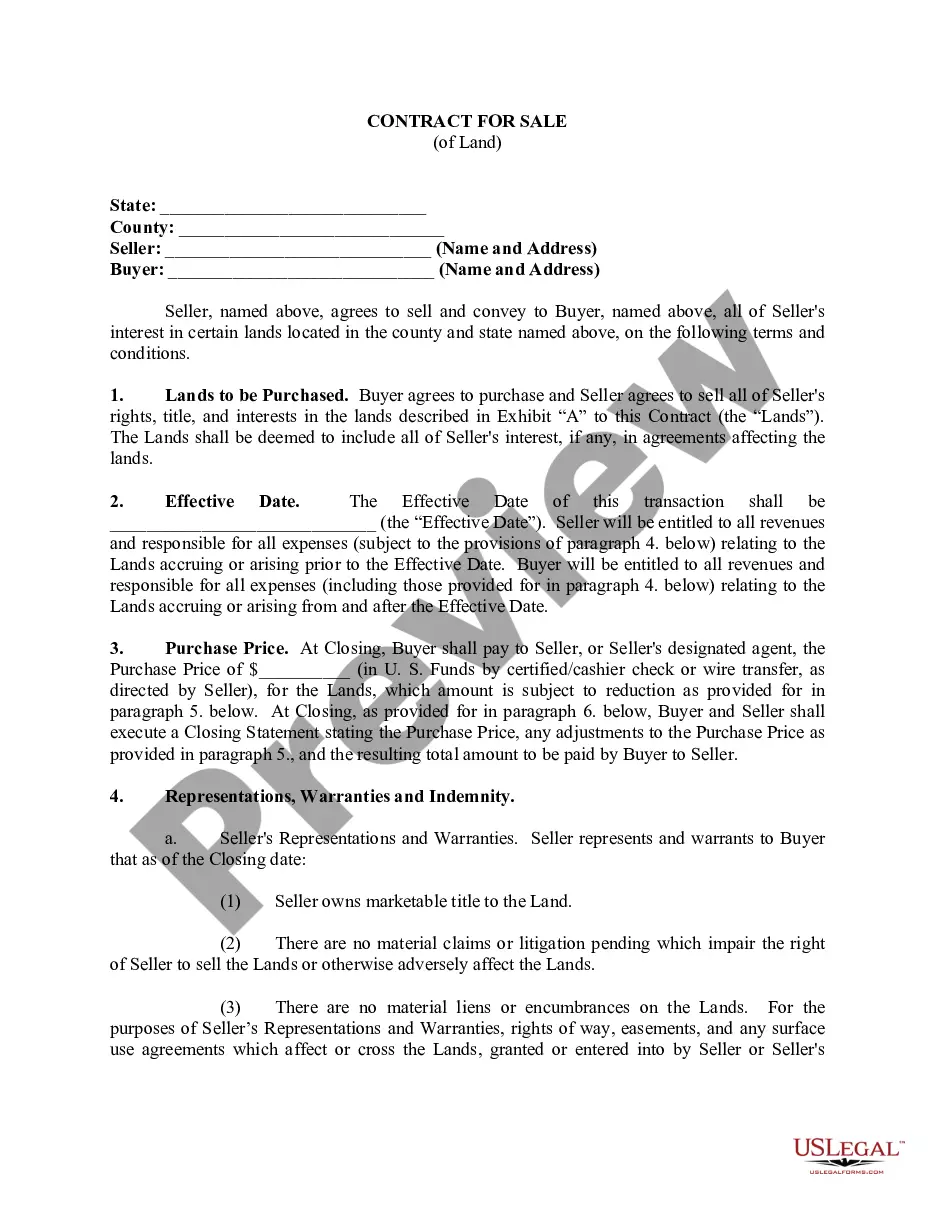

Florida Certificate of Trust for Successor Trustee

Description

How to fill out Florida Certificate Of Trust For Successor Trustee?

If you wish to full, down load, or produce lawful record web templates, use US Legal Forms, the largest assortment of lawful types, which can be found on the Internet. Utilize the site`s simple and hassle-free research to find the documents you want. Various web templates for company and specific reasons are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to find the Florida Certificate of Trust for Successor Trustee in a number of mouse clicks.

When you are presently a US Legal Forms buyer, log in to your bank account and then click the Obtain key to find the Florida Certificate of Trust for Successor Trustee. Also you can entry types you formerly acquired in the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the correct city/region.

- Step 2. Make use of the Review solution to look through the form`s content material. Do not overlook to see the description.

- Step 3. When you are not happy with all the type, take advantage of the Research area on top of the monitor to discover other variations from the lawful type template.

- Step 4. Upon having located the form you want, select the Acquire now key. Select the prices prepare you prefer and put your qualifications to sign up to have an bank account.

- Step 5. Approach the deal. You should use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Choose the structure from the lawful type and down load it on your own gadget.

- Step 7. Full, modify and produce or indication the Florida Certificate of Trust for Successor Trustee.

Every lawful record template you get is your own property eternally. You possess acces to each type you acquired with your acccount. Go through the My Forms area and decide on a type to produce or down load again.

Contend and down load, and produce the Florida Certificate of Trust for Successor Trustee with US Legal Forms. There are many expert and status-particular types you can utilize for the company or specific requires.