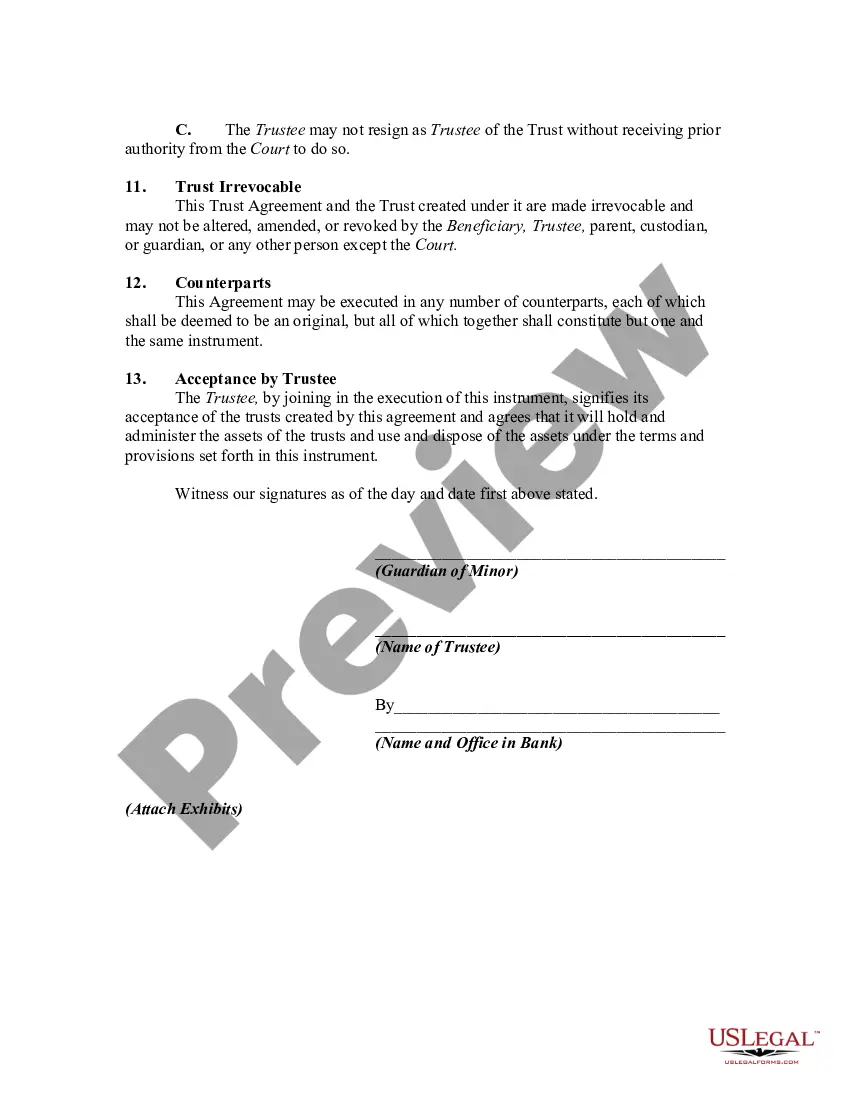

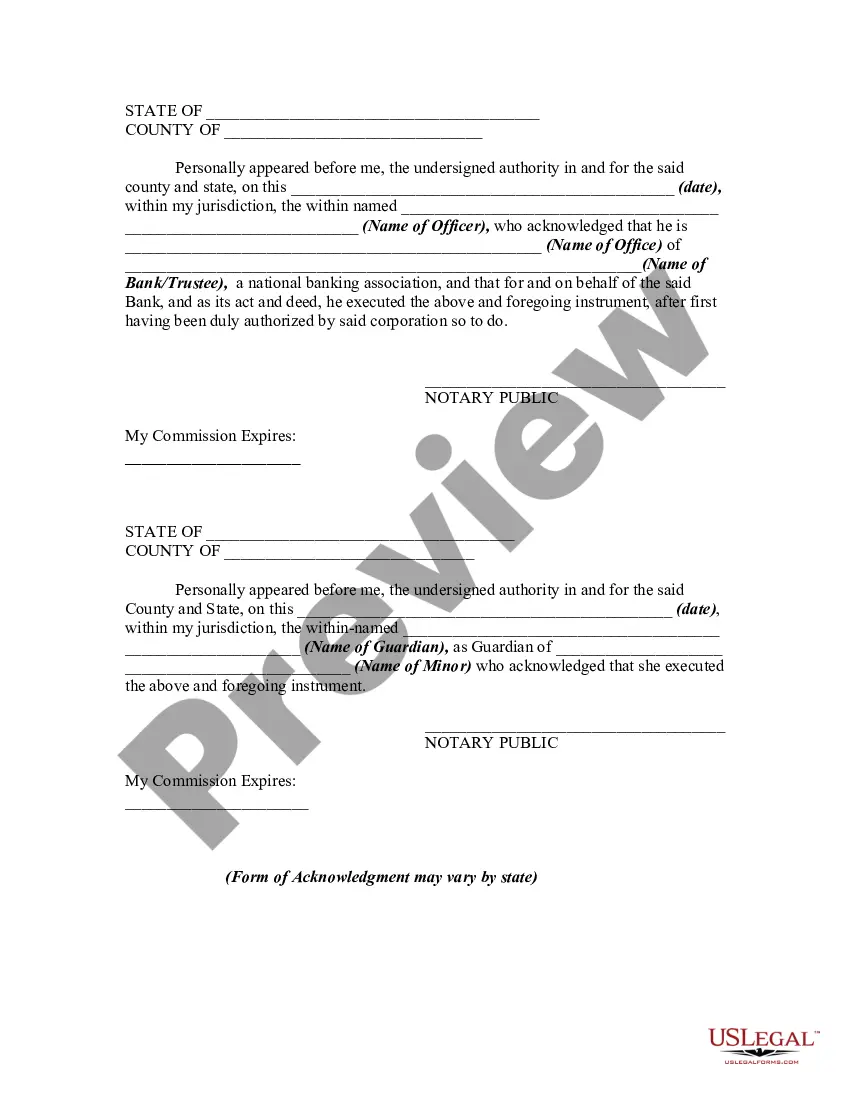

A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. This form is an example of a trust that is subject to direct court oversight since the initial trust funds resulted from a civil judgment in favor of a minor.

A Florida Trust Agreement for Funds for Recovery of Judgment for Minor is a legally binding document that outlines the management and distribution of funds awarded to a minor in a successful legal judgment. This type of trust agreement is specifically designed to protect the rights and ensure the financial well-being of a minor who has won a judgment in a court case. It serves as an effective tool for safeguarding the minor's interests and ensuring that their award is appropriately managed until they reach the age of majority. The Florida Trust Agreement for Funds for Recovery of Judgment for Minor encompasses various key components, including the identification of the minor involved, details of the judgment, and specific guidelines for the trust administration. It is crucial to collaborate with an experienced attorney well-versed in the legal intricacies of Florida trust law to draft a comprehensive and robust agreement. There are different types of Florida Trust Agreement for Funds for Recovery of Judgment for Minor, each tailored to specific circumstances. Some common variations include: 1. Revocable Trust Agreement: This type of trust allows for modifications to be made during the minor's lifetime, ensuring flexibility in managing the funds while providing protection. 2. Irrevocable Trust Agreement: In contrast to the revocable trust, the irrevocable trust cannot be altered or revoked once established. This type offers greater asset protection but limits flexibility. 3. Third-Party Trust Agreement: This agreement involves the appointment of a third party, such as a parent or guardian, to manage the funds on behalf of the minor. The appointed individual carries the fiduciary responsibility of ensuring appropriate utilization of the funds until the minor reaches' adulthood. 4. Special Needs Trust Agreement: If the minor has a disability or special needs, a special needs trust can be established to manage the funds while protecting the minor's eligibility for government assistance programs. 5. Pooled Trust Agreement: This type of trust involves pooling funds from multiple beneficiaries into a single trust managed by a non-profit organization. It offers administrative convenience and cost-sharing benefits. It is essential to consult with legal professionals who specialize in trusts and estates to determine the most suitable type of Florida Trust Agreement for Funds for Recovery of Judgment for Minor based on the specific circumstances. With proper guidance and a well-drafted agreement, the interests of the minor can be safeguarded, ensuring the effective utilization and protection of their awarded funds.