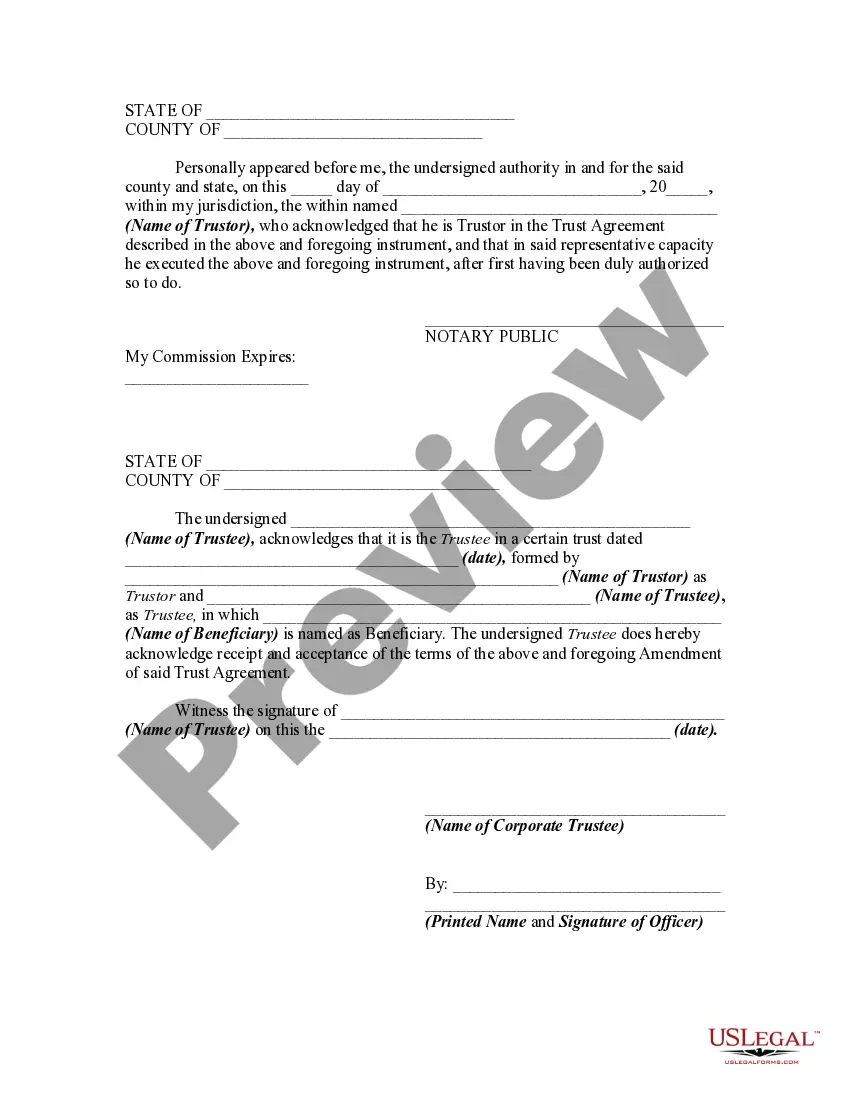

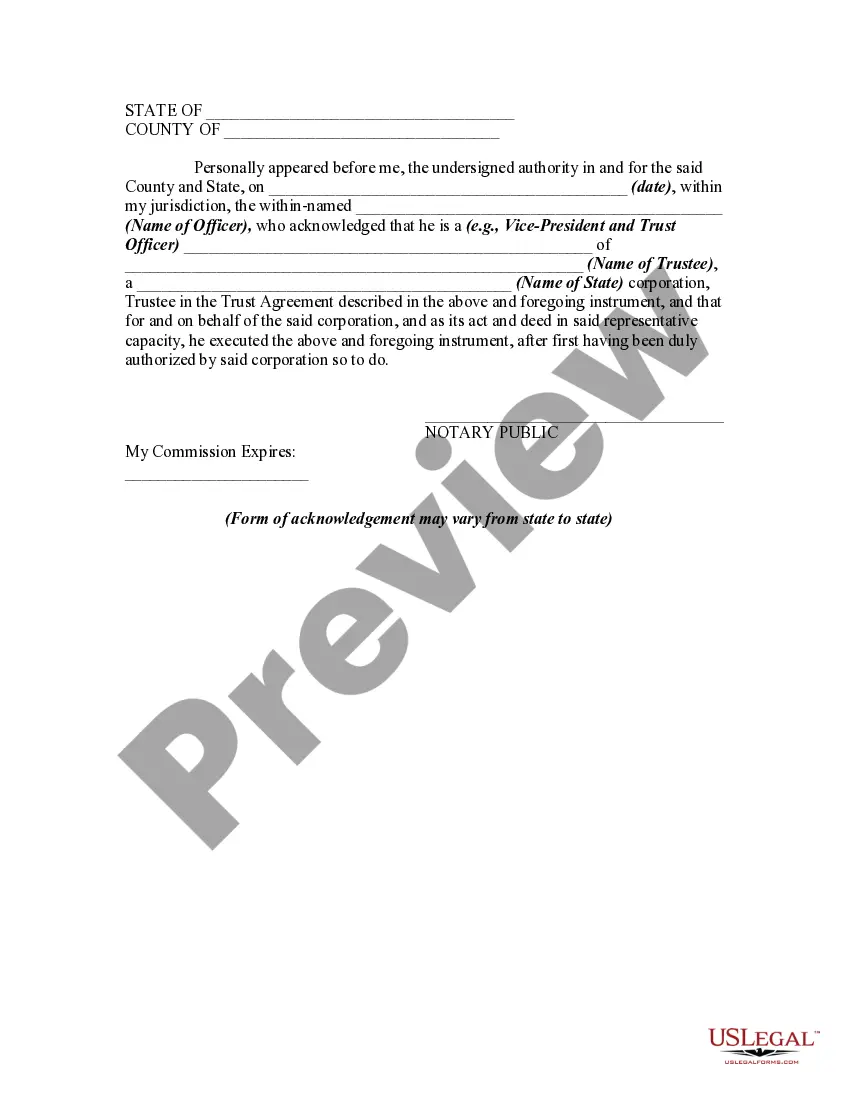

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to add property to the trust. This form is a sample of a trustor amending the trust agreement in order to add property to the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Amendment to Trust Agreement in Order to Add Property from Inter Vivos Trust and Consent of Trustee In the state of Florida, an Amendment to Trust Agreement in order to add property from an Inter Vivos Trust and the consent of the Trustee is a legal document that allows for the modification of an existing trust agreement to include additional assets or property from an inter vivos trust. This amendment ensures that any new property acquired by the trust can be properly managed and distributed according to the original intentions outlined in the trust agreement. There are several types of Florida Amendments to Trust Agreement in Order to Add Property from Inter Vivos Trust and Consent of Trustee, including: 1. Amendment to Supplemental Needs Trust Agreement: This type of amendment is used when adding property from an inter vivos trust to a supplemental needs trust. A supplemental needs trust is established for the benefit of a disabled individual, allowing them to maintain eligibility for government benefits while still receiving additional financial support from the trust. 2. Amendment to Revocable Living Trust Agreement: This amendment is employed when incorporating property from an inter vivos trust into a revocable living trust. A revocable living trust is a popular estate planning tool that allows the granter to retain control over their assets during their lifetime, while providing for the seamless transfer of those assets to beneficiaries upon their passing. 3. Amendment to Charitable Remainder Trust Agreement: If property from an inter vivos trust is intended to be transferred to a charitable remainder trust, this type of amendment is utilized. A charitable remainder trust enables individuals to donate assets to a charity while retaining an income stream from the trust during their lifetime or a specified period, after which the remaining assets are distributed to the designated charitable organization. 4. Amendment to Family Trust Agreement: This amendment is utilized when adding property from an inter vivos trust to a family trust. Family trusts are established to provide for the financial needs of family members, including children or grandchildren, while allowing the granter to maintain control over the assets during their lifetime and ensuring proper distribution upon their passing. The process of executing a Florida Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the Trustee involves careful consideration of the specific terms outlined in the original trust agreement, as well as compliance with Florida state laws and regulations regarding trust modifications. It is advisable to consult with an experienced estate planning attorney to ensure that the amendment is drafted accurately and in accordance with all legal requirements. Keywords: Florida, Amendment to Trust Agreement, Add Property, Inter Vivos Trust, Consent of Trustee, Supplemental Needs Trust, Revocable Living Trust, Charitable Remainder Trust, Family Trust, Estate Planning, Legal Document, Estate Planning Attorney.Florida Amendment to Trust Agreement in Order to Add Property from Inter Vivos Trust and Consent of Trustee In the state of Florida, an Amendment to Trust Agreement in order to add property from an Inter Vivos Trust and the consent of the Trustee is a legal document that allows for the modification of an existing trust agreement to include additional assets or property from an inter vivos trust. This amendment ensures that any new property acquired by the trust can be properly managed and distributed according to the original intentions outlined in the trust agreement. There are several types of Florida Amendments to Trust Agreement in Order to Add Property from Inter Vivos Trust and Consent of Trustee, including: 1. Amendment to Supplemental Needs Trust Agreement: This type of amendment is used when adding property from an inter vivos trust to a supplemental needs trust. A supplemental needs trust is established for the benefit of a disabled individual, allowing them to maintain eligibility for government benefits while still receiving additional financial support from the trust. 2. Amendment to Revocable Living Trust Agreement: This amendment is employed when incorporating property from an inter vivos trust into a revocable living trust. A revocable living trust is a popular estate planning tool that allows the granter to retain control over their assets during their lifetime, while providing for the seamless transfer of those assets to beneficiaries upon their passing. 3. Amendment to Charitable Remainder Trust Agreement: If property from an inter vivos trust is intended to be transferred to a charitable remainder trust, this type of amendment is utilized. A charitable remainder trust enables individuals to donate assets to a charity while retaining an income stream from the trust during their lifetime or a specified period, after which the remaining assets are distributed to the designated charitable organization. 4. Amendment to Family Trust Agreement: This amendment is utilized when adding property from an inter vivos trust to a family trust. Family trusts are established to provide for the financial needs of family members, including children or grandchildren, while allowing the granter to maintain control over the assets during their lifetime and ensuring proper distribution upon their passing. The process of executing a Florida Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the Trustee involves careful consideration of the specific terms outlined in the original trust agreement, as well as compliance with Florida state laws and regulations regarding trust modifications. It is advisable to consult with an experienced estate planning attorney to ensure that the amendment is drafted accurately and in accordance with all legal requirements. Keywords: Florida, Amendment to Trust Agreement, Add Property, Inter Vivos Trust, Consent of Trustee, Supplemental Needs Trust, Revocable Living Trust, Charitable Remainder Trust, Family Trust, Estate Planning, Legal Document, Estate Planning Attorney.