In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

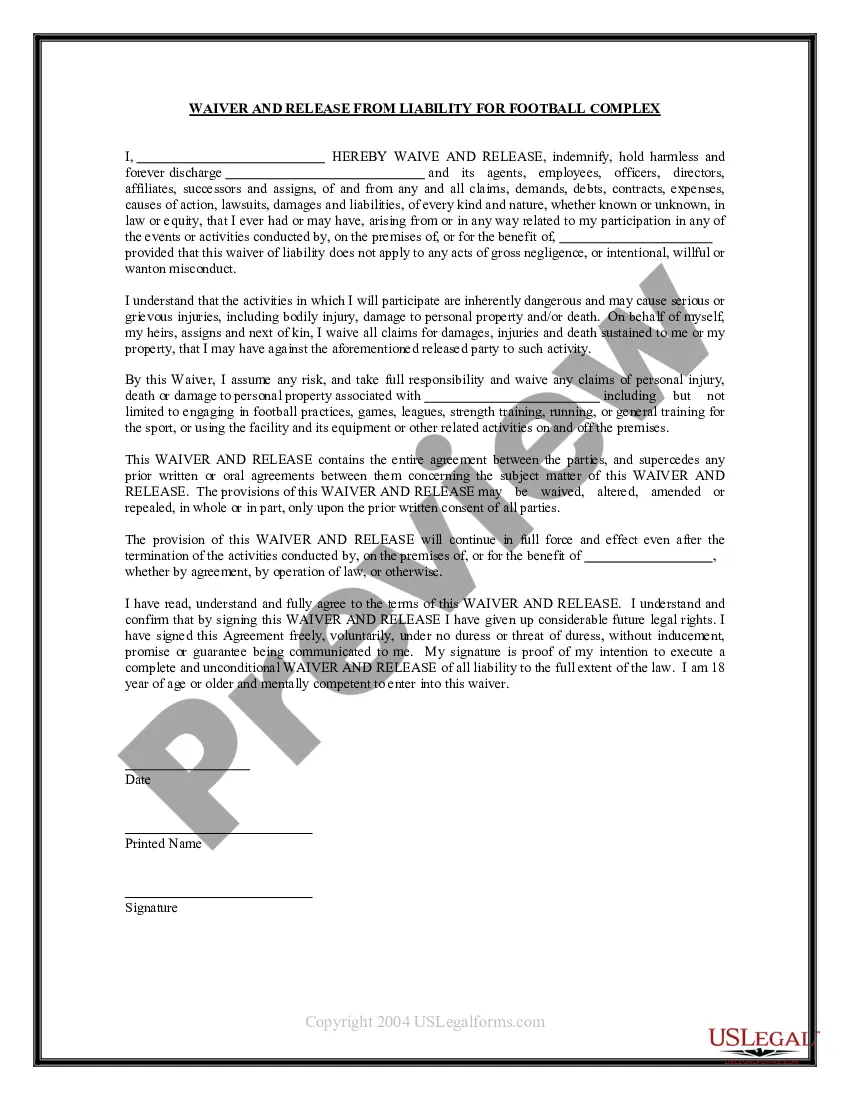

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

It is feasible to spend time online attempting to locate the permissible document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can easily obtain or generate the Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary from their service.

Check the form description to confirm you have selected the appropriate form. If available, use the Preview option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- Next, you can fill out, modify, generate, or sign the Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents section and click the appropriate option.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for the state or city of your choice.

Form popularity

FAQ

To remove a trustee in Florida, you generally need to demonstrate valid reasons, such as failure to comply with the trust terms or misconduct. The process may involve filing a petition in the appropriate court to seek a Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. Consulting legal resources or using services like US Legal Forms can streamline this process and help you navigate the legal system efficiently. Taking action ensures that your trust operates as intended.

In Florida, beneficiaries are entitled to receive information about the trust, which typically includes a copy of the trust document. This ensures that beneficiaries understand their rights and the terms of the Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. It is vital for beneficiaries to be informed about the trust's provisions and their roles. If you have further questions regarding trust documents, consider using platforms like US Legal Forms for guidance.

To shut down a trust, the trustee must follow formal steps that typically involve completing a termination process. This includes ensuring all obligations are fulfilled, notifying beneficiaries, and completing the Florida Termination of Trust By Trustee. Once these steps are in place, beneficiaries can then acknowledge receipt of their trust funds. Using USLegalForms can simplify this process, providing you with reliable templates and guidance throughout.

A receipt of a beneficiary of a trust serves as proof that the beneficiary has received their share of the trust's assets. This document is vital during the Florida Termination of Trust By Trustee process, as it ensures all parties confirm the distribution occurs correctly. It acts as a safeguard for both the trustee and the beneficiaries, establishing a clear record of transactions. Utilizing our services at USLegalForms can help you generate the necessary documentation efficiently.

A trust can become void if it lacks legal requirements, such as having no identifiable beneficiaries or a clearly defined purpose. Additionally, if the terms of the trust violate public policy or law, it may be deemed invalid. Understanding the nuances of what constitutes a void trust is crucial, especially regarding the Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. If you face challenges, consider seeking guidance from our platform, USLegalForms, for tailored assistance.

A common example of a termination of a trust occurs when the trust's purpose has been fulfilled, such as when the beneficiaries receive their designated shares. In such cases, the Florida Termination of Trust By Trustee is necessary to legally conclude the trust. By executing this process, the trustee officially relinquishes control, allowing beneficiaries to acknowledge receiving their trust funds. This not only simplifies financial management but also ensures clarity for all parties involved.

Terminating a trust in Florida generally requires the agreement of all beneficiaries and the trustee. Beneficiaries need to explore the trust document, which may outline the procedures for termination. If the trust is revocable, the creator can simply revoke it, but in irrevocable cases, beneficiaries may need to go to court. Understanding the process is crucial, and US Legal Forms provides essential tools for beneficiaries looking to manage Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

Yes, beneficiaries can remove a trustee in Florida under certain conditions. Typically, beneficiaries must demonstrate that the trustee is not fulfilling their duties or acting in the best interests of the trust. The process usually involves filing a petition in court, where the beneficiaries can present their case. Seeking guidance from resources like US Legal Forms can help beneficiaries navigate the Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary effectively.

A trust can be terminated in three primary ways: through fulfillment of its purpose, by the terms specified in the trust document, or by mutual consent of the settlor and beneficiaries. Each method requires careful planning and communication among those involved. Addressing these options through the lens of the Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary will ensure clarity and compliance.

A trustee terminates a trust by following the provisions in the trust document, oftentimes requiring beneficiaries to acknowledge receipt of their distributions. This procedure might also need the trustee to file specific documents with the court. Ensure compliance with the regulations surrounding the Florida Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary to avoid complications.