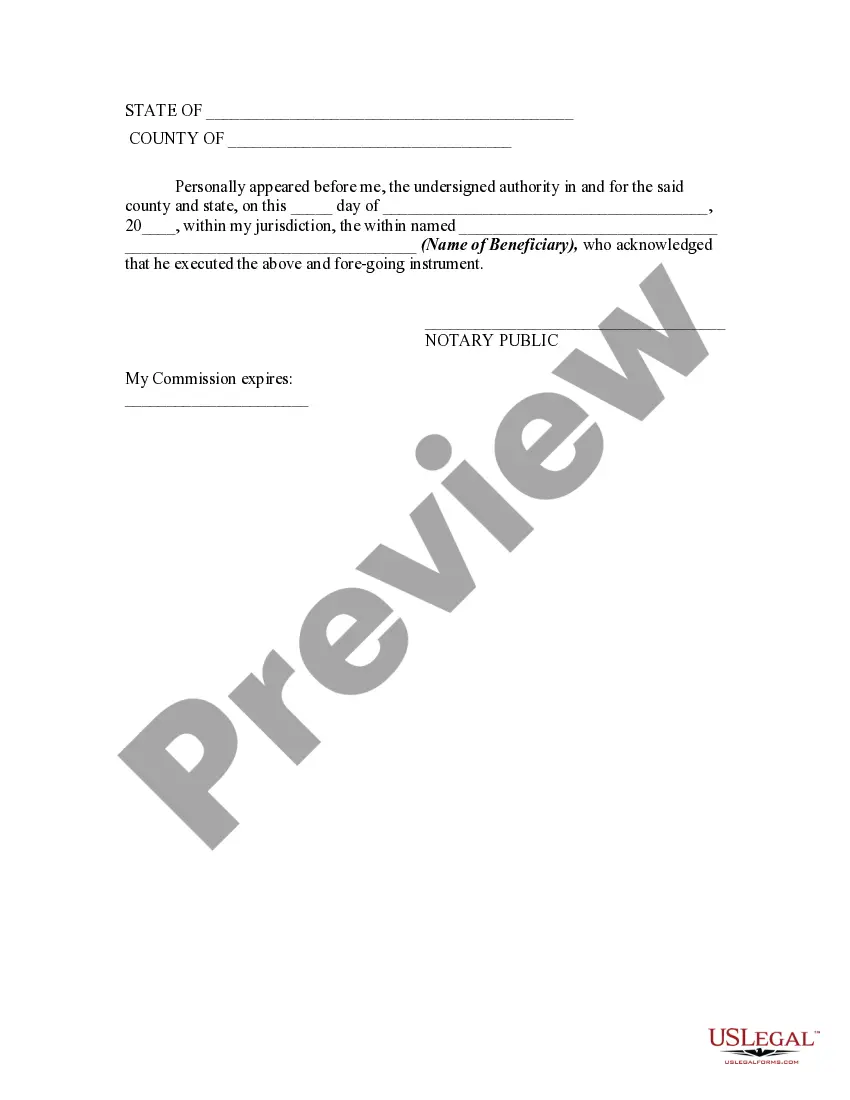

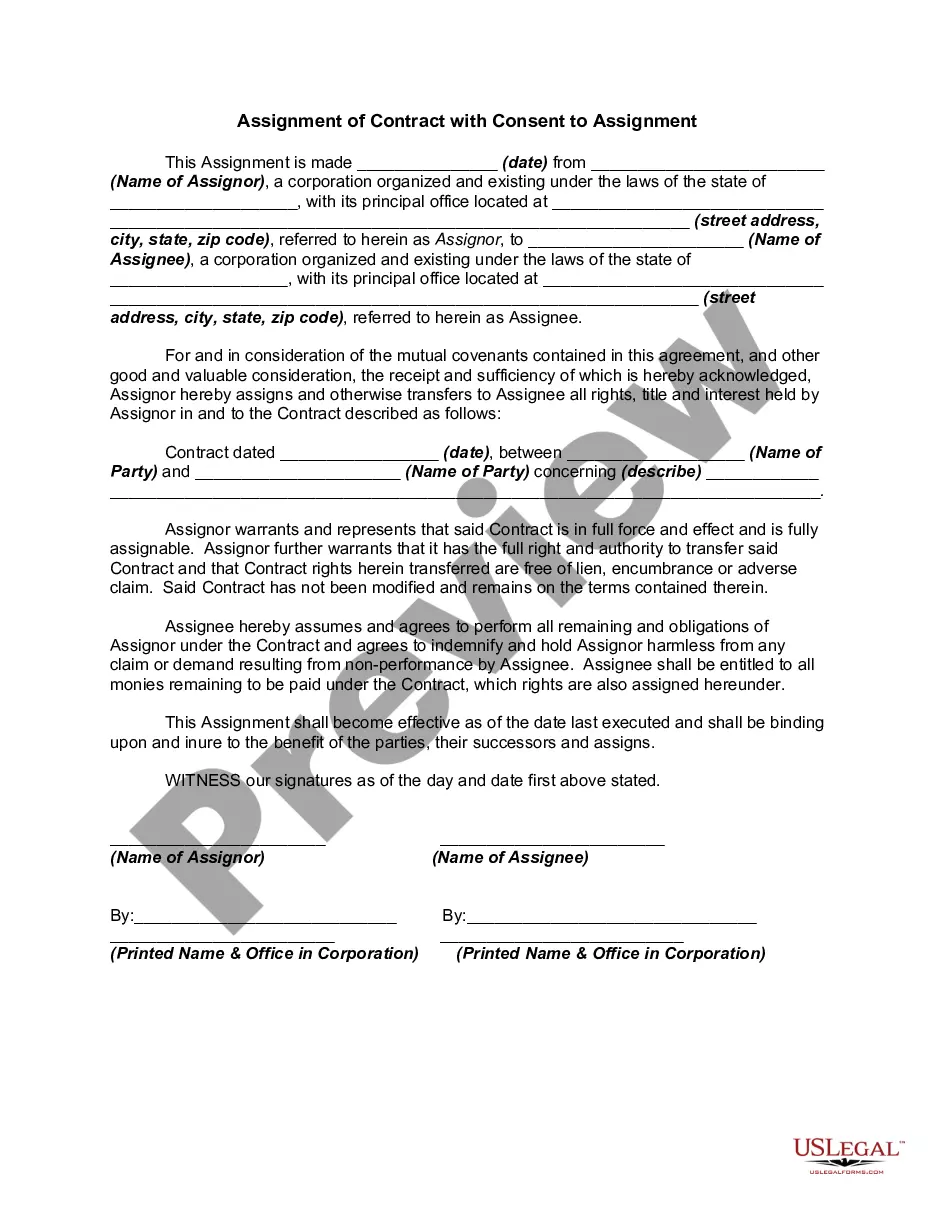

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

If you wish to be thorough, download, or print authentic template documents, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the website's straightforward and convenient search to find the documents you need.

A range of templates for business and personal purposes are categorized by type and location, or keywords. Use US Legal Forms to obtain the Florida Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary with just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Florida Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary. You can even retrieve forms you previously downloaded from the My documents section of your account.

Every legal document template you purchase is yours forever. You can access each form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Florida Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

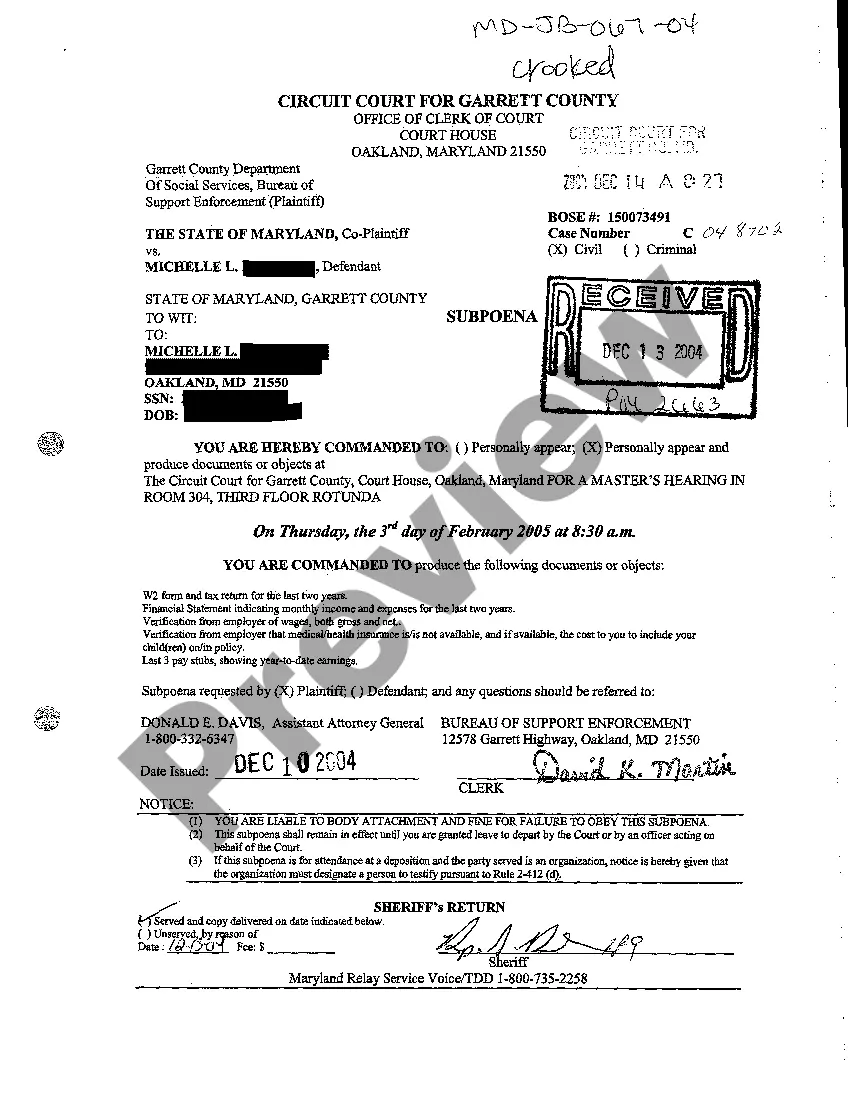

- Step 1. Verify that you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Florida Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

Form popularity

FAQ

Filling out a beneficiary designation form requires careful attention to detail. Start by gathering all necessary details about the beneficiaries, including full names and contact information. Then, when completing the Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, ensure you provide accurate data to prevent legal issues later on. If you need assistance, platforms like US Legal Forms offer valuable resources and guidance tailored to simplify this process.

One major mistake parents often make when creating a trust fund is failing to clearly outline the roles and responsibilities of beneficiaries. Without clear instructions, conflicts can arise, hindering the trust's purpose. Moreover, neglecting to update the Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can result in outdated information, which may lead to unintended outcomes. It’s crucial to regularly review and adjust the trust to reflect changes in family circumstances.

In Florida, a beneficiary typically does not override a will. A will dictates how assets are distributed at death, while a trust can manage assets during a person's lifetime and specify different terms for beneficiaries. However, when a Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is used, it may affect the distribution process. For clarity and legal support regarding your estate planning, consider using USLegalForms for accurate documentation.

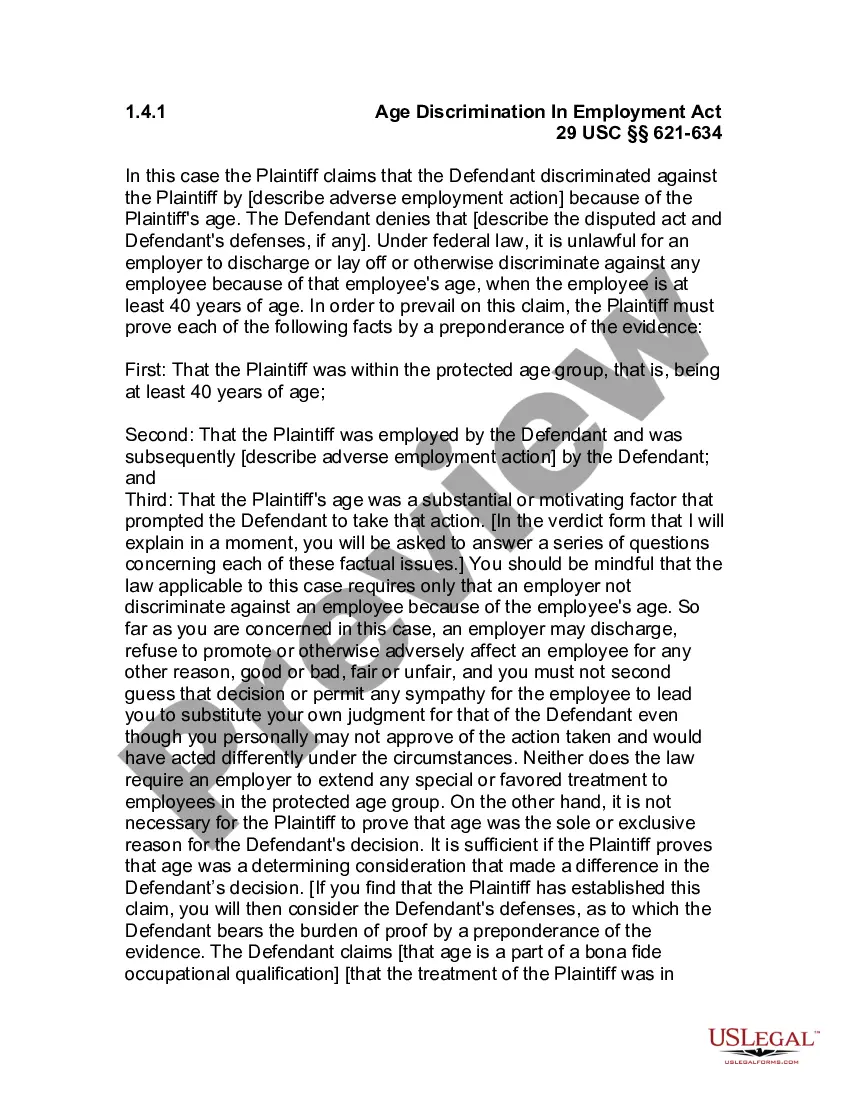

In Florida, a qualified beneficiary of a trust typically includes individuals who are current beneficiaries of the trust, as well as those who may become beneficiaries in the future. This means anyone who has an immediate right to receive benefits from the trust or has the potential to benefit later. Understanding the status of qualified beneficiaries is crucial when dealing with a Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. If you need assistance with trust documents, USLegalForms offers reliable templates and resources.

A beneficial interest in Florida represents the right to benefit from the assets held by a trust. This interest allows beneficiaries to receive distributions, such as income or principal, according to the trust's provisions. It is essential for beneficiaries to know their rights regarding this interest. You can find forms and information on our platform to help navigate beneficial interests in trust setups effectively.

A qualified beneficiary in Florida refers to an individual or entity that is entitled to receive benefits from the trust. This includes current beneficiaries and those who would receive benefits if the trust terminated. Understanding who qualifies as a beneficiary is vital, as it affects rights to information and potential distributions. Our tools help clarify the relationship and rights of qualified beneficiaries within trust structures.

In Florida, a trust may be required to file a tax return depending on its type and income. Generally, irrevocable trusts with taxable income must file a federal income tax return, which could also necessitate a Florida state return. The rules can vary, and it is advisable for trustees to consult tax professionals for specific guidance. Our platform provides resources that can assist you in understanding your tax obligations as a trustee.

Yes, a beneficiary can assign their interest in a trust, which is commonly referred to as a Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. This assignment allows beneficiaries to transfer their rights and benefits to another party. However, it is essential to follow the trust’s terms and the applicable laws to ensure the assignment is valid. You may consider using our platform to create the necessary documentation for this process.

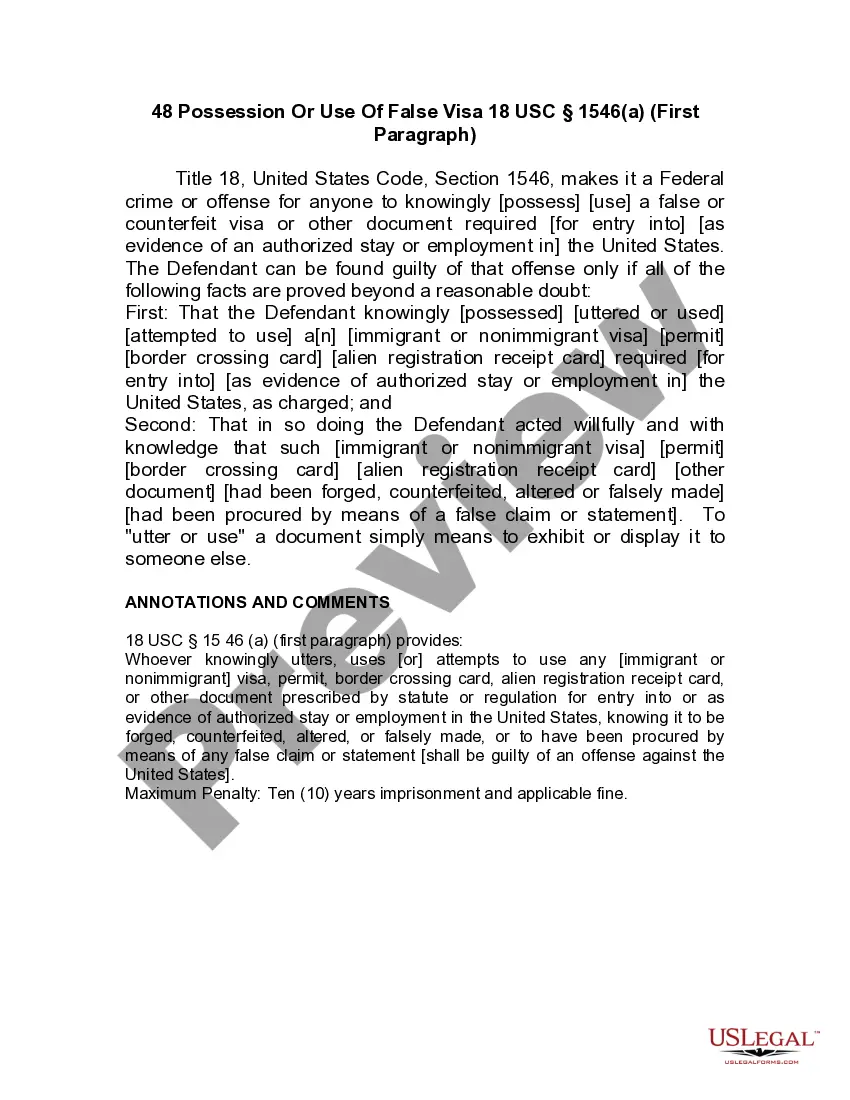

Florida Statute 739.104 focuses on the rights and obligations of trustees and beneficiaries in trust arrangements. This statute delineates how income and principal are distributed among beneficiaries, ensuring fair management of trust assets. For anyone involved in trust administration, especially in cases of Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, understanding this statute is vital for protecting beneficiaries’ rights.

In Florida, you cannot use excessive force to remove a trespasser from your property. Although property owners have the right to defend their property, the response must be reasonable and proportionate to the trespass. If you find yourself in a legal dispute involving a trespasser, legal resources like the Florida Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help manage any claims related to property and assets.