An open account is an account based on continuous dealing between the parties, which has not been closed, settled or stated, and which is kept open with the expectation of further transactions. An open account is created when the parties intend that the individual items of the account will not be considered independently, but as a connected series of transactions. In addition, the parties must intend that the account will be kept open and subject to a shifting balance as additional related entries of debits and credits are made, until either party decides to settle and close the account. This form is a complaint against a guarantor of such an account.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

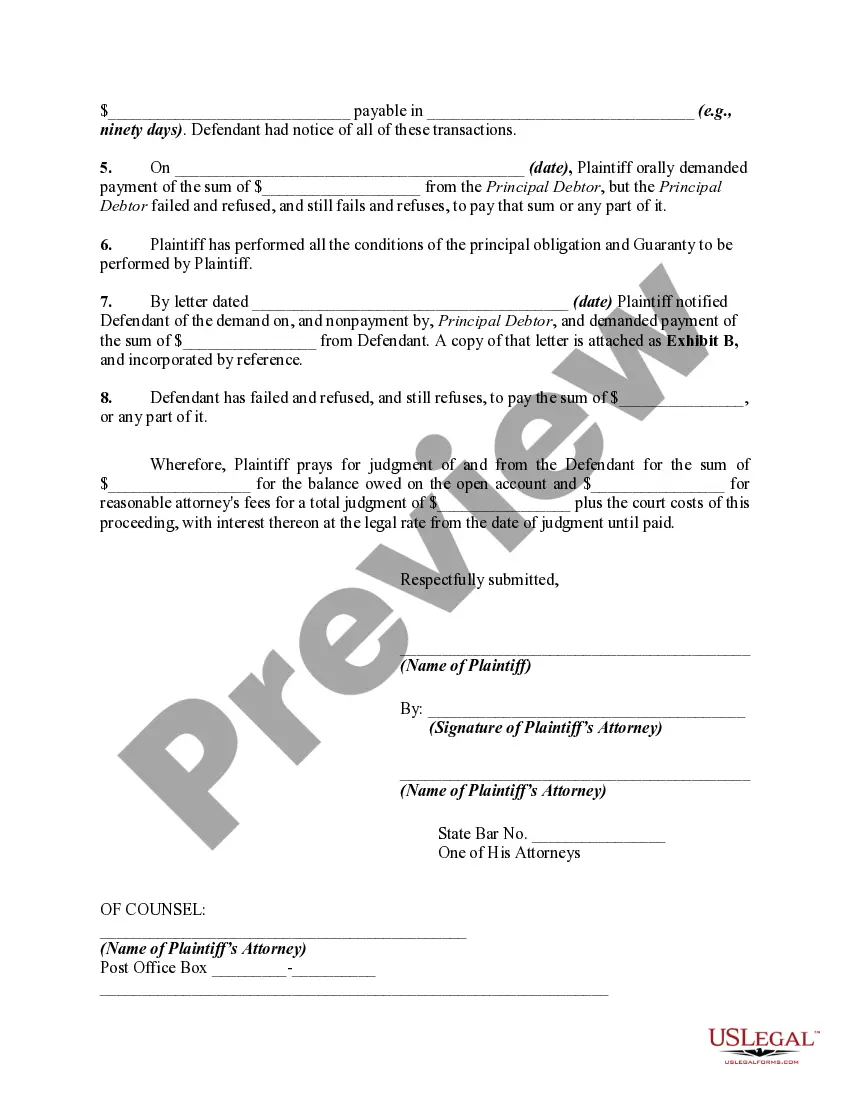

Florida Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts is a legal document filed in Florida to address situations where a guarantor of an open account credit transaction fails to fulfill their obligations. This complaint seeks to provide a detailed account of the breach of oral or implied contracts between the creditor and the guarantor, aiming to hold the guarantor accountable for their actions. Keywords: — Florida: This complaint is specific to the state of Florida and follows the legal procedures and regulations set forth in the state's jurisdiction. — Complaint: This document serves as an official complaint filed by the creditor against the guarantor, outlining the alleged breach of oral or implied contracts. — Guarantor: Refers to the individual or entity that has agreed to be responsible for the debt of the debtor. — Open Account: Indicates an ongoing credit agreement where the debtor can continuously make purchases on credit without further negotiation. — Credit Transaction: Refers to the act of buying goods or services on credit, allowing the debtor to delay payment until a later agreed-upon date. — Breach of Contract: Refers to the failure of one party to fulfill their obligations as stipulated in a legally enforceable contract. — Oral Contract: An agreement made verbally between the parties involved, without a written document. — Implied Contract: A contract where the terms and conditions are not explicitly stated, but can be implied from the actions, conduct, or circumstances of the parties involved. Types of Florida Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts may include: 1. Individual Guarantor Complaint: Filed when an individual has acted as a guarantor for an open account credit transaction and has allegedly breached their obligations. 2. Corporate Guarantor Complaint: Filed when a corporate entity has served as a guarantor and has failed to fulfill their responsibilities in an open account credit transaction. 3. Third-Party Guarantor Complaint: Filed when a third party unrelated to the creditor and debtor has assumed the role of guarantor and has allegedly breached the oral or implied contracts. 4. Joint Liability Complaint: Filed when multiple guarantors are held jointly responsible for the breach of oral or implied contracts in an open account credit transaction. In conclusion, a Florida Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts is a legal document used to address breaches of oral or implied contracts by a guarantor in an open account credit transaction. It aims to outline the details of the breach and holds the guarantor accountable for their obligations as per Florida law.Florida Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts is a legal document filed in Florida to address situations where a guarantor of an open account credit transaction fails to fulfill their obligations. This complaint seeks to provide a detailed account of the breach of oral or implied contracts between the creditor and the guarantor, aiming to hold the guarantor accountable for their actions. Keywords: — Florida: This complaint is specific to the state of Florida and follows the legal procedures and regulations set forth in the state's jurisdiction. — Complaint: This document serves as an official complaint filed by the creditor against the guarantor, outlining the alleged breach of oral or implied contracts. — Guarantor: Refers to the individual or entity that has agreed to be responsible for the debt of the debtor. — Open Account: Indicates an ongoing credit agreement where the debtor can continuously make purchases on credit without further negotiation. — Credit Transaction: Refers to the act of buying goods or services on credit, allowing the debtor to delay payment until a later agreed-upon date. — Breach of Contract: Refers to the failure of one party to fulfill their obligations as stipulated in a legally enforceable contract. — Oral Contract: An agreement made verbally between the parties involved, without a written document. — Implied Contract: A contract where the terms and conditions are not explicitly stated, but can be implied from the actions, conduct, or circumstances of the parties involved. Types of Florida Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts may include: 1. Individual Guarantor Complaint: Filed when an individual has acted as a guarantor for an open account credit transaction and has allegedly breached their obligations. 2. Corporate Guarantor Complaint: Filed when a corporate entity has served as a guarantor and has failed to fulfill their responsibilities in an open account credit transaction. 3. Third-Party Guarantor Complaint: Filed when a third party unrelated to the creditor and debtor has assumed the role of guarantor and has allegedly breached the oral or implied contracts. 4. Joint Liability Complaint: Filed when multiple guarantors are held jointly responsible for the breach of oral or implied contracts in an open account credit transaction. In conclusion, a Florida Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts is a legal document used to address breaches of oral or implied contracts by a guarantor in an open account credit transaction. It aims to outline the details of the breach and holds the guarantor accountable for their obligations as per Florida law.