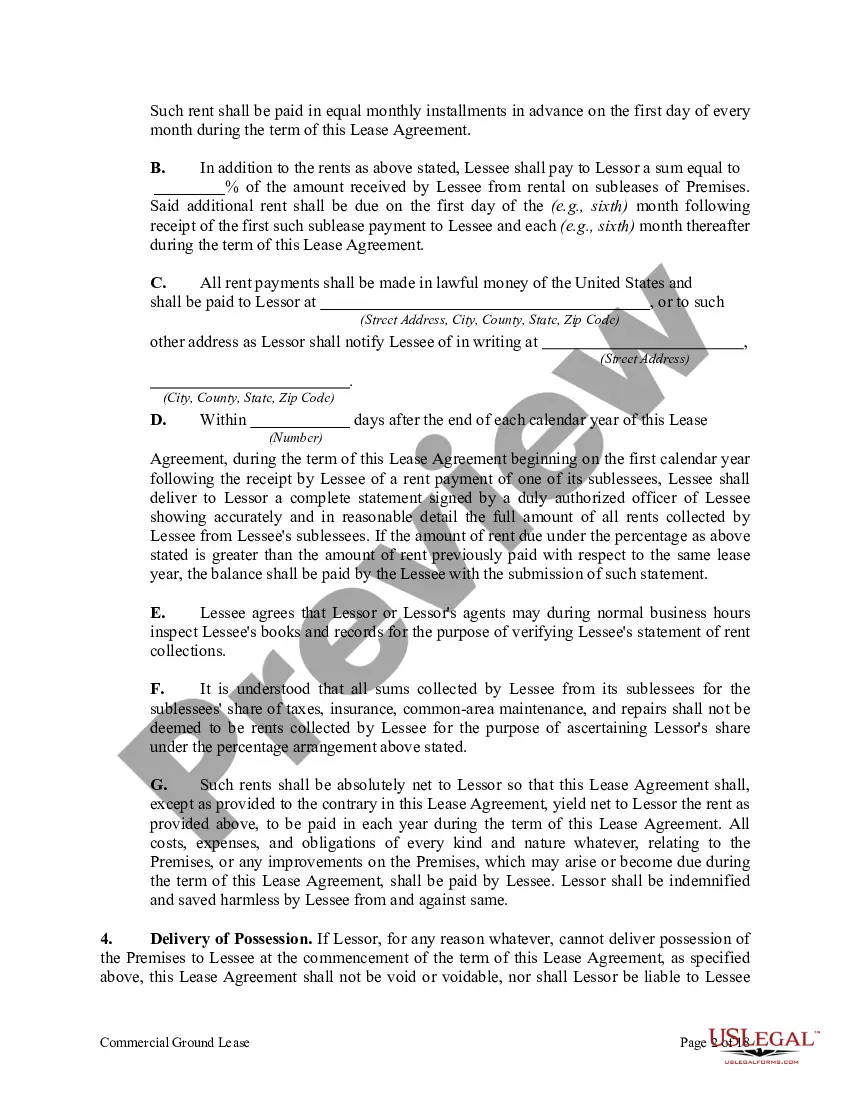

Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew

Description

How to fill out Commercial Ground Lease With Lessee To Construct Improvements And Option To Renew?

Have you ever found yourself needing documents for both business or particular purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of template documents, such as the Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, which are crafted to meet federal and state regulations.

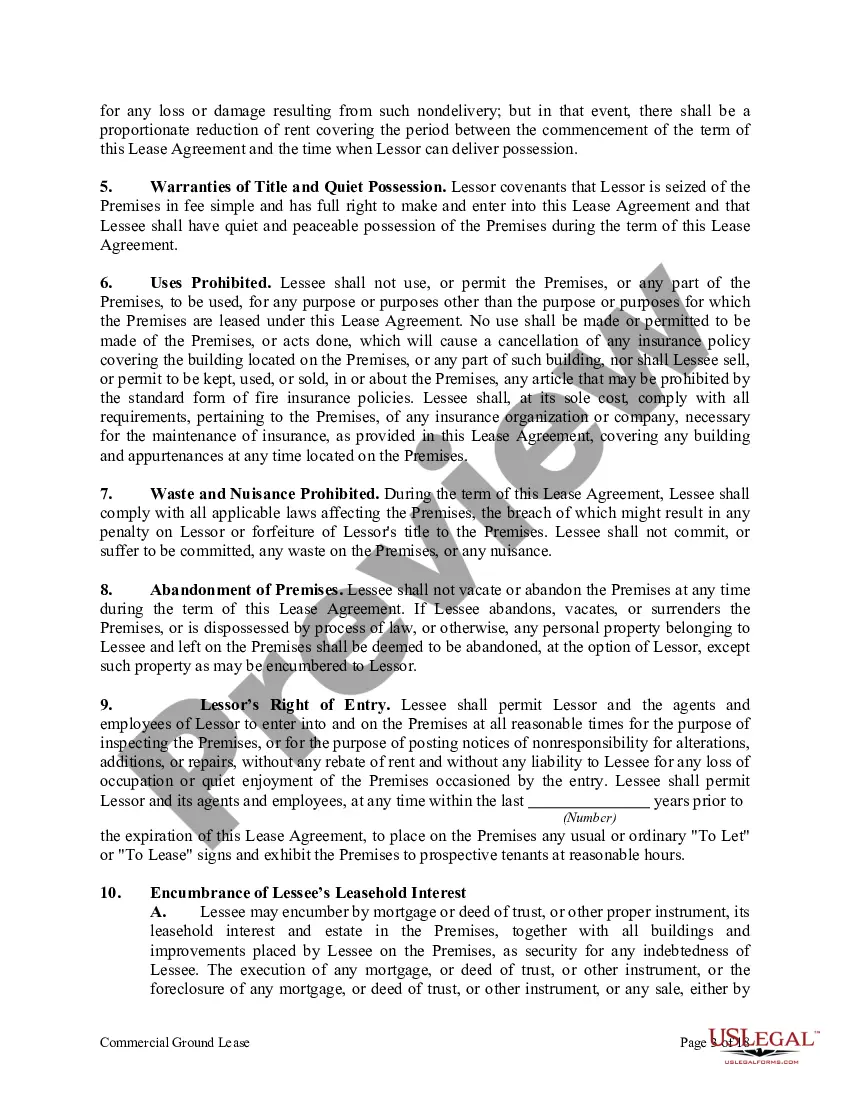

Once you locate the right form, click Get now.

Select the pricing plan you want, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it’s for the correct city/county.

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that satisfies your requirements.

Form popularity

FAQ

Yes, a landlord can refuse to renew a lease in Florida, including under a Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew. However, the reasons must comply with state laws and the original lease agreement. Factors such as ineligibility for lease renewal, past tenant violations, or personal circumstances may influence their decision. Understanding the legal framework will help you navigate the renewal process.

Negotiating a commercial lease renewal is essential for securing favorable terms. Begin by researching market rates and comparing similar Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew agreements. Open discussions with your landlord about desired changes, such as rent adjustments or lease duration. A well-prepared proposal can strengthen your position and lead to a successful negotiation.

To renovate a commercial property under a Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, start by assessing your project goals and budget. Obtain necessary permits and ensure your designs meet local codes. Communicate with the landlord throughout the process to align on expectations and gain approvals. Careful planning and execution will lead to successful renovations that enhance your space.

Renovations made to a building under a Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew can typically be depreciated. The Internal Revenue Service allows depreciation for qualifying improvements to commercial properties, which can offer tax benefits. Keeping accurate records and consulting a tax professional can help maximize these advantages. This approach can improve your financial position during your lease term.

Yes, under a Florida Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, renovations are often allowed. The lease typically outlines the scope and permissions for improvements. It is essential to communicate with the landlord to ensure that the proposed changes comply with lease terms and local regulations. Proper planning can enhance the leased property's value and appeal.

Lease improvements in a Florida Commercial Ground Lease with Lessee to Construct Improvements should be recorded as assets on the lessee's balance sheet. These improvements represent an investment in the property and affect depreciation calculations. It's crucial for lessees to keep accurate records for financial reporting and tax purposes.

In the context of a Florida Commercial Ground Lease, lease improvements are generally owned by the lessee during the lease term. However, these improvements often revert to the landowner upon the expiration of the lease unless the agreement states otherwise. This arrangement differentiates ground leases from traditional leases, where the landlord typically retains all improvements.

Yes, in a Florida Commercial Ground Lease with Lessee to Construct Improvements, the lessee typically has the right to renovate the property. However, lessees should consult the lease terms to understand what renovations are allowed. Any improvements may also need the landlord's approval, ensuring both parties are aligned on property use.

Lenders may view Florida Commercial Ground Leases with Lessee to Construct Improvements and Option to Renew as less stable due to the complexities involved. They often consider these leases risky because the lessee may not own the land. This uncertainty can lead to concerns over collateral value and ultimately impact financing options.

Liabilities in a Florida Commercial Ground Lease with Lessee to Construct Improvements can include maintenance responsibilities and property taxes. The lessee must ensure the property remains in good condition and compliant with local regulations. Additionally, if improvements are not maintained, the lessor could hold the lessee accountable for damages.