This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

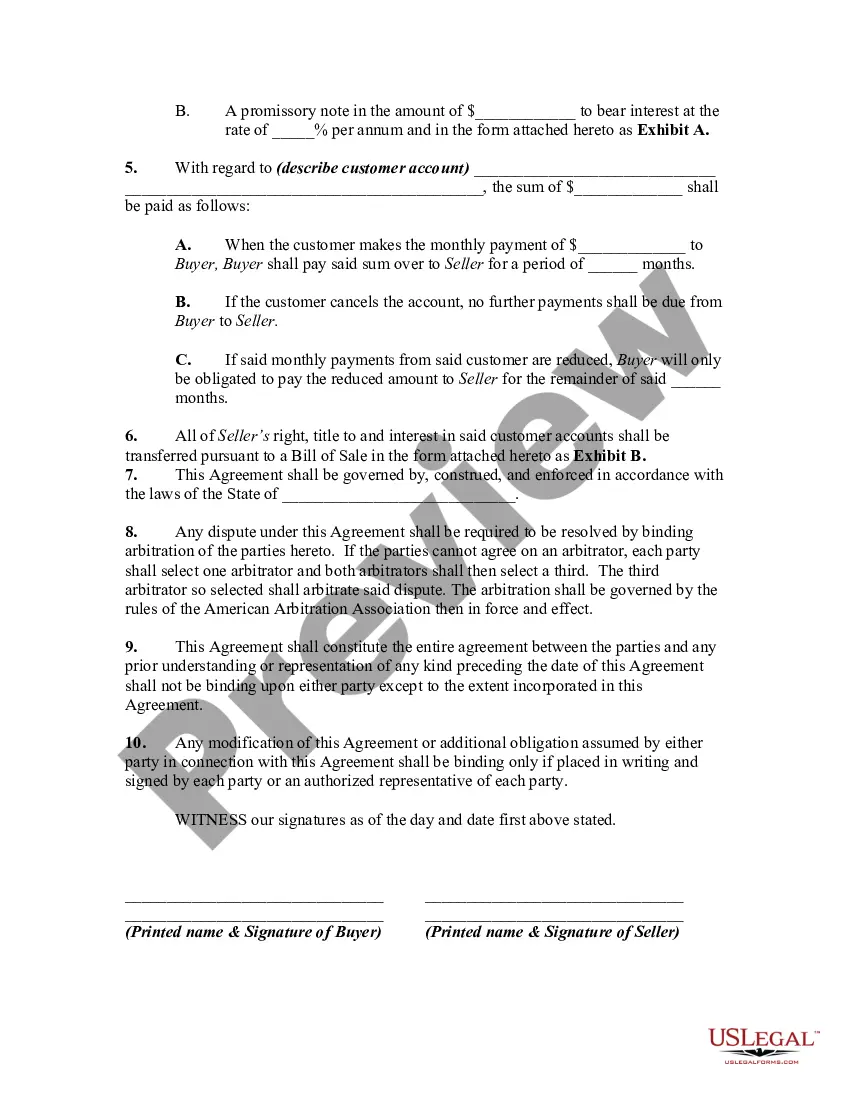

Florida Agreement to Sell and Purchase Customer Accounts

Description

How to fill out Agreement To Sell And Purchase Customer Accounts?

If you need to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's straightforward and efficient search feature to locate the documents you require.

An assortment of templates for business and individual purposes is organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Download and print the Florida Agreement to Sell and Purchase Customer Accounts with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to discover the Florida Agreement to Sell and Purchase Customer Accounts in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and press the Download button to receive the Florida Agreement to Sell and Purchase Customer Accounts.

- You can also access documents you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, adhere to the following instructions.

- Step 1. Ensure you've selected the form for the correct city/state.

- Step 2. Take advantage of the Preview feature to view the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative forms in the legal form template.

- Step 4. After locating the form you need, click the Get now button. Choose your pricing plan and add your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Florida Agreement to Sell and Purchase Customer Accounts.

Form popularity

FAQ

How to write a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A purchase agreement is a legally binding contract between a buyer and seller. These agreements usually relate to the buying and selling of goods instead of services, and they can cover transactions for just about any type of product.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

A customer agreement is a legally binding company contract between your company and customers, specifying the terms and conditions for using your products and services.

Types of purchase agreements. There are four primary types of purchase orders: standard, planned, blanket, and contract. The difference between them depends on the amount of information known when the order is made. Beyond these four categories, your purchase agreement can be as unique as your transaction or project.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

However, there are some basic items that should be included in every purchase agreement.Buyer and seller information.Property details.Pricing and financing.Fixtures and appliances included/excluded in the sale.Closing and possession dates.Earnest money deposit amount.Closing costs and who is responsible for paying.More items...?

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.