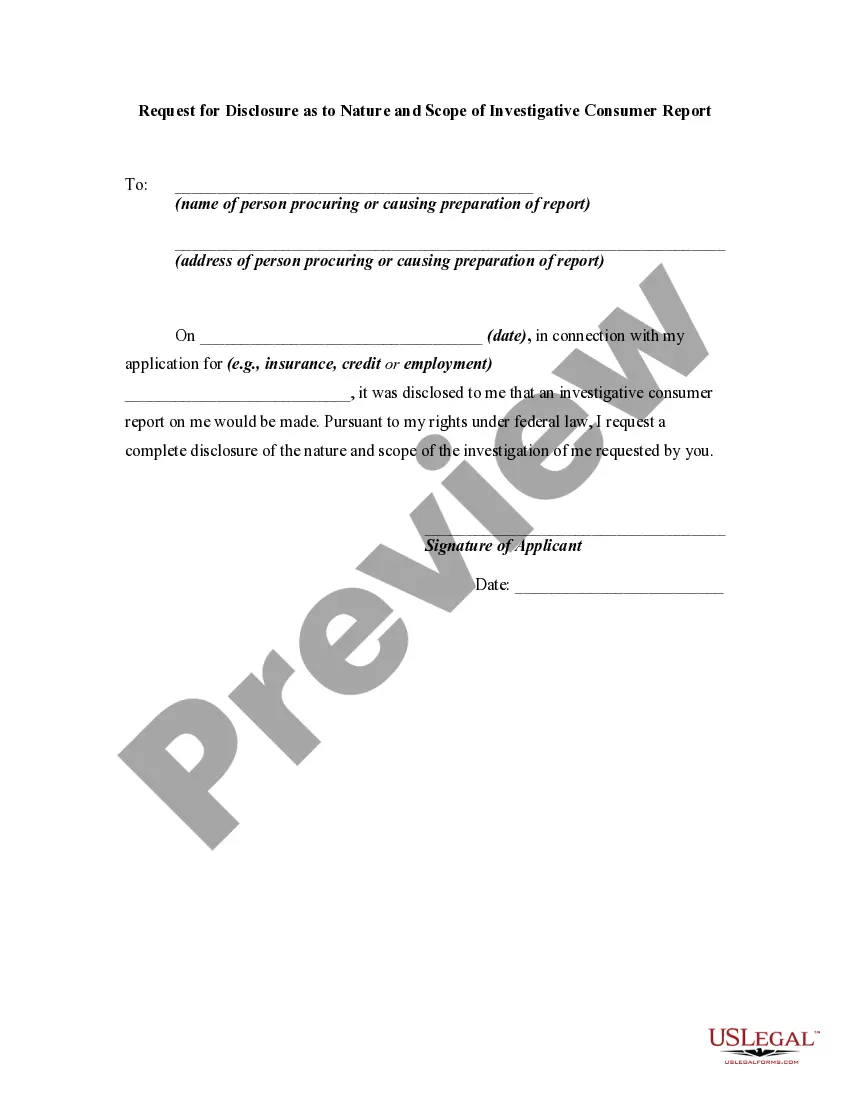

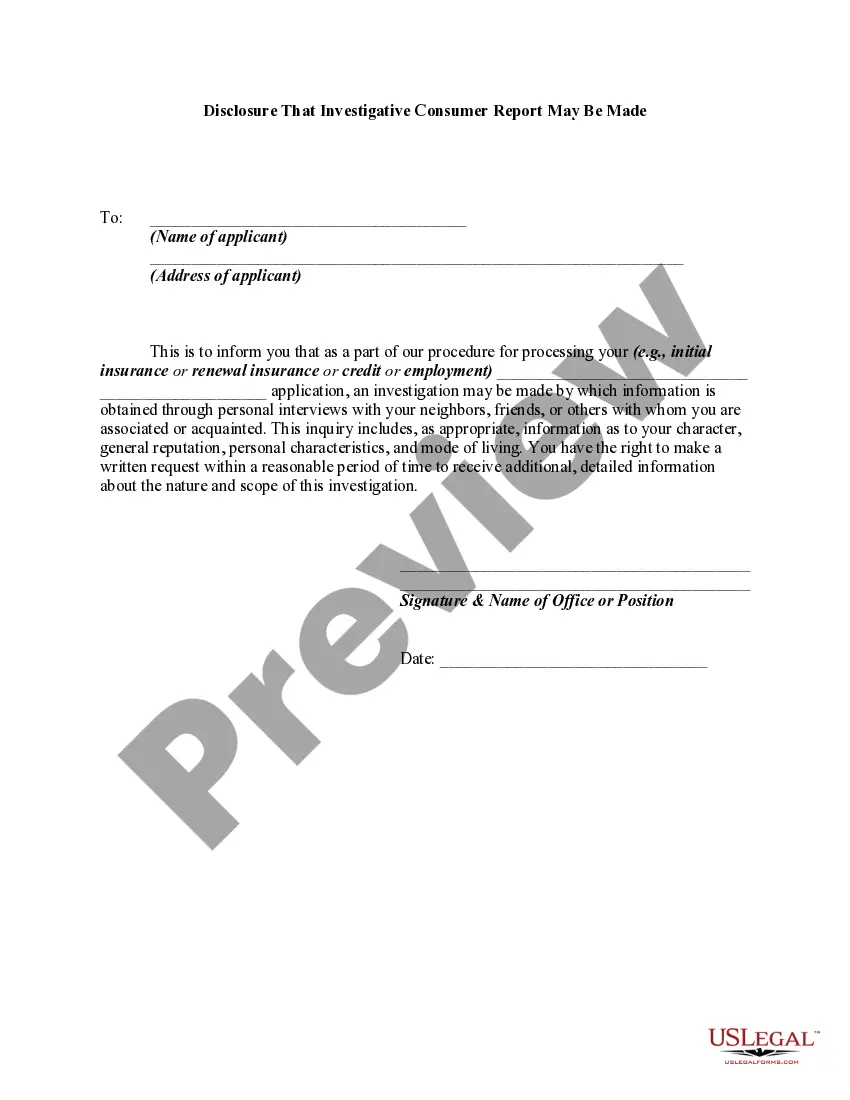

Under the Fair Credit Reporting Act, a person may not procure or cause to be prepared an investigative consumer report on any consumer unless: (1) it is clearly and accurately disclosed to the consumer that an investigative consumer report, including information as to character, general reputation, personal characteristics, and mode of living, whichever is or are applicable, may be made, and such disclosure: (a) is made in a writing mailed, or otherwise delivered, to the consumer not later than three days after the date on which the report was first requested; and (b) includes a statement informing the consumer of the right to request additional disclosures from the person requesting the report and the written summary of rights of the consumer prepared pursuant to ?§ 1681g(c) of the Act; and (2) the person certifies or has certified to the consumer reporting agency that the person has made the proper disclosures to the consumer as required under the Act.

Florida Disclosure That Investigative Consumer Report May Be Made

Description

How to fill out Disclosure That Investigative Consumer Report May Be Made?

It is possible to spend hrs online looking for the lawful file format that meets the federal and state specifications you want. US Legal Forms provides a large number of lawful forms which can be evaluated by specialists. It is simple to download or print the Florida Disclosure That Investigative Consumer Report May Be Made from our service.

If you currently have a US Legal Forms profile, you are able to log in and then click the Download key. After that, you are able to total, modify, print, or indicator the Florida Disclosure That Investigative Consumer Report May Be Made. Each and every lawful file format you acquire is your own property forever. To acquire an additional version associated with a acquired form, proceed to the My Forms tab and then click the corresponding key.

If you use the US Legal Forms website the first time, adhere to the basic recommendations listed below:

- First, be sure that you have chosen the best file format for the region/town of your liking. See the form description to make sure you have chosen the proper form. If available, utilize the Preview key to search with the file format at the same time.

- In order to get an additional model of your form, utilize the Search industry to discover the format that meets your needs and specifications.

- When you have located the format you desire, just click Buy now to carry on.

- Find the costs plan you desire, enter your qualifications, and register for an account on US Legal Forms.

- Comprehensive the transaction. You may use your credit card or PayPal profile to cover the lawful form.

- Find the formatting of your file and download it to your gadget.

- Make alterations to your file if required. It is possible to total, modify and indicator and print Florida Disclosure That Investigative Consumer Report May Be Made.

Download and print a large number of file templates while using US Legal Forms Internet site, which offers the most important assortment of lawful forms. Use skilled and express-distinct templates to tackle your organization or individual requires.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) is designed to protect the privacy of consumer report information ? sometimes informally called ?credit reports? ? and to guarantee that information supplied by consumer reporting agencies (CRAs) is as accurate as possible.

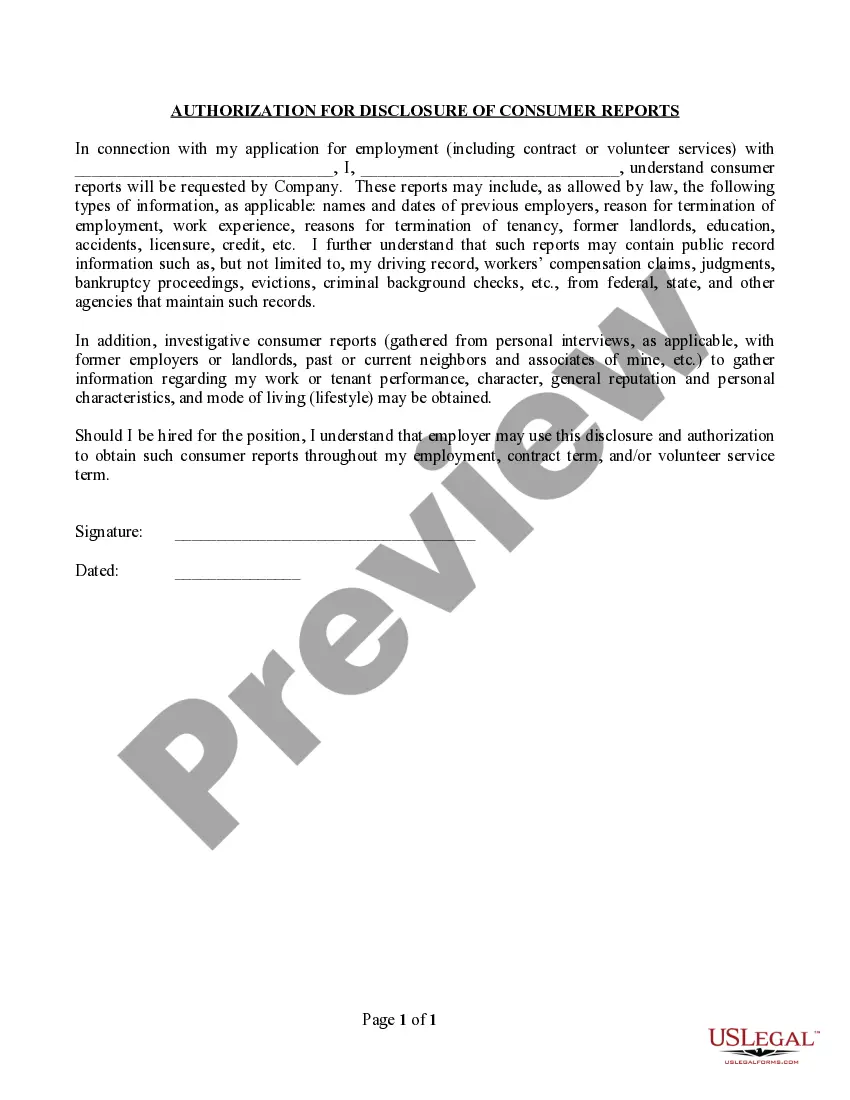

The FTC's interpretation of the definition of an Investigative Consumer Report notes that ?An 'Investigative Consumer Report' is a type of 'Consumer Report' that includes information obtained through personal interviews with the consumer's neighbors, friends, associates, or others.

Investigative Reports These obligations include giving written notice that you may request or have requested an investigative consumer report, and giving a statement that the person has a right to request additional disclosures and a summary of the scope and substance of the report.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

A consumer report is any written, oral or other communication of any information by a Consumer Reporting Agency bearing on a consumer's credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living.

A credit report or another type of consumer report to deny your application for credit, insurance, or employment ? or to take another adverse action against you ? must tell you, and must give you the name, address, and phone number of the agency that provided the information.

Investigate the dispute and review all relevant information provided by the CRA about the dispute; report your findings to the CRA; provide corrected information to every CRA that received the information if your investigation shows the information is incomplete or inaccurate; and.

Understanding the Basics: What Does FCRA Require? The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes.