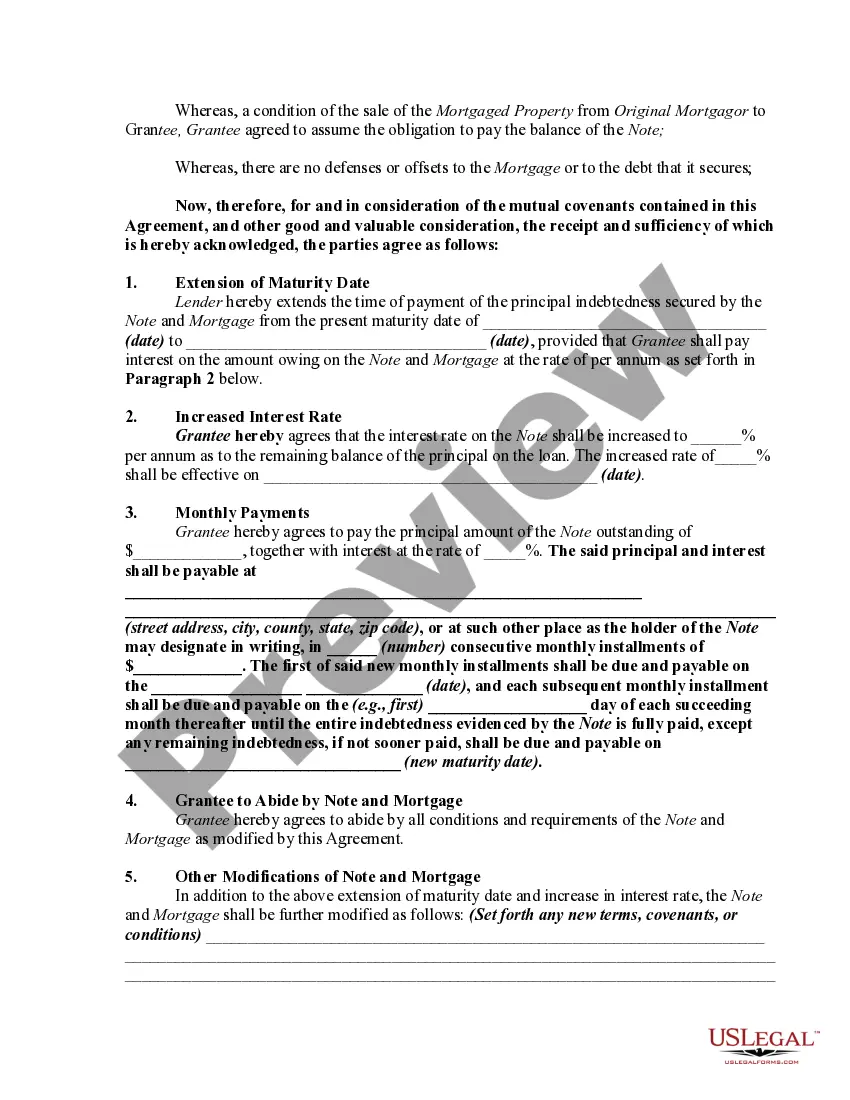

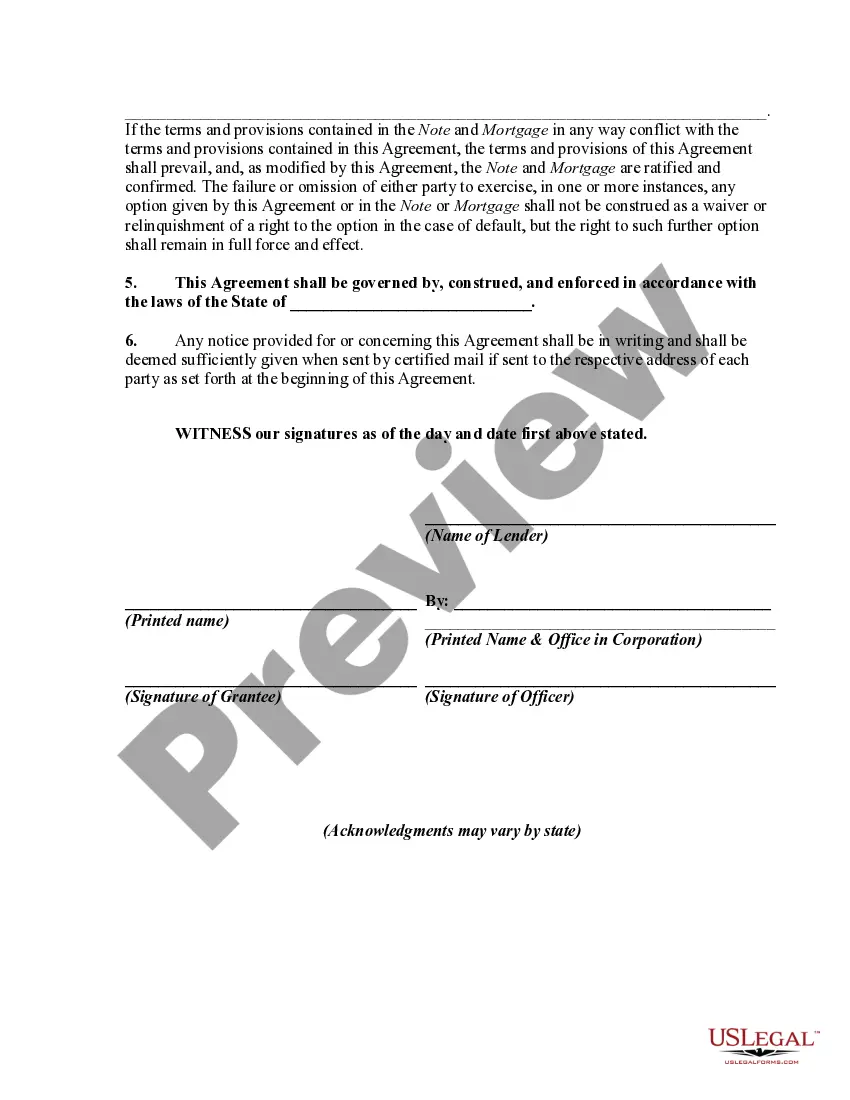

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Florida Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest is a legal contract that allows a new owner to assume the existing mortgage debt on a property in Florida, while also agreeing to an increase in the interest rate. This agreement is commonly used in situations where a property is being sold or transferred to a new owner, but the existing mortgage still needs to be paid off. Rather than requiring the new owner to obtain a new mortgage loan, the parties involved can enter into this extension agreement, allowing the new owner to assume the debt. The agreement typically outlines the terms and conditions of the assumption, including the amount of the original mortgage, the interest rate, and the repayment term. It also includes provisions for the increase in interest, which is negotiated between the parties involved. In some cases, there may be multiple types of Florida Mortgage Extension Agreements with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest. These variations could include agreements that differ in terms of the interest rate increase, repayment terms, or other specific provisions. It is important for the parties involved to carefully review and negotiate the terms of the agreement to ensure they align with their specific requirements and circumstances. Keywords: Florida Mortgage Extension Agreement, Assumption of Debt, New Owner, Real Property, Mortgage, Increase of Interest, Legal Contract, Transfer, Repayment Term, Negotiation, Terms and Conditions, Variations.