Title: Florida Sample Letter for Tax Deeds — Comprehensive Guide with Relevant Keywords Introduction: In Florida, tax deeds are legal documents used to transfer ownership of a property when the owner fails to pay their property taxes. This comprehensive guide will provide you with a detailed description of what Florida Sample Letters for Tax Deeds are, their purpose, and the various types available to assist you in understanding their significance. Keyword 1: Florida Tax Deeds Keyword 2: Sample Letter Keyword 3: Types I. What is a Florida Sample Letter for Tax Deeds? A Florida Sample Letter for Tax Deeds is a predefined template or document used to initiate or respond to tax deed proceedings. These letters help streamline the communication process between interested parties involved in tax deed sales, including the tax collector's office, property owners, and potential bidders. II. Purpose of Florida Sample Letters for Tax Deeds: 1. Notification Letters: These letters notify delinquent property owners of their outstanding tax obligations and the initiation of tax deed proceedings. 2. Redemption Letters: If property owners wish to redeem their property before the tax deed auction, this type of letter provides detailed instructions and requirements. 3. Surplus Letters: After the tax deed auction, surplus letters are sent to inform former owners about any remaining proceeds from the sale. 4. Notice of Sale Letters: These letters notify potential bidders and interested parties of the upcoming tax deed auction, providing essential details and auction requirements. III. Different Types of Florida Sample Letters for Tax Deeds: 1. Tax Deed Notification Letter: This letter officially notifies delinquent property owners about their unpaid taxes and the initiation of tax deed proceedings. 2. Property Redemption Letter: For property owners seeking to redeem their property, this letter provides information on payment details, deadlines, and necessary documentation. 3. Surplus Distribution Letter: After the tax deed sale, this letter informs former owners about any surplus funds from the auction and outlines the process for claiming their share. 4. Auction Notice Letter: Sent to potential bidders and interested parties, this letter provides essential details regarding the tax deed auction, including the date, time, location, and registration requirements. Conclusion: Florida Sample Letters for Tax Deeds play a crucial role in initiating or responding to tax deed proceedings. Whether you are a property owner, a bidder, or a tax collector, these letters serve as formal means of communication, ensuring clarity and transparency throughout the tax deed process. Understanding the various types of sample letters available can help you navigate the Florida tax deed system more efficiently.

Florida Sample Letter for Tax Deeds

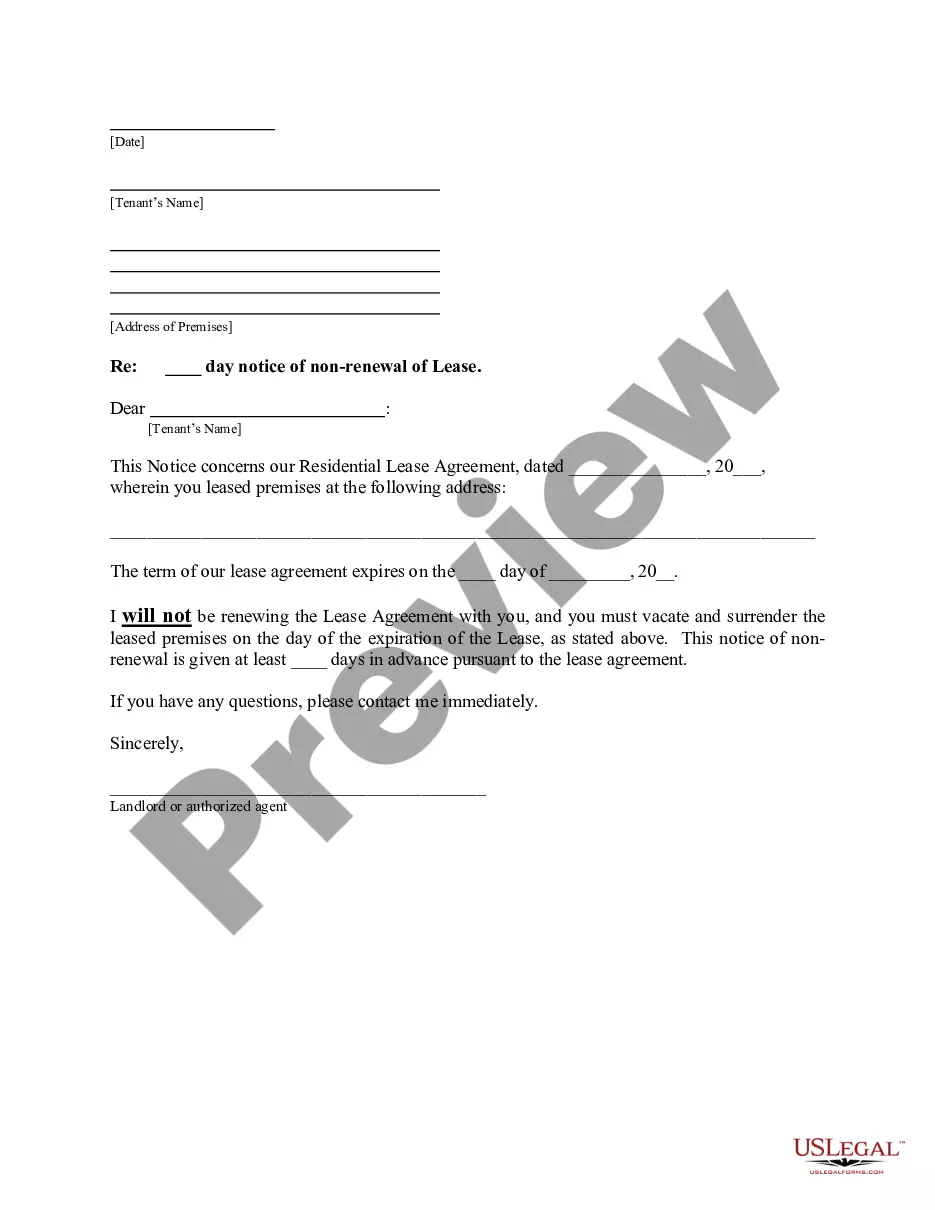

Description

How to fill out Florida Sample Letter For Tax Deeds?

If you need to total, obtain, or produce legal record layouts, use US Legal Forms, the most important variety of legal types, which can be found on the Internet. Take advantage of the site`s easy and hassle-free search to get the papers you need. A variety of layouts for enterprise and individual uses are categorized by classes and claims, or keywords. Use US Legal Forms to get the Florida Sample Letter for Tax Deeds in a handful of click throughs.

If you are already a US Legal Forms client, log in to the accounts and then click the Obtain switch to obtain the Florida Sample Letter for Tax Deeds. You can also entry types you earlier downloaded inside the My Forms tab of the accounts.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape for the appropriate city/nation.

- Step 2. Take advantage of the Preview choice to check out the form`s articles. Don`t forget about to read through the description.

- Step 3. If you are not happy with all the form, use the Lookup industry at the top of the display screen to get other models in the legal form template.

- Step 4. When you have identified the shape you need, click on the Purchase now switch. Opt for the prices plan you like and include your qualifications to register to have an accounts.

- Step 5. Process the deal. You should use your bank card or PayPal accounts to complete the deal.

- Step 6. Choose the structure in the legal form and obtain it in your system.

- Step 7. Total, revise and produce or indication the Florida Sample Letter for Tax Deeds.

Every single legal record template you buy is the one you have forever. You possess acces to every single form you downloaded with your acccount. Click on the My Forms segment and choose a form to produce or obtain once more.

Contend and obtain, and produce the Florida Sample Letter for Tax Deeds with US Legal Forms. There are millions of specialist and condition-distinct types you can utilize for your personal enterprise or individual requirements.

Form popularity

FAQ

In short, a tax lien has a lot of negatives. It affects your ability to sell your property and limits the effectiveness of bankruptcy relief. It also hurts your ability to get credit and ? through prospective employer credit checks ? can even harm your chances of getting a new job.

A successful quiet claim action means the holder of the tax deed can sell the property after a short appeal time period ? typically 30 days. Florida Statute Section 65.081. provides the authority for quieting title to tax deeds.

What is a Tax Deed Application? Tax Deed application is the action, initiated by a tax certificate holder, which begins the process of selling a property at public auction for the delinquent taxes.

Tax Deed states auction off the real estate when property owners become delinquent. A Tax Lien state sells tax certificates to investors when homeowners become delinquent. Once the homeowner pays the taxes the investor is paid off their investment plus interest. Florida is a Tax Deed and a Tax Lien state.

A tax certificate is basically a lien against your property. The certificates themselves are sold at auction. The bidder must pay the delinquent taxes plus costs. The successful bidder is the one who will demand the lowest interest rate on the certificate from the delinquent property owner.

The question that we're answering today is, ?Does a mortgage survive a tax deed sale in Florida?? The answer is no. Nothing survives the tax defaulted auction except, possibly, another government lien, and it must be filed by date and time.

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and place a lien on a property, while with a tax deed, an investor is actually purchasing the property, by virtue of a tax deed for unpaid real property taxes, at auction.

When a property is sold at a tax deed sale, the proceeds first pay for the delinquent taxes and the costs of bringing the property to auction. Any surplus over the opening bid amount is deposited with the Clerk and Comptroller and subject to a registry fee.