Florida Employment Verification Letter for Social Security

Description

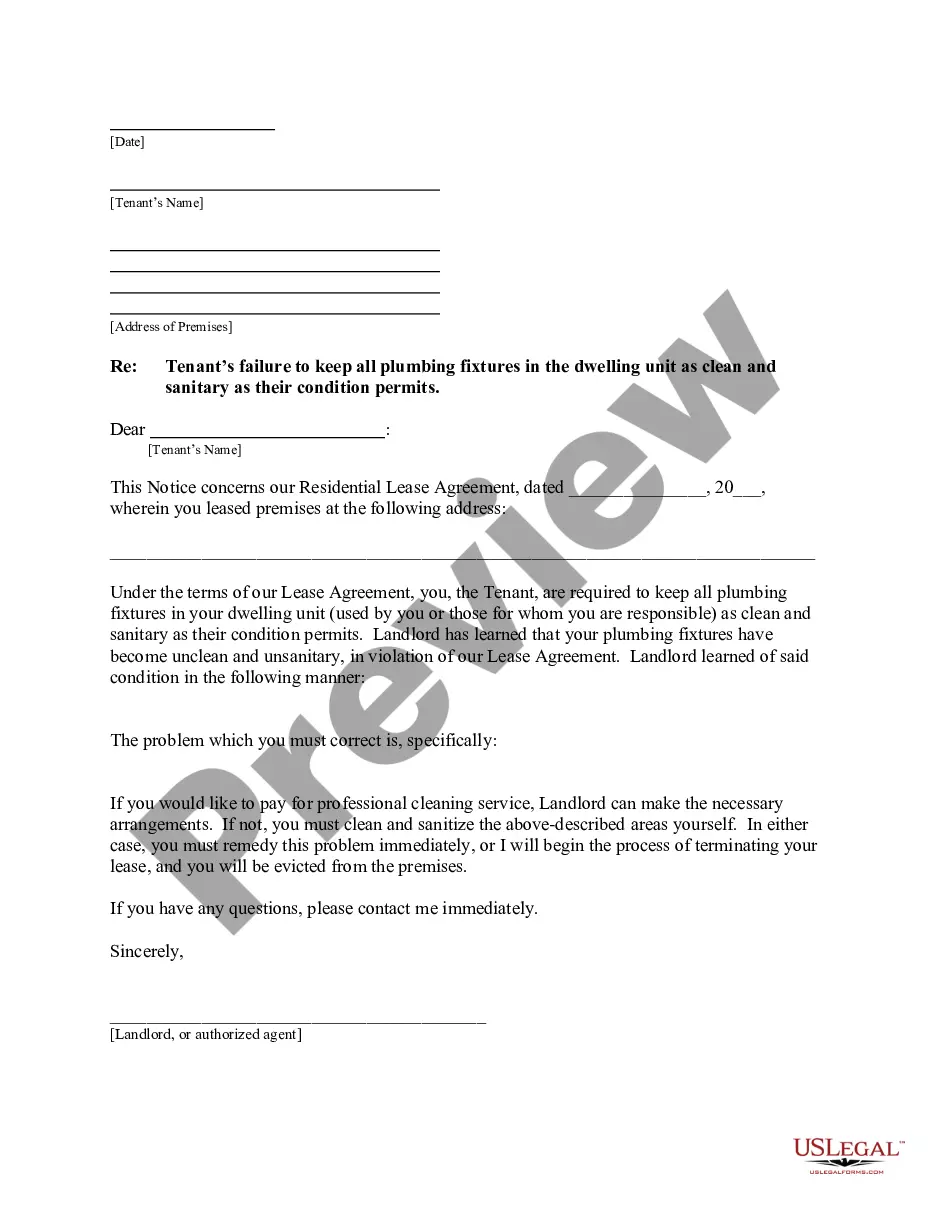

How to fill out Employment Verification Letter For Social Security?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can obtain or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can acquire the latest versions of forms such as the Florida Employment Verification Letter for Social Security within moments.

If you are already a member, Log In to download the Florida Employment Verification Letter for Social Security from the US Legal Forms repository. The Download button will be visible on each form you view. You can access all previously saved forms in the My documents section of your account.

Make edits. Fill out, modify, and print and sign the downloaded Florida Employment Verification Letter for Social Security.

Each template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to acquire or create another copy, simply go to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/county. Click the Review button to assess the form's content. Check the form details to confirm you have selected the right form.

- If the form does not meet your requirements, make use of the Search box at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Acquire now button. Then, choose your preferred pricing plan and provide your details to register for the account.

- Process the payment. Use your Visa or MasterCard or PayPal account to complete the transaction.

- Select the format and obtain the form to your device.

Form popularity

FAQ

You can get a benefit verification letter online instantly by using your personal my Social Security account. If you don't have an account, you can create one today. It's easy, convenient and secure.

A benefit verification letter is an official document that spells out your Social Security benefits, Supplemental Security Income or Medicare coverage. It can be used when you need proof of income or disability.

In all other instances, use the Inquiry Response Benefit Verification screen or the paper Form SSA-2458 (Report of Confidential Social Security Benefit Information) to manually generate a BEVE letter or respond to benefit and payment questions.

Sign in to your personal my Social Security account to get your letter. Already have a my Social Security Account? Sign In to your account below and go to Replacement Documents on the right side of the screen, then choose get a Benefit Verification Letter to view, save and print your personalized letter.

How can I get a benefit verification letter from Social Security? feffLog in to your My Social Security online account.Select the link entitled Get a Benefit Verification Letter, then Customize Your Letter.Select the information you want to include and click Apply to Letter.More items...

Whenever we send you a notice, it is because there is something you should know or do about your claim, benefit status or benefit amount. We send you a notice before we make a change to your benefit amount or eligibility. We will send a notice whenever we must tell you about activity on your case.

The Social Security Administration (SSA) states on its website that applicants may have to wait between three and five months to get a letter confirming your benefits after approval of your application. The application itself could take between one and three months to reach a decision.

The Benefit Verification letter, sometimes called a "budget letter," a "benefits letter," a "proof of income letter," or a "proof of award letter," serves as proof of your retirement, disability, Supplemental Security Income (SSI), or Medicare benefits.

You will be able to view, print, and save the letter immediately. If you receive benefits or have a pending application, you will have the option to request to have a copy mailed to you within 10 business days. We will mail your benefit verification letter to the address we have on file.

If you need to replace your original award letter, you can request a copy by calling Social Security at 800-772-1213 or visiting your local SSA office.