Florida Lease Purchase Agreement for Business

Description

How to fill out Lease Purchase Agreement For Business?

If you desire to acquire, retrieve, or produce valid document templates, utilize US Legal Forms, the top choice for authentic forms that are accessible online.

Employ the site's straightforward and user-friendly search feature to locate the forms you require.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose your pricing option and enter your details to register for an account.

Step 5. Complete the payment process. You can utilize your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Florida Lease Purchase Agreement for Business in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Purchase option to obtain the Florida Lease Purchase Agreement for Business.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

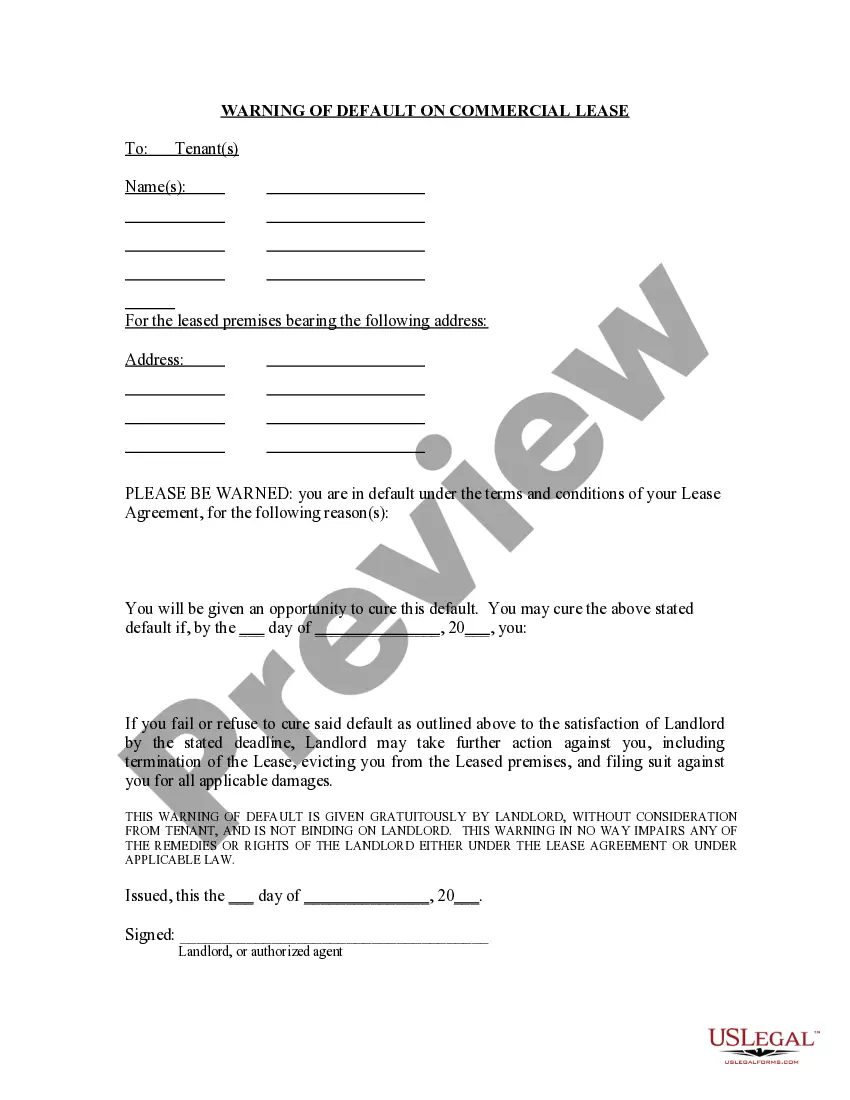

- Step 2. Use the Preview feature to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not pleased with the form, utilize the Search box at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

No, lease agreements do not need to be notarized in Florida, regardless of the duration of the lease. Landlords and tenants can agree to get a lease notarized if they prefer but it is not required in order for the lease to be legally binding.

Florida law requires that any rent to own contract be in writing and signed by both parties. It must include all essential terms before it is signed, and a copy of the signed contract must be delivered to you.

Yes, a contract to lease (or lease agreement) is legally binding in Florida. Both oral and written lease agreements are legal and enforceable in Florida. Written lease agreements must be signed in order to be legally binding, and the landlord must sign the lease in the presence of two witnesses.

Florida law requires that any rent to own contract be in writing and signed by both parties. It must include all essential terms before it is signed, and a copy of the signed contract must be delivered to you.

A Florida rent-to-own lease agreement allows the tenant an option to purchase the property under pre-determined terms. Similar to a standard lease, the landlord will request a financial background check on the tenant. If approved, the landlord will sign a lease and establish the terms for purchasing the property.

The way a lease option works is by an investor taking a lease with an option to buy on your home. That is, the investor will lease your home for a number of years, usually three initially, making monthly payments which are at least equal to the payments you have to make on your house.

While leases do not have to be notarized under Florida law, landlords and tenants can benefit under this new law when notarizing other documents recorded in connection with leases, such as memorandum of leases or subordination agreements.

Both landlords and tenants can terminate a month-to-month lease at any time, as long as they inform the other person in writing at least 15 days before the next rent payment is due. This timeline is much quicker than in other states, which generally require at least a month's notice.

optiontobuy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

Effective July 1, 2020, witnesses' signatures are no longer needed for residential and commercial leases. The amended Section 689.01, Florida Statutes, removed the requirement that a landlord's signature on a lease must be witnessed by two subscribing witnesses when the term of a lease is longer than one year.