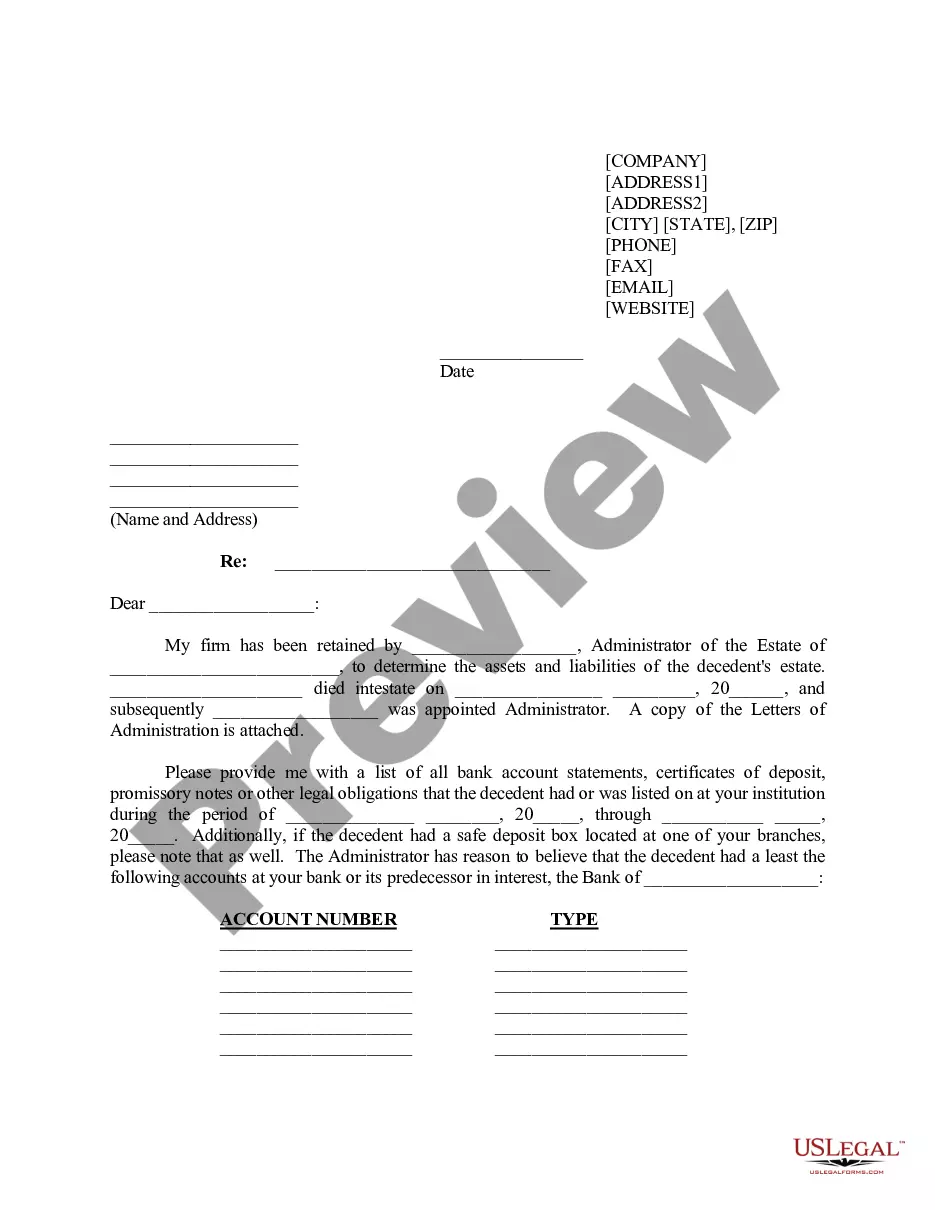

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

Have you ever been in a situation where you require documents for both corporate or personal purposes almost every day.

There are many legitimate document templates accessible online, but locating reliable ones is not straightforward.

US Legal Forms provides thousands of form templates, including the Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, that are designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Explore all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent at any time, if desired. Simply click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you will be able to download the Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview button to review the form.

- Check the description to confirm that you have chosen the right form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your requirements and criteria.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, enter the necessary details to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Bank accounts that have designated beneficiaries generally do not have to go through probate in Florida. These accounts transfer directly to beneficiaries upon the account holder's death, simplifying the process and circumventing lengthy probate procedures. This allows beneficiaries to access funds quickly and efficiently. A strategy that incorporates a Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can enhance understanding and clarity regarding these transfers.

Yes, an executor in Florida is required to communicate with beneficiaries throughout the probate process. Open communication about the status of the estate and its administration helps maintain trust and clarity among all parties involved. Executors must provide updates and allow beneficiaries access to important documents, which is essential for transparency. The Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent serves as a helpful resource in this communication.

Yes, Florida does allow transfer on death accounts, allowing individuals to designate beneficiaries for bank and investment accounts. This means that upon the account holder's death, the assets transfer directly to the named beneficiaries without going through probate. This can simplify the transfer of assets significantly and speed up the process. Utilizing a Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help clarify these transfers.

In Florida, an executor cannot sell, transfer, or dispose of estate assets without proper court approval unless specified in the will. Additionally, they must avoid any conflicts of interest and cannot favor one beneficiary over another when managing the estate. This is crucial to maintaining fairness and transparency during the estate settlement process. A Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can provide clear guidance on asset management.

The final accounting to beneficiaries in Florida involves a detailed report that outlines the estate's assets, liabilities, and distributions. This document serves as a summary of the executor's financial management during the estate administration process. It ensures transparency and helps beneficiaries understand how their inheritance is calculated. Utilizing a Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can streamline this communication.

If an investment account has no beneficiary, it may be transferred into the deceased's estate. The executor or trustee will need to address this through the probate process. Utilizing a Florida Letter of Instruction to Investment Firm can provide clear guidance on transferring the assets in the account to the trust, ensuring they are distributed according to the deceased's wishes.

When an individual with an investment account dies, the account typically becomes part of their estate. If there is no designated beneficiary, the executor or trustee must manage the account per the applicable laws. A Florida Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee can help streamline the process of transferring these assets to the trust for the benefit of the decedent.

In Florida, you generally have three months from the date of the first publication of the estate notice to file a claim against an estate. It’s important to act within this timeframe to protect your rights. If you have specific concerns about an investment account, a Florida Letter of Instruction to the investment firm may be required to facilitate communication with the estate's representatives.

When someone dies, their investments are typically transferred according to the account ownership or beneficiary designations. If the account lacks a designated beneficiary, the executor or trustee may need a Florida Letter of Instruction to initiate the transfer of assets to the appropriate party. This process ensures that the investments are handled in accordance with the deceased's wishes.

Yes, you can inherit an investment account if you are the named beneficiary. When the account holder passes away, a Florida Letter of Instruction can guide the investment firm to transfer the account to the identified individual. It's crucial to review the account terms and applicable laws to ensure a smooth transition.