Florida Change of Beneficiary

Description

How to fill out Change Of Beneficiary?

If you wish to comprehensive, obtain, or printing lawful papers themes, use US Legal Forms, the most important assortment of lawful kinds, which can be found on-line. Use the site`s simple and easy handy lookup to obtain the files you require. Different themes for business and specific purposes are sorted by classes and says, or search phrases. Use US Legal Forms to obtain the Florida Change of Beneficiary with a number of click throughs.

If you are currently a US Legal Forms consumer, log in to the account and click on the Acquire key to have the Florida Change of Beneficiary. You can also gain access to kinds you formerly acquired from the My Forms tab of your account.

Should you use US Legal Forms the very first time, refer to the instructions below:

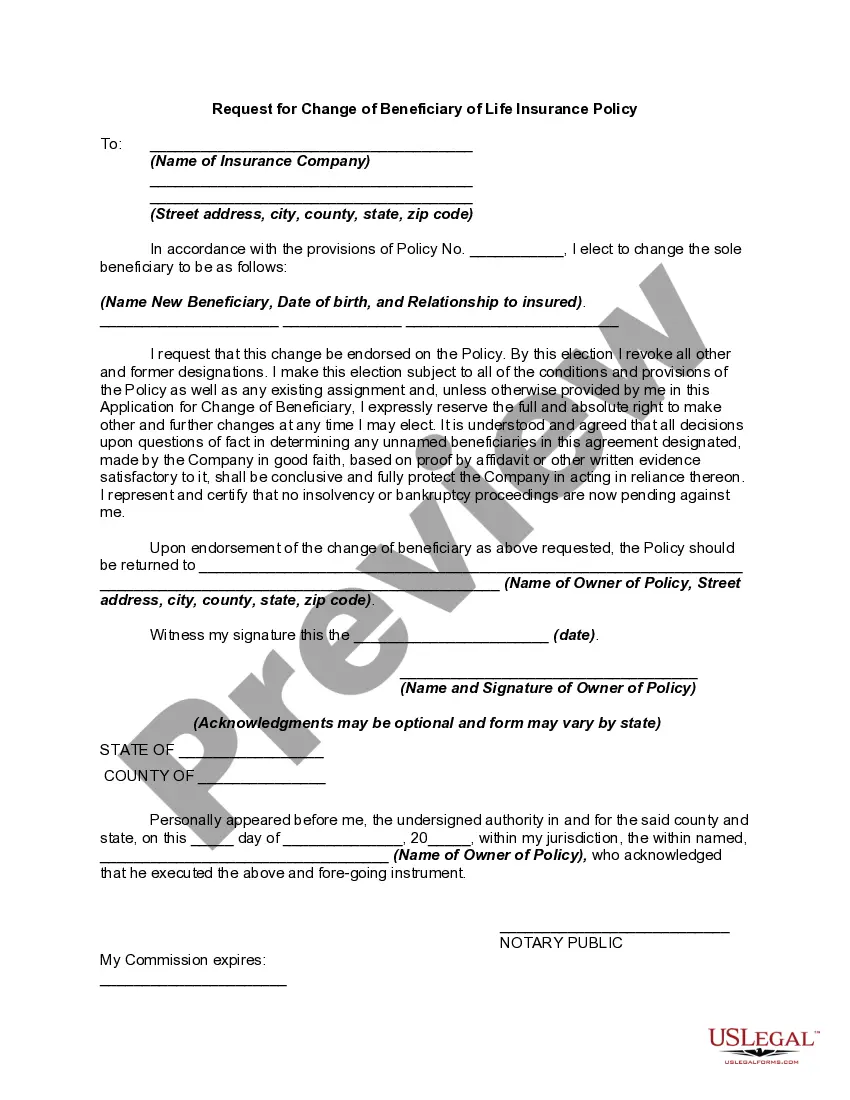

- Step 1. Be sure you have selected the shape for that correct metropolis/nation.

- Step 2. Use the Preview option to examine the form`s information. Do not neglect to read through the explanation.

- Step 3. If you are unsatisfied using the form, use the Search field at the top of the display to locate other types in the lawful form template.

- Step 4. When you have located the shape you require, select the Acquire now key. Opt for the pricing program you like and add your accreditations to register for the account.

- Step 5. Approach the transaction. You may use your charge card or PayPal account to perform the transaction.

- Step 6. Pick the formatting in the lawful form and obtain it on the device.

- Step 7. Complete, modify and printing or indicator the Florida Change of Beneficiary.

Every lawful papers template you purchase is your own for a long time. You possess acces to each form you acquired inside your acccount. Select the My Forms segment and decide on a form to printing or obtain yet again.

Remain competitive and obtain, and printing the Florida Change of Beneficiary with US Legal Forms. There are thousands of professional and express-distinct kinds you can utilize for the business or specific requirements.

Form popularity

FAQ

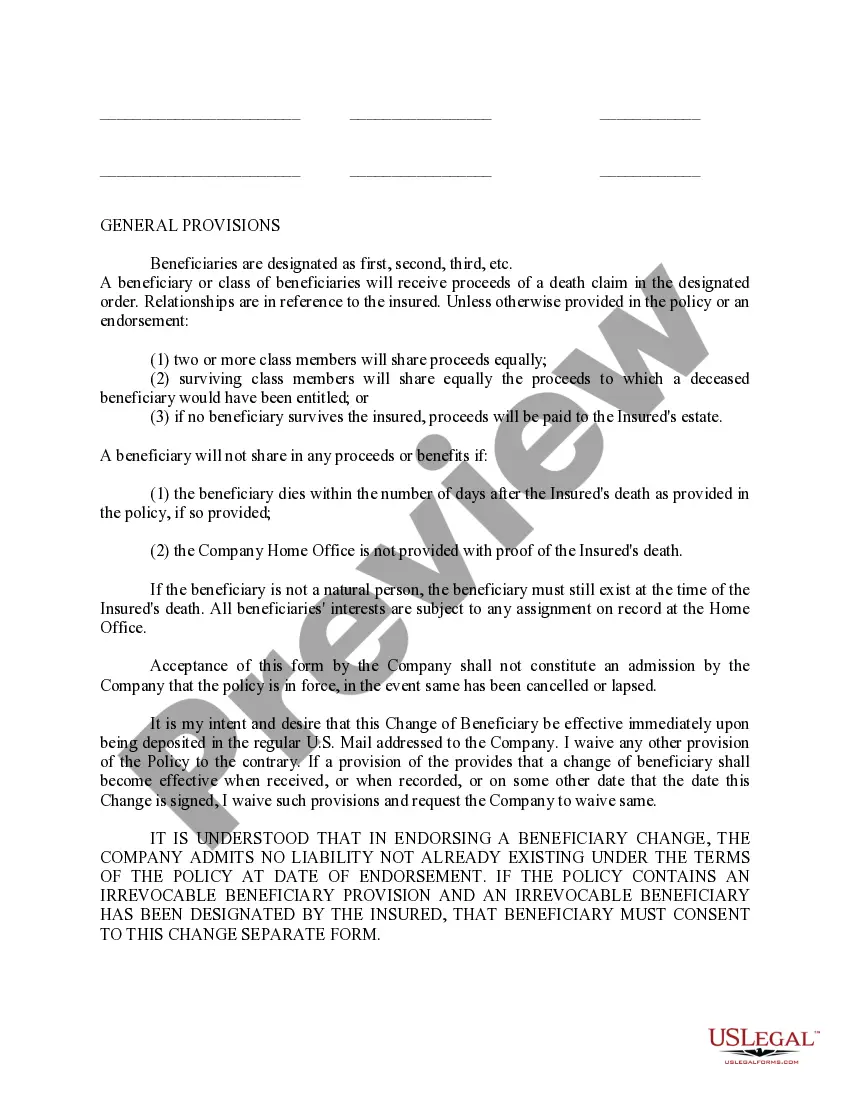

As the policyholder, only you ? or someone who holds durable power of attorney for you ? can change your life insurance beneficiaries. However, if your policy names an irrevocable beneficiary, you will also need to get that beneficiary's consent before making changes.

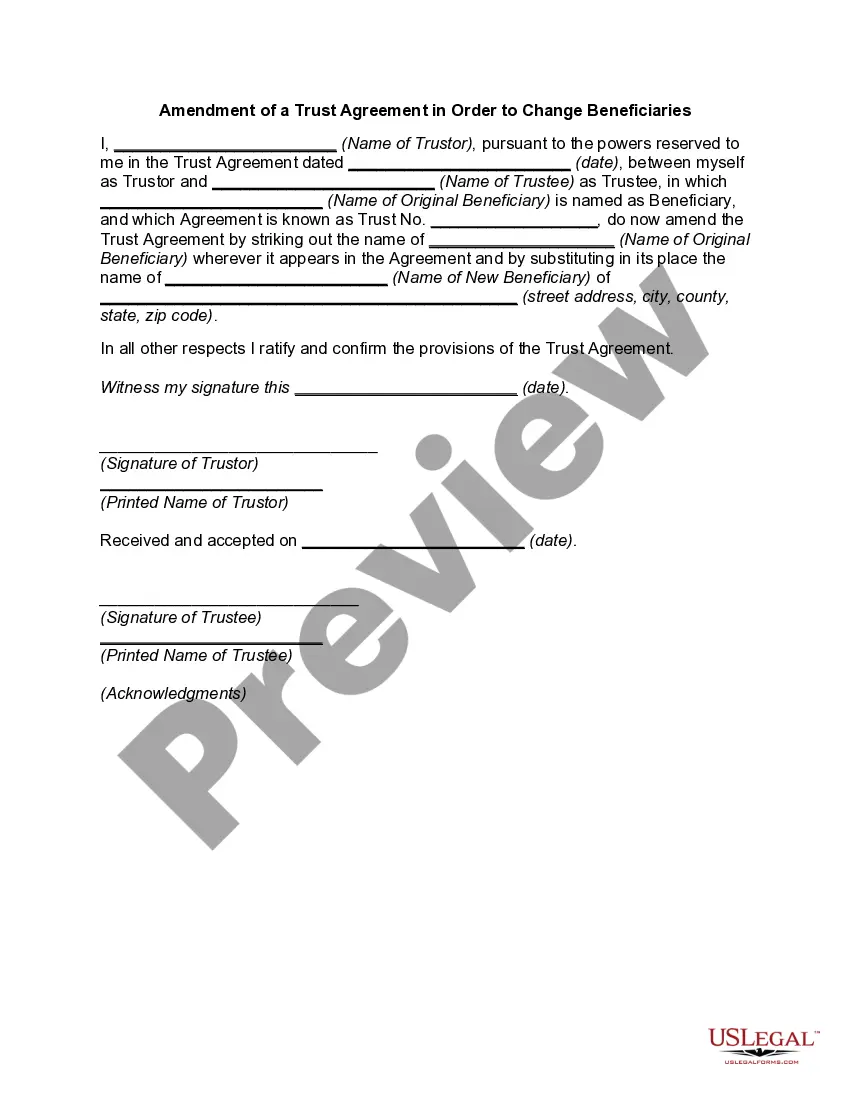

The beneficiary can be either revocable or irrevocable. A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent. You can name as many beneficiaries as you want, subject to procedures set in the policy.

Change a beneficiary Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online. Otherwise, you'll have to complete, sign, and mail a paper form.

The policyowner can change the beneficiary. A policyowner may change a beneficiary at any time. However, consent may be needed by the current beneficiary if designated as irrevocable.

The policy owner is the only person who can change the beneficiary designation in most cases. If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes. A power of attorney can give someone else the ability to change your beneficiaries.

A revocable beneficiary designation gives the policyholder the right to change the beneficiary without the consent of the named beneficiary.

The policyholderPolicyholderThe person who owns an insurance policy is the only person allowed to make changes to your life insurance beneficiaries. The only exception is if you've granted someone power of attorney, a legal document that lets someone make financial, legal, or medical decisions on your behalf.

As the policyholder, only you ? or someone who holds durable power of attorney for you ? can change your life insurance beneficiaries. However, if your policy names an irrevocable beneficiary, you will also need to get that beneficiary's consent before making changes.