A Florida Revocable Trust for lottery winnings is a legal instrument designed to protect and manage the assets received from lottery winnings in the state of Florida. This trust allows lottery winners to control the distribution and management of their winnings while providing flexibility and avoiding probate proceedings. The primary benefit of a Florida Revocable Trust for lottery winnings is that it allows the individual to maintain privacy and confidentiality regarding their winnings. Since lottery winners are often subject to media attention, a revocable trust offers a layer of protection by keeping the details of the winnings out of the public eye. Additionally, a revocable trust allows the lottery winner to have control over how the funds are managed and distributed. The trust document outlines the specific terms and conditions set by the granter, allowing them to designate who will be the beneficiaries of the trust, how much they will receive, and when the distributions will take place. This level of control ensures that the winnings are used in a manner consistent with the granter's intentions. Florida Revocable Trusts for lottery winnings come in various types, with each designed to cater to specific needs and circumstances of the lottery winner. Some different types of trusts that can be established include: 1. General Revocable Trust: This type of trust gives the granter complete control over the assets and allows modifications or revocation at any time. 2. Testamentary Trust: A testamentary trust is created through a will and only becomes effective upon the death of the granter. It can be used to provide for the management and distribution of lottery winnings for minor beneficiaries or those considered incapable of managing the funds themselves. 3. Special Needs Trust: This type of trust is designed to protect the lottery winner's winnings while considering the needs of beneficiaries who may have disabilities or special requirements. It ensures that the funds are used to supplement government benefits without jeopardizing their eligibility. 4. Charitable Remainder Trust: This trust allows the lottery winner to support charitable causes while still earning income from the winnings during their lifetime. After the granter's passing, the remaining funds are distributed to the designated charities. 5. Dynasty Trust: A dynasty trust is created to provide for multiple generations, allowing the winnings to benefit the granter's family for years to come. It can help preserve family wealth while minimizing estate taxes. In conclusion, a Florida Revocable Trust for lottery winnings offers lottery winners the ability to safeguard their newfound wealth, maintain privacy, and retain control over how their winnings are managed and distributed. With various types of trusts available, individuals can customize their trust to align with their unique goals and circumstances.

Revocable Trust For Lottery Winnings

Description revocable trust florida

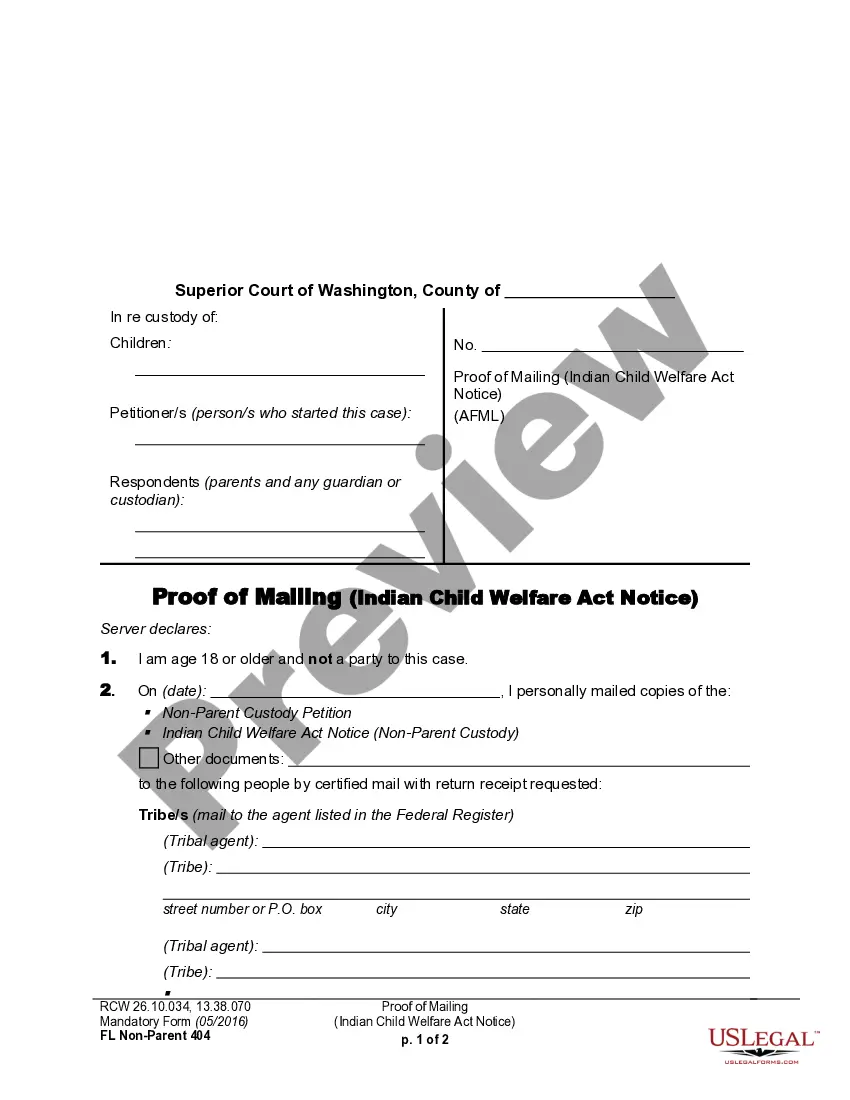

How to fill out Florida Revocable Trust For Lottery Winnings?

If you need to finalize, acquire, or create sanctioned document templates, utilize US Legal Forms, the leading selection of legal forms that are accessible online.

Take advantage of the website's simple and convenient search feature to find the documents you require. Various templates for business and individual applications are organized by categories and states, or keywords.

Employ US Legal Forms to obtain the Florida Revocable Trust for Lottery Winnings with just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to each form you downloaded within your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Florida Revocable Trust for Lottery Winnings with US Legal Forms. There are millions of professional and state-specific forms available to meet your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download option to retrieve the Florida Revocable Trust for Lottery Winnings.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Confirm that you have chosen the form for the appropriate area/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you desire, select the Purchase now option. Choose the payment plan you prefer and provide your information to register an account.

- Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Florida Revocable Trust for Lottery Winnings.

Form popularity

FAQ

Yes, lottery winnings can be inherited in Florida. If you create a Florida Revocable Trust for Lottery Winnings, you can specify how the winnings will be distributed upon your passing. The trust arrangement simplifies the transfer process and helps avoid probate complications. Engaging with uslegalforms can provide you with the necessary resources and documentation to establish your trust effectively.

To distribute lottery winnings to your family, first, consider setting up a Florida Revocable Trust for Lottery Winnings. This trust allows you to manage how the funds will be allocated among your family members, ensuring a smooth transition of wealth. Importantly, the trust can help avoid the lengthy probate process, providing quicker access to the winnings. Engaging a legal expert can guide you through the trust setup, ensuring compliance with Florida laws.

Handling large lottery winnings requires careful planning to secure your financial future. First, consult with a financial advisor to discuss options like investing and savings. Implementing a Florida Revocable Trust for Lottery Winnings allows you to maintain control over your assets while providing tax advantages. With Uslegalforms, you can easily create a trust that meets your specific needs.

yield savings account or a checking account specifically designed for large deposits are excellent choices after winning the lottery. These accounts typically offer better interest rates and more flexible features. Using a Florida Revocable Trust for Lottery Winnings can also be beneficial for managing these funds, shielding your assets from taxes and legal problems. Uslegalforms can provide the necessary documents to establish your trust quickly.

When winning the lottery, choosing the right place to deposit your winnings is crucial. Consider a reputable bank that offers high-interest accounts to maximize your funds. Additionally, using a Florida Revocable Trust for Lottery Winnings can protect your assets from potential claims and ensure a smooth transfer to your beneficiaries. Uslegalforms can help you set up the trust efficiently.

In Florida, winners generally cannot remain completely anonymous; however, a Florida Revocable Trust for Lottery Winnings can help shield your identity. When you claim the prize through a trust, the trust's name appears on the paperwork instead of your personal name. This method provides some level of privacy and allows you to manage your winnings without drawing public attention. To fully understand how this works, consider exploring resources on uslegalforms for guidance related to lottery winnings and trusts.

Yes, a trust can claim a lottery prize in Florida. Using a Florida Revocable Trust for Lottery Winnings allows you to collect your prize while maintaining a level of privacy and control over the funds. By claiming your lottery winnings through a trust, you can structure your finances in a way that protects your assets and benefits your heirs. Be sure to consult with legal professionals to ensure the trust complies with state regulations for lottery claims.

When a Florida Revocable Trust for Lottery Winnings wins the lottery, the prize is awarded to the trust rather than to an individual. This means that the funds will be managed according to the terms set forth in the trust document. A trust can provide better asset protection and can simplify the distribution process among beneficiaries, ensuring that your lottery winnings are handled according to your wishes. This setup also aids in avoiding probate, making the process smoother and more private.

To claim lottery winnings anonymously, you should establish a legal entity, such as a trust, prior to claiming your prize. A Florida Revocable Trust for Lottery Winnings can effectively shield your identity and secure your assets. Consult with legal professionals to ensure you follow the correct procedures.

Yes, you can form a trust to collect lottery winnings in Florida. Many winners choose a Florida Revocable Trust for Lottery Winnings as it provides a legal framework for claiming prizes. This option not only streamlines the collection process but also helps ensure confidentiality.

Interesting Questions

More info

We handle all the details for you in one place. You and your loved ones are better off trusting your estate in the hands of professionals who truly love what they do. We have been helping customers for over 25 years and have the experience to help you succeed. That is why every client in our firm knows we will be there “the next day”, that it “will work out”, that it “will be a big help to you”. Our Professional Estate Planning Lawyers Are here: We are your local estate planning attorney Our team has extensive experience handling estates Our team of licensed lawyers is ready to help Our attorneys will make sure your property will be safely administered Your money is safe as long as you give us your details No trust. Ever. Lottery Trusts Loan or loan your money to someone who wishes to use it for their needs. You have no control over what they should do with that money. We are not your banker. We do not have accounts.