Florida Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

You have the capability to spend time online searching for the correct legal document template that meets the federal and state requirements you require.

US Legal Forms offers a wide range of legal templates that are examined by experts.

You can easily download or print the Florida Revocable Trust for Real Estate from the service.

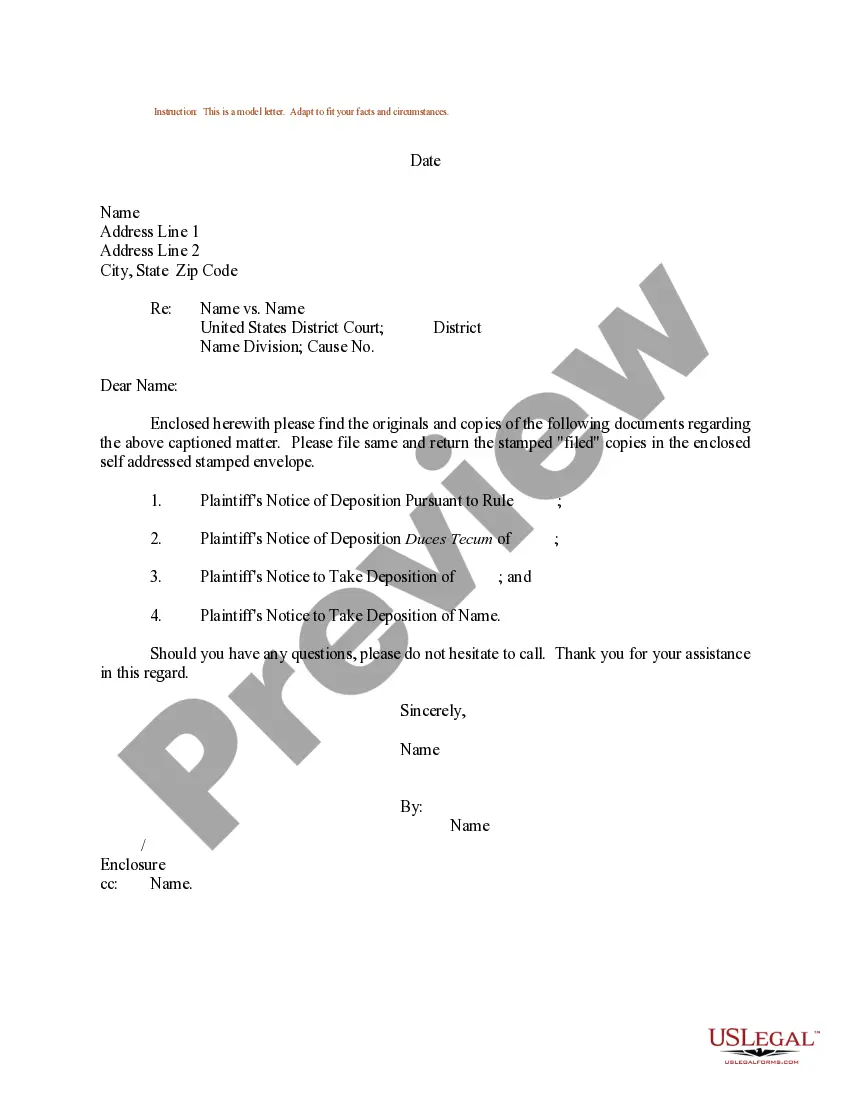

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Florida Revocable Trust for Real Estate.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of a purchased form, navigate to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document template for the state/city of your choice.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

While it is not legally required to have an attorney to set up a Florida revocable trust for real estate, it is highly advisable. An attorney can guide you through the complexities of estate planning, ensuring all legal requirements are met. Using a platform like uslegalforms can simplify the process, but having professional legal advice can prevent costly mistakes. In the end, having an expert on your side can give you peace of mind about your trust and its implications.

One notable disadvantage of a Florida revocable trust for real estate is that it does not provide protection from creditors or legal claims. Additionally, setting up this type of trust can involve various costs, including notary fees and potential attorney fees. Some people might also find the management of the trust confusing or overwhelming, especially if they have never dealt with similar legal matters before. It's essential to weigh these factors when deciding whether a Florida revocable trust for real estate is right for you.

In a Florida Revocable Trust for Real Estate, the property is owned by the trust itself, but as the creator, you retain control over it. This means you can manage, sell, or modify your assets without losing your rights. When you establish this type of trust, you are essentially acting as both the trustee and the beneficiary, allowing for flexibility in handling your real estate. This arrangement can provide peace of mind, knowing that your property is managed according to your wishes while you are alive.

One of the biggest mistakes parents make when establishing a trust fund is failing to clearly define their intentions. Without clear guidelines, beneficiaries may face confusion and disputes, which can lead to unnecessary stress. It's essential for parents to communicate their wishes effectively, and a Florida Revocable Trust for Real Estate can help simplify this process. By outlining specific instructions, families can prevent misunderstandings and ensure that their assets are distributed according to their desires.

Deciding if a Florida Revocable Trust for Real Estate is right for you depends on your specific circumstances. It can be a wise choice for many homeowners seeking to streamline their estate planning and protect their assets. However, you should carefully consider your needs and consult with an expert to ensure this option aligns with your long-term goals.

While a Florida Revocable Trust for Real Estate has advantages, it also has some drawbacks. For instance, establishing the trust may incur initial setup costs and ongoing management fees. Furthermore, transferring property into the trust might impact your mortgage or insurance, so it’s essential to consult with professionals to navigate these potential issues.

Placing your house in a Florida Revocable Trust for Real Estate offers several benefits. It helps avoid probate, allowing your property to pass to your beneficiaries quickly and without court interference. Additionally, a revocable trust gives you flexibility, enabling you to change the terms as needed while retaining control of your property during your lifetime.

To put your property in a Florida Revocable Trust for Real Estate, you should first draft the trust document and name the beneficiaries. Next, execute a deed that transfers the property into the trust, effectively changing its ownership. Lastly, file the deed with your local county to ensure that the trust is formally recognized.

In Florida, a revocable trust does not have to be recorded to be valid. However, if you transfer real estate into the trust, the deed must be recorded with the local county office. Keeping essential trust documents organized can help in clarifying the trust’s terms should they be needed later.

Generally, putting property into a Florida Revocable Trust for Real Estate does not trigger reassessment for property tax purposes. Since the trust is revocable, it does not change the ownership status from a legal standpoint. However, it is wise to check with local tax authorities for any specific regulations that may apply.