Florida General Form of Revocable Trust Agreement

Description

How to fill out General Form Of Revocable Trust Agreement?

Are you currently in a position that necessitates documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Florida Revocable Trust for Married Couple, designed to satisfy state and federal requirements.

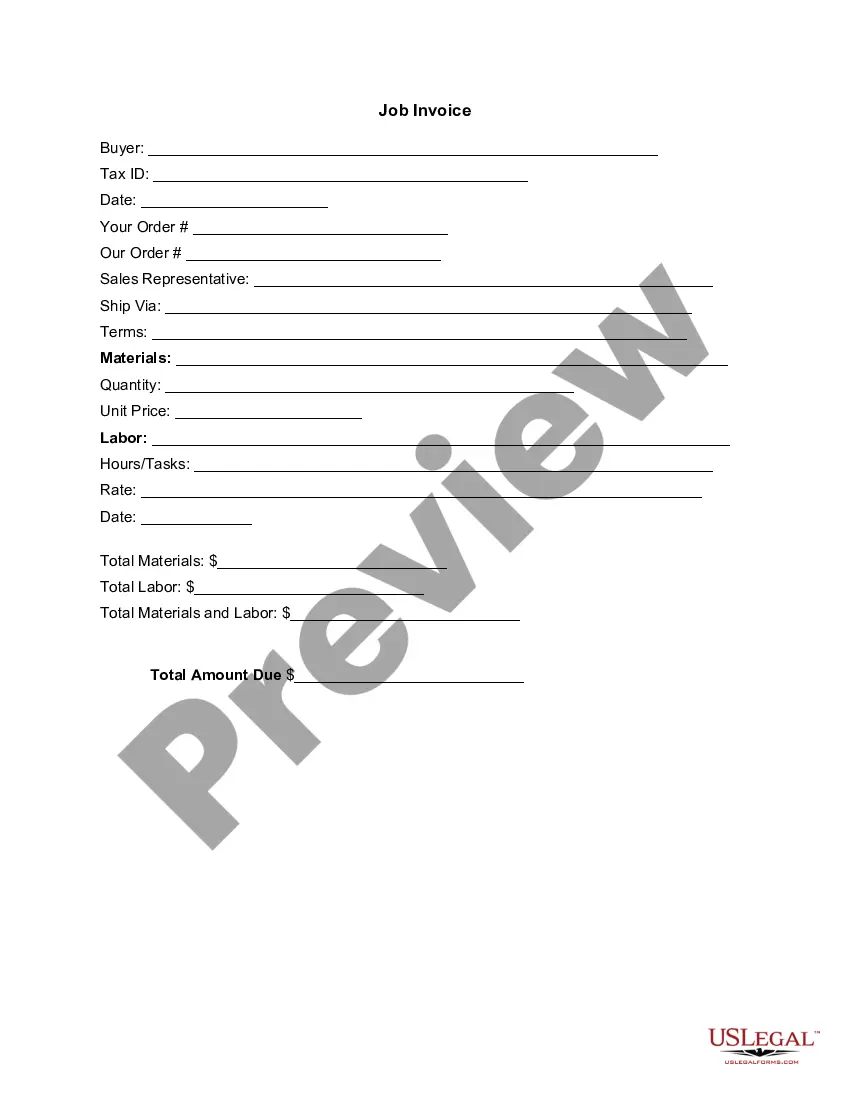

Once you find the appropriate form, click on Purchase now.

Select the pricing plan you require, fill in the necessary information to set up your account, and complete your purchase using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Florida Revocable Trust for Married Couple anytime, if needed. Just click on the desired form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers professionally drafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Florida Revocable Trust for Married Couple template.

- If you don't have an account and wish to start utilizing US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the appropriate city/state.

- Utilize the Preview button to review the document.

- Examine the description to confirm you have chosen the right form.

- If the form does not fit your needs, use the Search field to locate the form that meets your requirements.

Form popularity

FAQ

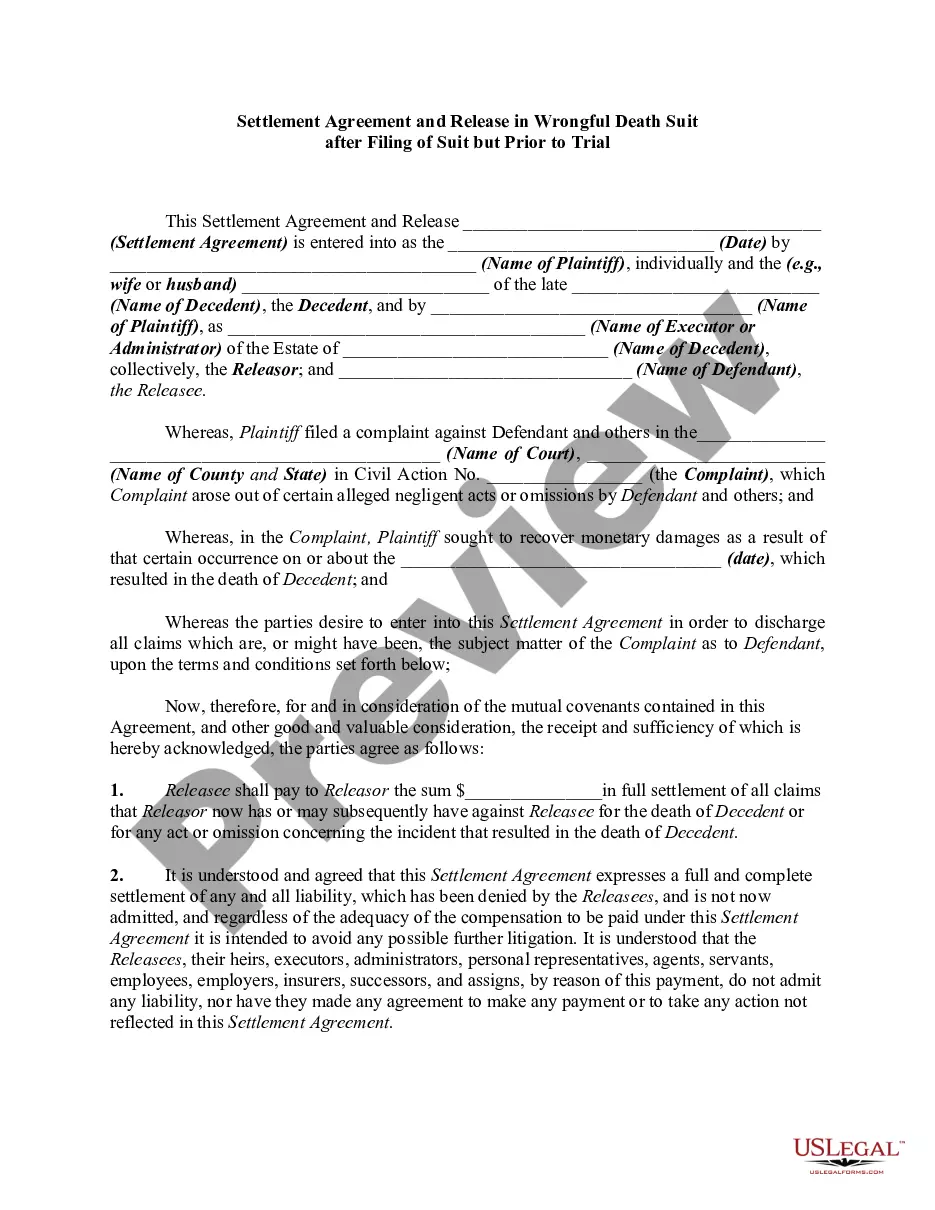

Setting up a Florida revocable trust for married couples involves several straightforward steps. First, you should define the assets you want to include and select a trustee, who can be one or both spouses. Next, you need to draft the trust document, clearly outlining the terms and designate beneficiaries. Lastly, funding the trust with your assets is crucial to ensure its effectiveness, and platforms like USLegalForms can assist you in navigating this process.

Marriage can influence the management and distribution of a Florida revocable trust for married couples. If you establish a trust before marriage, your spouse may have rights to its assets. Additionally, couples often update their trusts to reflect their wishes regarding asset distribution upon death or divorce. A well-drafted trust can help maintain transparency and protect both partners' interests.

A Florida revocable trust for married couples can provide a level of protection for assets. However, it's important to understand that trust provisions may not completely shield assets from division in a divorce. Courts typically evaluate assets held in trusts during divorce proceedings. Consulting an attorney is wise to ensure your trust serves your financial goals effectively.

When one grantor of a joint revocable trust passes away, the provisions of the Florida Revocable Trust for Married Couple determine how assets are managed and distributed. Typically, the surviving spouse assumes full control of the trust's assets, allowing for continued management without interruption. It simplifies the process of inheritance and can avoid the need for probate court. This benefit is significant as it helps the surviving spouse cope with the loss while ensuring that their financial needs remain secure.

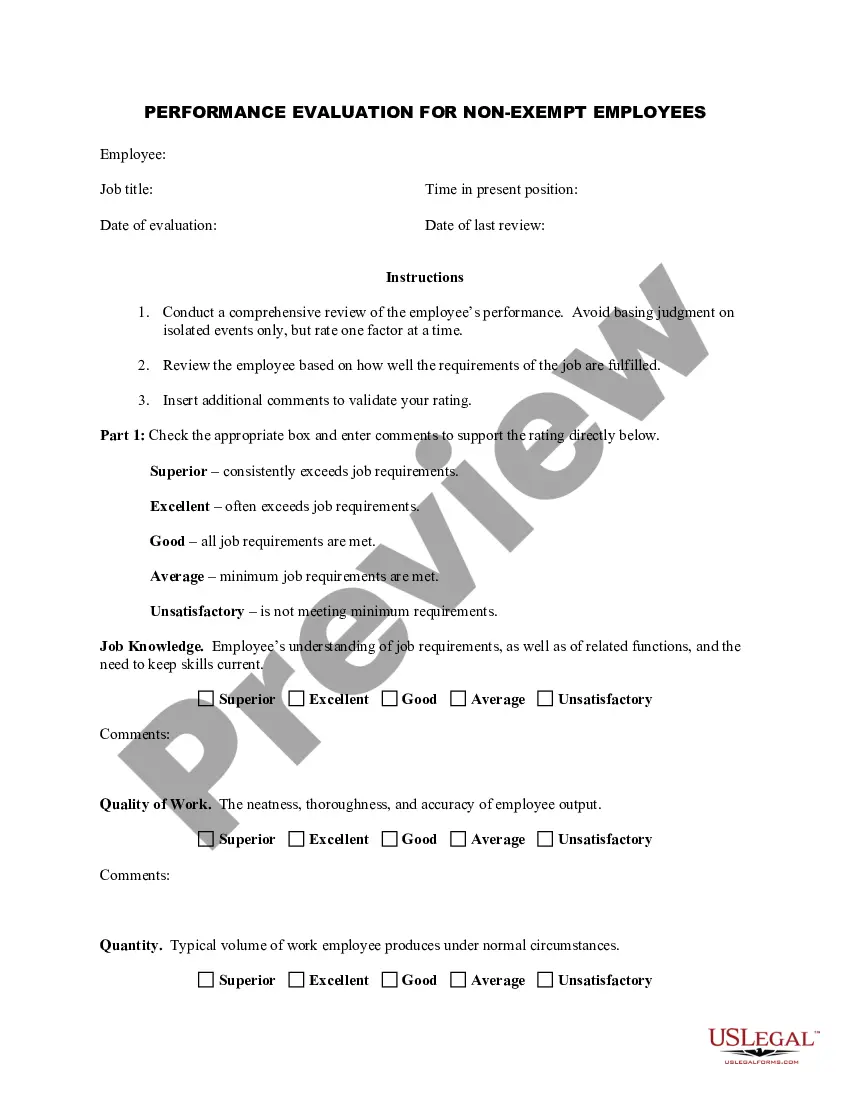

One major mistake parents commit when setting up a trust fund is not clearly defining terms for beneficiaries. If details are vague, it can lead to confusion and conflicts later on. With a Florida Revocable Trust for Married Couple, it is crucial to specify how and when your children will receive assets. Comprehensive planning from the beginning helps avoid complications and ensures your children's needs are met.

A Florida Revocable Trust for Married Couple provides a significant level of security for your assets, including properties and investments. While it remains flexible during your lifetime, meaning you can modify or revoke it, it still protects your estate from potential legal challenges. By placing your assets in this trust, you ensure a smoother transition to beneficiaries after your passing, safeguarding your wishes and minimizing disputes.

For many couples, a Florida Revocable Trust for Married Couple serves as an optimal choice for holding a home. This type of trust allows you to maintain control over your property while also providing an easy way to transfer it to your heirs. It can help avoid probate, which means your loved ones can inherit your home without the lengthy process. Additionally, it offers flexibility to make changes as your circumstances evolve.

The best living trust for a married couple often depends on their unique financial and familial circumstances. Many couples choose a Florida Revocable Trust for Married Couple due to its flexibility and ease of management. These trusts can be tailored to reflect their wishes and can simplify the estate transfer process. Consulting a legal expert can provide valuable insight tailored to your needs.

A trustee conflict of interest in Florida occurs when a trustee has a personal stake in a decision that affects the trust's beneficiaries. This can lead to complicated situations and potential legal issues. It's essential for trustees in a Florida Revocable Trust for Married Couple to prioritize the best interests of the trust at all times. Regularly reviewing the trust document can help avoid these conflicts.

In a Florida Revocable Trust for Married Couple, trustees typically must act unanimously to approve major decisions unless the trust document specifies otherwise. This requirement fosters collaboration and joint decision-making. However, ensuring open lines of communication can help make this process smoother. Designing the trust document with clear guidelines can also assist in navigating decisions effectively.