Florida Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

You can dedicate hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers a wide array of legal forms that have been reviewed by experts.

You can download or print the Florida Revocable Trust for Grandchildren from my service.

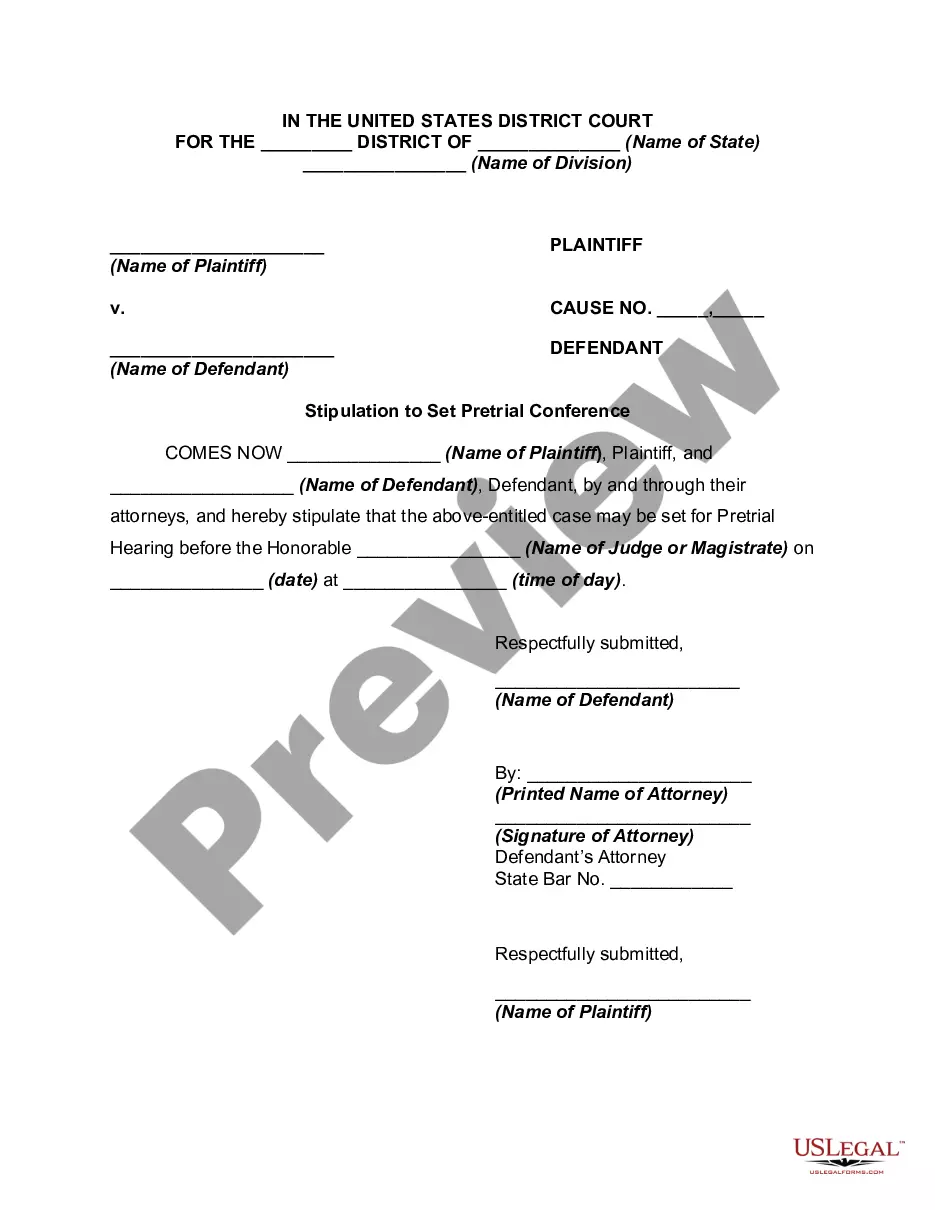

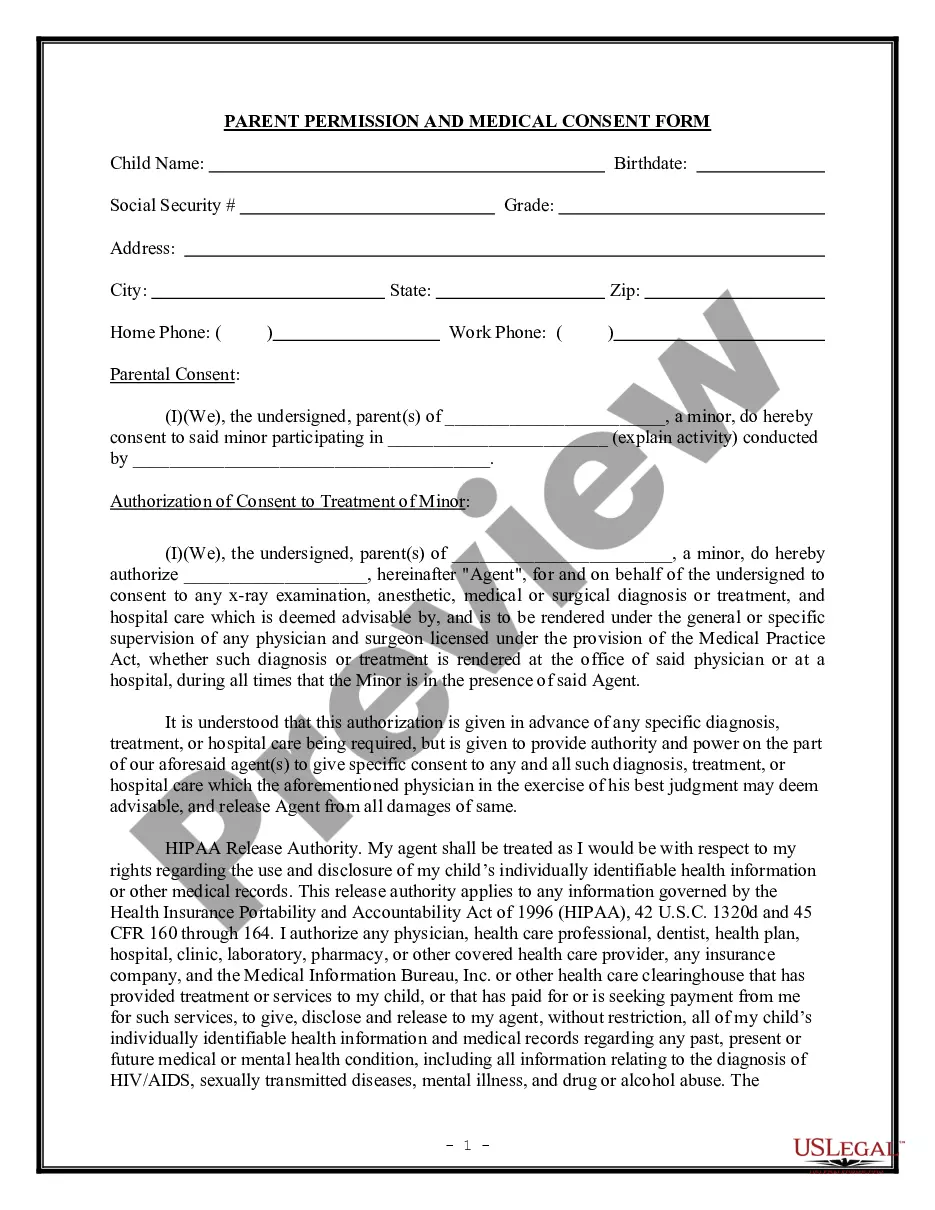

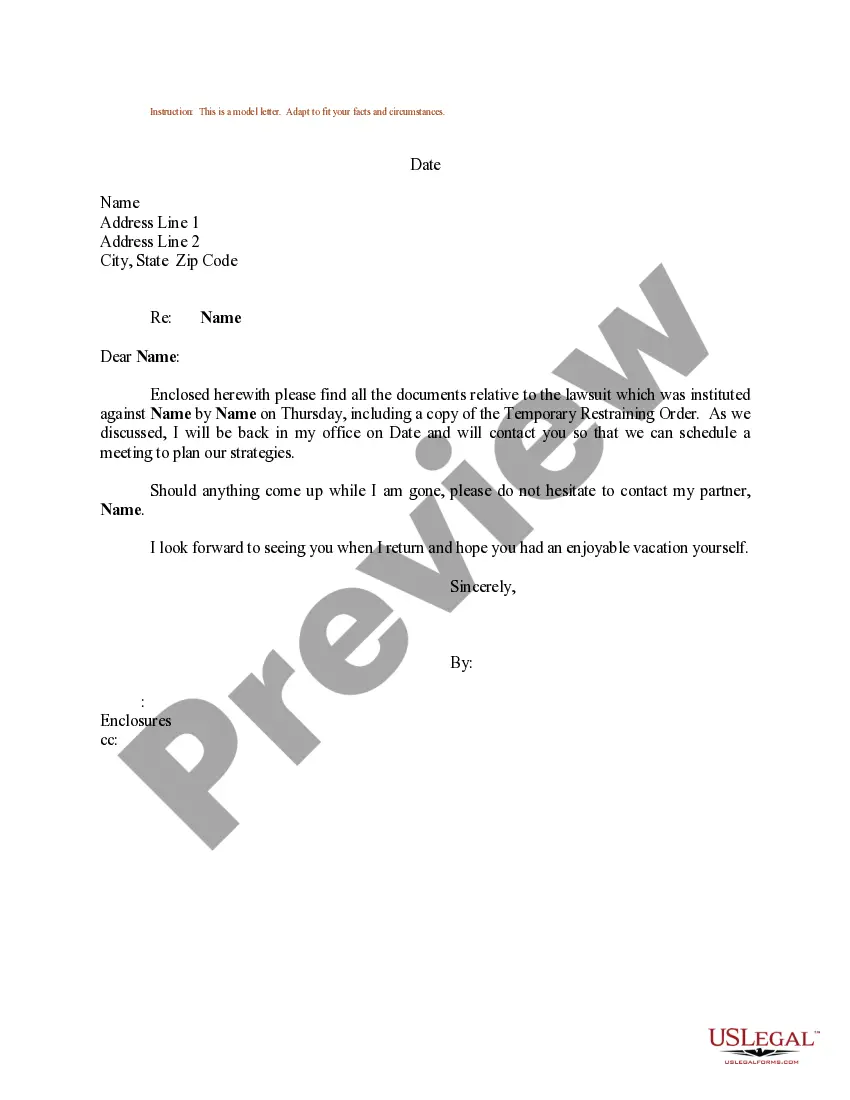

If available, use the Preview button to view the document template simultaneously.

- If you already possess an account with US Legal Forms, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Florida Revocable Trust for Grandchildren.

- Every legal document template you purchase is yours forever.

- To acquire an additional copy of the purchased form, visit the My documents tab and select the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure you've selected the correct document template for the state/city you choose.

- Refer to the form description to confirm you've selected the right template.

Form popularity

FAQ

A Florida Revocable Trust for Grandchildren can help minimize inheritance tax implications. While this type of trust typically does not avoid taxes entirely, it provides a structured approach to asset distribution. Additionally, it allows you to plan effectively, ensuring that your loved ones receive more of their inheritance.

While it's possible to set up a trust on your own, consulting an attorney for a Florida Revocable Trust for Grandchildren is wise. Attorneys can help ensure that your trust complies with Florida laws and accurately reflects your intentions. They can also assist you in navigating any complex situations that may arise.

A Florida Revocable Trust is also suitable for leaving assets to your children. This type of trust provides control over when and how your children receive their inheritance, which can help in their financial planning. Plus, it offers the flexibility to modify the trust as your family dynamics change.

Setting up a Florida Revocable Trust for Grandchildren is a beneficial approach to leaving an inheritance. This trust allows you to specify how and when your grandchildren receive their inheritance, ensuring it is used wisely. By using a trust, you can also avoid probate, which simplifies the transfer process.

A Florida Revocable Trust for Grandchildren is often an excellent choice. This trust allows you to manage assets during your lifetime and easily transfer them to your grandchildren upon your passing. Additionally, it provides flexibility, allowing you to make changes as circumstances evolve.

Yes, you can prepare your own trust in Florida, including a Florida Revocable Trust for Grandchildren. However, creating a trust without professional assistance can lead to oversights and misunderstandings. Using a trusted platform like uslegalforms can simplify the process, offering templates and guidance to ensure you meet all legal requirements. Ultimately, while DIY trusts are possible, a little help can make everything clearer and more secure.

For a Florida Revocable Trust for Grandchildren to be valid, it must meet several key requirements. First, the trust document should be in writing and signed by the grantor. Additionally, the grantor must have the legal capacity to create the trust, and the trust should have clearly defined beneficiaries and distributed assets. Lastly, proper funding of the trust must occur to ensure that the assets are managed according to your wishes.

While you can create a trust in Florida without a lawyer, seeking legal advice is highly recommended for a Florida Revocable Trust for Grandchildren. A lawyer can guide you through the intricacies of trust law, ensuring that your document complies with state requirements. Additionally, they can help you tailor the trust to fit your specific needs and family circumstances. This expertise can ultimately save time and reduce potential issues in the future.

A Florida Revocable Trust for Grandchildren often stands out as a top choice for guardians wanting to secure their grandchildren's future. This trust allows you to maintain control over your assets while designating how those assets should be distributed upon your passing. It offers the flexibility to change the terms if needed, and it also helps avoid the lengthy probate process. Overall, it ensures that your grandchildren receive their inheritance in a structured and intentional manner.

Setting up a revocable trust in Florida involves several steps, including deciding on the trust terms and transferring assets. You will want to consult with a legal professional to draft a Florida Revocable Trust for Grandchildren that meets your needs. Utilizing platforms like uslegalforms can simplify this process and provide necessary templates.