Florida Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

You might spend numerous hours online attempting to locate the authentic document template that fits the federal and state requirements you need.

US Legal Forms provides thousands of legitimate forms that are evaluated by experts.

You can easily download or print the Florida Retirement Cash Flow from my service.

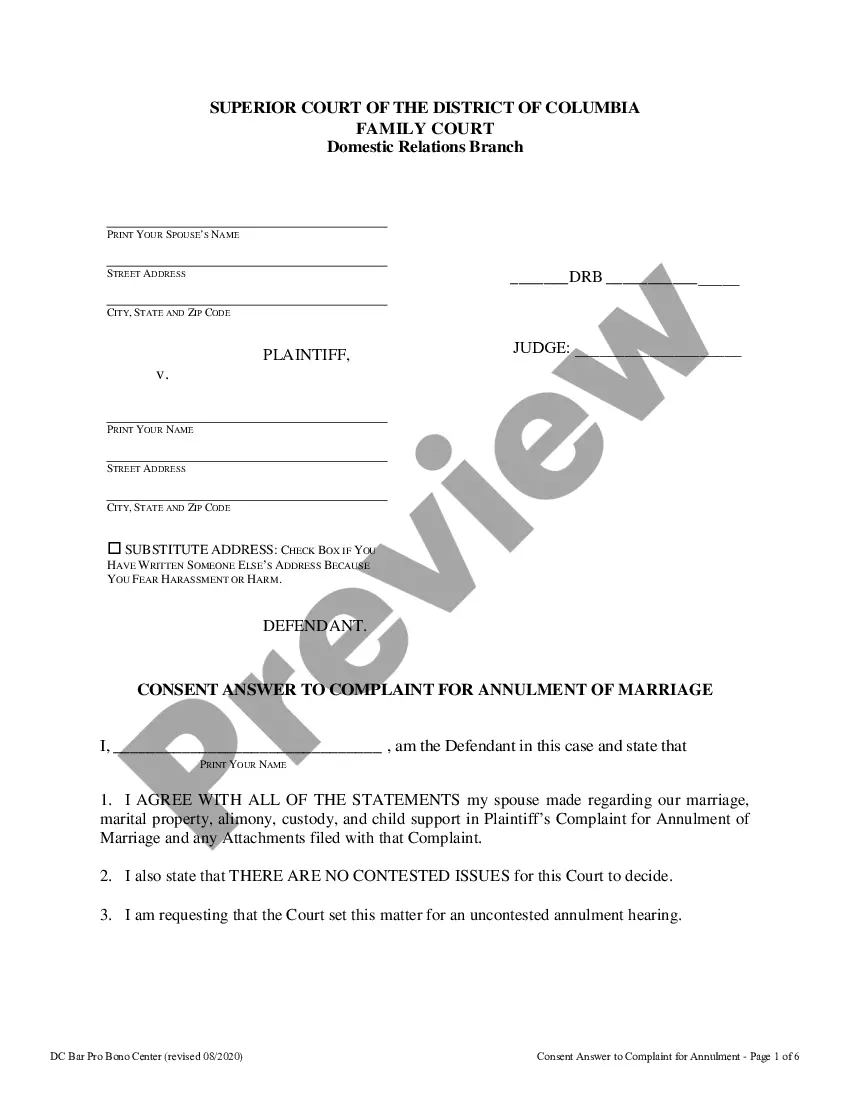

If available, use the Preview button to view the document template at the same time.

- If you already possess a US Legal Forms account, you can Log In and select the Download button.

- Subsequently, you can complete, modify, print, or sign the Florida Retirement Cash Flow.

- Every legitimate document template you obtain is yours permanently.

- To acquire another copy of any purchased form, go to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your choice.

- Review the form description to guarantee you have selected the correct form.

Form popularity

FAQ

If your plan does allow for loans, you can borrow up to $50,000 or 50 percent of the current value of the account, whichever is less. For example, if you have $60,000 in the account, you can borrow up to $30,000. If you have $120,000 in the account, the most you can borrow is $50,000.

The Investment Plan's funds are spread across five asset classes: stable value funds, inflation protection funds, bond funds, U.S. stock funds, and foreign and global stock funds.

To make your request online, log in to MyFRS.com. Select Investment Plan, FRS Investment Plan > Withdrawals and Rollovers > Withdraw or Roll Over Money, and then select a payment type. To make your request by phone, call 1-866-446-9377, Option 4 (TRS 711). You will need your PIN.

A number of situations could put your pension at risk, including underfunding, mismanagement, bankruptcy, and legal exemptions. Laws exist to protect you in such circumstances, but some laws provide better protection than others.

When You Own Your Benefit You will be eligible for a Pension Plan benefit (i.e. be vested) when you complete six years of service (if you were enrolled in the FRS prior to July 1, 2011) or eight years of service (if you were enrolled in the FRS on or after July 1, 2011).

To make your request online, log in to MyFRS.com. Select Investment Plan, FRS Investment Plan > Withdrawals and Rollovers > Withdraw or Roll Over Money, and then select a payment type. To make your request by phone, call 1-866-446-9377, Option 4 (TRS 711). You will need your PIN.

Once a person is vested in a pension plan, he or she has the right to keep it. So, if you're fired after you've become vested in the plan, you wouldn't lose your pension. It's also possible to be partially vested in a plan, which would mean that you could keep the portion that has vested even if you're fired.

Any public employee of a city, county or state employer participating in the Florida Retirement System (FRS) can face an action to forfeit their retirement benefits, including any pension plan, if they are accused of a specified criminal act or enter a plea of guilty or no contest even if the court withholds

Once you are considered retired: You will lose any non-vested Investment Plan or prior Pension Plan service. You can eventually be reemployed by any FRS-participating employer but, as the timeline on page 6 shows, you might not be eligible to receive additional distributions from your Investment Plan account.

The nation's fifth-largest pension system, the Florida Retirement System (FRS), has $36 billion in public pension debt.