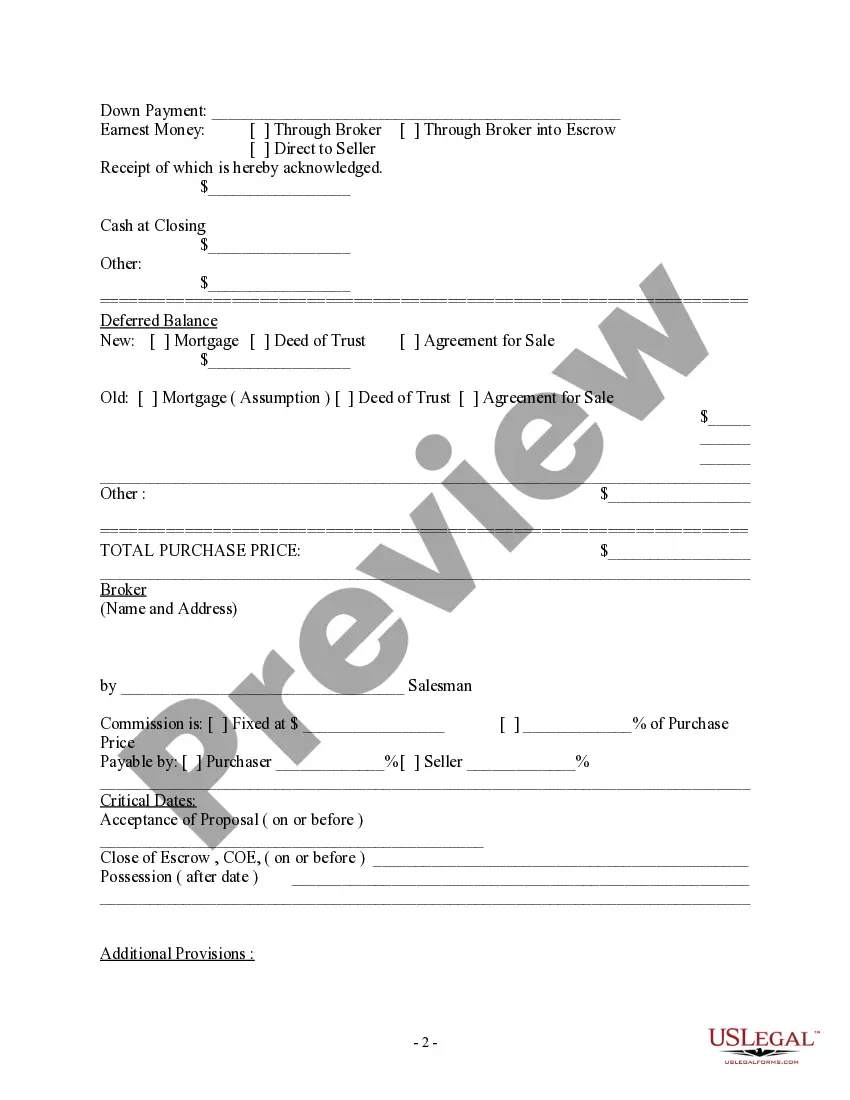

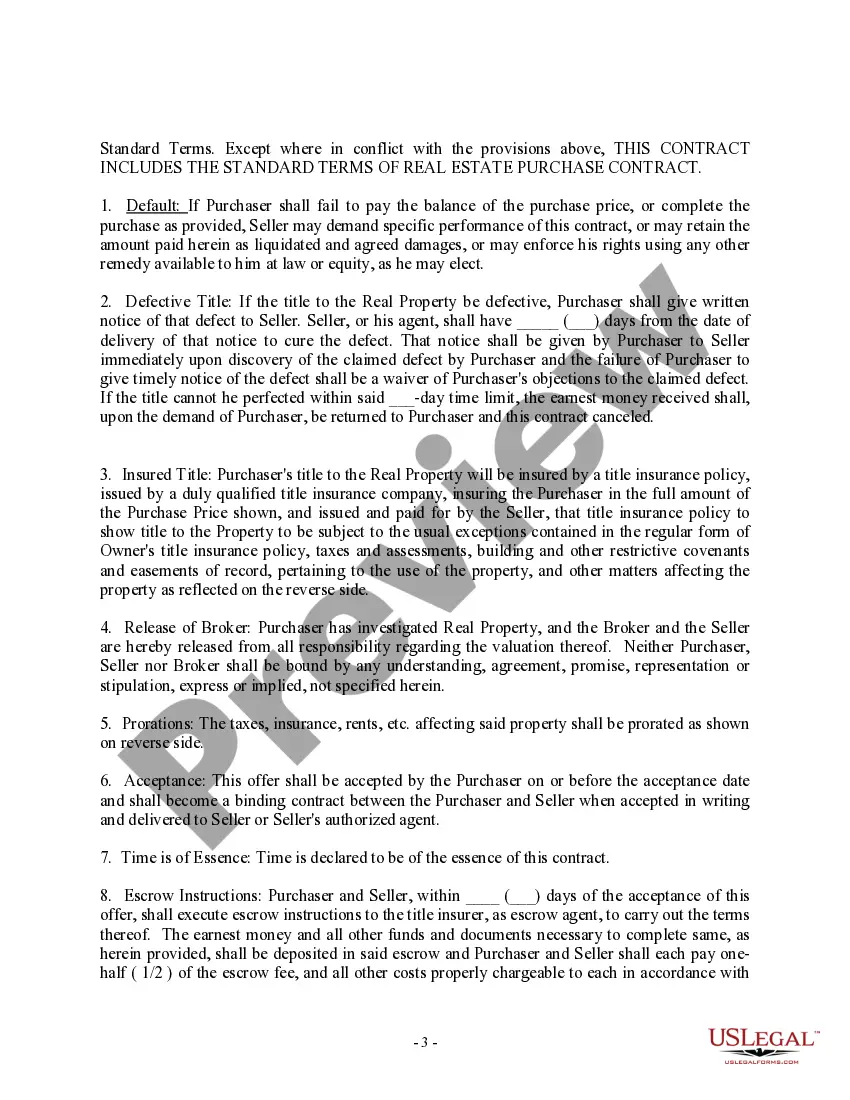

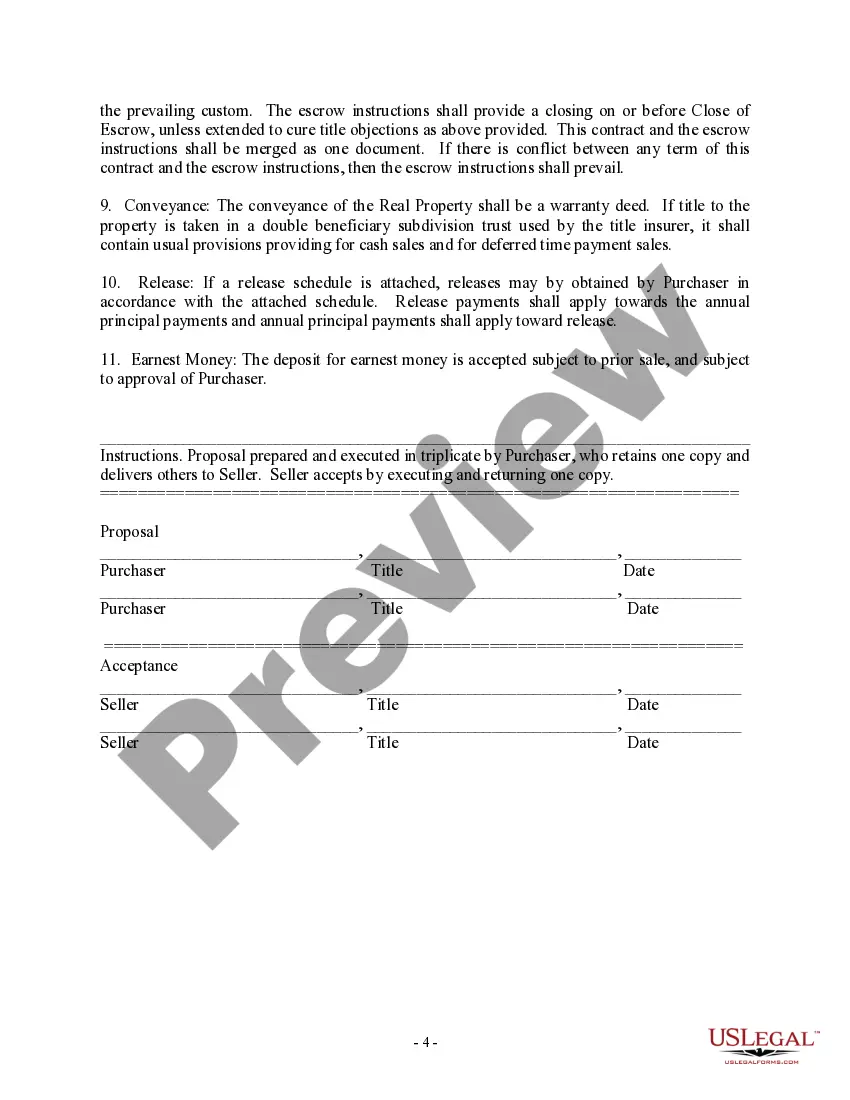

The Florida Purchase Contract and Receipt — Residential is a legal document that outlines the terms and conditions of a real estate transaction in the state of Florida. This contract is widely used by buyers and sellers to ensure that all parties are aware of their rights, obligations, and responsibilities during the sale of a residential property. The Florida Purchase Contract and Receipt — Residential provides a comprehensive framework for the purchase of residential real estate, offering protection to both buyers and sellers. It details the property's specifics, such as the address, legal description, and size, ensuring that all parties are on the same page regarding the property being bought or sold. Key provisions outlined in the Florida Purchase Contract and Receipt — Residential include the purchase price, financing details, contingencies, and deadlines. These provisions cover essential aspects such as the down payment, type of mortgage, and the timeframe for fulfilling financial obligations. The contract also addresses contingencies, such as inspections, appraisals, and the buyer's ability to secure financing, allowing the buyer to exit the transaction if certain conditions are not met. Different types of Florida Purchase Contract and Receipt — Residential can vary depending on specific scenarios or parties involved: 1. Standard Florida Purchase Contract: This is the most common type used for residential real estate transactions. It provides a general framework for buyers and sellers to complete a straightforward purchase without any unique circumstances or conditions. 2. As-Is Florida Purchase Contract: This type of contract is used when the seller does not want to make any repairs or improvements to the property before selling it. It releases the seller from any responsibility for the property's condition, and the buyer accepts it "as is" without the expectation of any repairs or concessions. 3. FHA or VA Florida Purchase Contract: These contracts are tailored specifically for transactions involving buyers using either FHA (Federal Housing Administration) or VA (Veterans Affairs) financing options. These documents include additional provisions to meet the requirements of these government-backed loan programs. 4. New Construction Florida Purchase Contract: When purchasing a newly constructed home or one under construction, a specific contract is used. It includes provisions related to construction milestones, anticipated completion dates, and allowances for customization or upgrades requested by the buyer. It is crucial for buyers and sellers in Florida to carefully review and understand the content of the Purchase Contract and Receipt — Residential before committing to any real estate transaction. Consulting with a real estate agent or attorney experienced in Florida real estate law is strongly advised to ensure compliance and protect the parties' rights.

Florida Purchase Contract and Receipt - Residential

Description

How to fill out Florida Purchase Contract And Receipt - Residential?

US Legal Forms - among the most significant libraries of legitimate varieties in the USA - provides a variety of legitimate document templates it is possible to download or printing. Using the website, you can find thousands of varieties for organization and personal reasons, categorized by categories, claims, or keywords.You will discover the latest types of varieties such as the Florida Purchase Contract and Receipt - Residential in seconds.

If you have a registration, log in and download Florida Purchase Contract and Receipt - Residential through the US Legal Forms library. The Download option will appear on every single develop you see. You have access to all earlier delivered electronically varieties in the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, listed here are simple instructions to obtain started off:

- Be sure you have picked the best develop for your personal area/region. Click the Review option to analyze the form`s content material. Read the develop outline to ensure that you have chosen the appropriate develop.

- In case the develop doesn`t fit your requirements, use the Search discipline on top of the monitor to find the one who does.

- Should you be satisfied with the form, verify your choice by visiting the Get now option. Then, select the pricing strategy you favor and provide your qualifications to register for an account.

- Procedure the financial transaction. Make use of your credit card or PayPal account to complete the financial transaction.

- Select the format and download the form on your device.

- Make modifications. Load, change and printing and signal the delivered electronically Florida Purchase Contract and Receipt - Residential.

Each design you included with your money lacks an expiration day which is your own property forever. So, if you want to download or printing one more backup, just proceed to the My Forms portion and click in the develop you require.

Get access to the Florida Purchase Contract and Receipt - Residential with US Legal Forms, one of the most substantial library of legitimate document templates. Use thousands of expert and state-particular templates that fulfill your company or personal needs and requirements.