Florida Personal Services Partnership Agreement

Description

How to fill out Personal Services Partnership Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms like the Florida Personal Services Partnership Agreement in a matter of minutes.

If you have an account, Log In to download the Florida Personal Services Partnership Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your details to create an account.

Process the payment. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make adjustments. Fill out, edit and print, and sign the downloaded Florida Personal Services Partnership Agreement. Every template you have saved in your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Florida Personal Services Partnership Agreement with US Legal Forms, the largest collection of legal document templates. Leverage thousands of professional and state-specific templates that fulfill your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the appropriate form for your city/county.

- Click the Review button to examine the form's details.

- Read the form information to confirm that you have selected the correct form.

- If the form does not meet your needs, utilize the Search section at the top of the screen to find one that does.

Form popularity

FAQ

Yes, a Florida LLC must file a state tax return under certain conditions, especially if the LLC generates income in Florida. Depending on your business structure and income, this may involve filing a Florida corporate tax return. If your LLC is formed as a partnership and generates income, you would refer to your Florida Personal Services Partnership Agreement for guidance on reporting income and responsibilities. Make sure to consult a tax professional to clarify your specific filing obligations.

Yes, Florida F-1065 can be filed electronically, making the process more convenient for partners and reducing the risk of errors. Many online tax software options support the electronic filing of Florida F-1065, streamlining your tax preparation efforts. Ensure that you have all necessary information ready, including details from your Florida Personal Services Partnership Agreement, to facilitate a smooth filing experience. Utilize electronic filing to enhance efficiency and stay compliant with state requirements.

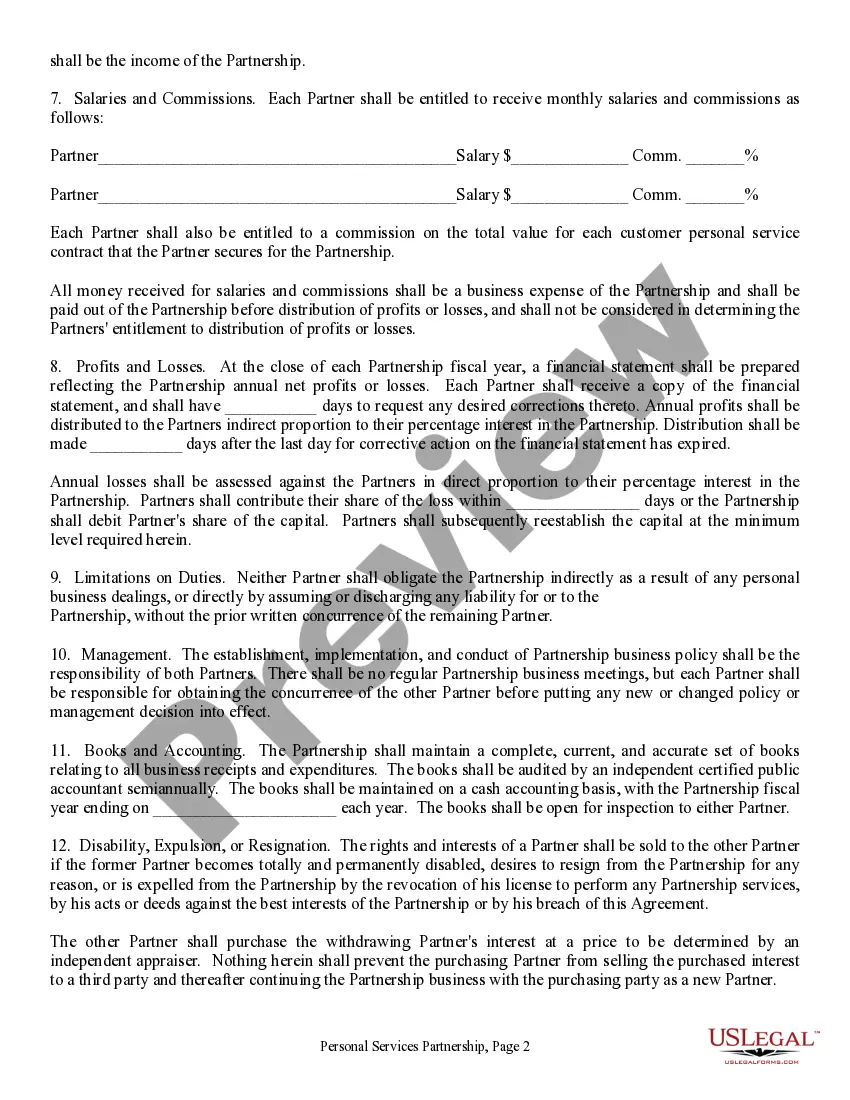

To set up a partnership in Florida, begin by choosing a partnership type that suits your needs, such as a general partnership or a limited partnership. Next, draft a Florida Personal Services Partnership Agreement outlining the roles, responsibilities, and profit-sharing arrangements between partners. Register your partnership with the Florida Division of Corporations if required, and obtain any necessary licenses or permits for your business activities. By following these steps, you can create a solid foundation for your partnership in Florida.

A personal services contract in Florida outlines the specific services one party will provide to another and the terms under which these services will be delivered. This type of contract should detail payment terms, the scope of work, and applicable deadlines to ensure clarity between both parties. Uslegalforms can guide you in crafting a tailored Florida Personal Services Partnership Agreement to effectively define your relationship and protect both parties involved.

A valid partnership agreement requires clear terms, mutual consent between parties, and a legal business purpose. Furthermore, both parties should exchange consideration, which refers to the value each party agrees to contribute to the partnership. When you create your Florida Personal Services Partnership Agreement using uslegalforms, you can rest assured that you include all essential elements and follow legal requirements clearly.

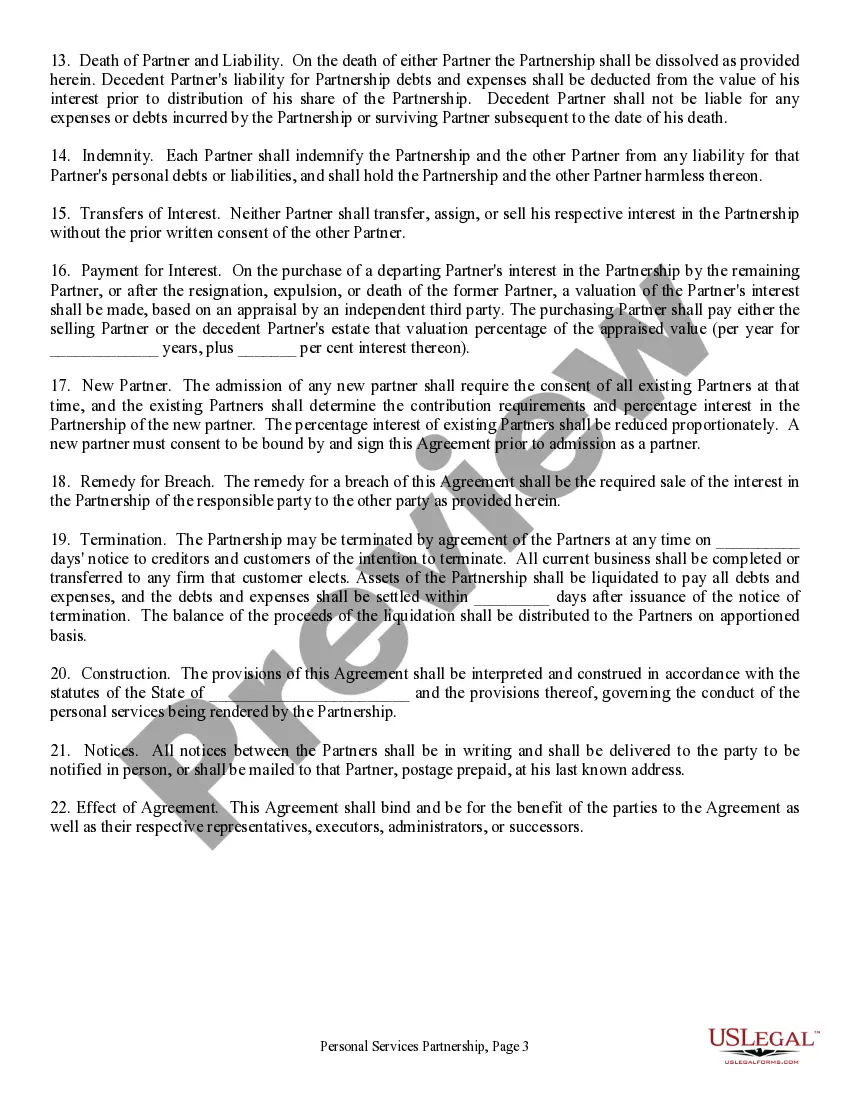

As previously mentioned, no, a partnership agreement does not need notarization to be legally binding in Florida. However, notarization can be a beneficial step in reinforcing the agreement's reliability. When you follow best practices and utilize tools like uslegalforms, you can create a comprehensive Florida Personal Services Partnership Agreement, whether or not you choose to notarize it.

Yes, a contract, including a Florida Personal Services Partnership Agreement, can still be valid even if it is not notarized. The essential factors for a contract's validity include mutual consent, a legal purpose, and consideration. That said, notarization can enhance the agreement's credibility and serve as protection if legal issues arise. Using uslegalforms can help ensure you include all necessary components to create a solid contract.

Witnessing a partnership agreement in Florida is not a legal requirement, but having witnesses can add another layer of legitimacy. While your Florida Personal Services Partnership Agreement will be enforceable without witnesses, having someone attest to the signing can help resolve any future claims about the agreement's validity. It is wise to consider having witnesses if your partnership involves substantial assets or obligations.

In Florida, a partnership agreement does not legally require notarization to be valid. However, having a notary public sign your Florida Personal Services Partnership Agreement can provide additional assurance and protect against disputes. It may serve as evidence of the agreement's authenticity, especially in situations that involve significant financial commitments. Using uslegalforms to create your agreement can simplify this process.

To fill out a partnership agreement effectively, begin by clearly defining the roles and responsibilities of each partner as outlined in your Florida Personal Services Partnership Agreement. Next, establish terms for profit sharing, decision-making processes, and procedures for addressing disputes. Make sure that all partners review the document to ensure mutual understanding and agreement. Utilizing resources from USLegalForms can assist in crafting a comprehensive and professional agreement.