This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Agreement to Extend Debt Payment

Description

How to fill out Agreement To Extend Debt Payment?

Are you currently in a situation where you need documents for either business or personal purposes nearly every day.

There are numerous official document templates available online, but locating reliable ones isn't straightforward.

US Legal Forms provides thousands of form templates, such as the Florida Agreement to Extend Debt Payment, designed to comply with federal and state requirements.

Once you find the correct form, click on Get now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Florida Agreement to Extend Debt Payment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it corresponds to your specific city/state.

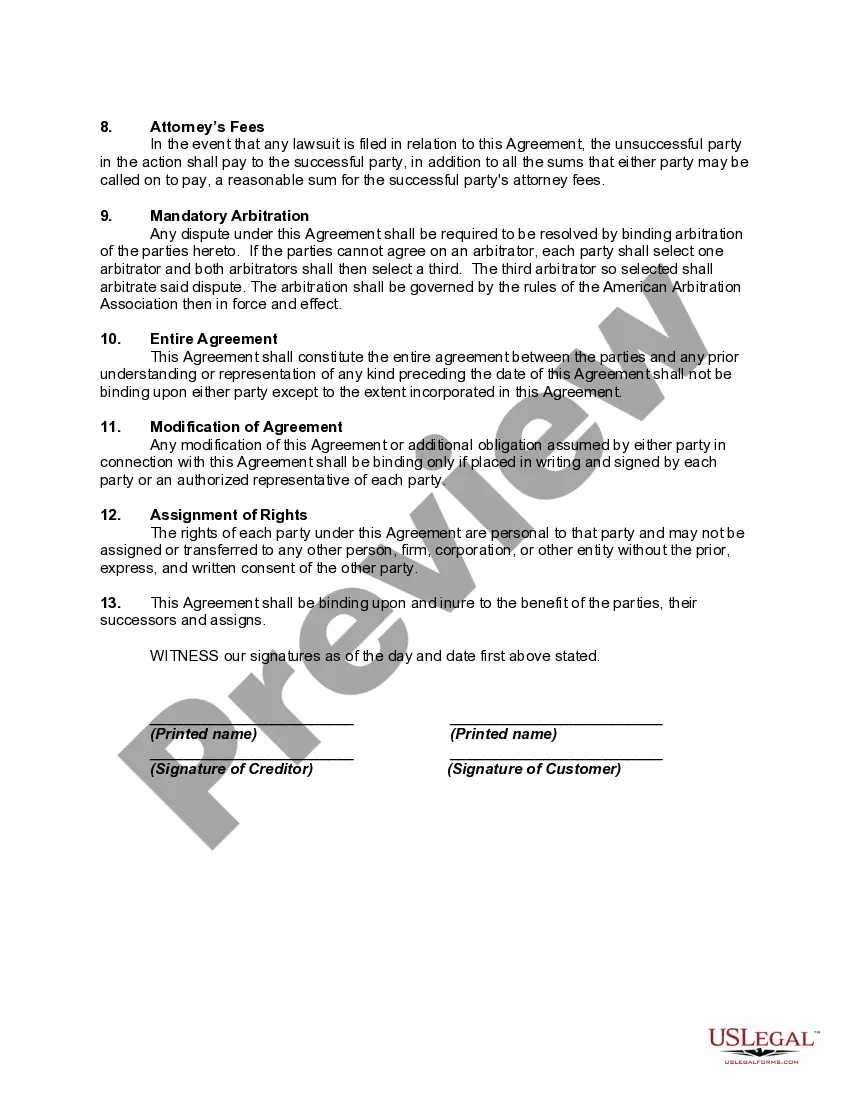

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the correct form.

- If the form isn't what you need, use the Search field to locate the form that fulfills your requirements.

Form popularity

FAQ

In Florida, creditors can pursue repayment for most debts for up to five years, as established by the statute of limitations. After this period, they cannot initiate a lawsuit to collect the debt. It's essential to address any outstanding obligations before reaching this timeline. Establishing a Florida Agreement to Extend Debt Payment can aid in managing your repayment strategy effectively.

Debt collectors are prohibited from using deceptive practices or harassing behavior to collect debts. This includes threats, excessive calls, or misrepresenting the amount owed. Knowing these restrictions can help you stand your ground when dealing with collectors. A Florida Agreement to Extend Debt Payment may provide a formal approach to handling negotiations and ensuring compliance.

Statute 687.03 in Florida pertains to the regulation of interest rates and lawful debt collection practices. This law ensures that terms are reasonable and protects consumers from excessive interest charges. If you are dealing with debt collection, knowing this statute can empower you during negotiations or when setting up a Florida Agreement to Extend Debt Payment.

Yes, a collection agency can take you to court in Florida to recover a debt. If they choose this route, they must follow specific legal procedures. If you face such legal action, responding promptly and appropriately is vital. You might explore options like a Florida Agreement to Extend Debt Payment to resolve outstanding debt before court actions escalate.

Florida law regulates debt collection practices under the Florida Consumer Collection Practices Act. This act establishes the rights of debtors and outlines the acceptable actions of collection agencies. It's designed to protect your rights while ensuring fair debt collection methods. Understanding these laws can help you navigate financial challenges when using a Florida Agreement to Extend Debt Payment.

In Florida, the statute of limitations for most debts is typically five years. This means creditors can no longer pursue legal action to collect on the debt after this period. However, debt can still affect your credit report and financial situation. Always consider a Florida Agreement to Extend Debt Payment to manage debt repayment proactively.

To stop debt collectors, you can phrase your request clearly. A widely recognized statement is, 'I require all communication to be in writing.' This phrase underlines your right to request that debt collectors cease calls or messages. Understanding your options can help you protect yourself under a Florida Agreement to Extend Debt Payment.

The government does provide various debt relief programs, particularly in areas like student loans and housing assistance. They aim to enhance financial stability for citizens facing hardship. However, it is crucial to research thoroughly and consider how a Florida Agreement to Extend Debt Payment can be beneficial in negotiating debts with private creditors. Platforms like US Legal Forms can help navigate the options effectively.

Yes, Florida debt relief exists and is a viable option for individuals struggling with financial burdens. Various companies and nonprofit organizations offer services designed to negotiate or restructure debt. Additionally, utilizing a Florida Agreement to Extend Debt Payment can formalize your arrangements, ensuring both parties understand the terms and obligations. It's important to seek out reputable sources when considering these options.

Debt relief options can impact your credit score for up to seven years, depending on the nature of the relief taken. However, timely payments and a structured financial plan, such as a Florida Agreement to Extend Debt Payment, can help you rebuild your credit more quickly. Staying informed about your credit and managing your finances positively will also assist in mitigating damage. Always monitor your credit report for any inaccuracies during this period.