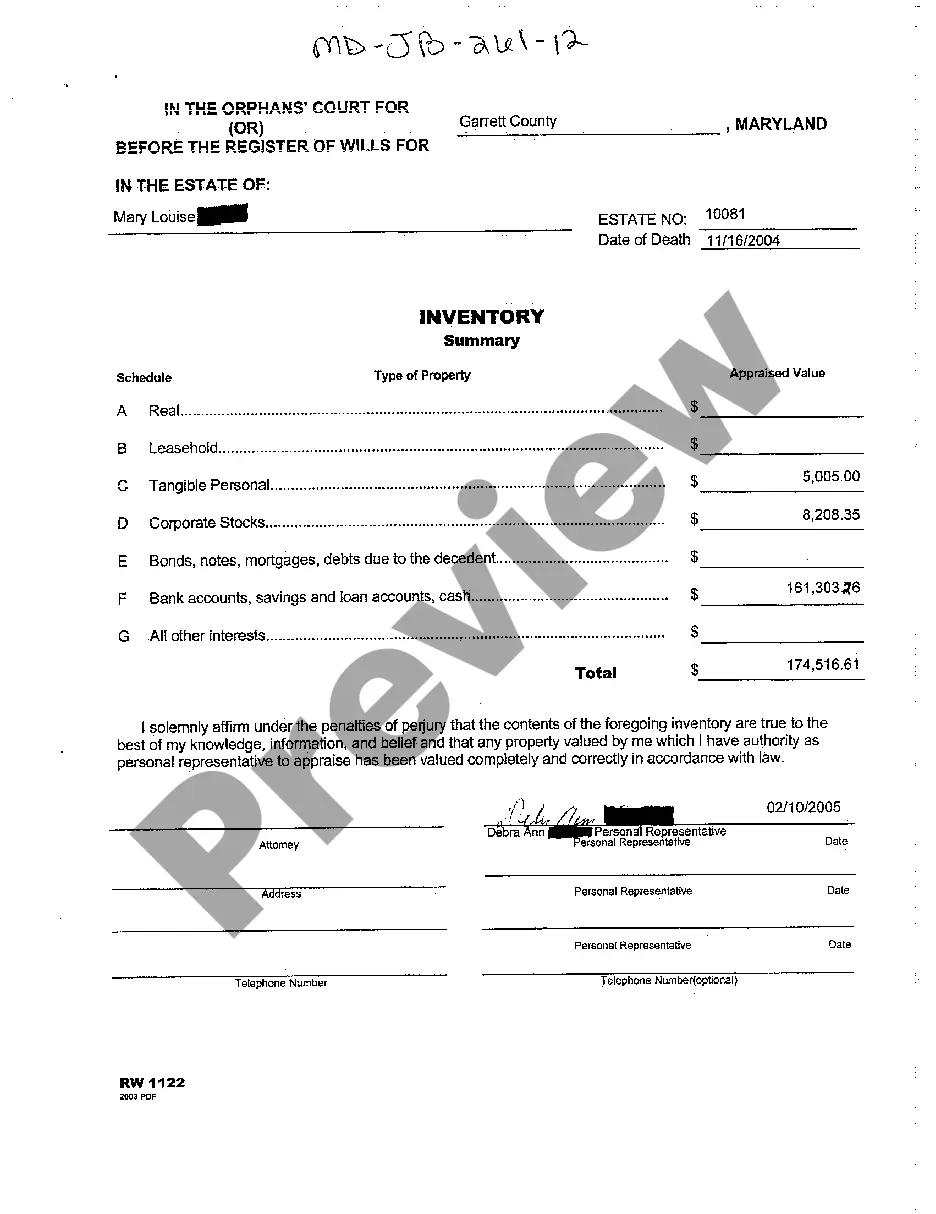

Title: Florida Summary of Account for Inventory of Business — A Comprehensive Overview Keywords: Florida Summary of Account, Inventory of Business, Types, Detailed Description, Business Assets, Reporting, Form DR-579C, Tax Filings Introduction: The Florida Summary of Account for Inventory of Business is an essential document that enables businesses to accurately report their inventory assets to the Florida Department of Revenue (FOR). This detailed description provides insights into the purpose, requirements, and various types of Florida Summary of Account for Inventory of Business, ensuring compliance and smooth tax filings. 1. Overview and Purpose: The Florida Summary of Account for Inventory of Business is designed to inventory assets held by businesses operating within the state. It serves as a basis for calculating accurate taxes, ensuring fairness, and promoting consistent tax reporting across different industries. 2. Reporting Inventory: Businesses are required to report their inventory assets on Form DR-579C, which serves as the official Florida Summary of Account for Inventory of Business document. This form must be filed annually with the FOR by relevant businesses operating in Florida. 3. Types of Florida Summary of Account for Inventory of Business: a) Form DR-579C — Original Filing: This is the primary type of Florida Summary of Account for Inventory of Business, used when reporting inventory assets annually to the FOR. Businesses must provide detailed information on the nature, quantity, and value of their inventory holdings. b) Form DR-579C — Amended Filing: If any errors or discrepancies are identified after submitting the original filing, businesses may need to file an amended Florida Summary of Account for Inventory of Business form. This allows corrections to be made and ensures accurate reporting. 4. Obligations and Timeframes: It is crucial for businesses to be aware of the reporting obligations and timeframes associated with the Florida Summary of Account for Inventory of Business. Typically, businesses must submit the completed original or amended form on or before May 15th of each year. Timely filing and accurate reporting avoid penalties and interest charges. 5. Contents of Florida Summary of Account for Inventory of Business: The Form DR-579C, Florida Summary of Account for Inventory of Business, includes various sections and requirements that need to be addressed by businesses. It encompasses details such as: — Business NameVEININ, Address, and Contact Information — Statement declaring the beginning and ending dates of the accounting period covered — Detailed inventory information including item descriptions, quantities, and values — Explanations for any significant changes in inventory from the previous year Conclusion: The Florida Summary of Account for Inventory of Business is an integral part of the tax reporting process for businesses operating in Florida. By accurately reporting their inventory assets on Form DR-579C, businesses ensure compliance with the state's tax regulations and contribute to fair taxation practices. Familiarity with the types, obligations, and content requirements of the Florida Summary of Account for Inventory of Business aids in avoiding penalties and ensures smooth tax filings.

Title: Florida Summary of Account for Inventory of Business — A Comprehensive Overview Keywords: Florida Summary of Account, Inventory of Business, Types, Detailed Description, Business Assets, Reporting, Form DR-579C, Tax Filings Introduction: The Florida Summary of Account for Inventory of Business is an essential document that enables businesses to accurately report their inventory assets to the Florida Department of Revenue (FOR). This detailed description provides insights into the purpose, requirements, and various types of Florida Summary of Account for Inventory of Business, ensuring compliance and smooth tax filings. 1. Overview and Purpose: The Florida Summary of Account for Inventory of Business is designed to inventory assets held by businesses operating within the state. It serves as a basis for calculating accurate taxes, ensuring fairness, and promoting consistent tax reporting across different industries. 2. Reporting Inventory: Businesses are required to report their inventory assets on Form DR-579C, which serves as the official Florida Summary of Account for Inventory of Business document. This form must be filed annually with the FOR by relevant businesses operating in Florida. 3. Types of Florida Summary of Account for Inventory of Business: a) Form DR-579C — Original Filing: This is the primary type of Florida Summary of Account for Inventory of Business, used when reporting inventory assets annually to the FOR. Businesses must provide detailed information on the nature, quantity, and value of their inventory holdings. b) Form DR-579C — Amended Filing: If any errors or discrepancies are identified after submitting the original filing, businesses may need to file an amended Florida Summary of Account for Inventory of Business form. This allows corrections to be made and ensures accurate reporting. 4. Obligations and Timeframes: It is crucial for businesses to be aware of the reporting obligations and timeframes associated with the Florida Summary of Account for Inventory of Business. Typically, businesses must submit the completed original or amended form on or before May 15th of each year. Timely filing and accurate reporting avoid penalties and interest charges. 5. Contents of Florida Summary of Account for Inventory of Business: The Form DR-579C, Florida Summary of Account for Inventory of Business, includes various sections and requirements that need to be addressed by businesses. It encompasses details such as: — Business NameVEININ, Address, and Contact Information — Statement declaring the beginning and ending dates of the accounting period covered — Detailed inventory information including item descriptions, quantities, and values — Explanations for any significant changes in inventory from the previous year Conclusion: The Florida Summary of Account for Inventory of Business is an integral part of the tax reporting process for businesses operating in Florida. By accurately reporting their inventory assets on Form DR-579C, businesses ensure compliance with the state's tax regulations and contribute to fair taxation practices. Familiarity with the types, obligations, and content requirements of the Florida Summary of Account for Inventory of Business aids in avoiding penalties and ensures smooth tax filings.