This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare

Description

How to fill out Agreement Between Professional Corporation And Non-Profit Corporation To Treat People Who Cannot Afford Healthcare?

Have you ever found yourself in a situation where you require documents for either professional or personal reasons nearly every day.

There are many legal document templates available online, but finding reliable forms can be challenging.

US Legal Forms offers an extensive collection of templates, including the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who cannot Afford Healthcare, which can be customized to comply with state and federal regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have a free account, simply Log In.

- Then, you can download the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who cannot Afford Healthcare template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/region.

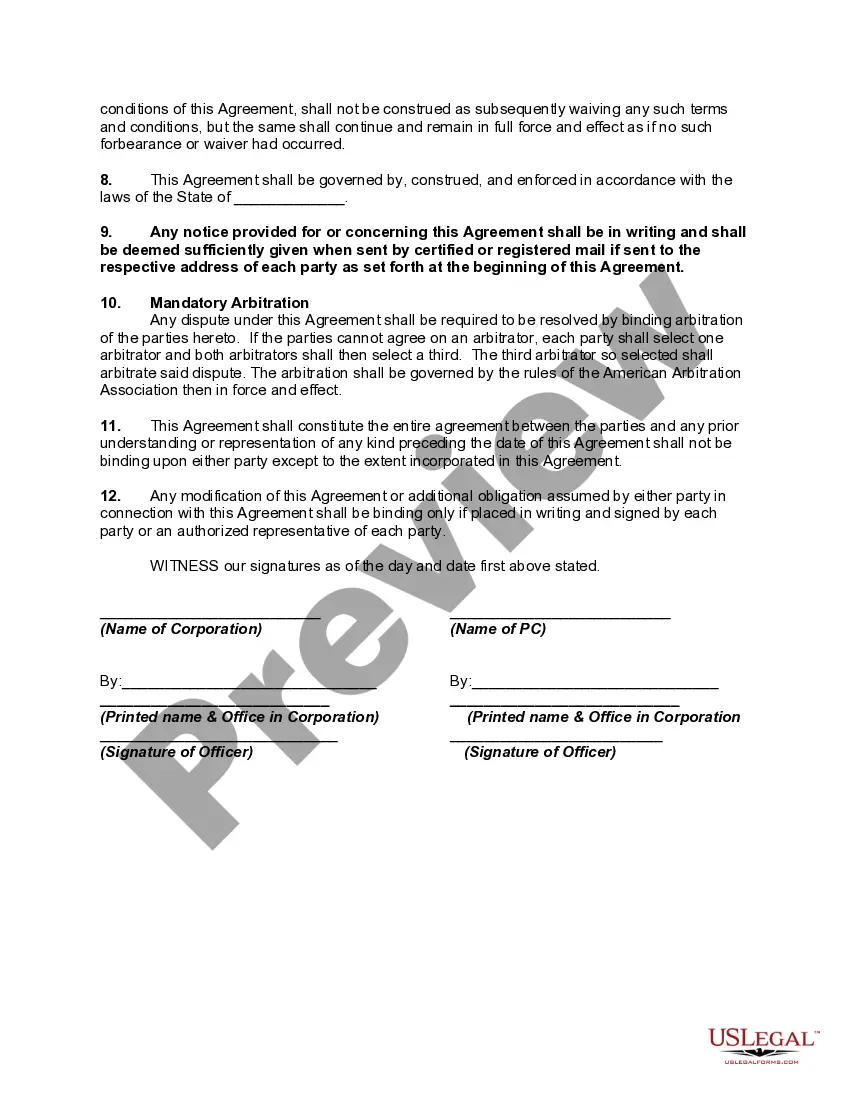

- Utilize the Preview feature to view the document.

- Check the description to confirm that you have selected the right form.

- If the document does not meet your needs, use the Search field to locate the form that fits your requirements.

Form popularity

FAQ

profit organization does not have a traditional owner as it operates for the benefit of the public. Instead, it is governed by a board of directors or trustees who oversee its activities. These individuals ensure compliance with the Florida Agreement Between Professional Corporation and NonProfit Corporation to Treat People who cannot Afford Healthcare and are responsible for the organization’s mission and resource management, always prioritizing the public good.

Owning a nonprofit organization presents various advantages, including fulfilling a social mission and enabling community support. You can create impactful programs and services, especially when implementing a Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Additionally, non-profits can access grants and tax exemptions, which can boost your funding potential and enhance your ability to serve those in need.

You can write off certain expenses related to your nonprofit organization on your tax return. This includes costs for operations, supplies, and special projects related to your mission, particularly when following a Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Additionally, if you are a donor, your contributions may be eligible for a tax deduction, making it financially beneficial for both the non-profit and its supporters.

Organizing your business as a non-profit corporation can offer significant tax advantages. When you establish a Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, you may qualify for federal and state tax exemptions. These benefits can increase your resources for helping those in need, as you won’t be burdened by income taxes. Additionally, contributions to your non-profit may be tax-deductible for your donors, encouraging more support.

Florida does impose certain restrictions on the corporate practice of medicine to ensure that only licensed professionals can manage healthcare decisions. However, specific structures like professional corporations are designed to comply with these regulations while facilitating efficient medical practice and patient care. This becomes vital when engaging in arrangements such as the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare.

A professional services corporation is similar to a professional corporation but specifically caters to service providers, such as medical practitioners and legal advisors. These corporations enjoy certain legal protections and benefits, similar to those of traditional corporations. In the context of the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, they can also extend their services to individuals who might otherwise lack access.

A professional corporation in healthcare is a legal entity created to provide medical services while offering liability protection to its owners. This structure is particularly beneficial for healthcare professionals as it combines professional practice with corporate advantages. Under the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, these organizations can effectively work to reduce healthcare disparities.

The term 'professional corporate' refers to a business organization that is owned and operated by licensed professionals in specific fields. This structure combines the principles of corporate business formation with professional practice, ensuring that members of the corporation are qualified to provide the necessary services. In Florida, this is particularly relevant in healthcare settings, especially when collaborating under agreements such as the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare.

A professional corporation structure typically includes a board of directors, shareholders, and officers, all of whom must be licensed professionals in the field of the service provided. This organizational format not only compiles compliance standards but also reinforces professional oversight. Such structures align closely with the commitments of the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare by encouraging collaboration for community health.

Forming a professional corporation to practice medicine provides physicians with legal protection against malpractice claims, which can protect personal assets. Additionally, this structure offers tax benefits, allows for easier transfer of ownership, and enhances organizational credibility. When combined with the Florida Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, it can create a framework to support under-resourced individuals.