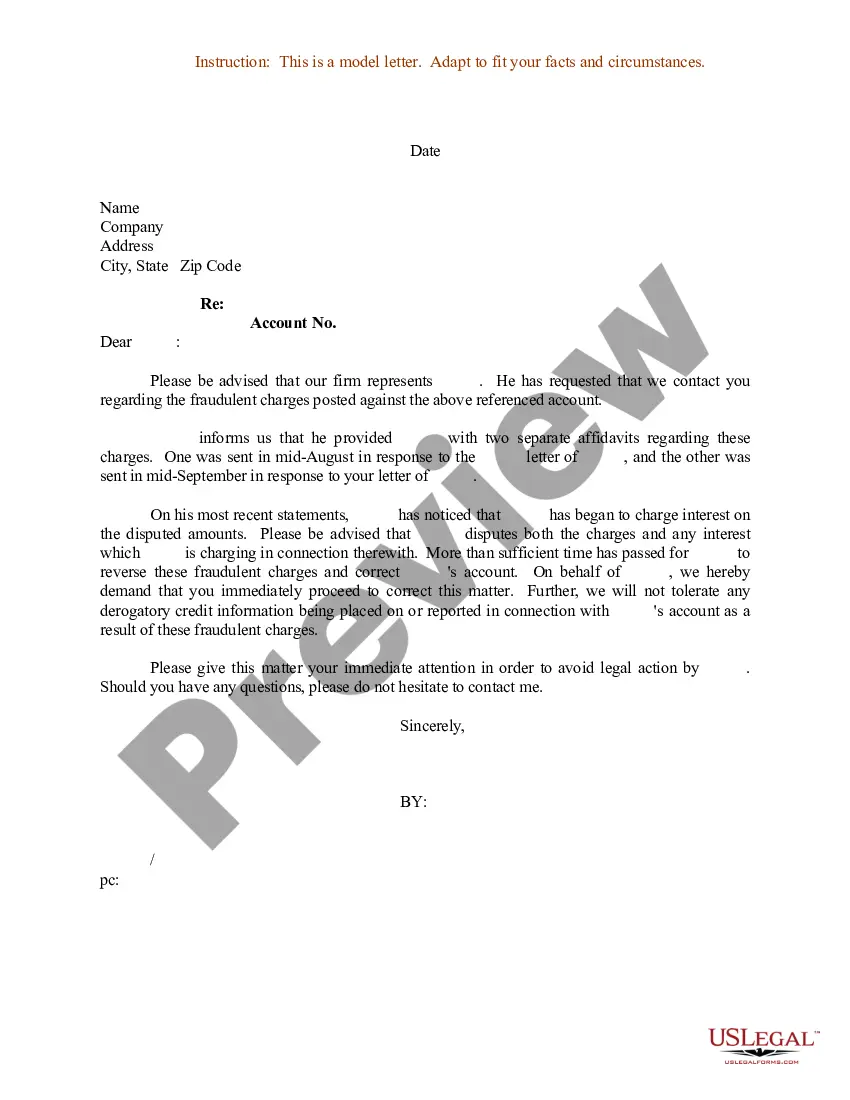

Florida Sample Letter for Fraudulent Charges against Client's Account

Description

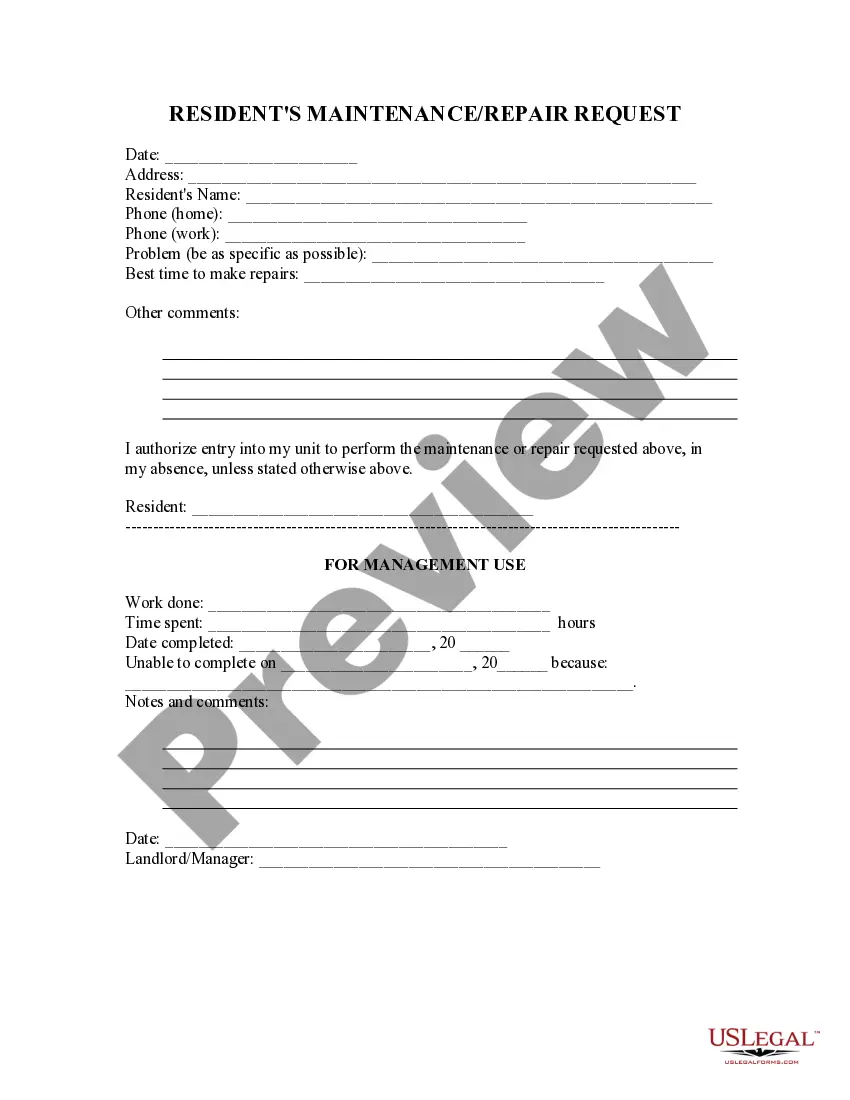

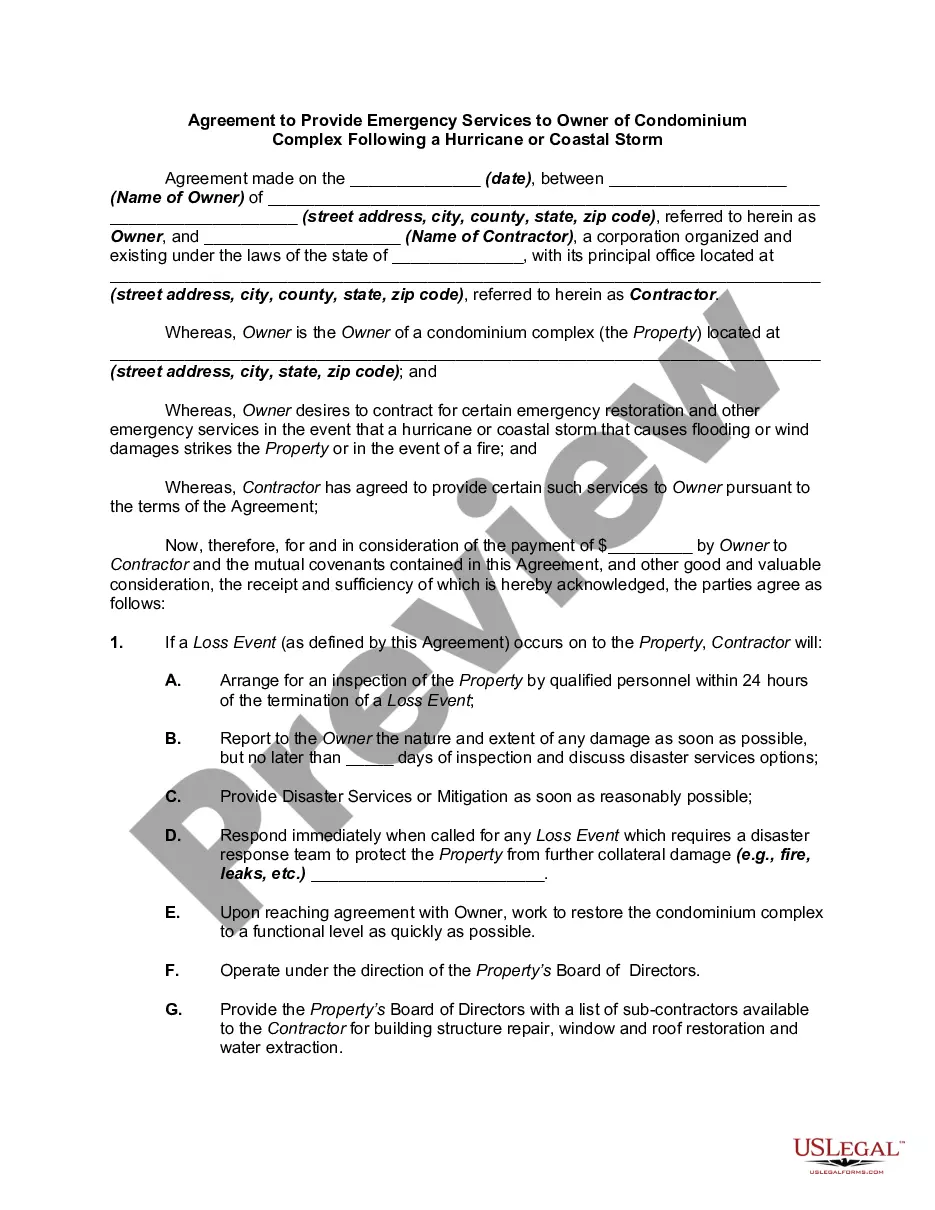

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

It is possible to spend time online searching for the legal file web template that meets the federal and state demands you need. US Legal Forms offers a large number of legal kinds that are examined by professionals. You can easily down load or print out the Florida Sample Letter for Fraudulent Charges against Client's Account from your services.

If you already possess a US Legal Forms account, you may log in and then click the Download button. Next, you may total, revise, print out, or indication the Florida Sample Letter for Fraudulent Charges against Client's Account. Every single legal file web template you acquire is the one you have eternally. To acquire an additional version of any purchased kind, go to the My Forms tab and then click the related button.

Should you use the US Legal Forms web site for the first time, stick to the simple guidelines below:

- Initial, make certain you have selected the right file web template for the region/area of your choice. Read the kind explanation to make sure you have selected the right kind. If accessible, use the Review button to appear with the file web template as well.

- In order to find an additional edition from the kind, use the Search industry to get the web template that suits you and demands.

- Once you have discovered the web template you would like, simply click Purchase now to continue.

- Find the rates plan you would like, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal account to pay for the legal kind.

- Find the format from the file and down load it to your system.

- Make modifications to your file if required. It is possible to total, revise and indication and print out Florida Sample Letter for Fraudulent Charges against Client's Account.

Download and print out a large number of file templates while using US Legal Forms web site, that provides the biggest collection of legal kinds. Use professional and condition-distinct templates to tackle your company or individual requires.

Form popularity

FAQ

Fortunately, most major card networks have a ?zero liability? policy that ensures you will not be held responsible for fraudulent charges. And federal law limits your losses for unauthorized credit card use to $50.

Transactions not made by you or anyone authorized to use your account are fraudulent, and federal law protects your money. Banks must refund you in certain circumstances, but the longer you wait to notify them, the more likely your bank won't refund stolen money.

Under Section 611, a credit reporting agency is not required to provide consumers with the verification method or send them any written result of the dispute if it is sent electronically. A 611 credit disputing letter is sent after a credit agency confirms that the information mentioned in the letter has been verified.

What should I do if there are unauthorized charges on my credit card account? Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

If you report a fraudulent charge within two days, you can't be held responsible for more than $50 in charges. Keep in mind that you have 60 days to dispute the transaction or else you could be stuck paying for it.

If you gave the fraudster your bank account number or routing number, contact your bank or credit union immediately. You may need to close the account and open a new one. Social security number. Go ahead with a fraud alert or credit freeze and report your information stolen at the FTC's identitytheft.gov website.

In short, consumers are rarely liable for credit card fraud. The merchant that processed the transaction or the bank that issued the card is usually liable for the charge.