A Florida General Letter of Credit with Account of Shipment is a financial instrument commonly used in international trade. It serves as a payment guarantee from a financial institution (usually a bank) to the exporter, ensuring that they will receive payment for goods or services rendered. This type of letter of credit includes specific provisions related to the shipment of goods. The Florida General Letter of Credit with Account of Shipment typically specifies the terms and conditions of the agreement between the exporter and the importer. It outlines the responsibilities of each party and ensures that proper documentation and procedures are followed for the successful completion of the transaction. One of the key features of this type of letter of credit is its requirement for the exporter to submit the necessary shipping documents to the bank before the importer is required to make payment. These shipping documents may include the bill of lading, commercial invoice, packing list, certificate of origin, and any other relevant documents. By submitting these documents, the exporter provides evidence that the goods have been shipped as per the agreed terms. The Florida General Letter of Credit with Account of Shipment provides security to both parties involved in the international trade transaction. For the exporter, it guarantees that they will be paid for the goods or services delivered, as long as they comply with the terms outlined in the letter of credit. On the other hand, the importer benefits from having a reliable mechanism to ensure that the goods are delivered and that they meet the agreed-upon specifications. Different types of Florida General Letters of Credit with Account of Shipment may include: 1. Revocable Letter of Credit: This type of letter of credit can be amended or canceled by the issuing bank without prior notice to the exporter. It provides less security for the exporter compared to an irrevocable letter of credit. 2. Irrevocable Letter of Credit: In contrast to a revocable letter of credit, an irrevocable letter of credit cannot be amended or canceled without the consent of all parties involved. It offers a higher level of security for the exporter as it provides a firm commitment from the issuing bank. 3. Confirmed Letter of Credit: A confirmed letter of credit involves the confirmation of a second bank, usually located in the exporter's country, in addition to the issuing bank. The exporter has the assurance of payment from both banks, reducing the risk of non-payment. 4. Transferable Letter of Credit: This type of letter of credit allows the exporter to transfer their rights to a third party, typically another supplier or middleman. It is useful in cases where the exporter does not have the necessary resources or capabilities to fulfill the entire order. Overall, the Florida General Letter of Credit with Account of Shipment provides a secure method of conducting international trade transactions. It ensures that both exporters and importers are protected by establishing clear terms and conditions and requiring the submission of shipping documents before payment is made.

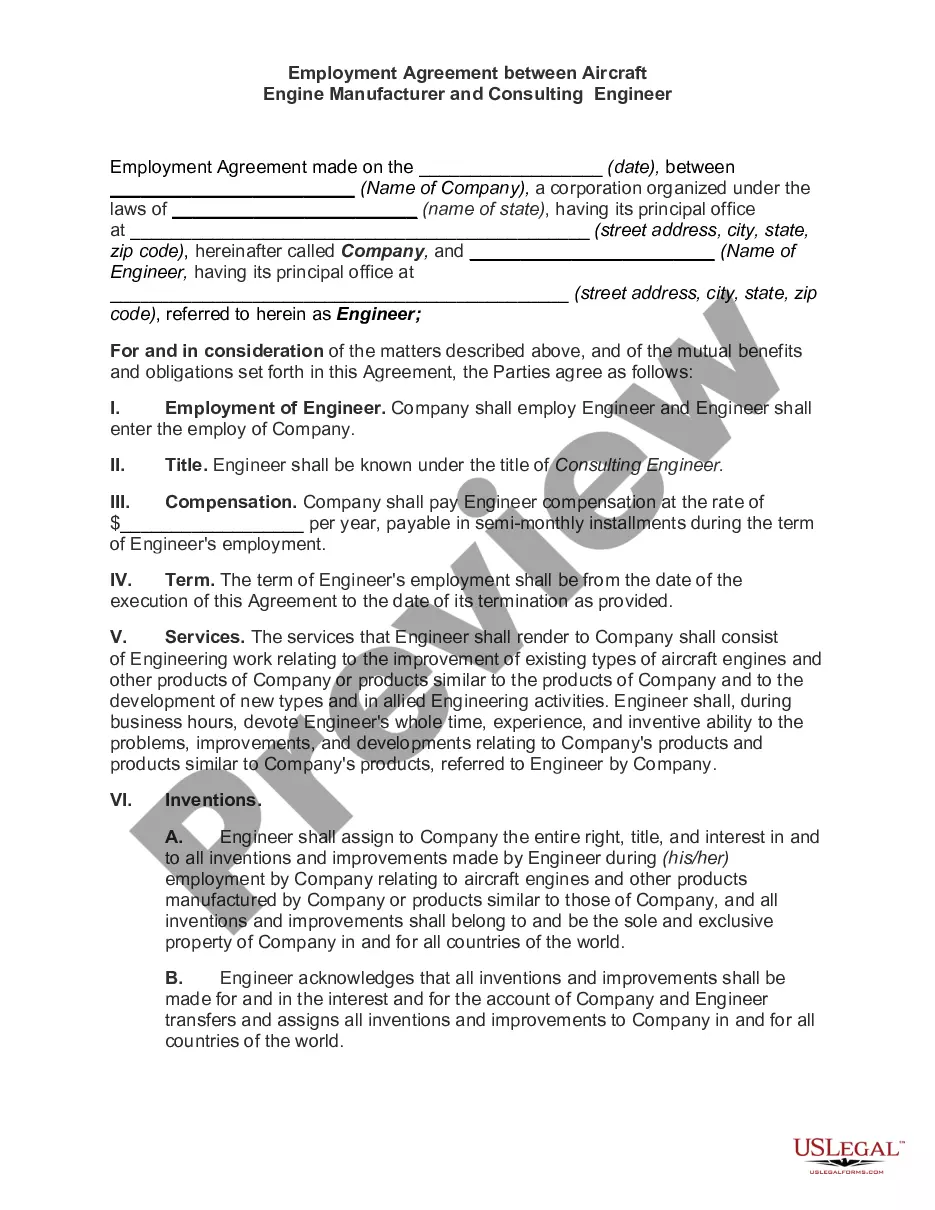

Florida General Letter of Credit with Account of Shipment

Description

How to fill out Florida General Letter Of Credit With Account Of Shipment?

US Legal Forms - one of the biggest libraries of authorized forms in America - offers a wide array of authorized papers templates it is possible to down load or print. While using site, you may get a large number of forms for enterprise and specific uses, sorted by classes, claims, or search phrases.You will discover the newest models of forms just like the Florida General Letter of Credit with Account of Shipment in seconds.

If you have a registration, log in and down load Florida General Letter of Credit with Account of Shipment in the US Legal Forms local library. The Acquire option will appear on every develop you perspective. You have access to all earlier downloaded forms from the My Forms tab of your respective accounts.

In order to use US Legal Forms the first time, here are simple guidelines to help you started out:

- Ensure you have picked the best develop for your personal city/region. Click on the Review option to examine the form`s content. Browse the develop information to actually have selected the appropriate develop.

- When the develop does not suit your specifications, utilize the Research discipline on top of the display screen to discover the one that does.

- If you are satisfied with the shape, confirm your choice by visiting the Get now option. Then, pick the prices plan you want and provide your qualifications to sign up to have an accounts.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal accounts to finish the transaction.

- Find the formatting and down load the shape on your own product.

- Make modifications. Complete, revise and print and sign the downloaded Florida General Letter of Credit with Account of Shipment.

Each design you included in your money does not have an expiry day and is your own eternally. So, if you wish to down load or print one more copy, just check out the My Forms segment and click about the develop you need.

Gain access to the Florida General Letter of Credit with Account of Shipment with US Legal Forms, by far the most substantial local library of authorized papers templates. Use a large number of skilled and status-specific templates that satisfy your company or specific requires and specifications.