A Florida Receiving Order, also known as an Assignment for the Benefit of Creditors (ABC), is a legal process utilized by financially distressed businesses to liquidate their assets in an orderly manner for the benefit of their creditors. It is an alternative to bankruptcy that allows companies to avoid the time-consuming and costly court proceedings involved in Chapter 11. Under a Florida Receiving Order, a business assigns its assets to a third-party receiver, who is appointed by the company's management or chosen by the court. The receiver acts as a fiduciary, responsible for taking possession of the business's assets, taking inventory, and selling the assets to generate funds to pay off creditors. The receiver is typically a licensed insolvency professional or an attorney with expertise in bankruptcy and insolvency law. There are two main types of Florida Receiving Orders: 1. Voluntary Florida Receiving Order: A voluntary order occurs when a business willingly chooses to initiate the process. In this case, the company's management or directors make the decision to assign the assets to a receiver for the orderly liquidation of the business. This option can be advantageous for a company facing insurmountable debts or struggling to meet its financial obligations. 2. Involuntary Florida Receiving Order: An involuntary order is initiated when creditors petition the court to appoint a receiver to take control of the company's assets. This occurs when creditors believe that the business is mismanaging its finances or is unable to pay its debts. Creditors can file a motion with the court, providing evidence of the company's financial distress, to seek the appointment of a receiver. Once a Florida Receiving Order is initiated, the receiver assumes control over the business's assets, manages the sale process, and ensures that the proceeds are distributed to creditors based on their respective claims. The receiver also has the authority to resolve disputes and negotiate settlements with creditors. Keywords: Florida Receiving Order, Assignment for the Benefit of Creditors, ABC, financially distressed businesses, liquidate assets, bankruptcy alternative, Chapter 11, third-party receiver, fiduciary, voluntary order, involuntary order, insolvency professional, attorney, petition, financial distress, mismanaging finances, creditors, assets liquidation, court proceedings, creditors' claims.

Florida Receiving Order

Description

How to fill out Florida Receiving Order?

Are you currently inside a position where you need to have papers for sometimes enterprise or person reasons nearly every time? There are plenty of lawful record templates accessible on the Internet, but locating ones you can rely isn`t easy. US Legal Forms provides thousands of form templates, much like the Florida Receiving Order, which are written to meet federal and state demands.

If you are previously acquainted with US Legal Forms website and get a merchant account, basically log in. After that, you can acquire the Florida Receiving Order format.

Should you not have an profile and need to start using US Legal Forms, follow these steps:

- Discover the form you will need and ensure it is to the right metropolis/county.

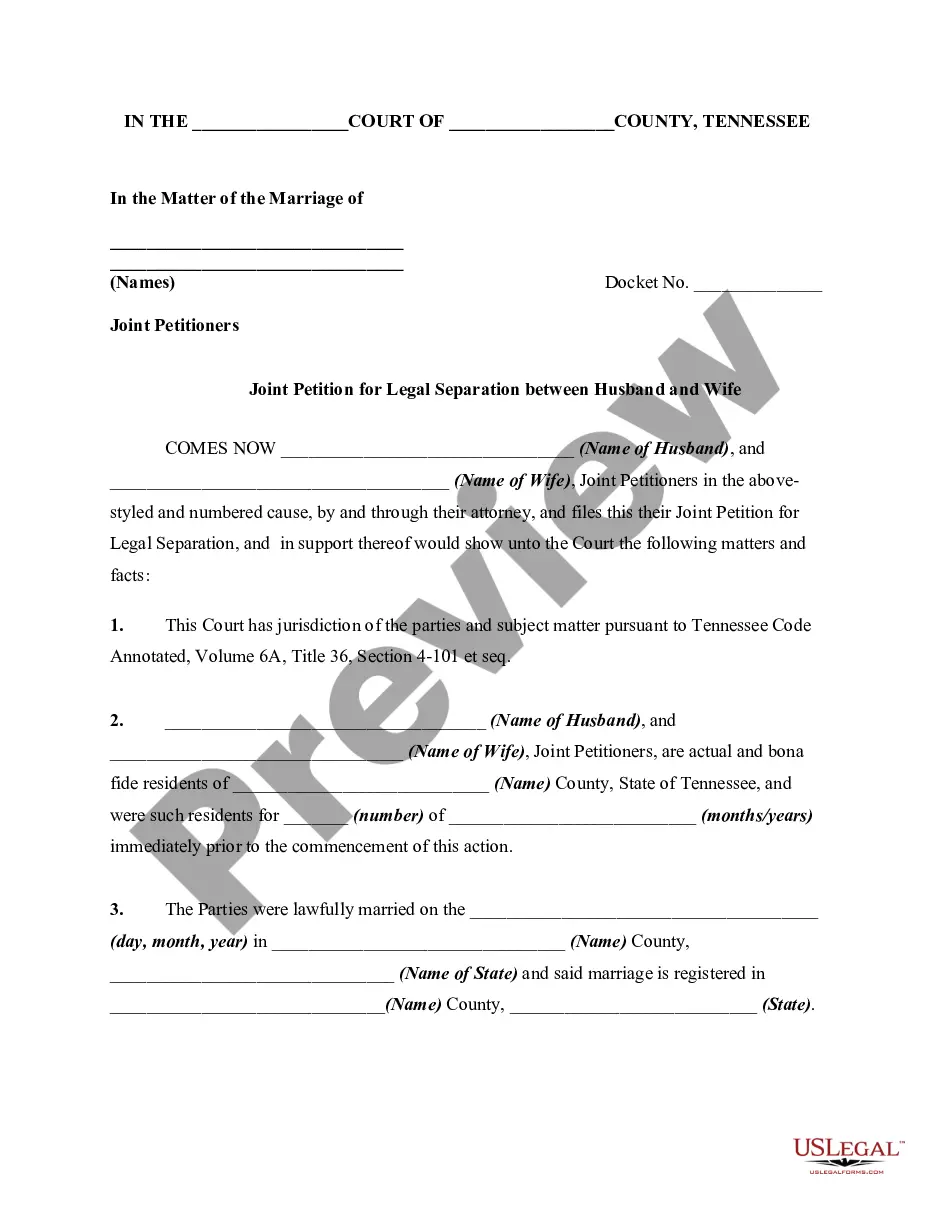

- Take advantage of the Review button to analyze the form.

- Read the outline to ensure that you have chosen the proper form.

- When the form isn`t what you are looking for, make use of the Research discipline to find the form that fits your needs and demands.

- When you obtain the right form, just click Buy now.

- Choose the prices prepare you would like, fill in the required info to create your bank account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Select a practical file formatting and acquire your backup.

Find all of the record templates you may have bought in the My Forms menu. You can obtain a further backup of Florida Receiving Order any time, if required. Just select the necessary form to acquire or printing the record format.

Use US Legal Forms, the most considerable selection of lawful forms, to save lots of some time and stay away from blunders. The service provides expertly produced lawful record templates that you can use for a variety of reasons. Create a merchant account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

Transfer your Title online!You can now transfer a title online. Learn more about the steps and get started.

Will I receive a confirmation that my filing was accepted?You will receive your filing confirmation by email at the address you provided.Your confirmation will be sent to you once the document is examined and approved by the Division of Corporations.You will not receive a confirmation by U.S. Mail.

Is a bill of sale required in Florida? A bill of sale for private car sales is required in the state of Florida. This document will be your proof of the transaction, the date of transfer, and the purchase price. You will also need it for your title transfer.

What Do I Need for a Florida Title Transfer?A completed vehicle title provided by the seller.An Application for Certificate of Title with/without Registration (Form 82040)A notarized bill of sale (if required)Lien release (if required)Payment for all applicable fees.

To transfer ownership of a motor vehicle or mobile home titled in Florida, you must bring the following to any Tax Collector's office:The Florida title properly and fully completed by both the buyer and seller.Each applicant, or their appointed power of attorney, must be present to sign a new application for title.More items...

In case of private sell or purchase of a vehicle, you can easily complete your title transfer online with eTags, without ever having to wait in line or make an appointment. A transfer of ownership is also needed in the case of a move to Florida.

If the title is held electronically, the seller and buyer must visit a motor vehicle service center to complete a secure title reassignment (HSMV 82994 or 82092) and disclose the odometer reading. The buyer and seller must both be present and provide photo identification.

While a bill of sale isn't legally required, and doesn't replace a title transfer, it is highly recommended and protects both the buyer and seller from fraud, theft, or mistakes.