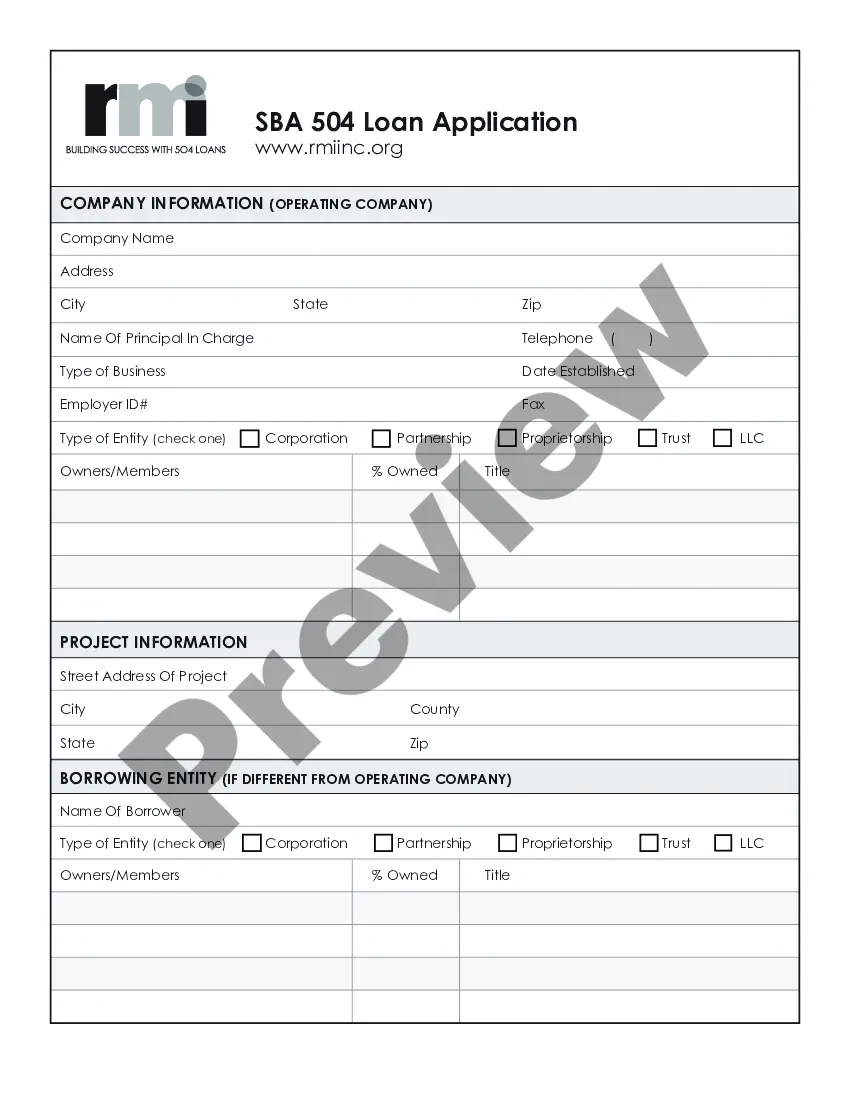

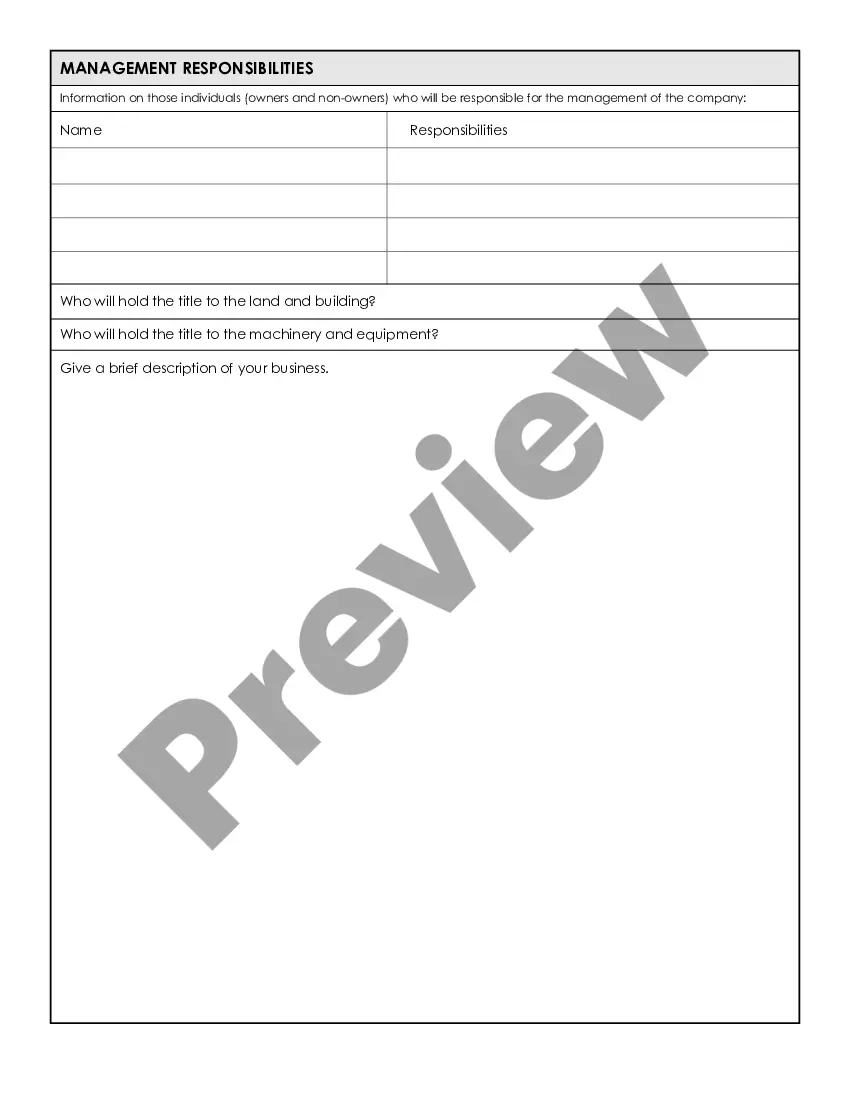

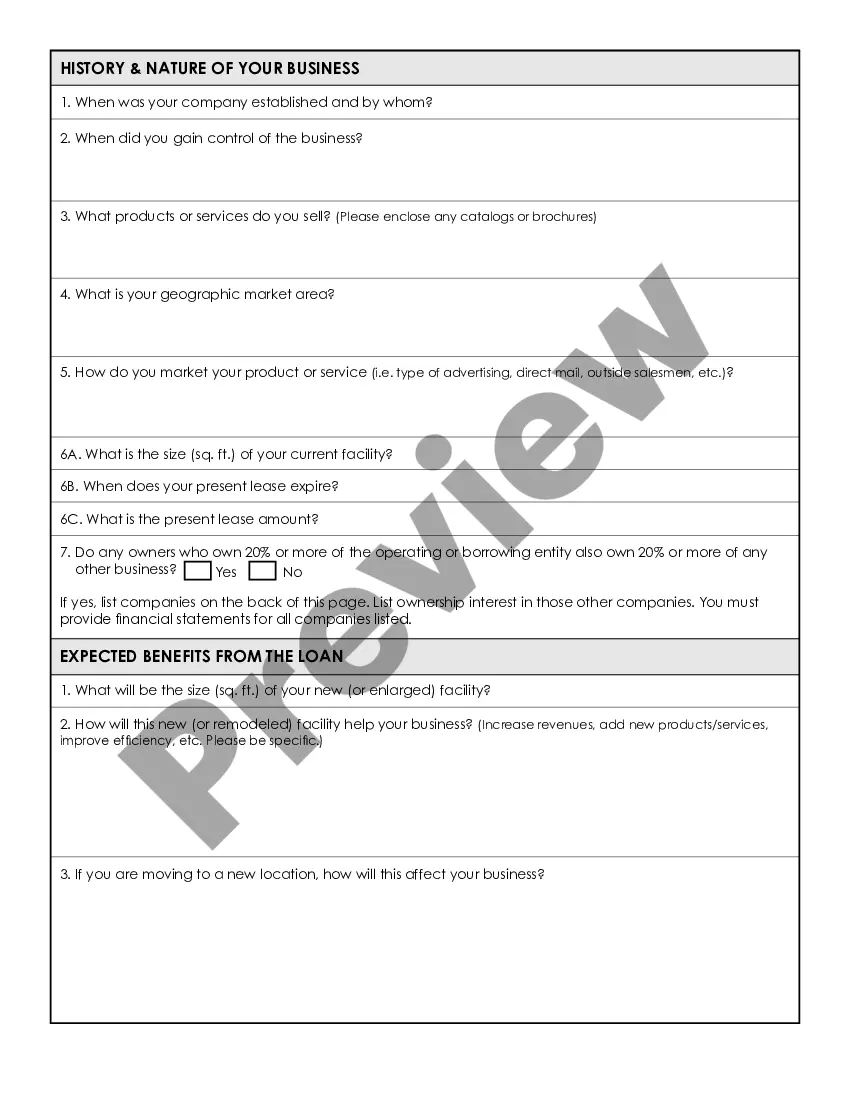

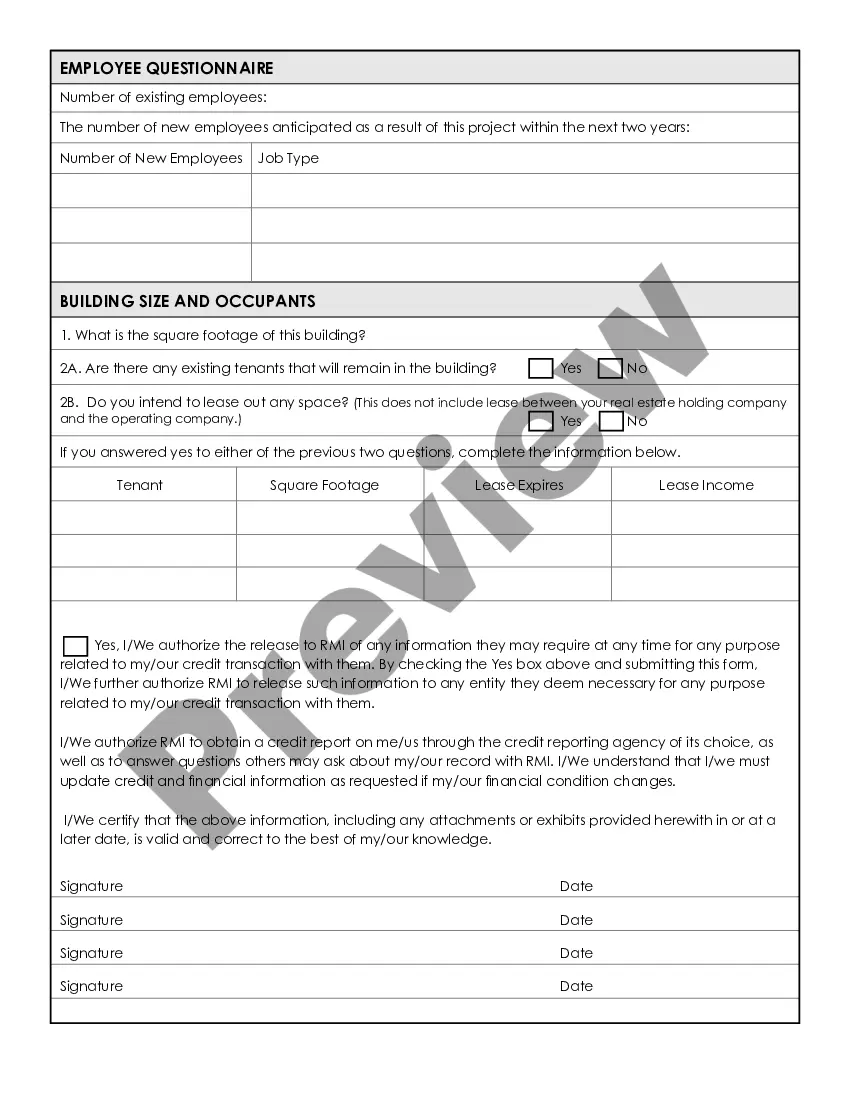

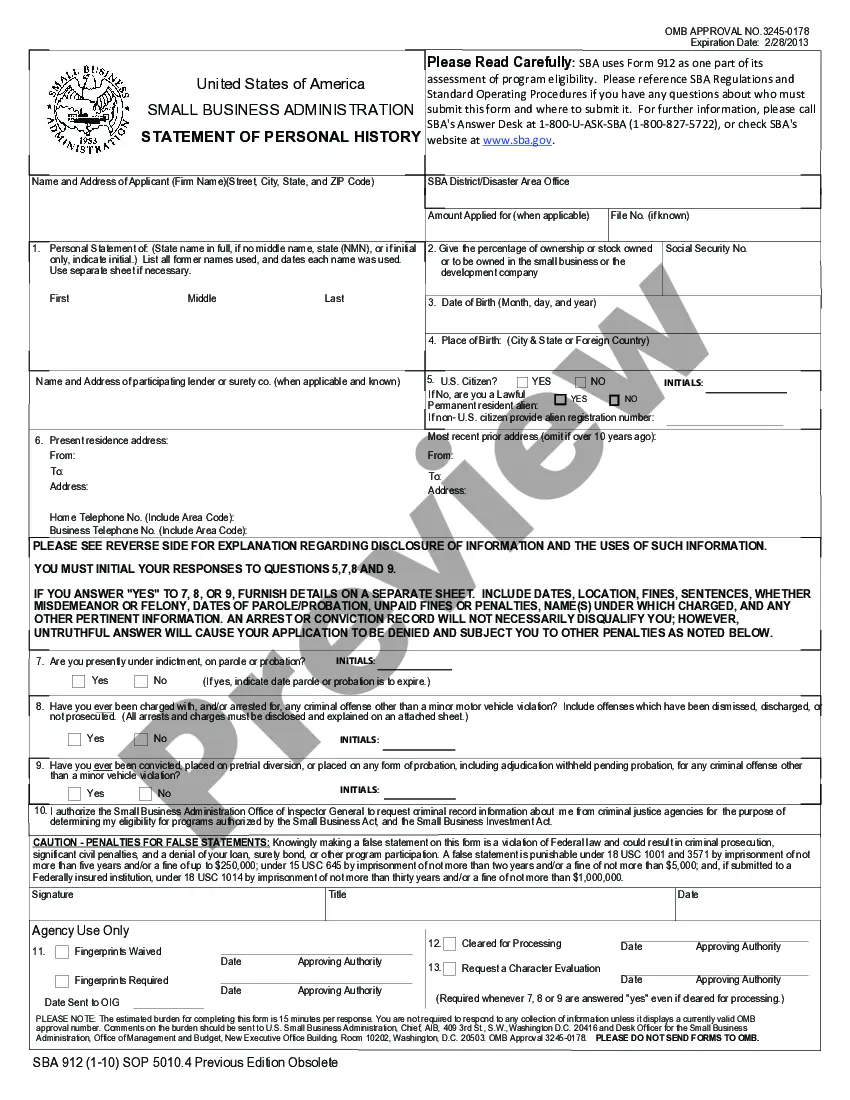

The Florida Small Business Administration (SBA) Loan Application Form and Checklist are essential tools for small businesses in Florida seeking financial assistance and support from the SBA. These forms help streamline the loan application process and ensure that all required documentation is provided. The Florida SBA Loan Application Form is a comprehensive document that collects detailed information about the business, its owners, and financial details. It includes sections for the applicant's contact information, business details such as legal structure and industry type, the estimated loan amount, and the purpose of the loan. The application form also asks for details regarding the business's history, management experience, and any existing debt obligations. In addition to the application form, the checklist is provided to assist applicants in gathering the necessary documents and information required to complete the loan application. This checklist serves as a guide, ensuring that applicants submit all the required paperwork and supporting documentation, such as business tax returns, financial statements, profit and loss statements, business licenses, personal financial statements, and personal tax returns of the business owners. It is important to note that the Florida SBA Loan Application Form and Checklist may vary depending on the specific loan program or initiative. Different types of SBA loans available in Florida include the SBA 504 Loan Program, SBA 7(a) Loan Program, SBA Microloan Program, and SBA Disaster Loan Program. Each program may have specific application forms and checklists tailored to its requirements. For example, the SBA 504 Loan Program provides long-term, fixed-rate financing for major fixed assets such as land, buildings, and equipment. The corresponding application form and checklist for this program may have additional sections related to asset information, appraisal reports, and environmental assessments. On the other hand, the SBA 7(a) Loan Program is more versatile and can be used for various business purposes such as working capital, purchasing inventory, or refinancing debts. Therefore, its application form and checklist may focus more on general business information and financial statements. Similarly, the SBA Microloan Program targets small businesses in need of smaller loan amounts and typically requires less documentation. The application form and checklist for this program may be simpler and less extensive compared to the other loan programs. Lastly, the SBA Disaster Loan Program assists businesses affected by natural disasters, providing them with financial aid for rebuilding and recovery purposes. The application form and checklist for this program may have specific sections requesting information about the extent of damage, insurance coverage, and proof of losses incurred. In conclusion, the Florida Small Business Administration Loan Application Form and Checklist are crucial resources for businesses seeking SBA loans. These documents capture essential business and financial information and help applicants ensure they gather and submit all required documentation. Additionally, depending on the specific loan program, there may be different types of forms and checklists available, tailored to the program's unique requirements.

Florida Small Business Administration Loan Application Form and Checklist

Description

How to fill out Florida Small Business Administration Loan Application Form And Checklist?

If you want to complete, obtain, or print lawful papers layouts, use US Legal Forms, the greatest assortment of lawful forms, that can be found on the web. Take advantage of the site`s simple and easy hassle-free look for to obtain the paperwork you will need. Various layouts for company and person purposes are categorized by groups and claims, or keywords. Use US Legal Forms to obtain the Florida Small Business Administration Loan Application Form and Checklist in a number of click throughs.

Should you be currently a US Legal Forms client, log in for your bank account and then click the Down load key to obtain the Florida Small Business Administration Loan Application Form and Checklist. You may also gain access to forms you formerly saved from the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that right city/region.

- Step 2. Utilize the Preview method to check out the form`s articles. Never overlook to read the description.

- Step 3. Should you be not satisfied with the develop, make use of the Research discipline near the top of the monitor to locate other types in the lawful develop format.

- Step 4. Once you have discovered the shape you will need, select the Buy now key. Pick the costs program you like and add your qualifications to register on an bank account.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Select the structure in the lawful develop and obtain it on the system.

- Step 7. Full, modify and print or indicator the Florida Small Business Administration Loan Application Form and Checklist.

Each lawful papers format you buy is your own property for a long time. You might have acces to every develop you saved with your acccount. Select the My Forms segment and decide on a develop to print or obtain once again.

Contend and obtain, and print the Florida Small Business Administration Loan Application Form and Checklist with US Legal Forms. There are millions of skilled and condition-specific forms you can use for your company or person requirements.

Form popularity

FAQ

SBA Form 1919 (Borrower Information Form) SBA Form 413 (Personal Finance Statement) Current profit and loss statement, along with schedules from the prior three fiscal years. One year of projected financial statements and a detailed explanation of how your business will meet these projections.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

Get your financials in order. To this end, you should generally try to have three years' worth of business and personal tax returns on hand as well as year-to-date profit and loss figures, balance sheets, accounts receivable aging reports, and inventory breakdowns, if possible.

Although loan requirements will vary from lender to lender, here are some important documents to prepare when applying for a small business loan. Credit report. ... Bank statements. ... Income statement. ... Budget. ... Business plan. ... Income tax returns.

KYC documents - Any government-issued KYC document such as an Aadhaar card, PAN card, passport or driving licence. Your employee ID card. Salary slips for the last three months. Bank account statements of your salary account for the previous three months.

In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.

These documents are used by the lenders to evaluate whether or not they will provide you with a loan. Loan documents are necessary to initiate a loan approval process by a lender. Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income.

Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements. Having these documents on hand will not only make the application process smoother but will increase your chances of getting approved in a timely manner.