Florida Guaranty of a Lease

Description

How to fill out Guaranty Of A Lease?

You can invest hours online looking for the legal document format that meets the federal and state requirements you need.

US Legal Forms provides numerous legal documents that can be reviewed by experts.

You can acquire or create the Florida Guaranty of a Lease through my service.

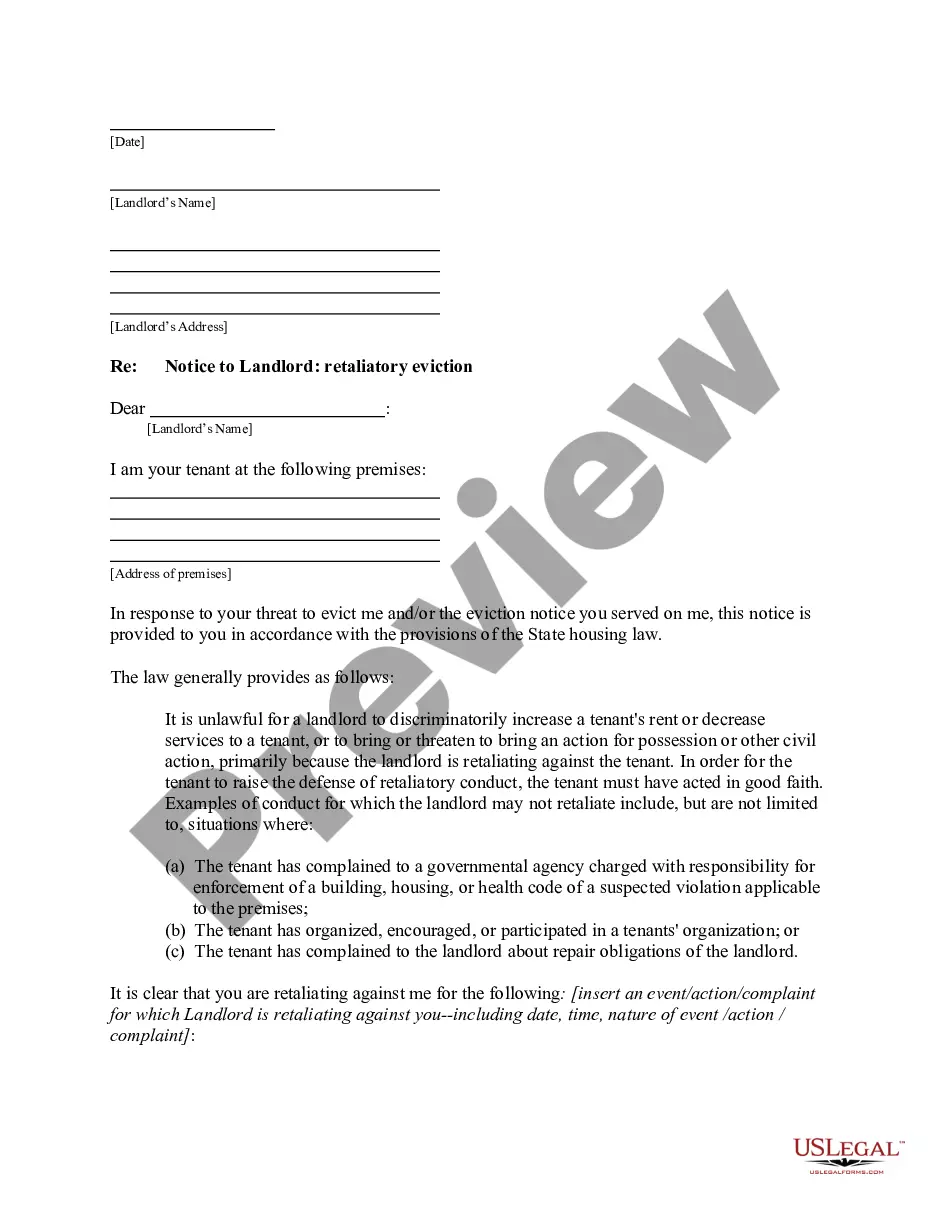

If available, use the Preview button to review the document format as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the Florida Guaranty of a Lease.

- Every legal document format you download is permanently yours.

- To get another copy of any downloaded form, visit the My documents section and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the county/town of your choice.

- Review the form outline to ensure you have chosen the right template.

Form popularity

FAQ

To personally guarantee a lease, you must complete a guaranty agreement that outlines your responsibilities and commitments. Be sure to read the agreement thoroughly to understand what is expected of you. This step is essential for a Florida Guaranty of a Lease, as it secures the landlord's interests while providing you with a clear definition of your obligations.

For a guarantor of a lease, common necessary documents include proof of income, credit history, and personal identification. These documents provide the landlord assurance that the guarantor can meet their obligations. When creating the Florida Guaranty of a Lease, these requirements should be clearly stated.

Yes, a lease can be legal and enforceable in Florida without notarization. The critical factor is that both parties must agree to the terms. That said, having certain documents, such as a Florida Guaranty of a Lease, notarized can provide peace of mind and strengthen the agreement in legal situations.

Similar to lease guarantees, a guaranty itself does not need notarization to be valid in Florida. However, notarization can help clarify its authenticity, especially in disputes. Therefore, while it's not mandatory, considering it when drafting the Florida Guaranty of a Lease can be beneficial.

Enforcing a guaranty in Florida generally involves informing the guarantor of the tenant's failure to uphold their lease obligations. The guarantor can then be asked to fulfill their responsibilities, such as paying overdue rent. If they refuse, legal action may be necessary, making the Florida Guaranty of a Lease critical for securing compliance.

In Florida, a lease guaranty does not typically need to be notarized to be enforceable. However, having it notarized can provide an extra layer of security for both parties. It's a good practice to discuss this with a legal professional to understand your options better in the context of the Florida Guaranty of a Lease.

A guarantor has the power to ensure the lease is honored, providing a safety net for landlords. However, they have limited control over the tenant's actions and cannot dictate behavior. This role primarily serves as a financial backstop, reflecting the responsibilities outlined in the Florida Guaranty of a Lease. Awareness of this role is vital for anyone considering being a guarantor.

Yes, personal guarantees are enforceable in Florida, as long as they comply with state laws. This means that if a guarantor signs a lease, that agreement can be upheld in court if necessary. However, it is crucial to fully comprehend the terms defined in the Florida Guaranty of a Lease to understand potential obligations and liabilities.

One significant downside of being a guarantor is the potential for financial risk. If the tenant fails to meet lease obligations, you become responsible for those debts, which could strain your finances. Additionally, being a guarantor may complicate your personal relationships, especially if there are disputes. Knowing the details of the Florida Guaranty of a Lease can help you gauge these risks.

Yes, being a guarantor on a lease can impact your credit score. If the tenant is late on rent or defaults, it may lead to collection accounts that reflect negatively on your credit history. This can limit your borrowing ability and create stress in your financial life. Therefore, reviewing the Florida Guaranty of a Lease is crucial.