Title: Florida Checklist — Action to Improve Collection of Accounts: Everything You Need to Know Introduction: The Florida Checklist — Action to Improve Collection of Accounts is a comprehensive guide that incorporates a series of crucial steps to enhance the process of collecting accounts receivable effectively. Whether you are a business owner, accounts manager, or individual seeking to recover unpaid debts, this checklist serves as a valuable resource to streamline your collection efforts. In this article, we will outline the essential components of the Florida Checklist and provide an overview of different types of checklists available for specific scenarios. 1. Assessment of the Debtor's Financial Situation: Before initiating any collection actions, it is essential to evaluate the debtor's financial capability thoroughly. This step involves conducting an in-depth analysis of their financial records, income sources, assets, and liabilities. 2. Verification and Documentation of Debt: Accurate documentation is crucial in establishing the validity of the debt owed. The checklist guides you on implementing measures to ensure proper documentation, including the creation of detailed invoices, contracts, purchase orders, and proof of delivery or completion of services. 3. Creation of Clear Debt Collection Policies: To facilitate efficient collections, it is important to have well-defined debt collection policies. The Florida Checklist provides guidance on creating clear payment terms, due dates, grace periods, and penalties for late payments. These policies establish a framework for future collection activities. 4. Utilization of Effective Communication Methods: Proactive communication plays a vital role in resolving outstanding debts. The checklist emphasizes establishing appropriate channels of communication with debtors, including phone calls, emails, and written correspondence, ensuring adherence to legal requirements and ethical practices. 5. Pursuing Legal Action: In cases where voluntary payment is not obtained, initiating legal action may be necessary. The Florida Checklist provides insights into the various legal options available, such as filing a lawsuit, obtaining a judgment, garnishing wages, and exploring alternative dispute resolution methods. 6. Measures to Prevent Future Debt Issues: Prevention is always better than cure. The checklist highlights preventive measures, such as conducting credit checks on potential clients, implementing credit limits, utilizing effective contract terms, and maintaining regular accounting practices minimizing the occurrence of bad debt. Types of Florida Checklists — Action to Improve Collection of Accounts: 1. Business-to-Business (B2B) Collections Checklist: This checklist specifically caters to businesses dealing with outstanding debts owed by other businesses. It covers industry-specific considerations, such as construction liens, mechanic's liens, and financial challenges faced by corporate clients. 2. Personal Debts Collections Checklist: Focused on individuals, this checklist provides guidance on recovering personal debts, including unpaid loans, credit card debts, medical bills, and other outstanding obligations. 3. Small Claims Collections Checklist: Designed for individuals or small businesses pursuing collection efforts within the small claims court system, this checklist assists in navigating the specific procedures, limits, and requirements of small claims courts. 4. Business-to-Consumer (B2C) Collections Checklist: For businesses seeking to collect debts from individual consumers, this checklist addresses consumer protection laws, fair debt collection practices, and compliance with federal and state regulations. Conclusion: Successfully collecting outstanding debts is paramount for businesses and individuals alike. The Florida Checklist — Action to Improve Collection of Accounts offers a comprehensive framework, encompassing crucial steps and best practices improving your collection efforts effectively. By following these guidelines, you can minimize financial losses, maintain strong cash flow, and increase the likelihood of debt resolution. Choose the appropriate checklist according to your specific needs and take proactive steps towards achieving successful debt recovery.

Florida Checklist - Action to Improve Collection of Accounts

Description

How to fill out Florida Checklist - Action To Improve Collection Of Accounts?

If you have to comprehensive, acquire, or print legal record themes, use US Legal Forms, the greatest collection of legal kinds, which can be found on-line. Take advantage of the site`s simple and handy look for to get the papers you want. Various themes for business and specific uses are sorted by groups and claims, or key phrases. Use US Legal Forms to get the Florida Checklist - Action to Improve Collection of Accounts in a number of mouse clicks.

In case you are currently a US Legal Forms consumer, log in for your accounts and click the Obtain option to get the Florida Checklist - Action to Improve Collection of Accounts. You can even gain access to kinds you formerly acquired from the My Forms tab of your own accounts.

If you work with US Legal Forms the first time, follow the instructions beneath:

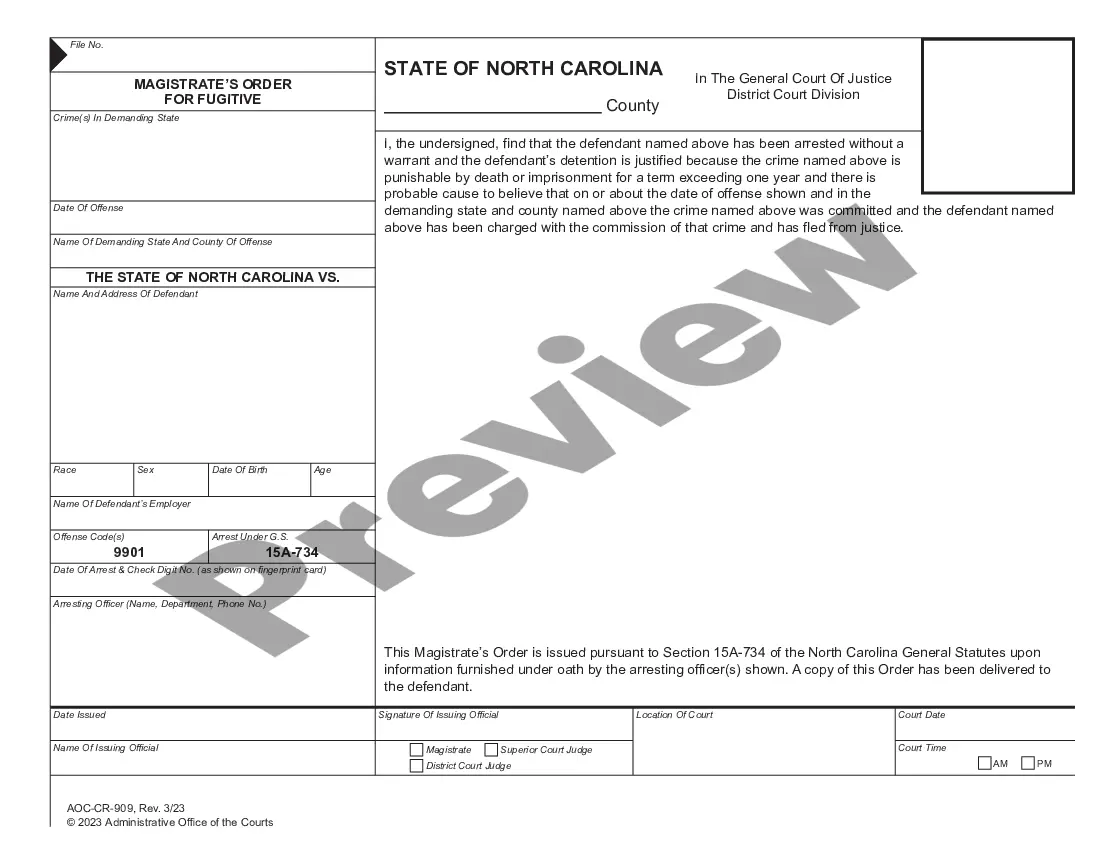

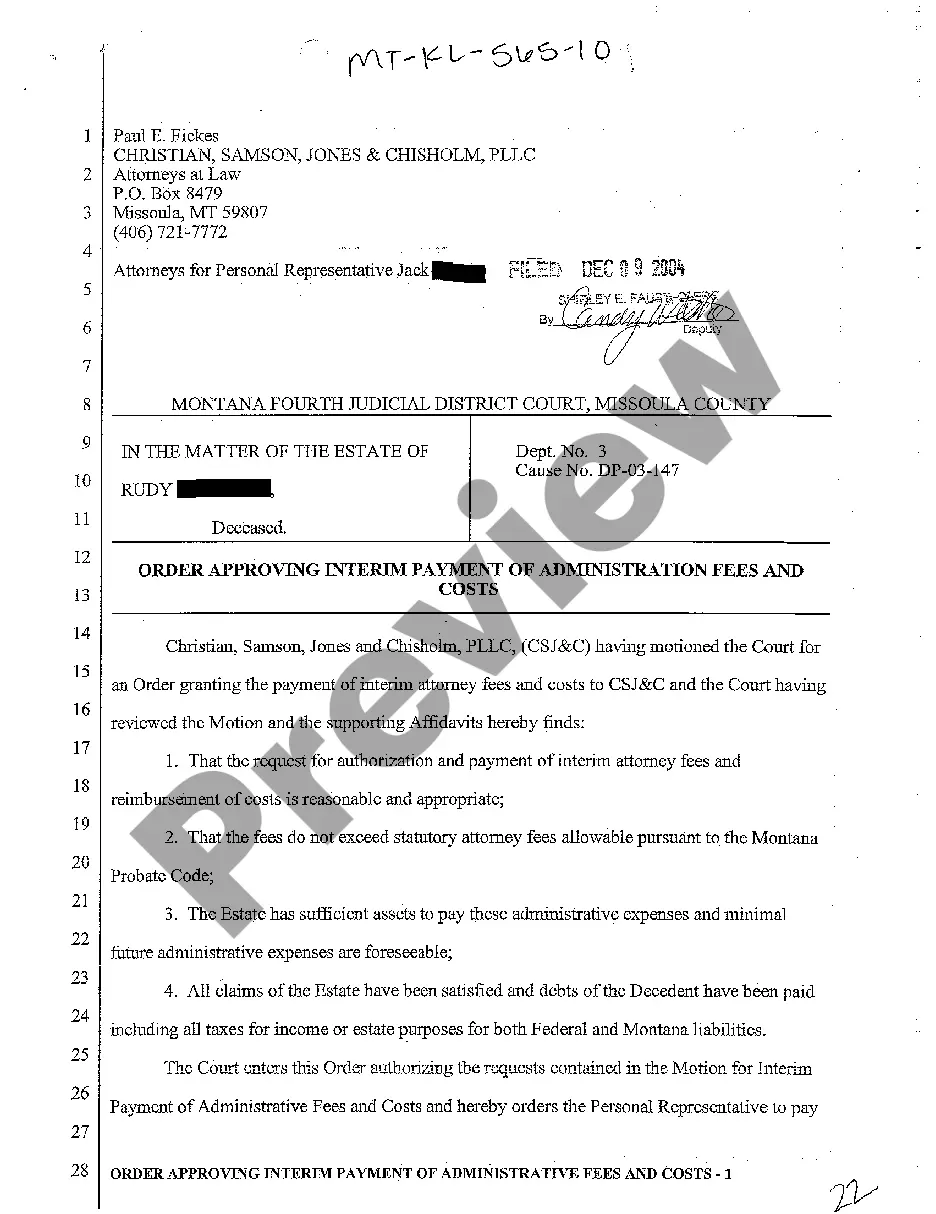

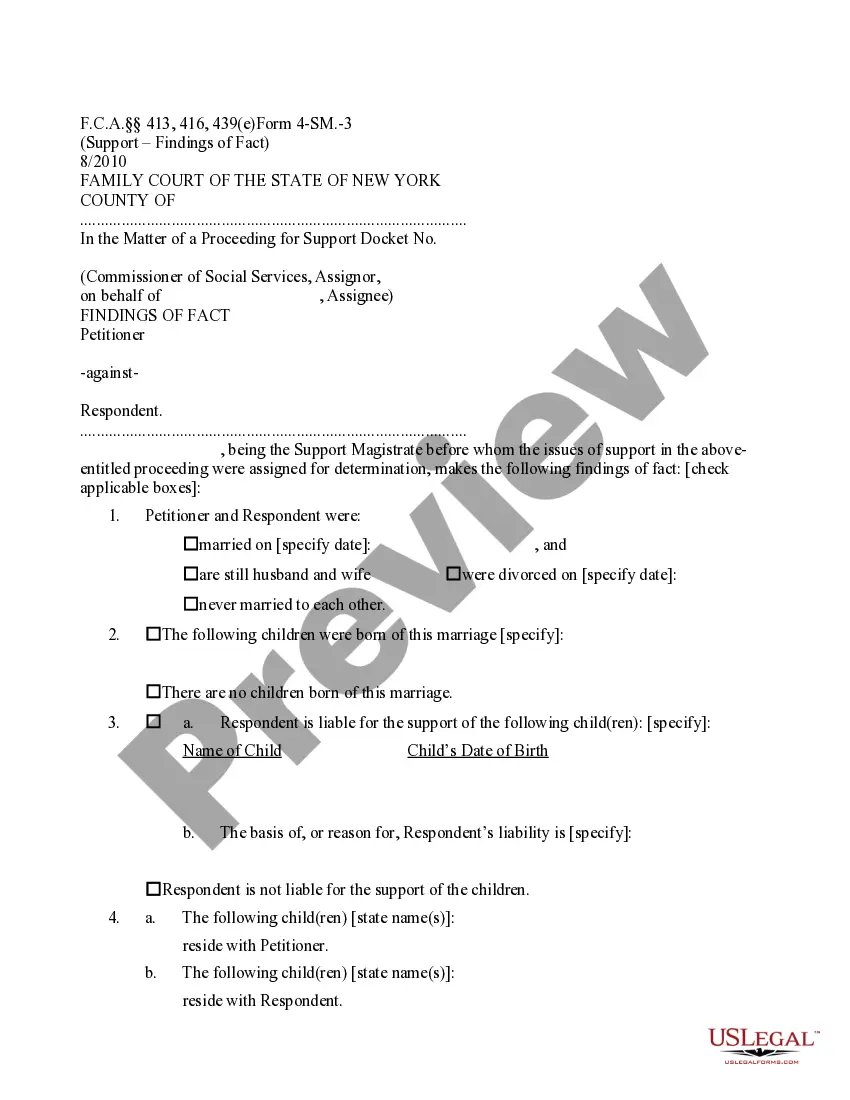

- Step 1. Make sure you have chosen the shape to the correct town/land.

- Step 2. Make use of the Review choice to check out the form`s articles. Don`t forget to see the information.

- Step 3. In case you are not happy using the form, make use of the Search discipline towards the top of the monitor to find other models from the legal form web template.

- Step 4. When you have discovered the shape you want, select the Buy now option. Select the rates program you favor and add your references to register on an accounts.

- Step 5. Method the deal. You should use your bank card or PayPal accounts to finish the deal.

- Step 6. Choose the format from the legal form and acquire it on your device.

- Step 7. Comprehensive, modify and print or signal the Florida Checklist - Action to Improve Collection of Accounts.

Every single legal record web template you get is your own property permanently. You have acces to each and every form you acquired with your acccount. Select the My Forms portion and decide on a form to print or acquire once again.

Compete and acquire, and print the Florida Checklist - Action to Improve Collection of Accounts with US Legal Forms. There are thousands of professional and express-specific kinds you may use to your business or specific requires.