Florida Return Authorization Form

Description

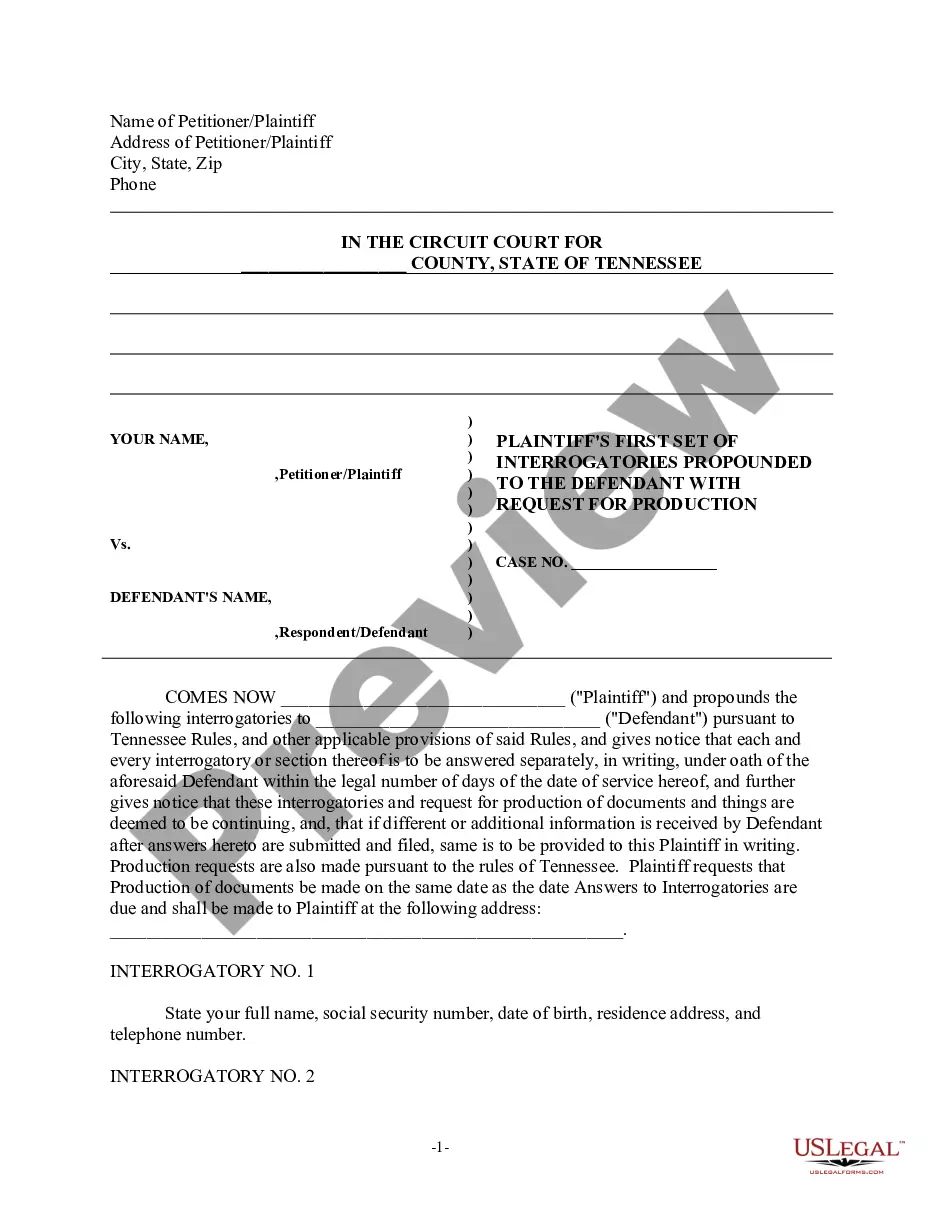

How to fill out Return Authorization Form?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Florida Return Authorization Form in just seconds.

Review the description of the form to confirm that you have selected the appropriate one.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you have a monthly subscription, Log In and download the Florida Return Authorization Form from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are straightforward instructions to help you begin.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to check the content of the form.

Form popularity

FAQ

To obtain a Florida RT number, you need to register with the Florida Department of Revenue as an employer. This process involves completing the appropriate registration forms and providing necessary information about your business. Once registered, you will receive your RT number, which is crucial for tax reporting and compliance. For further assistance with forms like the Florida Return Authorization Form, USLegalForms offers reliable support to help you navigate the requirements.

The Florida Dr. 835 is a document used for electronic remittance advice in the healthcare industry. It allows healthcare providers to receive detailed information about insurance payments and patient accounts. Understanding this document is vital for tracking payments and managing claims effectively. If you need to file additional paperwork, such as the Florida Return Authorization Form, consider the resources available through USLegalForms to streamline your process.

Florida reemployment assistance is often referred to as unemployment benefits, but there are slight distinctions. This program offers temporary financial aid to those who have lost their jobs through no fault of their own. While both terms may be used interchangeably, understanding the specific guidelines is essential for eligibility. If you need to file forms related to this assistance, including a Florida Return Authorization Form, USLegalForms can simplify the procedure for you.

A Florida Department of Revenue Notice of Final Assessment is a document that informs a taxpayer of their final tax obligation. This notice follows an audit or review process conducted by the Department of Revenue. If you receive this notice, it is important to respond promptly, as it outlines the amount owed and any necessary steps. For managing tax matters, such as submitting a Florida Return Authorization Form, consider using USLegalForms to guide your process.

You should file Florida form F-7004 with the appropriate agency as directed by the Florida Department of Revenue. Different entities may have specific filing locations, so verify where to send yours. If you encounter any challenges during this process, the Florida Return Authorization Form can aid you in navigating authorizations. It is crucial to file correctly to ensure compliance.

Yes, Florida F-7004 can be filed electronically, making the process quick and efficient. This option allows you to submit all required information with ease. When preparing to e-file, consider using the Florida Return Authorization Form if you need to delegate authority. This will help simplify your filing and ensure everything is handled properly.

Mail your Florida form F 7004 to the designated address based on your entity type, as specified by the Florida Department of Revenue. Ensuring that you send your form to the right location will help avoid complications or delays. If you have questions about the mailing process, leveraging the Florida Return Authorization Form can clear up any confusion. Always keep a copy for your records.

You can file form 4868 in Florida by either mailing it to the IRS or utilizing electronic filing options. It's essential to follow the specific instructions related to your situation. Use the Florida Return Authorization Form if you need to authorize someone else to act on your behalf. Ensure that your submission is timely to avoid penalties.

Yes, Florida partnership returns can be filed electronically, which streamlines the submission process. Utilizing e-filing options can save time and reduce errors. When preparing your return, remember to include the Florida Return Authorization Form if you require any changes or authorizations. Online resources can help you navigate the e-filing process effectively.

You should send your federal form 7004 to the appropriate address based on the type of entity you are filing for. The Internal Revenue Service provides specific mailing addresses for different types of filers. Make sure to include any necessary documentation and use the Florida Return Authorization Form if needed. Double-check the address before mailing to avoid delays.