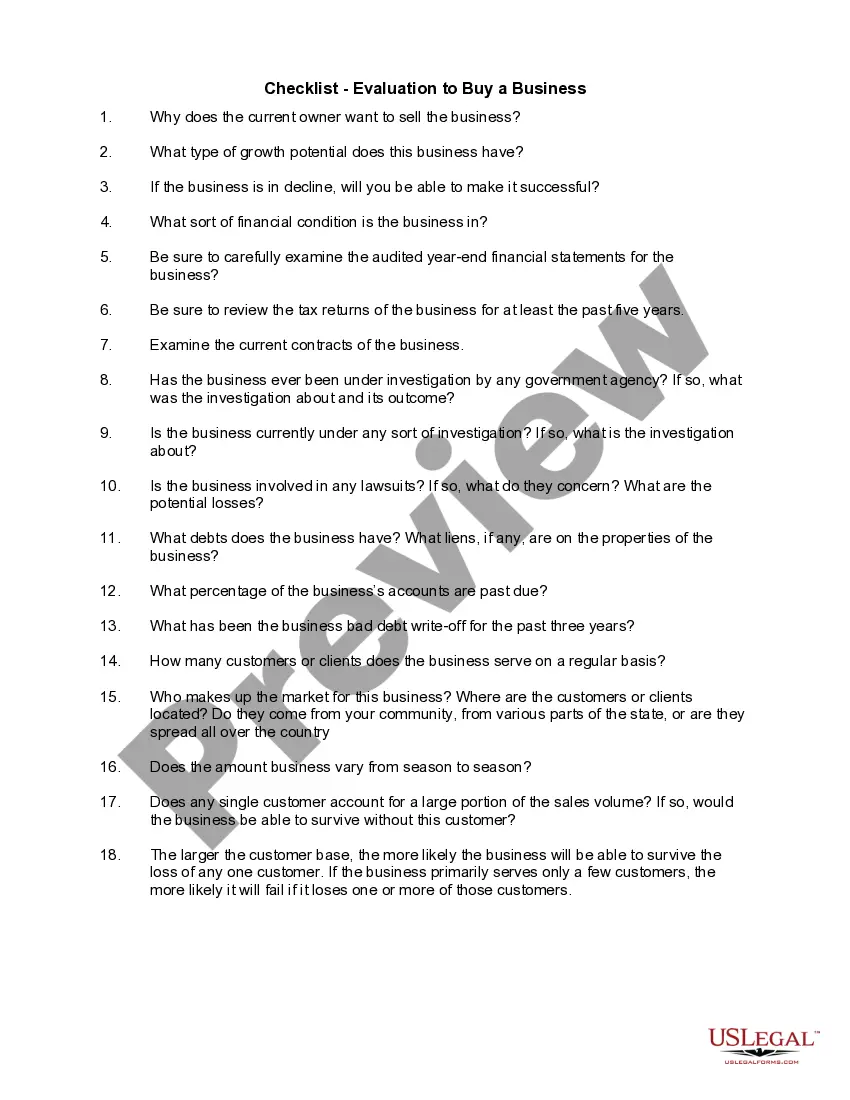

Florida Checklist — Evaluation to Buy a Business If you are considering buying a business in Florida, it is essential to conduct a thorough evaluation to ensure you are making an informed decision. The Florida Checklist — Evaluation to Buy a Business provides a detailed guide to assess the key aspects involved in acquiring and owning a business in the state. By following this checklist, you can minimize the risks and maximize the potential for success. 1. Financial Evaluation: Evaluate the financial records of the business, including profit and loss statements, balance sheets, tax returns, and cash flow statements. Assess the business's profitability, revenue trends, liabilities, and potential risks. 2. Market Analysis: Conduct a comprehensive market analysis to understand the industry trends, competition, target audience, and potential growth opportunities. Evaluate the business's market position, customer base, and marketing strategies. 3. Legal Due Diligence: Verify the legal compliance of the business, including licenses and permits, contracts, leases, and intellectual property rights. Assess any pending litigation or legal issues that may affect the business's operations. 4. Operational Assessment: Evaluate the business's operations, including its organizational structure, staffing, infrastructure, suppliers, inventory management, and production processes. Identify any operational inefficiencies or challenges. 5. Customer Analysis: Analyze the business's customer base, customer loyalty, and customer satisfaction. Understand the customers' preferences and buying behavior to determine the sustainability and growth potential of the business. 6. Technology and Infrastructure: Assess the technology systems, software, and hardware used by the business. Determine if upgrades or improvements are necessary to enhance efficiency and competitiveness. 7. Human Resources Evaluation: Evaluate the quality and skills of the existing workforce, including key employees. Assess the potential for employee retention and any necessary changes to the workforce structure. 8. Assets and Liabilities: Assess the tangible and intangible assets of the business, such as equipment, inventory, patents, trademarks, and goodwill. Evaluate any outstanding loans, debts, or liabilities that may impact the financial health of the business. 9. Sales and Marketing: Evaluate the business's sales strategies, customer acquisition methods, advertising efforts, and branding. Determine the effectiveness of the current marketing channels and identify potential opportunities for growth. 10. Exit Strategy: Consider the potential exit strategies for the business, such as selling to a new owner, merging with another company, or taking the business public. Evaluate how the business fits into your long-term goals. Types of Florida Checklist — Evaluation to Buy a Business: 1. Small Business Acquisition Checklist: Specifically designed for individuals or investors interested in acquiring small businesses in Florida. Focuses on the unique challenges and considerations involved in buying and running a small business. 2. Franchise Evaluation Checklist: Tailored for those evaluating franchise opportunities in Florida. Provides guidelines to assess the franchisor's reputation, support, training programs, and franchise agreement terms. 3. Industry-Specific Business Evaluation Checklist: Customized checklists for specific industries, such as restaurants, retail stores, healthcare services, or technology companies. Includes industry-specific evaluation criteria to ensure a comprehensive analysis. 4. Due Diligence Checklist: A comprehensive checklist covering all aspects of buying a business in Florida. Combines all the above checklists into one document, allowing buyers to evaluate businesses in a systematic and thorough manner. By using the Florida Checklist — Evaluation to Buy a Business, you can streamline the evaluation process and make well-informed decisions when purchasing a business in the state. It is crucial to adapt the checklist to your specific industry, investment size, and desired exit strategy to ensure a successful business acquisition.

Florida Checklist - Evaluation to Buy a Business

Description

How to fill out Florida Checklist - Evaluation To Buy A Business?

If you wish to comprehensive, down load, or print out legitimate papers themes, use US Legal Forms, the most important selection of legitimate kinds, which can be found on the web. Make use of the site`s basic and convenient research to find the documents you require. Different themes for organization and person uses are categorized by groups and suggests, or keywords. Use US Legal Forms to find the Florida Checklist - Evaluation to Buy a Business within a number of click throughs.

If you are currently a US Legal Forms customer, log in in your account and click the Download switch to obtain the Florida Checklist - Evaluation to Buy a Business. You can even access kinds you previously acquired inside the My Forms tab of the account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for the proper area/nation.

- Step 2. Make use of the Preview option to examine the form`s articles. Never forget about to read through the explanation.

- Step 3. If you are unsatisfied together with the develop, use the Research discipline near the top of the monitor to find other models in the legitimate develop web template.

- Step 4. Upon having found the shape you require, select the Purchase now switch. Opt for the pricing prepare you like and add your accreditations to register to have an account.

- Step 5. Approach the transaction. You should use your credit card or PayPal account to finish the transaction.

- Step 6. Find the structure in the legitimate develop and down load it in your system.

- Step 7. Total, revise and print out or indication the Florida Checklist - Evaluation to Buy a Business.

Each and every legitimate papers web template you get is your own property permanently. You may have acces to every develop you acquired in your acccount. Click the My Forms portion and decide on a develop to print out or down load yet again.

Compete and down load, and print out the Florida Checklist - Evaluation to Buy a Business with US Legal Forms. There are thousands of specialist and express-specific kinds you can use to your organization or person demands.