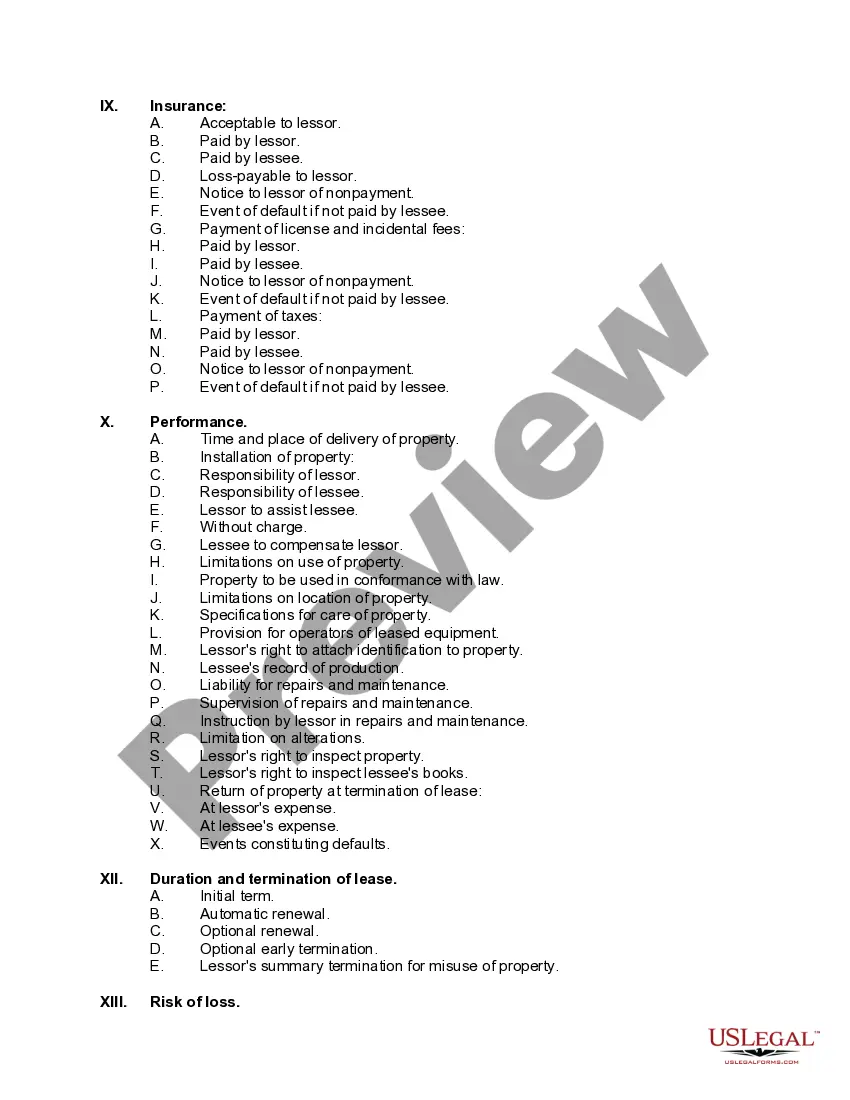

Florida Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

You are capable of spending hours online searching for the legal document template that meets both state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can easily obtain or print the Florida Equipment Lease Checklist from the service.

If available, use the Review option to view the document template at the same time.

- If you already possess a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can fill out, modify, print, or sign the Florida Equipment Lease Checklist.

- Every legal document template you purchase is yours forever.

- To receive another copy of the acquired form, navigate to the My documents tab and click on the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Check the form details to confirm you have selected the right form.

Form popularity

FAQ

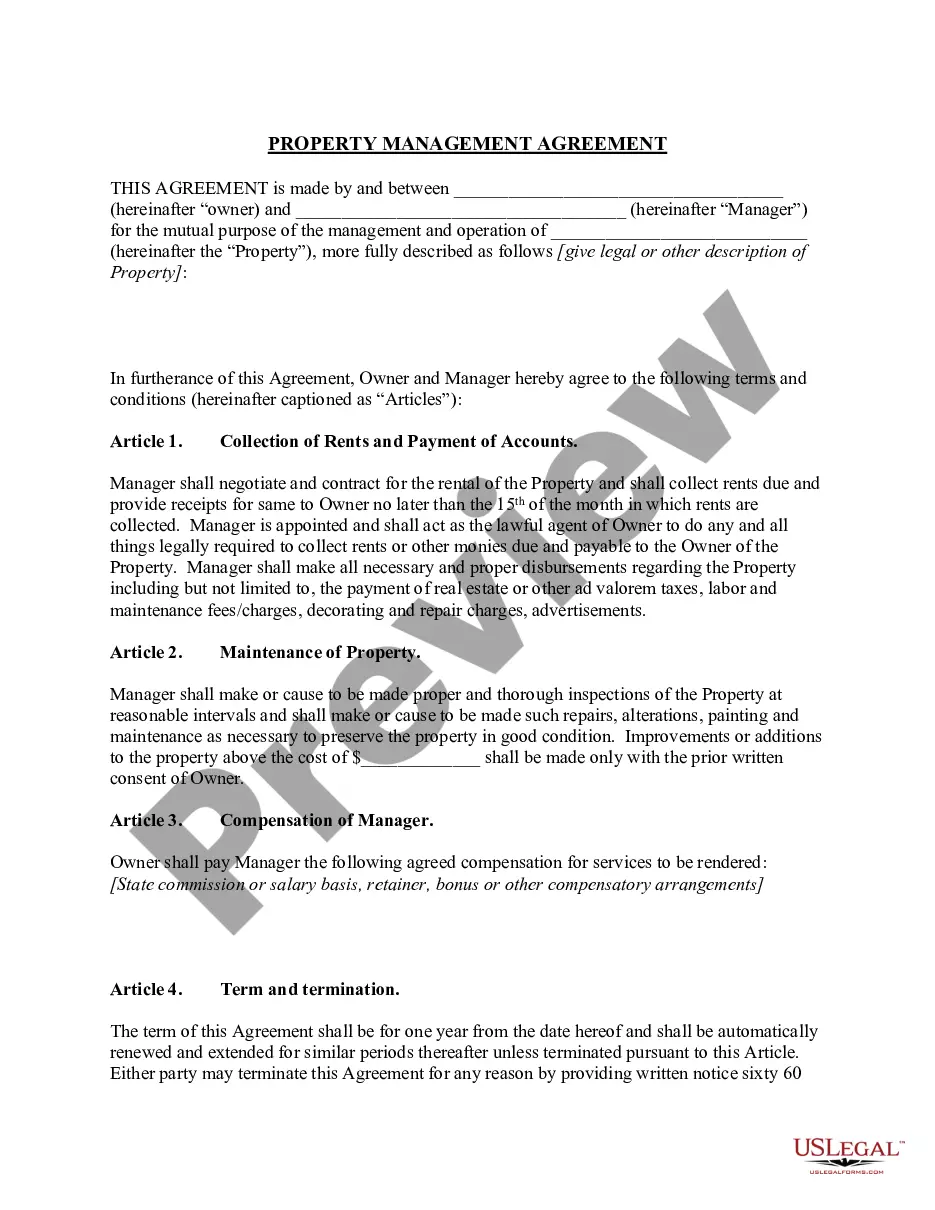

To book a lease in QuickBooks, start by recording the initial value of the lease asset and the corresponding liability. You should also set up recurring transactions for the lease payments. Using the Florida Equipment Lease Checklist will help ensure that you don’t miss any critical steps during this process.

The journal entry for a lease typically includes a debit to the leased asset and a credit to the lease liability. It’s essential to track interest expense and principal repayments correctly throughout the lease term. The Florida Equipment Lease Checklist can guide you in accurately recording these entries in your accounting system.

Setting up an equipment lease starts with defining your needs and choosing the right equipment. Next, review potential vendors and negotiate terms that serve your interests. Finally, use the Florida Equipment Lease Checklist to ensure all aspects of the lease agreement are documented and compliant with legal standards.

Lease payments can be treated differently based on the type of lease. Operating leases typically result in expenses, while capital leases lead to capitalization of assets. To gain clarity, consult the Florida Equipment Lease Checklist, which outlines the distinctions and helps you make informed financial decisions.

Recording a lease in accounting involves identifying it as either a capital or operating lease. For a capital lease, you must record the asset and liability on the balance sheet. Ensure that you follow guidelines outlined in the Florida Equipment Lease Checklist to maintain compliance and accuracy in financial reporting.

To record a lease in QuickBooks, first, set up the lease as a liability. Next, create an asset account for the leased equipment. Then, record the lease payments against the liability account accordingly. For a comprehensive process, refer to the Florida Equipment Lease Checklist to ensure all details are accurately documented.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

Key takeaway: With an operating lease, you have access to the equipment for a time but don't own it. The lease period tends to be shorter than the life of the equipment. With a finance lease, you own the equipment at the end of the term. Big companies typically use this type of lease.

Various Types of Lease: Finance, Operating, Direct, LeveragedVarious Types of Lease.(1) Finance lease :(2) Operating lease :(3) Sale and lease back :(4) Direct lease :(5) Single investor lease :(6) Leveraged lease :(7) Domestic Lease :More items...

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.