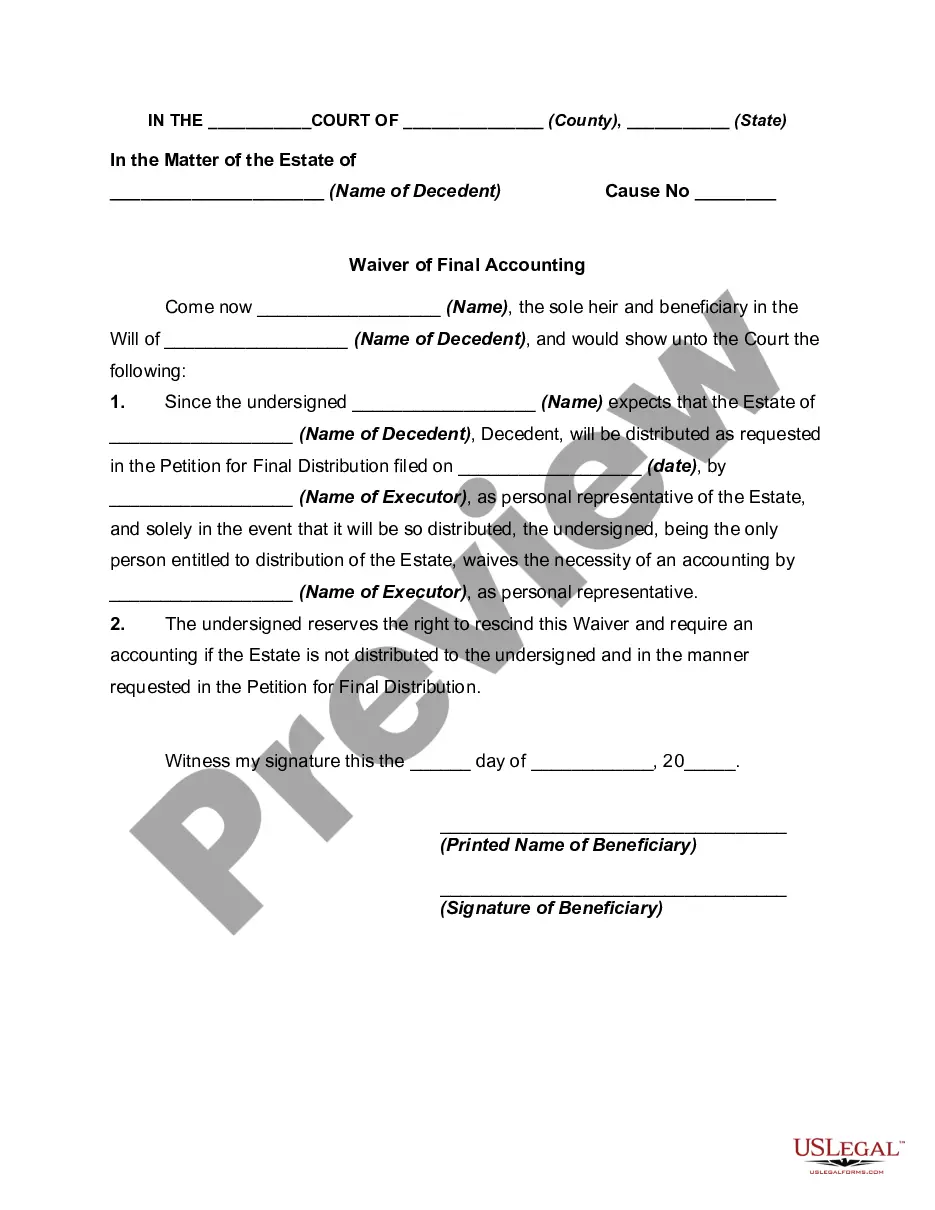

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

The Florida Waiver of Final Accounting by Sole Beneficiary refers to a legal document that can be used in estate planning or probate proceedings. It allows a sole beneficiary of an estate to waive their right to receive a final accounting of the estate's assets and transactions. In simpler terms, when someone passes away and leaves behind an estate, the executor or personal representative of the estate is required to provide a detailed accounting of all the assets, debts, and transactions involved. This accounting ensures transparency and accountability in the handling of the estate. However, in cases where there is only one beneficiary, the Florida Waiver of Final Accounting by Sole Beneficiary can be utilized. By signing this waiver, the sole beneficiary essentially agrees to forgo receiving a formal and detailed report of the estate's financial transactions. The purpose of this waiver is to simplify the probate process and save time and resources for both the beneficiary and the executor. It acknowledges that the estate has been properly managed and that the beneficiary has received their rightful inheritance without the need for a full accounting. It is essential to understand that this waiver is optional, and beneficiaries can choose whether to sign it. Furthermore, it is important for beneficiaries to carefully consider their options and consult with professionals such as estate attorneys or financial advisors before making a decision. Although the primary focus is on the Florida Waiver of Final Accounting by Sole Beneficiary, there are a few variations of waivers that deserve mention. These include: 1. Partial Waiver of Final Accounting: This type of waiver grants the beneficiary the option to receive a limited or summarized final accounting. It allows them to have a general overview of the estate's financial transactions without going into exhaustive detail. 2. Conditional Waiver of Final Accounting: This type of waiver sets specific conditions that must be met before the beneficiary agrees to waive their right to a final accounting. These conditions might include a certain distribution of assets or the fulfillment of certain obligations within the estate. 3. Informed Consent Waiver: This waiver emphasizes the need for beneficiaries to have a clear understanding of their rights and the implications of waiving their final accounting. It necessitates that beneficiaries receive comprehensive information and disclosures before making a decision. In conclusion, the Florida Waiver of Final Accounting by Sole Beneficiary provides beneficiaries with the option to waive their right to receive a detailed final accounting of an estate's assets and transactions. It is a valuable tool in simplifying the probate process when there is only one beneficiary. However, it is crucial for beneficiaries to seek professional advice to ensure they make an informed decision that aligns with their best interests.