This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

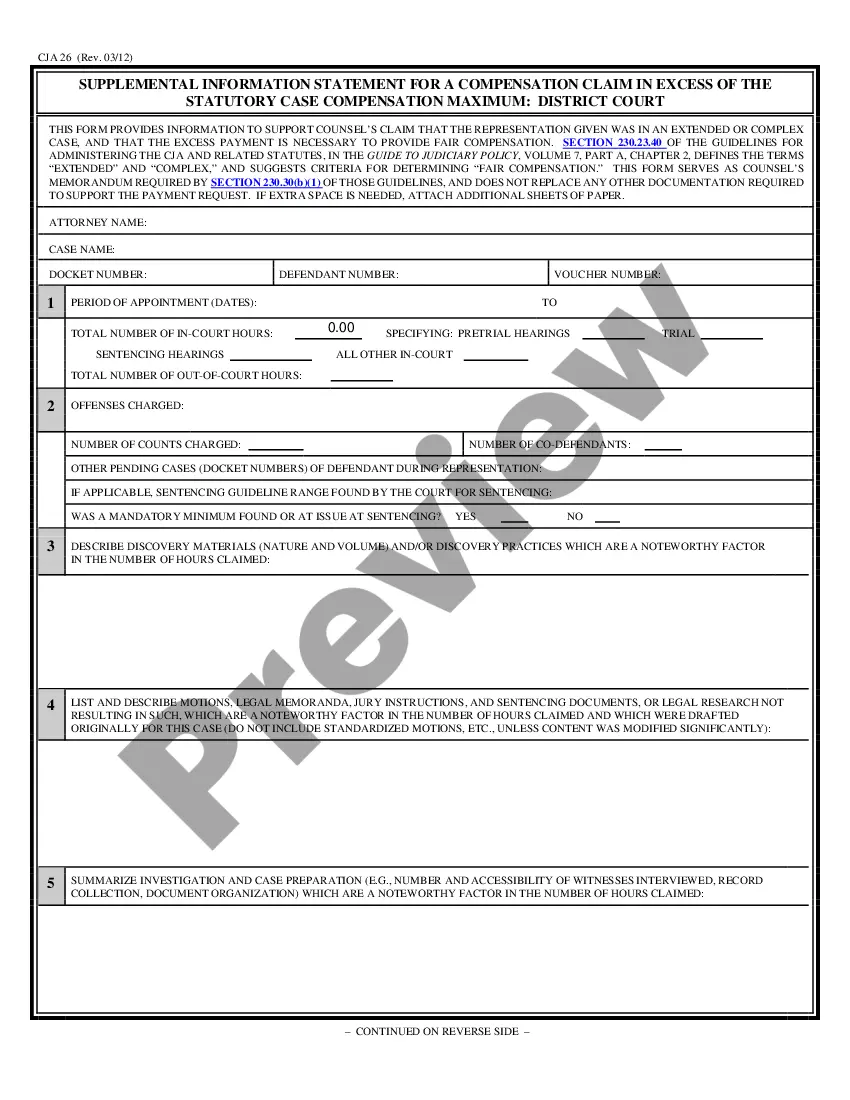

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Selecting the correct legal document template can be a challenge.

Certainly, there are numerous templates available online, but how do you find the legal form you need.

Take advantage of the US Legal Forms website. This service offers thousands of templates, including the Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary, which you can use for business and personal purposes.

First, make sure you have selected the correct form for your city/region. You can preview the form using the Preview button and read the form description to confirm it’s the right one for you.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary.

- Use your account to view the legal forms you have previously purchased.

- Visit the My documents tab of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can take.

Form popularity

FAQ

Not all supplemental needs trusts qualify as disability trusts. For a supplemental needs trust to be labeled a qualified disability trust, it must meet specific IRS criteria, including establishment for a disabled individual under the age of 65. By carefully crafting a Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary, families can navigate these regulations and ensure both compliance and support for their loved ones.

In Florida, a special needs trust serves the purpose of providing financial support while allowing the individual to maintain eligibility for public assistance programs. This trust is structured to ensure that assets are not deemed available for the disabled beneficiary, thus protecting benefits like Medicaid and SSI. Establishing a Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary is a strategic way to enhance quality of life without sacrificing essential government support.

One key disadvantage of a third-party special needs trust is that it cannot be used for basic living expenses, like food and housing, without risking government benefits. Furthermore, families might face complexities in trust management and distribution rules, which demand informed planning. A Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary, while beneficial, requires careful consideration of how funds are allocated.

A qualified disability trust must meet certain criteria, including being established for a disabled individual under the age of 65 and ensuring that the trust is irrevocable. It needs to be directly established and funded by a third party. By creating a Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary, families can assure compliance with the qualifications, maximizing the benefits for their loved ones.

Generally, a properly established special needs trust does not impact an individual’s eligibility for Social Security Disability Insurance (SSDI). This is because the funds held in the trust are not considered income for the purposes of SSDI qualifications. Establishing a Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary can help safeguard financial resources while allowing the beneficiary to retain their SSDI benefits.

While a supplemental needs trust offers many benefits, there are some disadvantages to consider. One major concern is the potential for strict regulations and the need for ongoing management, which may require legal expertise. Additionally, if not set up properly, a Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary might lead to unintended consequences regarding government benefit eligibility.

Typically, the trust itself is responsible for paying taxes on any income generated by its assets. However, because the funds in a third-party special needs trust do not count towards the disabled individual’s income, they do not affect government benefits. Utilizing a Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary is advantageous in maintaining tax efficiency while securing quality care.

Yes, a third-party special needs trust can provide financial support to a disabled beneficiary without affecting their eligibility for government benefits. This means it can cover additional expenses like vacations, entertainment, and hobbies. Families often utilize a Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary to enhance their loved ones’ lives, ensuring a level of care that goes beyond the basic needs covered by public assistance.

party special needs trust operates when family members or friends create a trust fund to benefit a disabled individual. This type of trust ensures that the assets are not counted towards the beneficiary's income limits for government assistance. By establishing a Florida Supplemental Needs Trust for Third Party Disabled Beneficiary, families can provide the necessary financial support while preserving vital public benefits.

A supplemental needs trust is a legal arrangement designed to provide financial support for individuals with disabilities, without jeopardizing their eligibility for government benefits. This trust allows funds to be set aside for certain expenses that enhance their quality of life, such as education, health care, and rehabilitation. Specifically, the Florida Supplemental Needs Trust for Third Party - Disabled Beneficiary can help families ensure their loved ones receive the necessary support without losing crucial benefits.