Dear [Recipient's Name], I hope this letter finds you well. We are writing to inform you about an important step in the incorporation process for your Florida-based business. Today, we will discuss the Articles of Incorporation and the election of Sub-S Status, which can offer significant tax benefits to eligible businesses. First, let's briefly discuss what Florida Articles of Incorporation entail. When forming a corporation in Florida, it is necessary to file specific documents with the state government. Articles of Incorporation serve as a legal record that formally establishes the existence of your corporation in accordance with Florida state laws. This document typically includes essential information about your business, such as the corporate name, purpose, registered agent, and initial directors. Now, let's delve into the topic of the election of Sub-S Status. Subchapter S corporations, commonly referred to as Sub-S corporations, are a type of corporation that allows businesses to pass income, losses, deductions, and credits through to their shareholders for tax purposes. This election effectively eliminates the double taxation typically associated with traditional C corporations, where both the corporation and its shareholders are taxed. To be eligible for Sub-S Status election, your business must meet certain criteria. It must be a domestic corporation, have no more than 100 shareholders, have only one class of stock, and all shareholders must be either U.S. citizens or resident aliens. Additionally, certain types of businesses, such as financial institutions and insurance companies, are ineligible for Sub-S Status election. By electing Sub-S status, eligible Florida corporations can enjoy numerous advantages. These include the ability to avoid corporate-level federal income tax, the opportunity for significant tax savings, and the simplification of the overall tax reporting process. However, it is important to consult with a qualified tax professional to fully understand the implications and assess whether Sub-S Status election is suitable for your specific business needs. It's crucial to note that the process of electing Sub-S Status involves submitting Form 2553 to the Internal Revenue Service (IRS) within a specific timeframe. Failure to complete this process accurately and on time may result in missed opportunities or the loss of Sub-S Status eligibility. In conclusion, the Florida Sample Letter regarding Articles of Incorporation — Election of Sub-S Status serves as a guide for businesses seeking to understand the benefits and requirements of electing Sub-S Status for their corporation. It provides a detailed overview of the incorporation process, explains the advantages of Sub-S Status election, and emphasizes the significance of consulting with a tax professional. By following the guidelines outlined in the sample letter, Florida businesses can make informed decisions about their tax strategies while ensuring compliance with state and federal laws. Best regards, [Your Name] [Your Title/Organization]

Florida Sample Letter regarding Articles of Incorporation - Election of Sub-S Status

Description

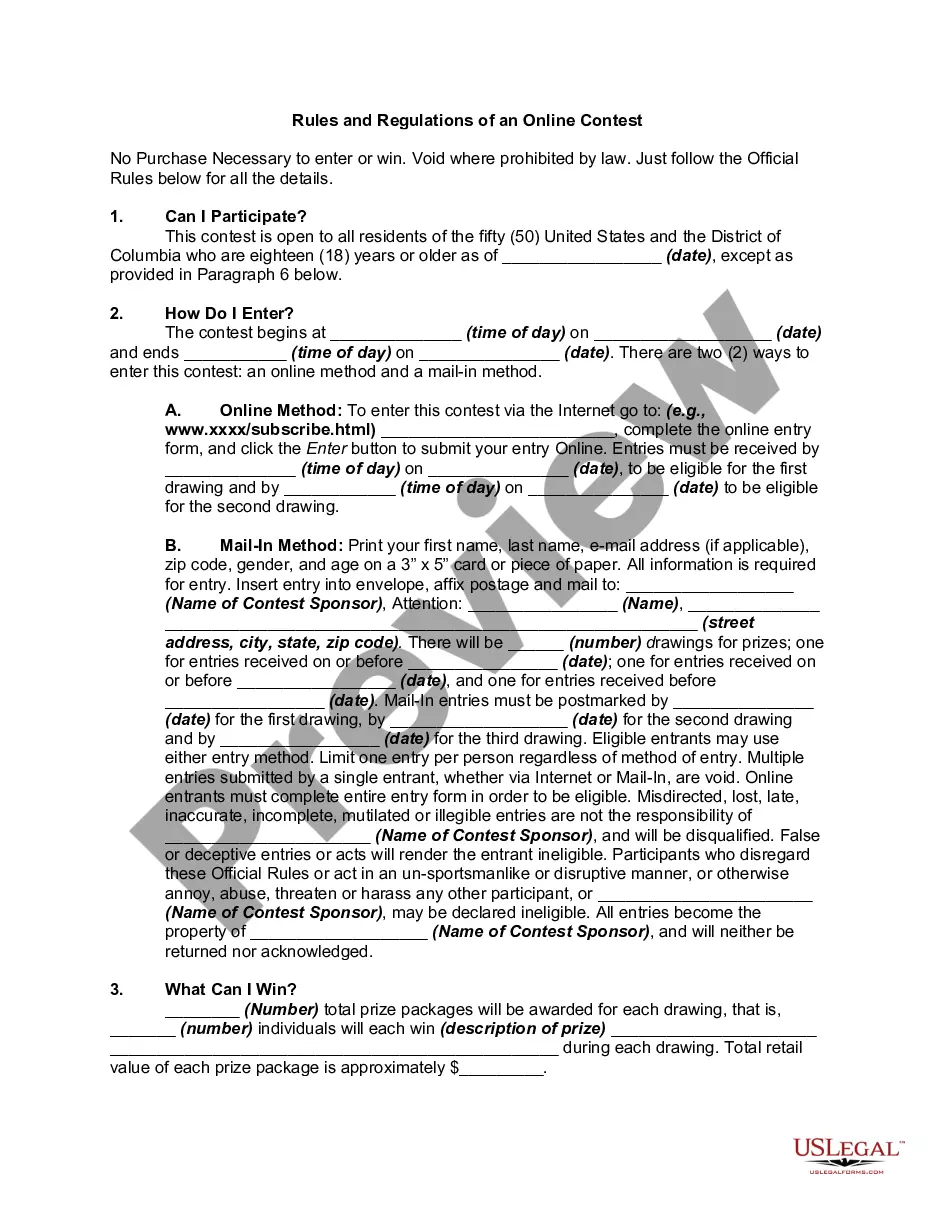

How to fill out Florida Sample Letter Regarding Articles Of Incorporation - Election Of Sub-S Status?

Have you been inside a position that you need to have documents for possibly company or person reasons just about every day? There are a variety of legal document layouts available on the net, but getting types you can depend on isn`t simple. US Legal Forms provides 1000s of type layouts, such as the Florida Sample Letter regarding Articles of Incorporation - Election of Sub-S Status, that are composed to satisfy state and federal demands.

When you are presently acquainted with US Legal Forms internet site and also have a merchant account, simply log in. Following that, you can down load the Florida Sample Letter regarding Articles of Incorporation - Election of Sub-S Status web template.

Unless you have an profile and want to start using US Legal Forms, abide by these steps:

- Find the type you want and ensure it is to the appropriate city/county.

- Make use of the Review switch to check the form.

- See the explanation to ensure that you have selected the proper type.

- In the event the type isn`t what you`re searching for, use the Look for discipline to obtain the type that fits your needs and demands.

- Once you discover the appropriate type, just click Acquire now.

- Opt for the prices plan you want, submit the necessary info to make your money, and purchase your order with your PayPal or credit card.

- Pick a hassle-free document format and down load your duplicate.

Discover each of the document layouts you have purchased in the My Forms menus. You may get a further duplicate of Florida Sample Letter regarding Articles of Incorporation - Election of Sub-S Status whenever, if possible. Just click the necessary type to down load or print the document web template.

Use US Legal Forms, one of the most comprehensive collection of legal forms, to conserve time as well as stay away from faults. The services provides skillfully produced legal document layouts which you can use for a variety of reasons. Produce a merchant account on US Legal Forms and commence generating your way of life easier.