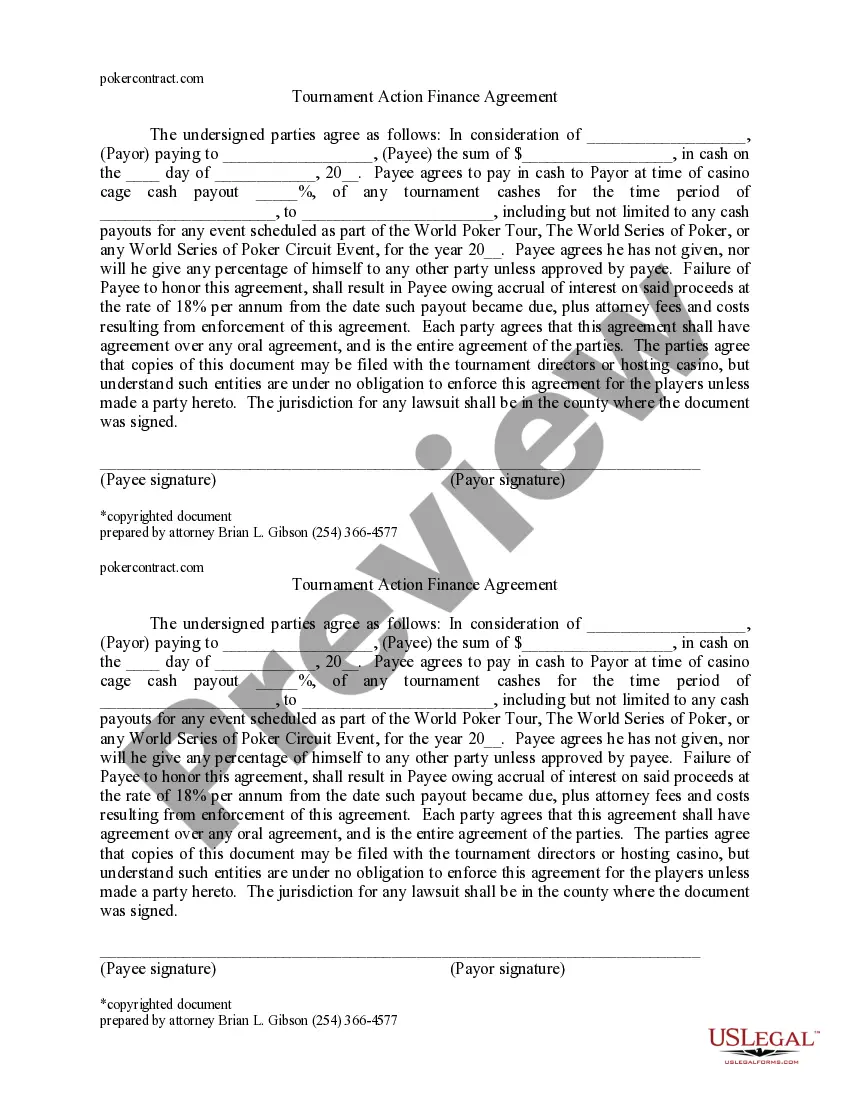

Florida Sample Letter for Tax Exemption — Review of Applications Dear [Applicant's Name], We would like to inform you that we have received your application for tax exemption in the state of Florida. Our team of experts will now proceed with a thorough review of your application to determine your eligibility for tax exemption benefits. Florida offers various types of tax exemptions to individuals and organizations based on specific criteria. Below, we have outlined some different types of tax exemption applications that we review: 1. Individual Tax Exemption: This type of application is applicable to individuals who meet certain criteria, such as senior citizens, veterans, or disabled individuals. Florida provides tax relief to eligible individuals based on their income levels, age, and other qualifying factors. 2. Non-Profit Organization Tax Exemption: Non-profit organizations play a significant role in the development of our communities. To support their valuable contributions, Florida provides tax exemptions to qualifying non-profit organizations. These exemptions often apply to property and sales taxes, enabling organizations to allocate more resources towards their charitable endeavors. 3. Agricultural Tax Exemption: Florida boasts a vibrant agricultural industry, and farmers contribute significantly to the state's economy. The agricultural tax exemption aims to reduce the tax burden on farmers and promote sustainable agriculture practices. This exemption typically covers property taxes for agricultural lands and equipment. 4. Renewable Energy Tax Exemption: As part of its commitment to environmental sustainability, Florida encourages the use of renewable energy sources. The renewable energy tax exemption is designed to incentivize the installation and use of renewable energy systems, such as solar panels. These exemptions can mitigate the upfront costs and make renewable energy more accessible to residents and businesses. Rest assured that our team will meticulously review your application, ensuring that all necessary documentation is provided and all eligibility requirements are met. The review process typically involves assessing your financial information, supporting documents, and determining compliance with state regulations. Please note that the review process may take several weeks due to the volume of applications we receive. We kindly request your patience during this time, as we strive to provide a thorough and fair evaluation of each application. If any additional information or documentation is required, we will reach out to you promptly. Our team is available to assist you with any inquiries or concerns throughout the process. You can contact us at [Phone Number] or [Email Address]. Thank you for your interest in obtaining tax exemption in Florida. We appreciate your cooperation and look forward to completing the review process soon. Sincerely, [Your Name] [Your Organization] [Contact Information]

Florida Sample Letter for Tax Exemption - Review of Applications

Description

How to fill out Florida Sample Letter For Tax Exemption - Review Of Applications?

If you wish to total, obtain, or print out legitimate record templates, use US Legal Forms, the biggest assortment of legitimate varieties, which can be found on the web. Utilize the site`s easy and handy lookup to discover the files you need. Different templates for enterprise and individual uses are sorted by types and states, or keywords. Use US Legal Forms to discover the Florida Sample Letter for Tax Exemption - Review of Applications in just a handful of click throughs.

If you are already a US Legal Forms customer, log in in your profile and then click the Down load button to get the Florida Sample Letter for Tax Exemption - Review of Applications. You may also accessibility varieties you earlier acquired within the My Forms tab of your respective profile.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for your right town/country.

- Step 2. Take advantage of the Preview option to look through the form`s content. Don`t neglect to read the outline.

- Step 3. If you are not happy together with the type, utilize the Research industry near the top of the monitor to get other variations in the legitimate type template.

- Step 4. After you have located the shape you need, go through the Buy now button. Select the pricing plan you favor and add your references to register on an profile.

- Step 5. Process the transaction. You can use your bank card or PayPal profile to perform the transaction.

- Step 6. Pick the format in the legitimate type and obtain it in your gadget.

- Step 7. Full, revise and print out or indicator the Florida Sample Letter for Tax Exemption - Review of Applications.

Each and every legitimate record template you get is yours forever. You may have acces to each and every type you acquired inside your acccount. Select the My Forms segment and choose a type to print out or obtain once more.

Remain competitive and obtain, and print out the Florida Sample Letter for Tax Exemption - Review of Applications with US Legal Forms. There are many professional and condition-particular varieties you can use for your enterprise or individual requirements.

Form popularity

FAQ

Use the FL Tax-Verify mobile app to verify a purchaser's Florida sales and use tax resale or exemption certificate is valid before making tax-exempt sales. To use FL Tax-Verify, dealers must be registered to collect Florida sales and use tax and have a valid resale certificate.

You must provide all vendors and suppliers with an exemption certificate before making tax-exempt purchases. See Rule 12A-1.038, Florida Administrative Code (F.A.C.). Your Consumer's Certificate of Exemption is to be used solely by your organization for your organization's customary nonprofit activities.

Florida's general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3% Amusement machine receipts - 4% Rental, lease, or license of commercial real property - 5.5%

Applications are approved by mid-June; the status of an approved exemption will change to 'green' on your property record's detail page, and the status listed above for the appropriate year will change to ?Yes.? In some cases, applications may be denied.

How to Lose Your 501(c)(3) Tax Exempt Status (Without Really Trying) Private benefit/inurement. Lobbying. Political campaign activity. Unrelated business income (UBI) Annual reporting obligation. Operation in with stated exempt purpose(s)

To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer's Certificate of Exemption, Form DR-14) from the Florida Department of Revenue.

Phone: 877-FL-RESALE (877-357-3725) and enter the customer's Annual Resale Certificate number. Online: Go to the Seller Certificate Verification application and enter the required seller information for verification.

Renewing Your Certificate: Your Consumer's Certificate of Exemption will be valid for a period of five (5) years. If you wish to renew your exemption, you must submit another Application for Consumer's Certificate of Exemption (Form DR-5) and copies of the required documentation.