Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

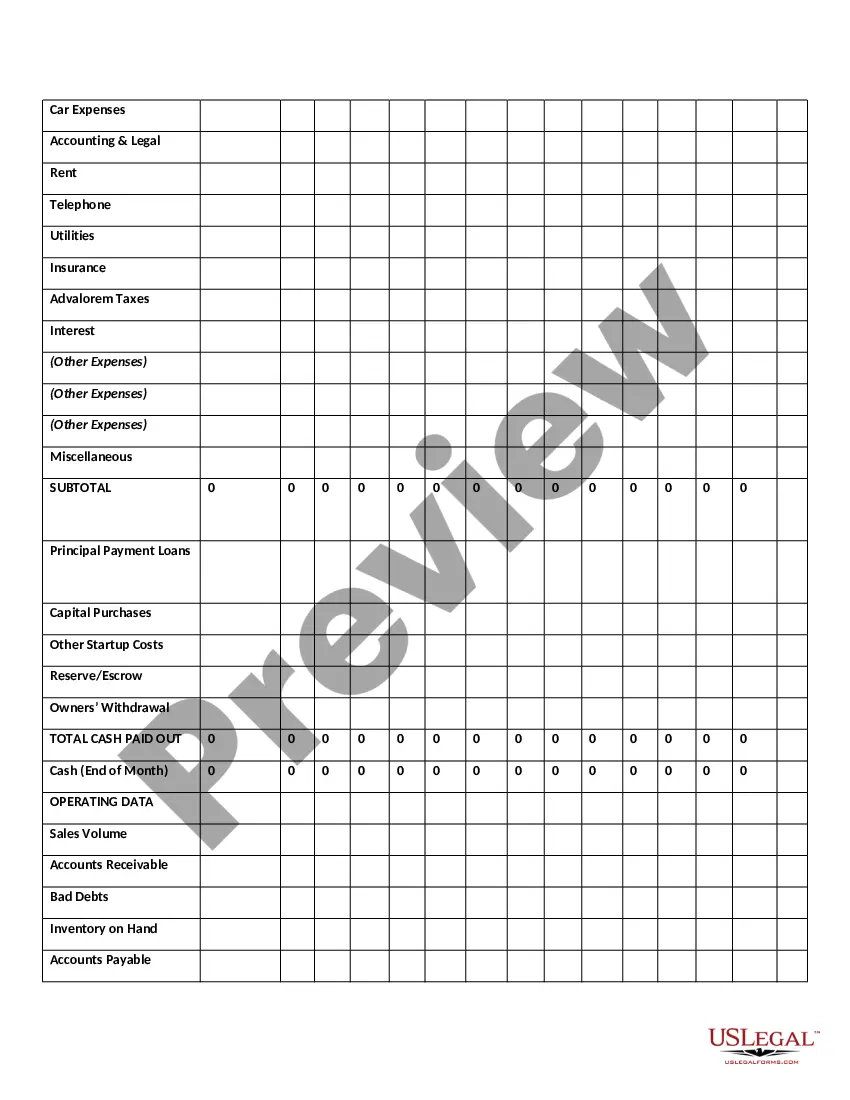

Florida Twelve-Month Cash Flow refers to a financial document that outlines the incoming and outgoing cash from various sources over a period of twelve months in the state of Florida. It provides a comprehensive overview of an individual or organization's financial health and helps in evaluating cash flow patterns, identifying areas of improvement, and making informed financial decisions. The Florida Twelve-Month Cash Flow typically includes various components such as income, expenses, investments, loans, grants, taxes, and other inflows and outflows. It takes into account both regular and irregular cash flows to provide a more accurate representation of an entity's financial situation. There are different types of Florida Twelve-Month Cash Flow that can be tailored to specific purposes. Some common variations include: 1. Personal Florida Twelve-Month Cash Flow: This focuses on an individual's personal finances, incorporating income from sources such as salary, investments, rental properties, and other sources, as well as personal expenses, loans, and tax obligations. 2. Business Florida Twelve-Month Cash Flow: This is designed for businesses operating in Florida and includes revenue from sales, services, investments, and other sources, along with business-related expenses such as employee salaries, rent, utilities, taxes, and loan repayments. 3. Real Estate Florida Twelve-Month Cash Flow: This version is specifically meant for real estate investors, property managers, and developers. It tracks rental income, property expenses (maintenance, repairs, insurance), mortgage payments, and other financial aspects related to real estate holdings in Florida. 4. Nonprofit Florida Twelve-Month Cash Flow: This cash flow statement is tailored for nonprofit organizations in Florida. It includes revenue streams like donations, grants, sponsorships, and membership dues, as well as expenses related to programs, fundraising, administration, and other operational costs. 5. Government Florida Twelve-Month Cash Flow: This cash flow statement is used by government entities in Florida to manage their inflows and outflows. It accounts for revenue sources such as taxes, fees, fines, grants, and intergovernmental transfers, as well as expenses related to public services, infrastructure, salaries, and debt payments. It is essential to regularly review and analyze the Florida Twelve-Month Cash Flow to gauge financial stability, identify potential cash flow issues, and develop strategies for better financial management. Utilizing appropriate software or consulting with a financial professional can help in accurately preparing and interpreting the cash flow statement to ensure optimum financial health and growth.Florida Twelve-Month Cash Flow refers to a financial document that outlines the incoming and outgoing cash from various sources over a period of twelve months in the state of Florida. It provides a comprehensive overview of an individual or organization's financial health and helps in evaluating cash flow patterns, identifying areas of improvement, and making informed financial decisions. The Florida Twelve-Month Cash Flow typically includes various components such as income, expenses, investments, loans, grants, taxes, and other inflows and outflows. It takes into account both regular and irregular cash flows to provide a more accurate representation of an entity's financial situation. There are different types of Florida Twelve-Month Cash Flow that can be tailored to specific purposes. Some common variations include: 1. Personal Florida Twelve-Month Cash Flow: This focuses on an individual's personal finances, incorporating income from sources such as salary, investments, rental properties, and other sources, as well as personal expenses, loans, and tax obligations. 2. Business Florida Twelve-Month Cash Flow: This is designed for businesses operating in Florida and includes revenue from sales, services, investments, and other sources, along with business-related expenses such as employee salaries, rent, utilities, taxes, and loan repayments. 3. Real Estate Florida Twelve-Month Cash Flow: This version is specifically meant for real estate investors, property managers, and developers. It tracks rental income, property expenses (maintenance, repairs, insurance), mortgage payments, and other financial aspects related to real estate holdings in Florida. 4. Nonprofit Florida Twelve-Month Cash Flow: This cash flow statement is tailored for nonprofit organizations in Florida. It includes revenue streams like donations, grants, sponsorships, and membership dues, as well as expenses related to programs, fundraising, administration, and other operational costs. 5. Government Florida Twelve-Month Cash Flow: This cash flow statement is used by government entities in Florida to manage their inflows and outflows. It accounts for revenue sources such as taxes, fees, fines, grants, and intergovernmental transfers, as well as expenses related to public services, infrastructure, salaries, and debt payments. It is essential to regularly review and analyze the Florida Twelve-Month Cash Flow to gauge financial stability, identify potential cash flow issues, and develop strategies for better financial management. Utilizing appropriate software or consulting with a financial professional can help in accurately preparing and interpreting the cash flow statement to ensure optimum financial health and growth.