The Florida Reorganization of Partnership by Modification of Partnership Agreement refers to a legal process that allows changes to be made to an existing partnership agreement in order to restructure or reorganize the partnership. This modification is aimed at better aligning the partnership with the current business goals, operational requirements, or other changing circumstances. There can be various types of modifications or reorganizations performed under this framework, each serving a unique purpose. Some notable types include: 1. Changes in Capital Structure: This type of modification may involve altering the partnership's capital contributions and profit-sharing arrangements among partners. It can be used to adjust the distribution of profits or losses, modify partner capital accounts, or introduce new partners to the partnership. 2. Dissolution and Reconstitution: In certain cases, a partnership may need to dissolve its current structure and reconstitute itself under a new partnership agreement. This may occur due to changes in ownership, business objectives, or to resolve conflicts among partners. The process involves winding down the existing partnership and establishing a new one with revised terms. 3. Convertibility to Other Business Entity: The Reorganization of Partnership Agreement also opens up the possibility of converting the partnership into a different type of business entity, such as a limited liability company (LLC) or a corporation. This conversion can offer advantages in terms of liability protection, tax benefits, or ease of raising capital. 4. Realignment of Partnership Roles: Partnerships may undergo restructuring to redefine the roles and responsibilities of partners within the business. This may involve changes in management, decision-making authority, or the introduction of new leadership positions. 5. Merger or Acquisition: In some cases, partnerships may choose to merge with or be acquired by another partnership or business entity. This type of reorganization often involves the transfer of assets, liabilities, contracts, and intellectual property rights from one entity to another, and the modification of partnership agreements accordingly. In all cases, the Florida Reorganization of Partnership by Modification of Partnership Agreement requires careful consideration, planning, and drafting of legal documents to ensure compliance with Florida partnership laws and the protection of the partners' rights and interests. It is advisable to consult with a qualified attorney who specializes in partnership law for guidance and assistance throughout the reorganization process.

Florida Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Florida Reorganization Of Partnership By Modification Of Partnership Agreement?

Choosing the right legitimate record web template could be a battle. Obviously, there are tons of themes available on the net, but how can you discover the legitimate develop you will need? Take advantage of the US Legal Forms internet site. The assistance offers thousands of themes, like the Florida Reorganization of Partnership by Modification of Partnership Agreement, that can be used for enterprise and personal demands. All of the forms are checked by experts and satisfy federal and state needs.

Should you be currently signed up, log in in your bank account and then click the Download key to find the Florida Reorganization of Partnership by Modification of Partnership Agreement. Make use of your bank account to look throughout the legitimate forms you may have acquired formerly. Check out the My Forms tab of the bank account and acquire an additional version in the record you will need.

Should you be a brand new user of US Legal Forms, listed below are basic instructions for you to comply with:

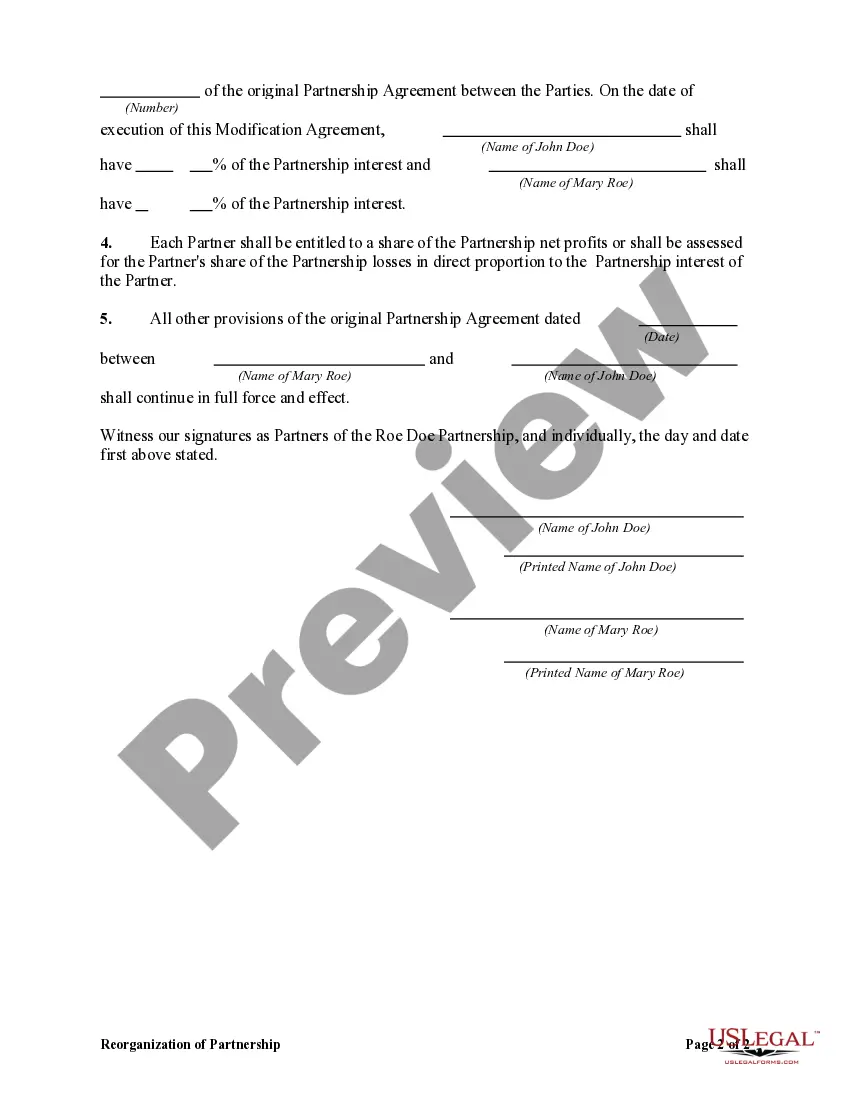

- Initially, be sure you have selected the proper develop for the metropolis/region. You are able to look through the form while using Review key and look at the form outline to guarantee this is basically the best for you.

- In case the develop will not satisfy your preferences, take advantage of the Seach area to obtain the appropriate develop.

- Once you are positive that the form would work, go through the Purchase now key to find the develop.

- Select the costs strategy you would like and enter in the necessary information. Build your bank account and buy your order utilizing your PayPal bank account or credit card.

- Opt for the submit format and download the legitimate record web template in your system.

- Total, revise and print out and signal the acquired Florida Reorganization of Partnership by Modification of Partnership Agreement.

US Legal Forms is the most significant catalogue of legitimate forms that you can find numerous record themes. Take advantage of the service to download professionally-manufactured paperwork that comply with condition needs.