Title: Florida Sample Letter for Note and Deed of Trust: Template and Variations Introduction: When entering into a real estate transaction in Florida, it is crucial to have the necessary legal documents in place to ensure clarity and protection for all parties involved. The Florida Sample Letter for Note and Deed of Trust is a comprehensive template commonly used in such transactions. This article will discuss the important components of this letter, the significance of a Note and Deed of Trust, and mention some variations of these documents commonly used in Florida. 1. Importance of a Note and Deed of Trust: A Note and Deed of Trust is a legal arrangement used primarily in real estate financing. It outlines the terms of a loan, including the principal amount, interest rate, repayment schedule, and other pertinent details. This document allows the borrower to secure the loan by granting the lender a security interest in the property through a deed of trust. 2. Components of a Florida Sample Letter for Note and Deed of Trust: — Contact Information: The letter should include the names, addresses, and contact information of both the borrower and the lender. — Loan Terms: This section outlines the loan amount, interest rate, repayment schedule, and any associated fees. — Collateral Description: A detailed description of the property being offered as collateral for the loan is essential. This includes the property's address, legal description, and any encumbrances or liens. — Governing Law: Specify that the agreement adheres to the laws of Florida. — Default and Remedies: Clearly define the actions that may lead to default, such as missed payments, and describe the remedies available to the lender in case of default. — Signatures: Both the borrower and the lender must sign and date the document to acknowledge their agreement to the terms. 3. Variations of Note and Deed of Trust in Florida: — Simple Note and Deed of Trust: This standard document is used for conventional mortgages and contains the basic elements mentioned above. — Balloon Payment Note and Deed of Trust: In this variation, the loan terms include periodic payments with a final lump sum payment due at the end of the loan term. — Adjustable-Rate Note and Deed of Trust: This type of agreement features an interest rate that fluctuates based on an adjustable-rate index, such as the prime rate. — Construction Loan Note and Deed of Trust: Specifically designed for construction financing, this variation delineates disbursement schedules and lien waiver processes during the construction phase. — Assumption Addendum: In some cases, an addendum might be necessary to include terms related to the assumption of an existing loan. Conclusion: Having a well-drafted Florida Sample Letter for Note and Deed of Trust is crucial to protect the rights and interests of both the borrower and the lender in a real estate transaction. Whether opting for a standard agreement or a specialized variation, it is advisable to consult with a legal professional to ensure compliance with Florida laws and regulations. Remember, the Note and Deed of Trust serve as the foundation for a secure and legally binding transaction.

Florida Sample Letter for Note and Deed of Trust

Description

How to fill out Florida Sample Letter For Note And Deed Of Trust?

Have you been in the position where you require papers for either organization or specific uses almost every day? There are a variety of lawful papers web templates accessible on the Internet, but getting ones you can trust is not easy. US Legal Forms offers 1000s of develop web templates, much like the Florida Sample Letter for Note and Deed of Trust, that are composed to fulfill federal and state requirements.

Should you be presently familiar with US Legal Forms web site and possess your account, merely log in. Afterward, you can obtain the Florida Sample Letter for Note and Deed of Trust format.

If you do not have an account and want to start using US Legal Forms, abide by these steps:

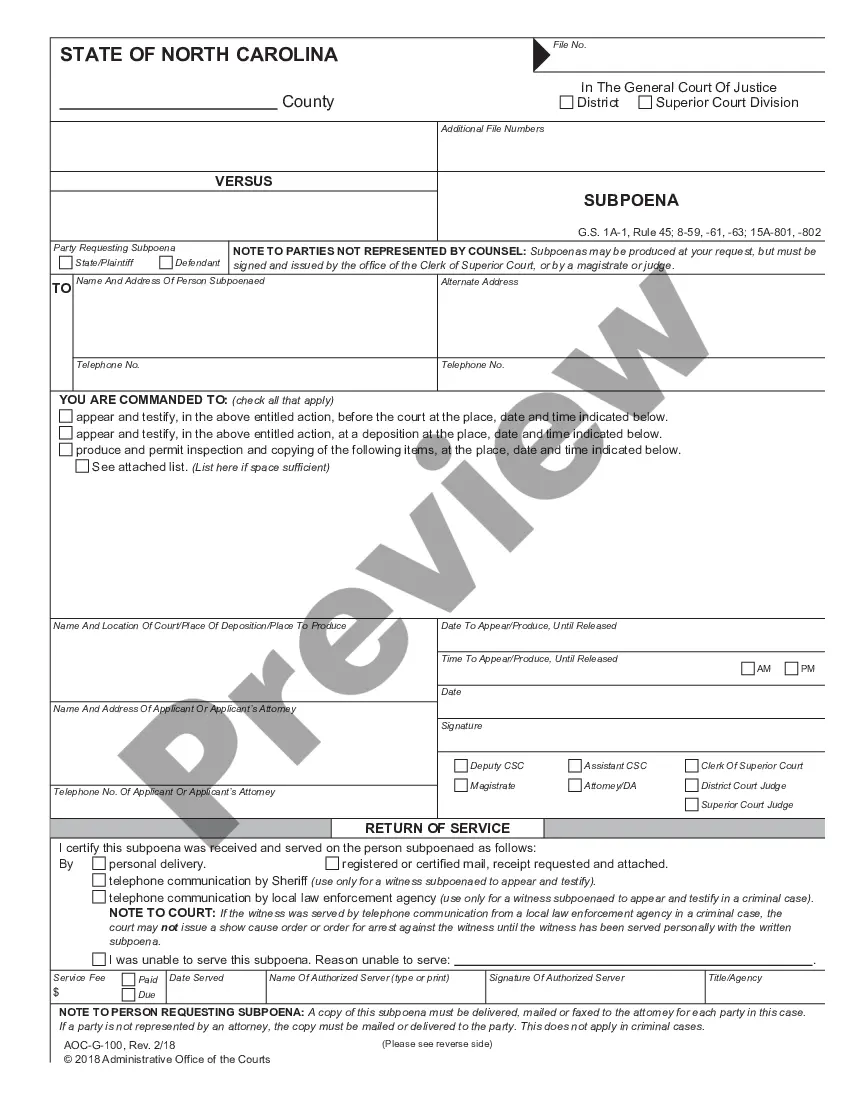

- Find the develop you require and make sure it is for the proper town/state.

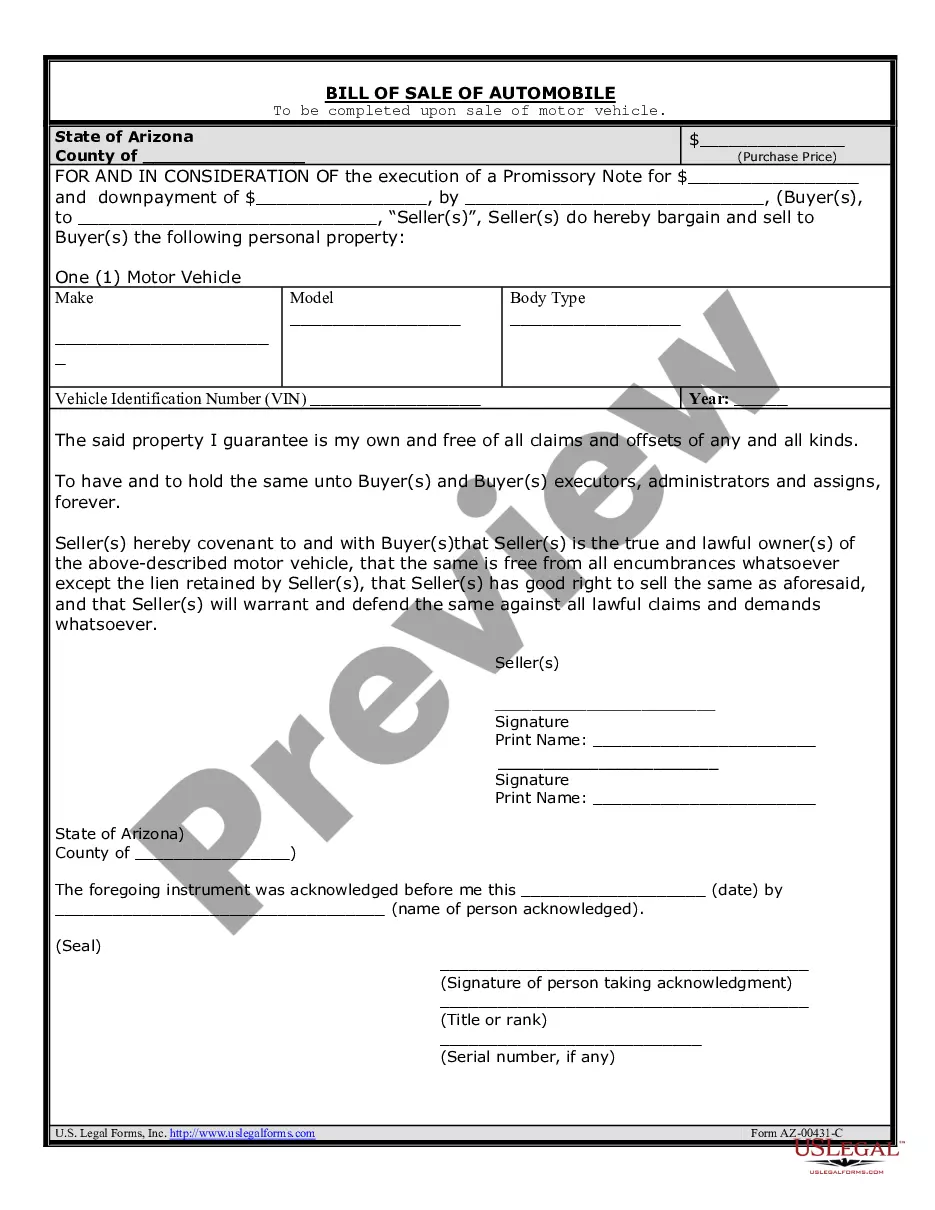

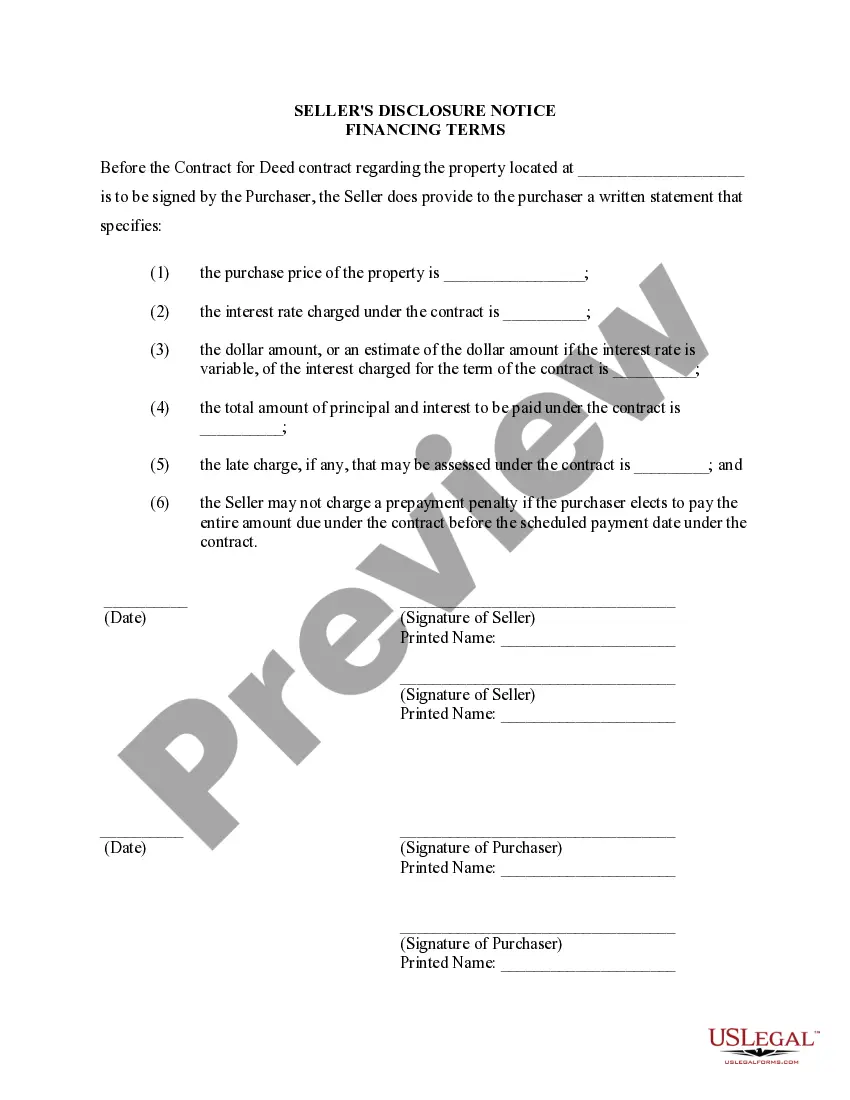

- Take advantage of the Review option to review the shape.

- See the description to actually have chosen the appropriate develop.

- When the develop is not what you`re looking for, take advantage of the Research area to obtain the develop that meets your needs and requirements.

- When you find the proper develop, click Buy now.

- Pick the prices plan you want, submit the required information to create your money, and pay for the order with your PayPal or bank card.

- Choose a hassle-free paper structure and obtain your duplicate.

Find all the papers web templates you may have purchased in the My Forms food list. You may get a extra duplicate of Florida Sample Letter for Note and Deed of Trust at any time, if possible. Just click on the essential develop to obtain or printing the papers format.

Use US Legal Forms, by far the most extensive selection of lawful varieties, in order to save efforts and avoid blunders. The services offers professionally produced lawful papers web templates which can be used for a selection of uses. Make your account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

The Deed is a recorded document memorializing the transfer of property from the Grantor to the Grantee. The Note is an unrecorded paper that binds an individual who has assumed debt through a promise-to-pay instrument.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

An All Inclusive Trust Deed (AITD) is a new deed of trust that includes the balance due on the existing note plus new funds advanced; also known as a wrap-around mortgage. A wrap-around mortgage, more-commonly known as a ?wrap?, is a form of secondary financing for the purchase of real property.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.