The Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a crucial document for Florida homeowners who are planning to sell or exchange their primary residence. This certification plays a significant role in ensuring that no tax reporting is necessary for the sale or exchange and thus exempts homeowners from certain tax obligations. The primary purpose of the Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is to relieve homeowners from reporting the details of the transaction to the Florida Department of Revenue. By obtaining this certification, individuals are exempted from submitting Form DR-219, which generally requires homeowners to report the sale or exchange of their principal residence. This certification serves as a way for homeowners to save time and effort by eliminating the need to complete additional forms and reporting procedures. It streamlines the process and allows individuals to focus on the sale or exchange itself, without the burden of extensive tax reporting. To obtain the Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners must meet certain criteria set by the Florida Department of Revenue. These criteria typically include: 1. The residence being sold or exchanged must be the homeowner's primary residence. 2. The property must be eligible for a homestead exemption as granted by the county property appraiser. 3. The homeowner must not have claimed an exemption on another Florida property during the three years preceding the sale or exchange. 4. The transaction must not involve a sale to a related party, such as immediate family members. It is important to note that there are different types of Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption based on specific circumstances. These variations may include exemptions for individuals who are 55 years or older, certain military personnel, or those who qualify for other statutory exemptions. By obtaining the Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners can simplify the process of selling or exchanging their primary residence while ensuring compliance with state tax regulations. This certification provides homeowners with peace of mind, knowing that their transaction is properly documented without the need for extensive reporting.

Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Florida Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

US Legal Forms - one of the largest libraries of legitimate types in the States - offers a variety of legitimate file templates you can down load or produce. While using internet site, you will get 1000s of types for company and person purposes, sorted by types, states, or keywords and phrases.You can get the most recent versions of types just like the Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in seconds.

If you already have a monthly subscription, log in and down load Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in the US Legal Forms library. The Download switch can look on every kind you view. You gain access to all previously acquired types within the My Forms tab of your own accounts.

In order to use US Legal Forms for the first time, allow me to share easy directions to help you get started:

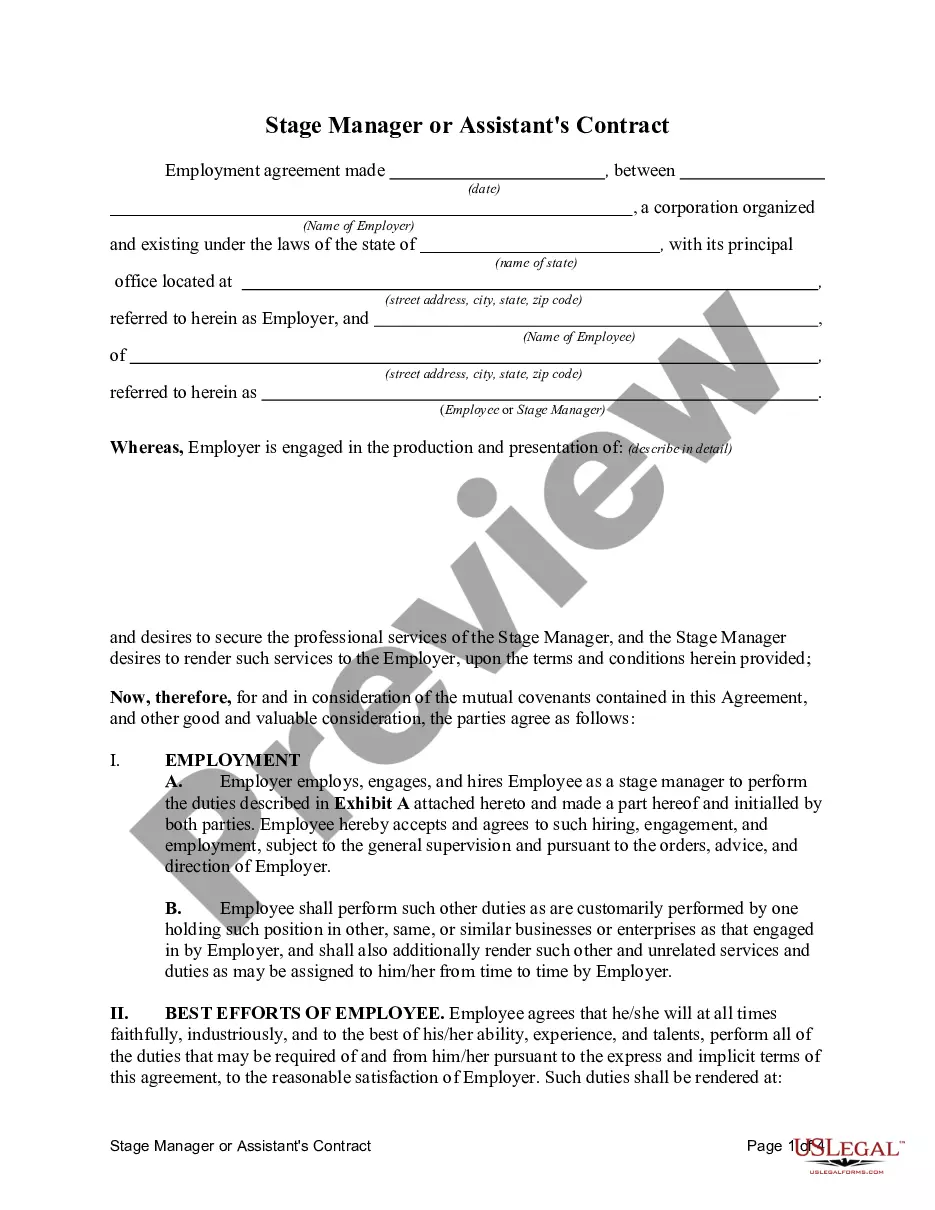

- Be sure you have chosen the proper kind to your town/area. Go through the Review switch to examine the form`s content material. See the kind explanation to actually have selected the correct kind.

- When the kind does not fit your needs, use the Lookup industry on top of the display screen to find the one that does.

- In case you are pleased with the form, validate your selection by visiting the Purchase now switch. Then, select the prices prepare you prefer and offer your credentials to register for an accounts.

- Procedure the deal. Make use of your credit card or PayPal accounts to finish the deal.

- Find the file format and down load the form on the device.

- Make modifications. Fill up, revise and produce and indication the acquired Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

Each design you added to your account does not have an expiration day and is also your own eternally. So, in order to down load or produce an additional copy, just go to the My Forms section and click in the kind you will need.

Obtain access to the Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with US Legal Forms, one of the most extensive library of legitimate file templates. Use 1000s of skilled and status-specific templates that satisfy your company or person needs and needs.

Form popularity

FAQ

Yes, you must report your 1099-S.

CERTIFICATION FOR NO INFORMATION REPORTING. ON THE SALE OR EXCHANGE OF A PRINCIPAL RESIDENCE. This form may be completed by the seller of a principal residence.

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return.

You may not always receive a 1099-S form. When selling your home, you may have signed a form certifying you will not have a taxable gain on the sale.

If you are looking for 1099s from earlier years, you can contact the IRS and order a wage and income transcript. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

The form you are referring to Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is a form which is to be completed by the seller of a principal residence in order to determine whether the sale or exchange needs to be reported to the IRS on Form 1099-S, Proceeds

The form you are referring to Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is a form which is to be completed by the seller of a principal residence in order to determine whether the sale or exchange needs to be reported to the IRS on Form 1099-S, Proceeds

File Form 1099-S, Proceeds From Real Estate Transactions, to report the sale or exchange of real estate.